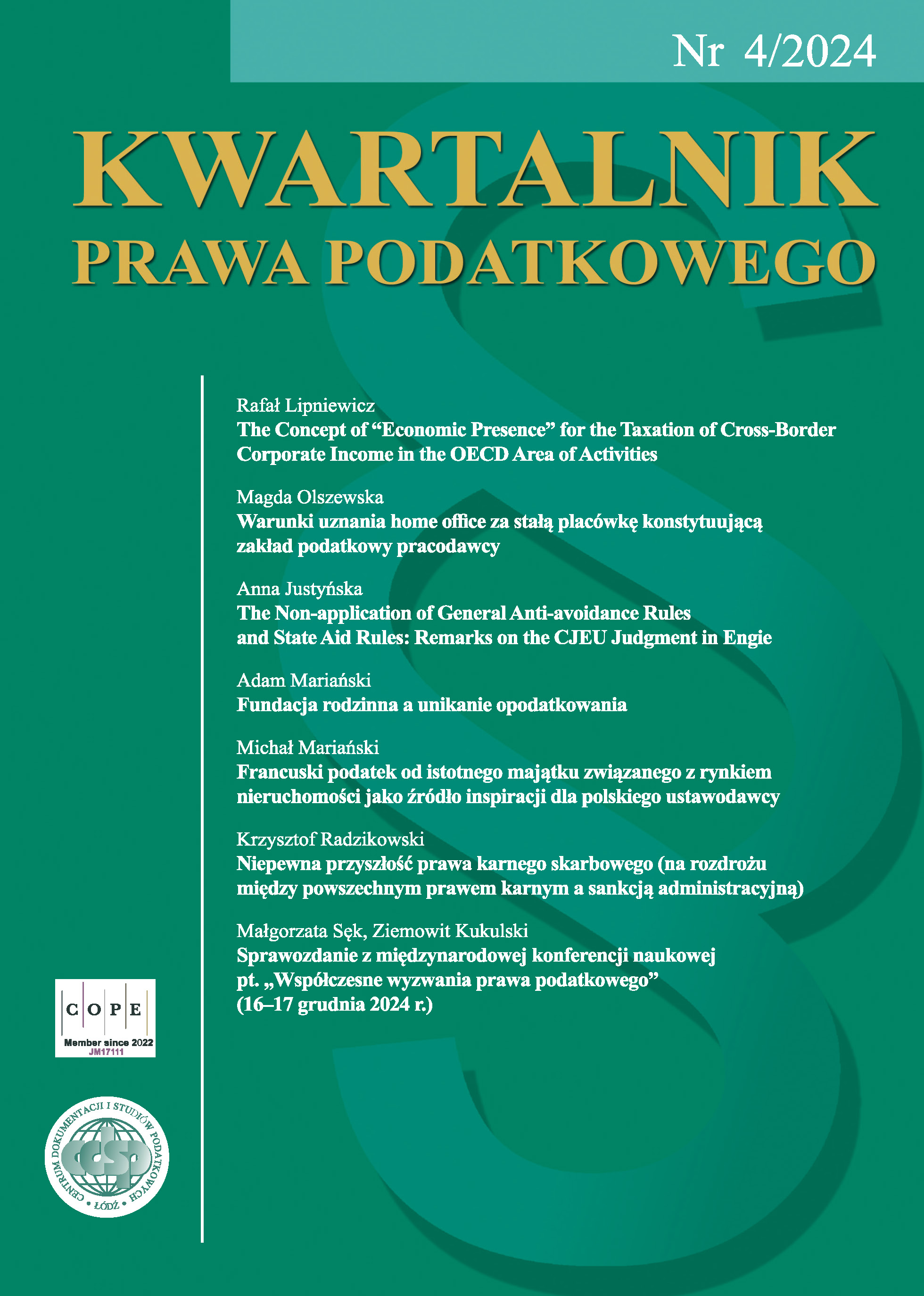

Warunki uznania home office za stałą placówkę konstytuującą zakład podatkowy pracodawcy

DOI:

https://doi.org/10.18778/1509-877X.2024.04.02Słowa kluczowe:

zakład podatkowy, home office, praca zdalna, prawo do dysponowania, Konwencja Modelowa OECDAbstrakt

Artykuł omawia tematykę ukonstytuowania się zakładu podatkowego przedsiębiorcy poprzez stałą placówkę w postaci zagranicznego home office pracownika. W tekście przedstawiono szczegółową analizę zapisów Konwencji Modelowej OECD oraz Komentarza do niej, poglądy doktryny, orzecznictwo sądów administracyjnych oraz praktykę interpretacyjną organów podatkowych. Szczególną uwagę poświęcono pojęciom „prawo do dysponowania” i „skuteczna władza do użytkowania placówki” oraz kontrowersjom przy ich interpretacji. W dalszej kolejności omówione zostały wyłączenie z definicji zakładu działalności o charakterze pomocniczym w odniesieniu do placówki home office oraz wątpliwości, które zagadnienie to w praktyce budzi. Zdaniem autorki przedstawiana tematyka stawia pod znakiem zapytania przesłankę posiadania stałej placówki do dyspozycji w dobie nowoczesnej gospodarki opartej na wiedzy. Z drugiej strony w warunkach upowszechniającej się pracy mobilnej konieczne jest uregulowanie podziału dochodu pomiędzy państwami, z uwzględnieniem postulatu unikania nakładania nadmiernych obciążeń administracyjnych na podatników.

Pobrania

Bibliografia

Bendlinger S., Steuerlicher Nexus durch „digitale Nomaden“ und der Sinn der Homeoffice-Betriebstätte, „SWI Steuer und Wirtschaft International” 2021, Bd. 9.

