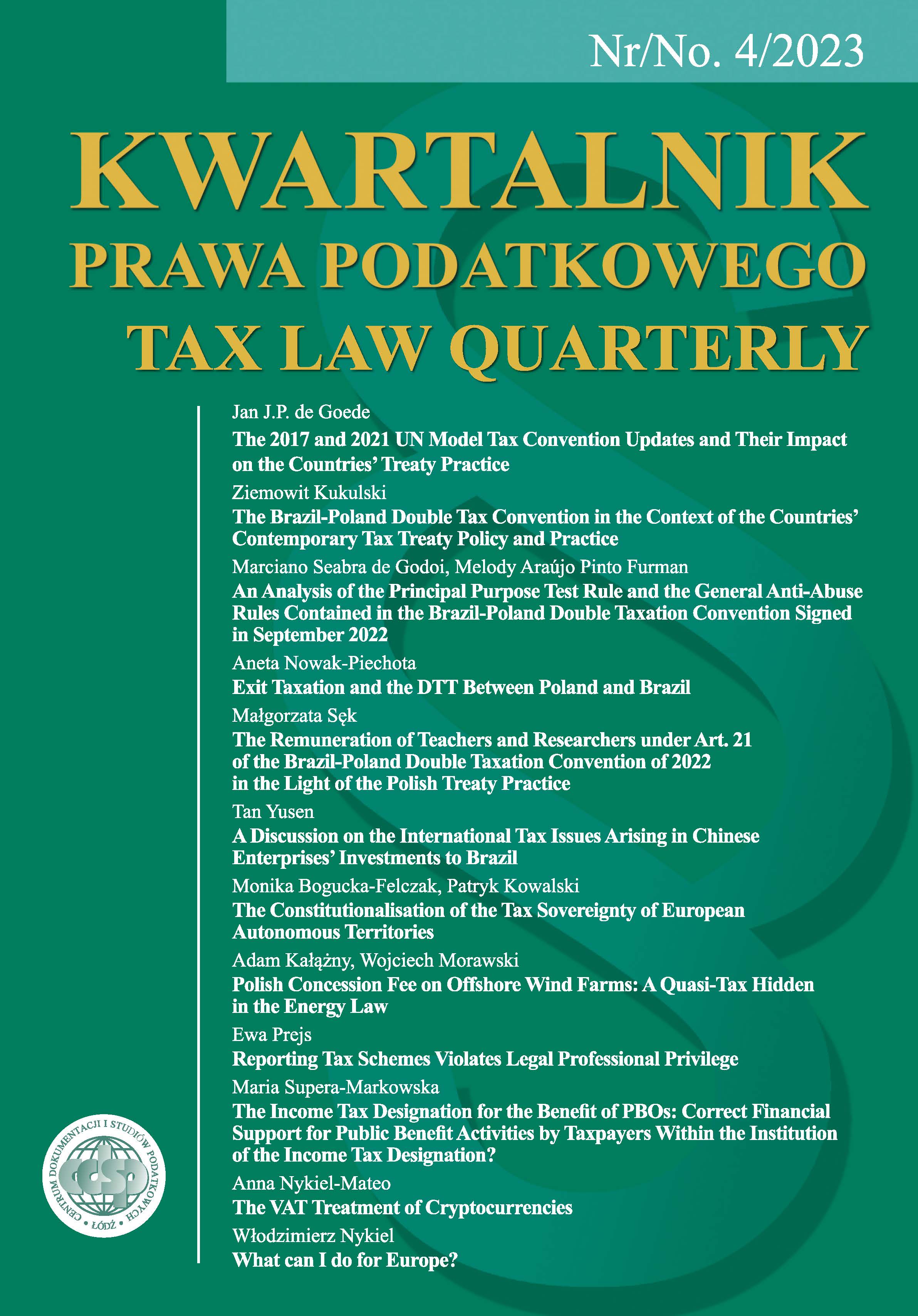

Polish Concession Fee on Offshore Wind Farms: A Quasi-Tax Hidden in the Energy Law

DOI:

https://doi.org/10.18778/1509-877X.2023.04.08Keywords:

offshore, real estate tax, wind farms, property taxation, concession fee, energy transformationAbstract

The production of electricity using offshore wind farms is at a preparatory stage in Poland. However, it has the opportunity to become the most dynamically-developing segment of the power industry, especially considering ambitious targets for reducing CO2 emissions. The development of the renewable energy sector in Poland has major real estate tax context when one takes into account that RET paid for the infrastructure projects constitutes an important source of tax revenue for the local communities. The taxation of wind farms is a well-recognised issue, but jurisprudence developed in this area cannot help in solving the problem of the taxation of the offshore wind farms. A legal loophole in the Polish RET provisions made it impossible to tax the offshore constructions. In order to capture the tax from offshore wind farms, the Polish legislator introduced a special concession fee, whose amount is approx. equal to the hypothetical RET to be paid from the wind farm if it was located onshore. The purpose of the article is to present the doubts regarding the offshore concession fee from the perspective of Polish constitutional standards as well as the Polish tax system consistency.

Downloads

References

Antonów D., Pojęcie opłaty w polskim języku prawnym [Concept of fee in Polish legal language], [in:] W. Miemiec (ed.), Księga jubileuszowa ku czci profesor Krystyny Sawickiej. Gromadzenie i wydatkowanie środków publicznych. Zagadnienia finansowoprawne, Wrocław 2017.

Google Scholar

Gomułowicz A. [in:] A. Gomułowicz, J. Małecki, Podatki i prawo podatkowe [Taxes and Tax Law], Warsaw 2008.

Google Scholar

Hasterok D., Castro R., Landrat M., Piko K., Doepfert M., Morais H., Polish Energy Transition 2040: Energy Mix Optimization Using Grey Wolf Optimizer, “Energies” 2021, no. 14(501).

Google Scholar

Lynne O., Miller A., Mulligan E., Principles of international Taxation, Bloomsbury Professional, 2017.

Google Scholar

Pahl B., Morskie farmy wiatrowe zlokalizowane w wyłącznej strefie ekonomicznej a podatek od nieruchomości [Offshore wind farms located in the exclusive economic zone and property tax], “Finanse Komunalne” 2013, no. 3.

Google Scholar

Ruta M., Podatek od morskich farm wiatrowych – proponowany model opodatkowania inwestycji offshore [Tax on offshore wind farms – a proposed model for taxing offshore investments], “Przegląd Podatkowy” 2020.

Google Scholar

Schultes-Schnitzlein S., Dettmeier M., The Taxation of German Offshore Wind Farms, “International Tax Review” 2012, no. 23(4).

Google Scholar

Similä J., Soininen N., Paukku E., Towards sustainable blue energy production: an analysis of legal transformative and adaptive capacity, “Journal of Energy & Natural Resources Law”, vol. 40, no 1.

Google Scholar

Wiśniewski G., Michałowska-Knap K., Koć S., Energetyka wiatrowa – stan aktualny i perspektywy rozwoju w Polsce [Wind energy – current status and development prospects in Poland], Warszawa 2012.

Google Scholar

Published

Versions

- 2024-04-26 (2)

- 2023-12-30 (1)

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

PlumX metrics