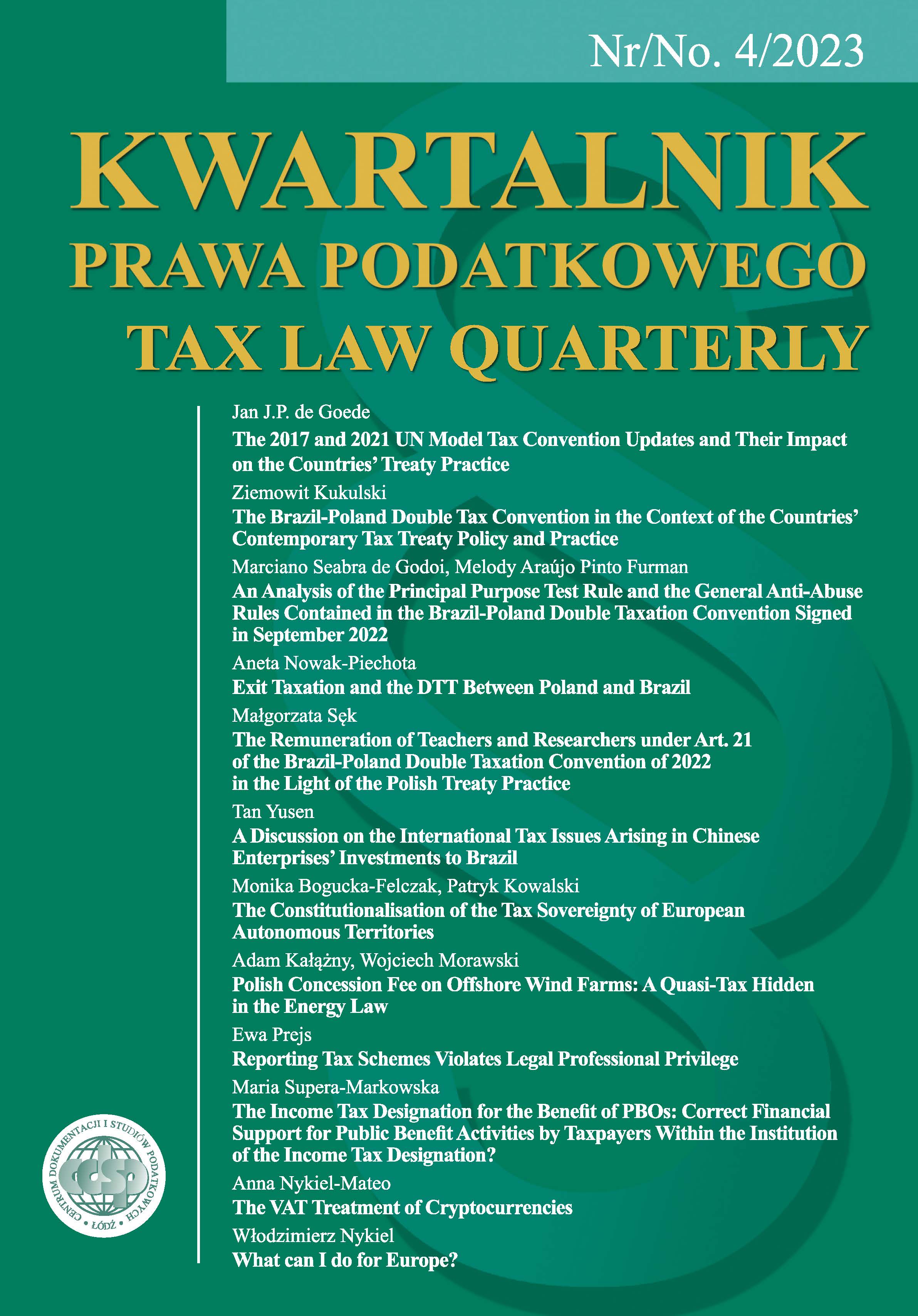

The Constitutionalisation of the Tax Sovereignty of European Autonomous Territories

DOI:

https://doi.org/10.18778/1509-877X.2023.04.07Keywords:

autonomous territory, tax sovereignty, territorial autonomy, taxes, constitutionAbstract

This article presents the results of a comparative legal research concerning tax sovereignty granted to 13 European autonomous territories by constitutional law. Research material includes the constitutions of the main states and legal acts constituting the autonomous territories as well as selected scientific publications in the field of tax sovereignty and territorial autonomy. The most important research findings are as follows: tax sovereignty has been constitutionalised for the vast majority of European autonomous territories (11 out of 13); tax sovereignty has been regulated in only 2 constitutions (but in relation to 7 autonomous territories); the scope of granted tax sovereignty differs between the autonomous territories (some norms indicate the structural elements of the tax, while others define tax sovereignty in very general terms); the provisions granting tax sovereignty are protected against amendment, but, in principle, the approval of the central state is required; Madeira and the Azores are, in the opinion of the authors, characterised by the highest level of constitutionalisation in terms of tax sovereignty.

Downloads

References

Benedikter T., Territorial autonomy as a means of minority protection and conflict solution in the European experience – An overview and schematic comparison, http://www.gfbv.it/3dossier/eu-min/autonomy.html (access: 20.07.2023).

