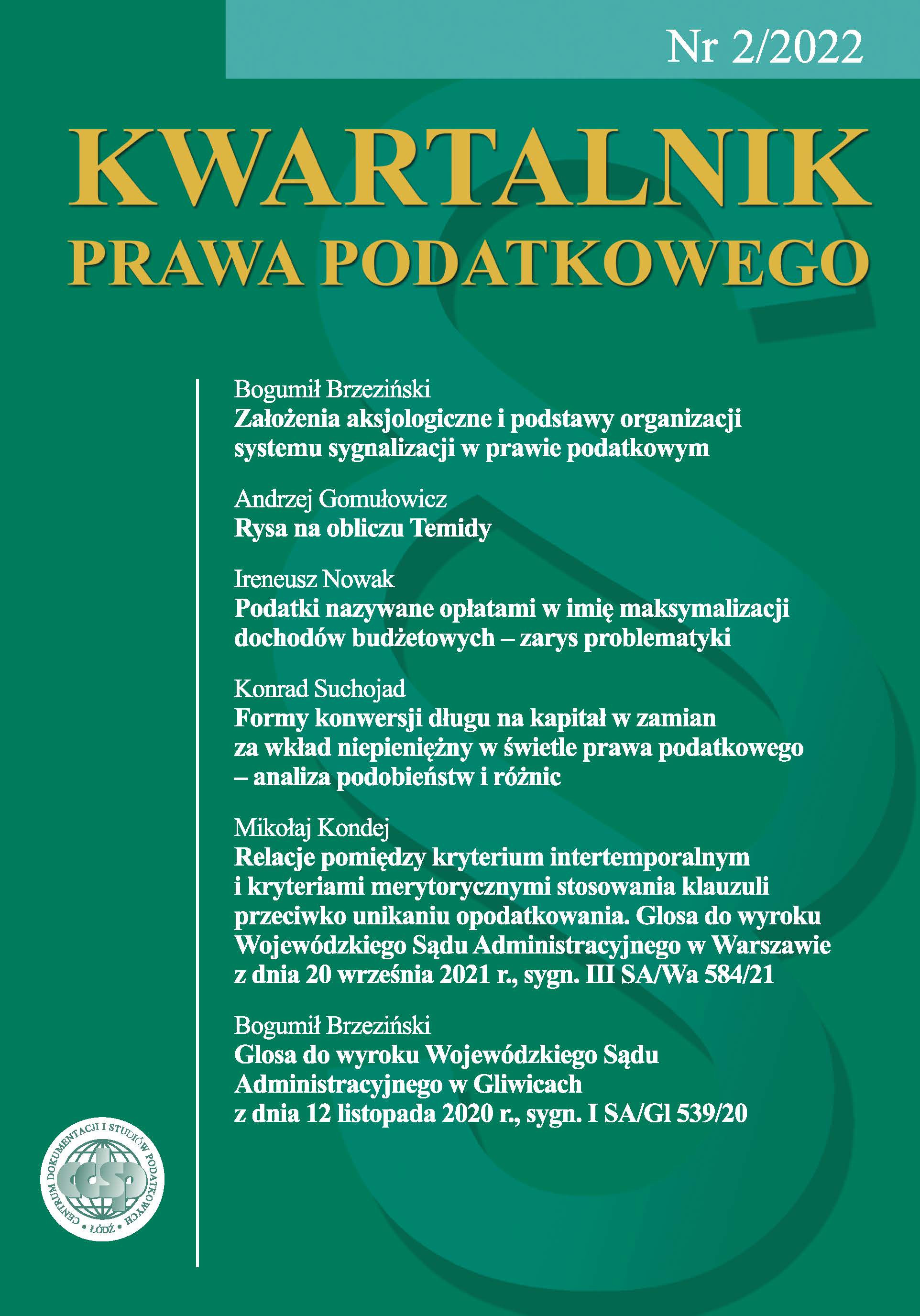

New issue of the Tax Law Quarterly (2/2022)!

Authorities in the field of tax law published their articles in the latest issue of Tax Law Quarterly 2/2022. The following issues were discussed:

Axiological assumptions and basis of organization of the whistleblowing system in the tax law

Bogumił Brzeziński

A scratch on the face of Themis

Andrzej Gomułowicz

Taxes called charges in the name of maximising budget revenues – outline of issues

Ireneusz Nowak

Forms of debt-to-equity swap in exchange for in-kind contributions performance in the light of tax law – similarities and differences analysis

Konrad Suchojad

Relations between intertemporal and substantive criteria of GAAR application. Gloss to the decision of Voivodship Administrative Court in Warsaw of 20 September 2021 (III SA/Wa 584/21)

Mikołaj Kondej

The commentary of the Judgment of the Provincial Administrative Court in Gliwice of November 12, 2020 (I SA/Gl 539/20)

Bogumił Brzeziński

We invite you to read!