THE GEOGRAPHY OF INDUSTRY 4.0 IN A POST-TRANSITION COUNTRY: COMPARING FIRMS ACROSS POLISH REGIONS

Marta GÖTZ  *

*

Barbara JANKOWSKA  *

*

Iwona OLEJNIK  *

*

Abstract. The ubiquitous nature of the technologies of Industry 4.0 (I4.0) might seemingly make geographic location not matter, leaving regional aspects unimportant. This is due to the common assumption that I4.0 technologies and solutions are agnostic about regional equipment and that their peculiarities are space neutral. In this paper, we conduct a comparative analysis of the regional aspects of the fourth industrial revolution in Poland.

The results of our comparative study indicate that the highest degree of saturation in new technologies of I.40 (RDM) is in these regions which are successful in representing high / medium-high technology industries – successfully selling advanced products in high and medium-high technology sectors and are locations of firms that care for their staff and train employees, invest in HR development.

Key words: regions, Industry 4.0, Poland, digital technology, comparison.

1. INTRODUCTION

The ubiquitous nature of the technologies of Industry 4.0 (I4.0) might seemingly make geographic location not matter leaving regional aspects unimportant. This is due to the common assumption that I4.0 technologies and solutions are agnostic about regional equipment and their peculiarities are actually space neutral – they can be applied anytime, anywhere. Smit et al. (2016) defined the term I4.0 as novel products, processes and technologies applied in the management and organisation of firms’ value chains. Laffi and Boschma (2021) have argued that technological paradigm 4.0 is not characterised by a single and easily identifiable technology but it stands for a set of very different technologies (Ménière et al., 2017; Popkova et al., 2019). I4.0 technologies often combine advanced 3.0 technologies (both hardware and software) with technologies pertaining to different application domains. They offer flexibility, improve efficiency alongside the value chain and enable production to be synchronised by integrated ICT systems, replacing traditional isolated production with fully automated and integrated industries (Pelle et al., 2023).

Scholars have a growing perception that the regional dimension along the qualitative study approach needs to be incorporated to fully reflect the far-reaching consequences of the ongoing trends (De Propris and Bellandi, 2021). The literature on the regional dimension of digital transformation is slowly increasing, yet it is evidently dominated, if not monopolised, by studies on advanced regions. It is widely known that all industrialised countries have defined their national programs to facilitate the development of Industry 4.0. In Asia, the leading countries are South Korea, China, and Japan. In 2014, South Korea launched its “Innovation of Manufacturing 3.0” (Kang et al., 2016), China developed the “Made in China 2025” program, and in 2015 Japan announced the “Super Smart Society” plan (Kang et al., 2016; Phuyal et al., 2020). Quite similar attempts are visible in European Union countries. In the EU the Digital Single Market industry-related initiative package has been established and resonates with the EU agenda priorities for 2019−2024. Particularly, EU countries being on the route to Industry 4.0 have established their national programs − Italy has implemented the Piano Industria 4.0, Portugal the i4.0 program, Spain the Industria Conectada 4.0, Austria the Industrie 4.0, Germany the Digital Hub program, the UK the Catapult program, France, in Poland − national program oriented to digitise manufacturing. The development of such programmes at the national and supranational levels reflects the significance of digitisation, especially for the manufacturing sector. These programmes need to be translated to lower levels and their priorities need to be incorporated into the strategies of regions. We hope to address the existing literature gap with our exploration devoted to Poland – a CEE country.

Poland is regarded as a post-transition or semi-periphery country affected by the legacy of communism, described as representing Dependent Market Economy (DME) model of capitalism, heavily based on FDI (Drahokoupil-Myant, 2015). Poland, with its pre-1990 legacy, is below the European average in terms of innovation and digitalisation in manufacturing and is characterised by huge internal differences between the more developed western part of the country and the east (Churski et al., 2021). These differences, which are reflected in the current spatial diversity of socio-economic development levels in Poland, are significantly influenced by historical conditions, especially those resulting from the 18th-century partitions of Poland between three powers (Russia, Prussia, and Austria). Moreover, the spatial differentiation of socio-economic development in Poland at the local level is increasingly influenced by the polarisation of development processes in cities and their functional areas, which results in the marginalisation of many rural areas and contributes to their marginalisation (Churski et al., 2021).