Google Scholar

Bendlinger S., Bendlinger V., Der VwGH zur Verfügungsmacht und das jähe Ende der Homeoffice-Betriebsstätte, „SWI Steuer und Wirtschaft International” 2022, Bd. 9.

Google Scholar

Bendlinger V., Romstorfer J., SWI-Jahrestagung: Homeoffice-Tätigkeit von Arbeitnehmern als Betriebsstätte des Arbeitgebers?, „SWI Steuer und Wirtschaft International” 2023, Bd. 9.

Google Scholar

Beretta G., „Work on the Move”: Rethinking Taxation of Labour Income under Tax Treaties, „International Tax Studies” 2022, vol. 5(2), https://doi.org/10.59403/3mgn45y

Google Scholar

DOI: https://doi.org/10.59403/3mgn45y

Brzeziński B., Lasiński-Sulecki K., Morawski W., Problemy wykładni międzynarodowych umów w sprawie unikania opodatkowania, sporządzonych w dwóch lub większej liczbie języków, „Kwartalnik Prawa Podatkowego” 2023, nr 1, https://doi.org/10.18778/1509-877X.2023.01.01

Google Scholar

DOI: https://doi.org/10.18778/1509-877X.2023.01.01

Laskowska M., Niedźwiedzki W., Powstanie zagranicznego zakładu w przypadku agenta zależnego i pracy zdalnej na podstawie orzecznictwa sądowego w Polsce, „Przegląd Podatkowy” 2023, nr 6.

Google Scholar

Lipniewicz R., Dysponowanie placówką, [w:] R. Lipniewicz, Podatkowy zakład zagraniczny. Koncepcja i funkcjonowanie, Warszawa 2017, LEX.

Google Scholar

Lipniewicz R., Zakład typu podstawowego w polskich umowach podatkowych, [w:] R. Lipniewicz, Podatkowy zakład zagraniczny. Koncepcja i funkcjonowanie, Warszawa 2017, LEX.

Google Scholar

Litwińczuk H., Międzynarodowe prawo podatkowe, Warszawa 2020.

Google Scholar

Majdańska A., Zastosowanie Modelu Konwencji OECD oraz Komentarza w praktyce polskich organów podatkowych i sądów administracyjnych, „Monitor Podatkowy” 2015, nr 6.

Google Scholar

OECD, Interpretation and Application of Article 5 (Permanent Establishment) of the OECD Model Tax Convention, 12 October 2011 to 10 February 2012, Paris 2011, https://web-archive.oecd.org/2012-06-14/91526-48836726.pdf (dostęp: 11.02.2024).

Google Scholar

OECD, Model Tax Convention on Income and on Capital 2017, Full Version (as it read on 21 November 2017), Paris 2019, http://dx.doi.org/10.1787/g2g972ee-en

Google Scholar

DOI: https://doi.org/10.1787/g2g972ee-en

OECD, OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2022, Paris 2022, https://doi.org/10.1787/0e655865-en

Google Scholar

DOI: https://doi.org/10.1787/0e655865-en

Owoc J., Glosa do wyroku Wojewódzkiego Sądu Administracyjnego w Gliwicach z dnia 31 stycznia 2022 r., sygn. I SA/Gl 1340/21, „Kwartalnik Prawa Podatkowego” 2023, nr 2, https://doi.org/10.18778/1509-877X.2023.03.09

Google Scholar

DOI: https://doi.org/10.18778/1509-877X.2023.02.08

Rasch S., Rosenberger F., Brülisauer P., Auswirkungen dezentraler Home-Office Aktivitäten auf die Betriebsstättenbegründung, Gewinnzuordnung und Arbeitnehmerbesteuerung, „Archiv für Schweizerisches Abgaberecht” 2020/2021, Bd. 89(9).

Google Scholar

Reimer E., Article 5. Permanent Establishment, [w:] Klaus Vogel on Double Taxation Conventions, red. E. Reimer, A. Rust, Alphen aan den Rijn 2015.

Google Scholar

Reimer E., Permanent Establishment in the OECD Model Tax Convention, [w:] E. Reimer, S. Schmid, M. Orell, Permanent Establishments: A Domestic Taxation, Bilateral Tax Treaty and OECD Perspective, Alphen aan den Rijn 2018.

Google Scholar

Rohner T., Home Office – Steuerliche Behandlung im grenzüberschreitenden Bereich, „Zeitschrift für Schweizerisches und Internationales Steuerrecht” 2015, Bd. 4.

Google Scholar

Schuster R., Verleger T., Wenn das Home zum Office wird – Bedingt jede Tätigkeit im Homeoffice eine Betriebsstätte im abkommensrechtlichen Sinn?, „IWB Internationales Steuer- und Wirtschaftsrecht” 2020, Bd. 21.

Google Scholar

Skaar A.A., Permanent Establishment: Erosion of a Tax Treaty Principle, Alphen aan den Rijn 2020.

Google Scholar

Wassermeyer H.C.F., Kaeser C., Art. 5, [w:] Doppelbesteuerung. Kommentar, Band 1, red. H.C.F. Wassermeyer, München 2019.

Google Scholar

Woźniak T., Powstanie zakładu a unikanie opodatkowania w międzynarodowym prawie podatkowym, Warszawa 2022.

Google Scholar

DOI: https://doi.org/10.33226/0137-5490.2022.1.4

Opublikowane

Jak cytować

Numer

Dział

Licencja

Utwór dostępny jest na licencji Creative Commons Uznanie autorstwa – Użycie niekomercyjne – Bez utworów zależnych 4.0 Międzynarodowe.

PlumX metrics