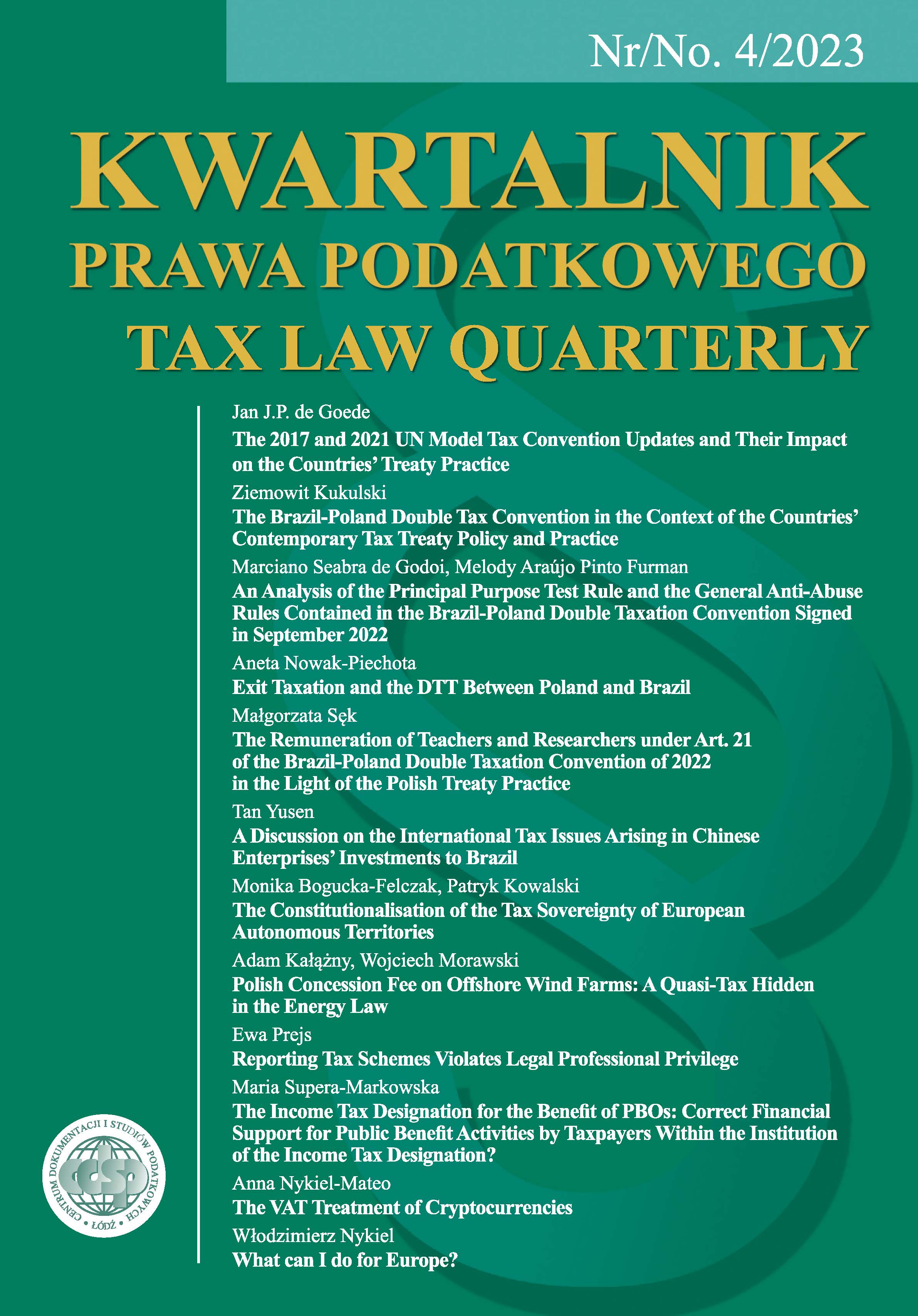

Analiza klauzuli testu celu podstawowego i klauzul ogólnych zawartych w umowie o unikaniu podwójnego opodatkowania między Brazylią i Polską podpisanej we wrześniu 2022 r.

DOI:

https://doi.org/10.18778/1509-877X.2023.04.03Słowa kluczowe:

Brazylia, Polska, umowa o unikaniu podwójnego opodatkowania, klauzule przeciwdziałające nadużyciom traktatu, klauzula testu celu podstawowego (PPT-Rule)Abstrakt

Artykuły dotyczy analizy normatywnych aspektów klauzuli testu celu podstawowego (PPT-Rule) oraz klauzul ogólnych zapobiegających nadużyciom traktatu zawartych w brazylijsko-polskiej bilateralnej umowie o unikaniu podwójnego opodatkowania zawartej 20 września 2022 r. w świetle brazylijskiej polityki i praktyki bilateralnych umów podatkowych. Autorzy omawiają zagadnienia związane z interakcją klauzuli celu testu podstawowego (PPT-Rule) z innymi traktatowymi klauzulami szczególnymi zapobiegającymi traktatowymi przeciwdziałającymi unikaniu opodatkowania, a także obiektywne i subiektywne elementy samej klauzuli testu celu podstawowego (PPT-Rule) oraz możliwe konsekwencje jej stosowania, w szczególności wyzwania związane z wymogami prawnymi zasada pewności.

Pobrania

Bibliografia

Chand V. The Interaction of the Principal Purpose Test (and the Guiding Principle) with Treaty and Domestic Anti-avoidance rules, “Intertax” 2018a, vol. 46, no. 2.