In our opinion, Poland indeed deserves special attention as the (post) transition economy of CEE. According to the DESI 2022 Poland performs quite poorly being positioned 24th among 27 EU countries [EU (2022)], DESI Poland (https://digital-strategy.ec.europa.eu/en/policies/countries-digitisation-performance, accessed on: 23.02.2024).

In this paper, we conduct a comparative analysis of the regional aspects of the fourth industrial revolution in Poland. We want to examine the factors determining the geography of Industry 4.0 in the country, in particular, by establishing if there are any differences and regularities in I4.0 performance among Polish regions or rather geographic distribution is irrelevant to firms’ performance in terms of their digital maturity. If yes, then would like to go deeper and check if there is a pattern suggesting that strong regions help and offer a booster for I4.0 development or rather weak regions cast a shadow – i.e., being embedded in an unpleasant and unfavourable environment hinders the implementation of Industry 4.0.

2. LITERATURE REVIEW AND CONCEPTUAL UNDERPINNINGS

2.1. The adoption of I4.0 technologies among regions – what do we know up until now

In our investigation, we adopted a traditional/narrative literature review of previous studies in line with Grant and Booth (2009). This involved collecting existing relevant research, then excluding papers of inferior quality, and synthesising the key findings from the field to date. This approach, as emphasised by Grant and Booth (2009), allowed for a fairly wide range of topics to be covered with varying degrees of depth and breadth, with different narrative lenses being adopted, and consequently allowed for some advancement of knowledge in a given area of research. As highlighted by Andersen et al. (2024), a narrative literature review relies on expert knowledge and is suitable for exploratory evaluations and the synthesis of findings from different perspectives, thus also allowing for the creation of new perspectives (Gancarczyk, 2019; Sovacool et al., 2018; Torraco, 2005).

The term Industry 4.0 is associated with the fourth industrial revolution. That revolution manifests itself by the adoption of a bundle of new technologies, such as cyber-physical systems (CPS – a combination of physical and digital spaces) (Ciffolilli and Muscio, 2018), the Internet of Things (IoT) and the Internet of Systems (Morrar et al., 2017), additive Manufacturing, Big Data, Artificial Intelligence, Cloud Computing, Augmented and Virtual Reality and Blockchain, Cybersecurity, and 3D printing. These technologies facilitate a profound transformation in the corporate sector which is reflected in the changes in the relationships within and across ecosystems in which companies operate and in how firms run their businesses. The firms are established in particular locations which may be linked to the regional dimension. Thus, the level of the adoption of the I4.0 technologies by firms in a particular region translates to regional digital maturity. The exploitation of those novel solutions reflects how mature in terms of digitalisation a region is.

It is not a novel message that the territory matters for firms’ innovativeness (Beaudry and Shiffauerova, 2009). Corradini et al. (2021) have, by focusing on patent data for four technologies at the core of I4.0 between 2000 and 2014, provided evidence of their uneven distribution across NUTS-2 European regions and confirm the role of regional absorptive capacity, and cognitive and spatial proximity as drivers of I4.0 knowledge flows.

Micek et al. (2022) have investigated whether the fourth industrial revolution or I4.0, do not provide new opportunities for old industrial regions to dynamise new paths of development. One of the Polish regions, i.e., Silesia, represents an atypical transformation towards a high-technological Industry 4.0 path. An active innovation policy and system-level agency enabled the dynamic growth of the Industry 4.0 subsector as the conjuncture of the IT sector and the automotive industry. Crucial for the Silesian path diversification towards the I4.0 pathways are the related variety, existing regional assets, knowledge flows from the outside, and the development of a public-driven side of RIS; in short, new policy instruments and tailor-made organisations.