Google Scholar

Benedikter T., The World’s Modern Autonomy Systems. Concepts and Experiences of Regional Territorial Autonomy, Bolzen 2009.

Google Scholar

Bogucka-Felczak M., Konstytucyjne determinany funkcjonowania mechanizmów korekcyjno-wyrównawczych w systemie dochodów jednostek samorządu terytorialnego, Warszawa 2017.

Google Scholar

Bogucka-Felczak M., Kowalski P., Financial Sovereignty of Autonomous Territories in 20th Century Central and Eastern Europe, “Historia Constitucional” 2022, Issue 23.

Google Scholar

Brauner Y., An Essay on BEPS, Sovereignty, and Taxation, [in:] S.A. Rocha, A. Christians (eds.), Tax Sovereignty in the BEPS Era, Kluwer International 2017.

Google Scholar

Christians A., Sovereignty, Taxation and Social Contract, “Minnesota Journal of International Law” 2008, vol. 18.

Google Scholar

Dagan T., Klaus Vogel Lecture 2021: Unbundled Tax Sovereignty – Refining the Challenges, “Bulletin For International Taxation” 2022, July, https://www.ibfd.org/sites/default/files/2022-09/ifa-free-bit-article.pdf

Google Scholar

Elkins Z., Ginsburg T., Melton J., Constitute: The World’s Constitutions to Read, Search, and Compare, https://www.constituteproject.org/content/about (access: 21.07.2023).

Google Scholar

Ghai Y., Woodman S., Practising Self-Government: A Comparative Study of Autonomous Regions, Cambridge University Press 2013.

Google Scholar

Glumińska-Pawlic J., Konstytucyjne gwarancje władztwa podatkowego jednostek samorządu terytorialnego. Teoria i praktyka, [in:] R.P. Krawczyk, A. Borowicz (eds.), Aktualne problemy samorządu terytorialnego po 25 latach jego istnienia, Łódź 2016, https://doi.org/10.18778/8088-114-3.03

Google Scholar

Godula D., Problematyka władztwa podatkowego gminy, [in:] W. Miemiec (ed.), Finanse samorządowe po 25 latach samorządności. Diagnoza i perspektywy, Warszawa 2015.

Google Scholar

https://www.gov.pl/web/diplomacy/mfa-statement-on-the-sixth-anniversary-of-russias-annexation-of-crimea (access: 20.07.2023).

Google Scholar

Ichijo A., What are Territorial Autonomies and Why the Handbook?, [in:] B.C.H. Fong, A. Ichijo (eds.), The Routledge Handbook of Comparative Territorial Autonomies, Routlege, New York 2022.

Google Scholar

Ickiewicz-Sawicka M., Pogranicze Serbsko-Albańskie – konflikt o Kosowo, [in:] J. Regina-Zacharski, R. Łoś (eds.), Sąsiedztwo i pogranicze – między konfliktem a współpracą, tom 2, Łódź 2013.

Google Scholar

Iwanek J., Pojęcie autonomii terytorialnej we współczesnej europejskiej przestrzeni demokratycznej, [in:] M. Domagała, J. Iwanek (eds.), Autonomia terytorialna w perspektywie europejskiej. Tom I. Teoria – Historia, Toruń 2014.

Google Scholar

Kielin Ł., Constitutionalisation of Fiscal Rules in Times of Financial Crises – a cure or a trap?, “Financial Law Review” 2021, no. 22(2).

Google Scholar

Kornberger-Sokołowska E., Bitner M., Prawo finansów samorządowych, Warszawa 2018.

Google Scholar

Łaski P., Autonomous Territory In the Light of International Law, “Teka Komisji Prawniczej PAN Oddział w Lublinie” 2022, XV, no. 1, https://ojs.academicon.pl/tkppan/article/view/4462

Google Scholar

Miemiec W., Prawne gwarancje samodzielności finansowej gminy w zakresie dochodów publicznoprawnych, Wrocław 2005.

Google Scholar

Przyborowska-Klimczak A., The Role of Parliamentary Bodies of Autonomous Territories in European States, “Studia Iuridica Lublinensia” 2022, Issue 5, https://journals.umcs.pl/sil/article/view/14659/pdf

Google Scholar

Raritska V., Tax Sovereignty as a Fundamental Characteristic of Tax Law System, [in:] M. Radvan (ed.), System of Financial Law. System of Tax Law. Conference Proceedings, Brno 2015, https://is.muni.cz/repo/1353424/system-of-tax-law.pdf#page=346

Google Scholar

Suksi M., Sub-State Governance throught Territorial Autonomy. A Comparative Study in Constitutional Law of Powers, Procedures and Institutions, Berlin 2011.

Google Scholar

Tegler E., Władztwo podatkowe gminy, [in:] W. Miemiec, B. Cybulski (eds.), Samorządowy poradnik budżetowy na 1997 rok, Warszawa 1997.

Google Scholar

Published

Versions

- 2024-04-26 (2)

- 2023-12-30 (1)

How to Cite

Issue

Section

License

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

PlumX metrics