Google Scholar

Chand V. The Principal Purpose Test in the Multilateral Convention: An in-depth Analysis, “Intertax” 2018, vol. 46, no. 1.

Google Scholar

Danon R.J. Treaty Abuse in the Post-BEPS World: Analysis of the policy shift and impact of the principal purpose test for MNE Groups, “Bulletin for International Taxation” 2018, vol. 72, no. 1.

Google Scholar

De Broe L., Luts J. BEPS Action 6: Tax treaty abuse, “Intertax” 2015, vol. 43, no. 2.

Google Scholar

Duff D.J. Tax Treaty Abuse and The Principal Purpose Test – Part 2, “Canadian Tax Journal” 2018, vol. 66, no. 4.

Google Scholar

Elliffe C. The Meaning of the Principal Purpose Test: One Ring to Bind Them All?, “World Tax Journal” 2019, vol. 11.

Google Scholar

Furman M.A.P. Abuso de Tratados Internacionais e a Regra do Principal Purpose Test, Arraes, Belo Horizonte 2022.

Google Scholar

de Godoi M.S., Exercício de Compreensão Crítica do Acórdão do Supremo Tribunal Federal na Ação Direta de Inconstitucionalidade n. 2.446 (2022) e de suas Consequências Práticas sobre o Planejamento Tributário no Direito Brasileiro, “Direito Tributário Atual” 2022, vol. 52, pp. 465–485.

Google Scholar

de Godoi M.S., Cirilo S.B.M., A exigência de um padrão mínimo de combate ao abuso dos Tratados tributários (Ação 6 do Projeto BEPS) e a política fiscal internacional brasileira, “Revista de Direito Internacional Econômico Tributário” 2020, vol. 15, pp. 1–43.

Google Scholar

Gomes M.L., The principal purpose test in the Multilateral Instrument, Lumen Juris, Rio de Janeiro 2021.

Google Scholar

Kuzniacki B., The Principal Purpose Test (PPT) in BEPS Action 6 and the MLI: Exploring Challenges Arising from Its Legal Implementation and Practical Application, “World Tax Journal” May 2018.

Google Scholar

Lang M., BEPS Action 6: Introducting na Antiabuse Rule in Tax Treaties, “Tax Notes International” 2014, vol. 74, no. 7.

Google Scholar

Moreno A.B., GAARs and Treaties: From the Guiding Principle to the Principal Purpose Test. What Have We Gained from BEPS Action 6?, “Intertax” 2017, vol. 45.

Google Scholar

OECD. Model Taxation Convention on Income and on Capital, Condensed Version 2017, OECD Publishing, Paris 2017.

Google Scholar

OECD. OECD/G20 Base Erosion and Profit Shifting Project, Preventing the Granting of Treaty Benefits in Inappropriate Circumstances, Action 6 – 2015 Final Report, OECD Publishing, Paris 2015.

Google Scholar

Pegoraro A., A Cláusula de Principal Propósito (PPT) nos acordos para evitar a dupla tributação da renda, IBDT, Kindle Edition, São Paulo 2021.

Google Scholar

Republic of Brazil & Republic of Poland, Agreement Between the Federative Republic of Brazil and the Republic of Poland for the Elimination of Double Taxation in Respect to Taxes on Income and the Prevention of Tax Abuse, New York 2022, https://concordia.itamaraty.gov.br/detalhamento-acordo/12613?tipoPesquisa=2&TipoAcordo=BL&IdEnvolvido=246

Google Scholar

Schoueri L.E., Moreira C.G., Abuso dos Acordos de Bitributação e Teste do Objetivo Principal: Repensando o Teste do Objetivo Principal à Luz da Segurança Jurídica, [in:] C.A. de Azevedo Campos, G. Da Gama Vital de Oliveira, M.A.F. Macedo (eds.), Direitos Fundamentais e Estado Fiscal: estudos em homenagem ao professor Ricardo Lobo Torres, JusPodivm, Salvador 2019.

Google Scholar

Taboada C.P., OECD Base Erosion and Profit Shifting Action 6: The General Anti-Abuse Rule, “Bulletin for International Taxation” 2015, vol. 69, no. 10.

Google Scholar

Weber D., The Reasonableness Test of the Principal Purpose Test Rule in OECD BEPS Action 6 (Tax Treaty Abuse) versus the EU Principle of Legal Certainty and the EU Abuse of Case Law, “Erasmus Law Review” 2017, no. 1, Online Journal.

Google Scholar

van Weeghel S., A Deconstruction of the Principal Purposes Test, “World Tax Journal” 2019, vol. 11, no. 1.

Google Scholar

Zahra I., The Principal Purpose Test: A Critical Analysis of Its Substantive and Procedural Aspects – Part 1, “Bulletin for International Taxation” 2019a, vol. 73, no. 11, Online Journals.

Google Scholar

Zahra I., The Principal Purpose Test: A Critical Analysis of Its Substantive and Procedural Aspects – Part 2, “Bulletin for International Taxation” 2019b, vol. 73, no. 11, Online Journals.

Google Scholar

Pobrania

Opublikowane

Wersje

- 2024-04-26 - (2)

- 2023-12-30 - (1)

Jak cytować

Numer

Dział

Licencja

Utwór dostępny jest na licencji Creative Commons Uznanie autorstwa – Użycie niekomercyjne – Bez utworów zależnych 4.0 Międzynarodowe.

PlumX metrics