Götz (2021) conducted a qualitative study on 36 clusters in Germany and demonstrated that local knowledge and the presence of local institutions had been crucial factors that made the I 4.0 solutions attractive for cluster companies. Isaksen et al. (2020) focussed on two clusters in Norway that dealt with three categories of digitalisation. Those studies have revealed that mature districts can move more towards digitalisation in the presence of strong policies that support the cooperation among firms and universities and the training programs for firms’ employees (Isaken et al., 2020). Ingaldi and Ulewicz (2020) studied the adoption of automation and robotics by the metal and metallurgical SMEs belonging to the district of Czestochowa region in Poland and pointed to difficulties related to that process. It appeared that within a cluster operating in that region humans were substituted by I4.0 technologies and robots. That calls for investment to adjust production processes to these new technologies. Other authors express that the existence of clusters or traditional industrial districts, and in particular inter-firm linkages matter for the adoption of I4.0 technologies (De Propris and Bailey, 2020; Hervás-Oliver et al., 2019; Lepore and Spigarelli, 2020). The adoption level may be even more upgraded when there are linkages with foreign entities. These linkages play a role in terms of knowledge exchange.

A case study of Ontario, Canada, and Massachusetts, USA, shows how adequate policies and collaboration can facilitate I4.0. Baker, Gaspard and Zhu (2021) stressed the role of four principal factors: industrial clusters, context, collaborative synergies, and network intermediaries. Balland and Boschma (2021) have showed that European regions with a high potential in terms of I4T-related technologies are more likely to diversify successfully in new I4Ts. Case studies of regions show how I4.0 is transforming local productive systems (Bellandi et al., 2020; De Propris and Bailey, 2020). German, French, and British regions reveal the highest probability of developing I4Ts in the future, while many European regions show a weak potential to contribute to new knowledge production in I4Ts. Nevertheless, these authors found no single geography of I4T in Europe, but many because I4Ts rely on different related technologies that are also located in different regions in Europe. In other words, the geographies of specific I4Ts in Europe tend to reflect the geographical distributions of their most relevant regional capabilities. Thus, it is recommended that public policy intervention that aims to develop I4Ts takes the particular I4T potentials that the region possess as a point of departure. Thus, since the risk of policy failure is high, Balland and Boschma (2021) have argued that regions with a low or no I4T potential should think twice before investing public funds in I4Ts. Public policy should target those regions that have related I4T capabilities as these provide local assets that might be exploited to make the policy effective. The existence of an ecosystem of related technologies is the prerequisite for the effective exploitation of I4T technologies. The growth of those technologies needs to draw on the specific knowledge bases in regions (Balland et al., 2019).

Hervás-Oliver et al. (2021) provided a deep dive into the nascent European Commission (EC) digital innovation hub (DIH) program designed to foster transition into Industry 4.0. The obtained results suggest that DIHs despite their trial-and-error stage are designed to stimulate the advancement of I 4.0 by promoting place-based collaboration alliances that respond to local contextual specificities and demands. DIHs launched in 2016, aimed at creating digital innovation ecosystems in all member nations for the purpose of facilitating digital change. DIHs as “one-stop-shop” help companies to become more competitive with regard to their business/production processes, products or services using digital technologies and operate as if they were digital-dedicated regional clusters or ecosystems to help regional firms to transit towards digitisation. When focusing solely on EU Member States, the countries with the largest number of supportive hubs are as follows: Spain (68), Germany (55), Italy (51), and France (56). These hubs range from those led by accelerators, public universities, regional governments, and public technology transfer organisations to others led by clusters and even SMEs.

Ciffolilli and Muscio (2018) have deployed for studying the geography of I4.0 as a specific proxy of such I4.0 technologies the facts and figures on related Horizon 2020 programmes implemented across EU regions. They showed that research networks in Europe, even in the case of I4.0 were rarely evenly distributed, which raised some concerns considering that the EC for years has been trying to reduce the wide regional differences in R&I performance across the EU. Hence, the H2020 programme besides helping Europe to produce world-class science and technology that drives economic growth aims to contribute to reducing the significant R&D disparities within the EU. Regional EU exploration by Ciffolilli and Muscio (2018) has revealed that capacities in I4.0 remain strongly concentrated not only at an international level but also within Member States. The divide between North-Central Europe and South-Eastern Europe, which is a weakness of the EU framework programmes for R&I, is exacerbated in terms of I4.0 as many if not most Eastern European regions are excluded from these competitive research projects financed by Horizon 2020.

Dyba et al. (2022) found significant differences in ‘digital readiness’. Their study showed that there are significant differences between European regions, mainly related to regional GDP and innovation levels. Unfortunately, the gap in industrial progress and productivity between the most innovative regions and the less prosperous European regions is likely to widen (see Orłowski, 2014). In order to learn more about the regional dimension of digital transformation, the efforts within ESPON are essential. ESPON is an EU-funded programme that bridges research and policy (https://www.espon.eu/about). It aims to support EU development policies, in particular the Cohesion Policy, and to help public authorities benchmark their regions or cities, identify new challenges and potentials, and design successful development policies for the future. ESPON, in cooperation with the European Commission and the Committee of the Regions, has developed LORDIMAS, an interactive digital maturity assessment tool to help local, metropolitan, and regional governments understand where they are in their digital transition journey (https://gis-portal.espon.eu/arcgis/apps/experiencebuilder/experience/?id=975e0dd3bcf84aa9810f0f5b5f7b9b65&page=page_18&views=view_104). However, this tool is not used for Poland due to the lack of appropriate data.

Given what we know so far about the regional dimension of digital transformation, we would like to draw attention to the following issues − key findings that emerge from our analysis. Firstly, it is striking that most studies use proxies for Industry 4.0, such as General Purpose Technologies (GPT) or Key Enabling Technologies (KET), data from HORIZON projects, etc., which interacts with the lack of a concrete definition of Industry 4.0 and reflects the multidimensionality of the issue. Secondly, although studies show that there is no single geography of Industry 4.0, which is a consequence of the lack of specific terminology and the above-mentioned multidimensionality, at the same time most reports confirm persistent regional disparities and growing spatial discrepancies with core-periphery patterns. Thirdly, it should also be stressed that, in addition to studies that describe the general landscape and geography of Industry 4.0 and assess the potential or maturity of regions, there are also studies that propose what should be done to make regions reorient themselves towards I4.0, to change their profiles, highlighting in particular what public support is needed in this regard, what resources are required, etc., and thus addressing regional issues in the context of the transformation of these regions, supported by appropriate policies.

2.2. Facilitators and inhibitors of I4.0 adoption – what are the factors within regions

The disruptive novelty brought about by the 4.0 paradigm relies on the appropriate recombination that leads to a radical change previously not affected by the 3.0 paradigm. Laffi and Boschma (2021) have showed that the relationship between 4.0 technologies and 3.0 technologies is quite heterogeneous, with some 4.0 technologies being technologically closer to the previous 3.0 technological paradigm than others. The diagnosed cumulative dimension between these two streams bears significant implications for the geography of I4.0 innovation in Europe as the probability of developing 4.0 technologies seems larger in those regions that are specialised in the production of 3.0 technologies. Pinheiro et al. (2022) found that low-income and low-complexity regions across Europe tended to be close to simpler technologies and industries, while high-income and high-complexity regions tended to be close to more complex technologies and industries. This implies that diversification may galvanise economic inequalities and polarisation processes across European regions. Peripheral regions need to explore opportunities to diversify into new activities that are related to local activities, preferably in new activities that would lift the overall complexity of their regional economies and policymakers should encourage the development of less complex activities that build on existing local capabilities (Balland et al., 2019).

Those considerations suggest that regions whose economy is penetrated by industries exploiting more advanced technologies and providing products embedding more sophisticated technologies pretend to be leaders in terms of the fourth industrial revolution. The level of technological sophistication in an industry is important for the successful implementation of digital transformation for several reasons. More technologically advanced industries are better able to use cutting-edge technologies to outperform their competitors. They often have well-established systems that make it easier to integrate new digital solutions, while less advanced industries may require more effort to connect to modern technologies. Companies representing high-tech industries may already have a data-driven culture, which is essential for digital transformation (Kinkel et al., 2022; Maroufkhani et al., 2023). In such companies, one is more likely to find skilled professionals with expertise in digital technologies. In addition, technologically advanced industries may have more experience and resources to comply with new regulations on digital transformation, as well as more experience with demanding customers who expect digital engagement. In fact, companies belonging to high-tech industries are part of broader innovation ecosystems, making it easier to access resources, research, and collaboration opportunities for digital projects. It can, therefore, be argued that the level of technological sophistication of an industry influences the readiness, infrastructure, and culture required for successful digital transformation. Thus, the authors formulate the hypothesis (H1):

H1: The operation of firms in technologically sophisticated industries in a region is correlated with the adoption of I4.0 solutions in the region.

Isaksen and Rypestøl (2022) have argued that progress in the fourth industrial revolution of regions’ industries requires relevant assets in firms and in the regional innovation system (RIS). Drawing on two dimensions, firm-level and system-level assets, four types of regions can be identified, which bear obvious implications for policymakers. Firstly, “low-potential regions” that have a low stock of relevant digital assets in both firms and the RIS; secondly, regions with a high stock of assets relevant for digitalisation in firms while without supportive RIS labelled as “firm-driven potential for digitalisation”; thirdly, the opposite “system-driven potential for digitalisation “regions showing a significant volume of RIS but not firm-level digital assets”; and fourthly, “high-potential regions” that are characterised by large stock of relevant assets in firms and RIS. Given the “potential” differences, distinction between actor-based and system-based policy approaches is necessary (Isaksen et al., 2018). Whereas actor-based policy approaches include equipping actors such as firms, universities, or vocational schools, with the required capabilities to adopt or develop digital technologies, system-based policy approaches imply adapting the functioning of RISs so that they provide better support for digitalisation in existing and new firms for instance by ensuring that formal and informal institutions support digitalisation activities and contribute to resolving potential innovation system failures (Klein Woolthuis et al., 2005). As digitalisation is “complex and involves a diverse set of actors it calls for a systemic approach” (Edler and Bonn, 2018, p. 433), “requires continuous adjustments and reflexivity among several involved stakeholders” (Bugge et al., 2018, p. 468), and active governance. Labory et al. (2021) have reckoned that regions have to develop dynamic capabilities to successfully adapt to big disruptions such as I4.0. Dynamic capabilities can mediate between structure and agency in regional path development and promote value creation and capture. Since particular capabilities are embedded in particular actors, much in human resources the quality of them and the investment in the development of human resources is not to be overestimated. Appropriate human resource management plays a crucial role in the successful implementation of Industry 4.0, as these technologies often require employees to acquire new skills, such as data analytics, artificial intelligence and robotics (Behrens et al., 2014; Benhabib and Spiegel, 2005). Successful implementation of I4.0 requires individuals with the right digital skills and knowledge, who can understand the specific roles and competencies required for digital transformation. This is even more important as the introduction of new technologies and processes can be disruptive, requiring support to help employees adapt to new ways of working, manage resistance to change, and ensure a smooth transition. In addition, successful digital transformation requires a shift in an organisation’s culture towards innovation, adaptability and collaboration. Therefore, this culture needs to be shaped and nurtured by promoting values and behaviours that are aligned with the transformation goals. It also requires effective leadership that can guide the organisation through change and inspire its teams. Attracting and retaining talent is essential to keep employees motivated and committed to the organisation’s digital journey. Finally, as digital transformation often involves the handling of sensitive data, ensuring compliance with data privacy and security regulations and educating employees on these issues is paramount. In summary, HR training and management appears to be key to the success of digital transformation initiatives, ensuring that the organisation has the right talent, culture and strategies in place to embrace change and maximise its benefits.

That is why the authors formulate the hypothesis (H2):

H2: The organisation of training for employees by firms in a region to improve the automation of production processes is correlated with the adoption of I4.0 technologies in the region.

Industrial districts (IDs), clusters, and urban agglomerations work as innovation systems. For IDs and clusters to facilitate the adoption of I4.0 technologies by incumbent firms the development of initial territorial conditions is crucial as they will enable the substitutions of the local workforce by machines. These aspects were indicated by Hervás-Oliver et al. (2019) in a paper on the ceramic tile district in the province of Castellon (Spain). Firms in that ID managed to implement digital solutions in their traditional manufacturing processes thanks to the support of ad hoc place-based industrial policies which helped to further develop the system of private and public relationships between the ceramic manufacturing industries and institutions. Clusters are conducive to I4.0 technology adoption since they are founded and value chains of entities which give rise to connectivity (Seetharaman et al., 2019; Szalavetz, 2019). The adoption of I4.0 needs collaborations and compatibility among agents, thus the links to suppliers, customers, competitors, substitute providers, and other cluster incumbents may facilitate the adoption of I4.0 solutions (Schuh et al., 2014; Crupi et al., 2020; Ganzarain and Errasti, 2016). If a location is characterised by the presence of knowledge-intensive business services (KIBS), it can sustain the implementation of Industry 4.0 technologies within manufacturing firms (Corrocher and Cusmano, 2014; Shearmur and Doloreux, 2015) and it provides specialised support in the form of territorial servitisation (Lafuente et al., 2017). The literature presents that regional features may help implement I4.0 solutions in manufacturing SMEs thanks to the promotion of multi-partner collaboration (Hervás-Oliver et al., 2020). And the context supporting the multi-partner collaboration is the context of clusters. Regions may become the foundation for an innovation ecosystem to implement new technologies. The dynamics of adoption of I4.0 technologies may be influenced by the financial support and collective knowledge provisions which are institutional factors at the regional level (Pagano et al., 2020) and clusters work often as repositories of that collective knowledge. There is a huge literature on how the existence of clusters may matter for the adoption of I4.0 solutions (see Table 1) and their importance is well documented in extant literature (Mackiewicz and Götz, 2024).

| Dimensions and aspects of possible cluster role in advancing I4.0 |

Research |

|---|---|

| the technological maturity of companies requires not only access to technology but the proper organisation and context; integration of advanced technologies into manufacturing processes can be done quickly in a conducive environment offering technological, entrepreneurial, and government competencies; including social competencies and the digital literacy of staff. | Giuliani et al., 2020; Mackiewicz and Pavelkova, 2022; Pelle et al., 2020; Naudé et al., 2019 |

| I4.0 as a consistent combination of both technological and business aspects, contingent on an enabling industrial ecosystem and policy regime; adaptation of significant disruptions such as I4.0 requires the right structure and the agency for value creation and capture. | Labory and Bianchi, 2021; Ortt et al., 2020 |

| skilfully guided public policies; adoption of policy instruments; the network structure and government subsidy’s role in crossing the valley of death (transformation of scientific and technological achievements); clusters as organisational vehicles for the diffusion of innovation achievements. | Teixeira and Tavares-Lehmann, 2022; Yin et al., 2022 |

| boundaries between firms are blurring; traditional value chain configuration implies joint participation, increased attention to competition and cooperation. | González-Torres et al., 2020 |

| changing market needs and increasing pressure for innovation; geographical proximity and interaction with other companies and external agents; micro-geographic proximity for the formation of knowledge transfer relationships and different types of inter-organisational relationships; the importance of the “neighbourhood effect”; cognitive proximity between firms; collaboration between businesses and industries, an alternative inter-organisational network driven by competition and cooperation. | Tavares et al., 2021; Ferretti et al., 2021; Molina Morales et al., 2012; Yström and Aspenberg, 2017; Strand, Wiig, Torheim, Solli-Sæther, and Nesset, 2017 |

| the positive effects of agglomeration related to knowledge transfer; the importance of social capital and local institutions; intermediaries in open innovation, mutual trust, compatibility, close cooperation, and standard rules; overcoming barriers; raising awareness of industrial associations, business organisations and cluster initiatives as knowledge gatekeepers, transfer intermediaries and mediators of spontaneous diffusion. | Jankowska et al., 2021; Capello and Lenzi, 2014; Belussi, Sammarra, and Sedita, 2010; Molina-Morales, Capó-Vicedo, Teresa Martínez-Fernández, and Expósito-Langa, 2013; Ortega-Colomer, Molina-Morales, Fernández de Lucio, and Lucio, 2016; McPhillips 2020; Dyba, De Marchi, 2022 |

Source: adopted after Mackiewicz, M. and Götz, M. (2024), Table 1. Why & how clusters (cluster organisations) matter for I4.0.

Thus, the authors formulate the hypothesis (H3):

H3. The presence of clusters in the region is correlated with the adoption of I4.0 technologies among firms in the region.

3. RESEARCH SETTING AND DESIGN

3.1. Data, research variables, and research method

In our study, we purposefully explored factors determining the geography of I4.0, establishing the pattern of relations and defining the role of selected factors in advancing I4.0 in Polish regions.

We combine a critical literature review with quantitative empirical research. The literature review process used the SALSA (Search, Appraisal, Synthesis and Analysis) framework (Grant and Booth, 2009). To collect the primary data, we conducted Computer-Assisted Telephone Interviews (CATIs) and used a questionnaire. The questionnaire had 24 questions; the 5-point Likert and nominal dichotomous scales were applied. Since the aim was to investigate the geography of I4.0 in Poland, we tried to map the regions in Poland according to the I4.0 technologies adoption. The investigation on adopting I4.0 solutions across Polish regions somehow reflects certain initial conditions, i.e., in some areas, it is easier to implement, but in others, it is more complicated. And the level of that adoption may be associated with the regional digital maturity index (RDMI). That is a new measure created and applied for the purpose of that research (details how the index was developed are in Table 2). Thus, the empirical studies were based on primary and secondary statistical data. Information about the use of modern solutions in I4.0 published by Polish public statistics is very vague. It mainly is reduced to using computers and the Internet in their activities. Hence, it was reasonable to conduct our own survey considering modern solutions of I4.0. It was conducted on a representative sample of 400 industrial enterprises.

CATIs were conducted from November 2019 to January 2020 among large and mid-sized companies in Poland that operate in the manufacturing industry – according to the NACE Rev. 2.0. They followed the random selection of those entities. Prevalence (p) (a proportion of a population who have a specific characteristic in a given time period) − in our case, 0.663, i.e., a share of the largest (in terms of the number of employees) enterprises in the population. The margin of error (e) (a percentage that describes how close we can expect a survey result to be relative to the actual population value) − we took 5%. The sampling confidence level shows the reliability of the research (it is expressed as a percentage, which shows a level of certainty regarding how accurately a sample reflects the population within a chosen confidence interval) − in our case it’s 90%.

The dependent variable is the adoption of particular I4.0 technologies by firms established in specific regions of Poland, which corresponds with the regional digital maturity index (RDMI) proposed by the authors (Table 2). The set of I4.0 technologies embraced eleven different solutions: Big Data Analytics, Digital Twin, Internet of Things, Cybersecurity, Cloud Computing, Additive Manufacturing, Virtual Reality, Mobile Technologies, and social media. In that matter, we followed the approach developed by Rüßmann et al. (2015).

| Variables | Definition and measures |

|---|---|

| The regional digital maturity (RDMI) | The regional digital maturity is measured by an index. It is calculated on the basis of the level of adoption of eleven different I4.0 technologies – Big Data Analytics, Digital Twin, Internet of Things, Cybersecurity, Cloud Computing, Additive Manufacturing, Virtual Reality, Mobile Technologies, and social media by firms from a particular region. While investigating the level of adoption of I4.0 technologies we |

| The regional digital maturity (RDMI) (cont.) | referred to the list of I4.0 technologies indicated in the literature (Rüßmann et al., 2015) − big data, autonomous robots, simulation; integration; Internet of things; cybersecurity, cloud computing; additive manufacturing; augmented reality; mobile technologies and social media. Managers representing the companies were asked to use the 5-point Likert scale while assessing the adoption of eleven I4.0 technologies, where 1 stood for – we don’t use it at all − never, 2 − we use it hardly ever, 3 − we use it seldom, 4 – we use it often, 5 – we use very often. The index was calculated as a weighted arithmetic average, where the weight was the frequency of using I4.0 technologies. |

| The operations of firms in technologically advanced industries in the region | The level of technological sophistication of the industry was based on NACE Rev. 2 3-digit level: high technology, medium-high technology, medium-low technology, low technology and coded accordingly. The presence of the technologically sophisticated industries in the region was measured with the share of net income from sales of products of entities included in high and medium-high technology in net income from sales of products of entities included in the section “Manufacturing”. |

| The organisation of trainings for employees by the firm | It was measured by the 5-point Likert scale where 1 means I absolutely don’t agree; 2 – I don’t agree; 3 – I neither agree, nor disagree; 4 – I agree; 5 – I absolutely agree. |

| The presence of clusters in region | It was measured with the number of clusters per 10 million residents in a region, data from the Statistics Poland. |

Source: own work.

The survey data and the secondary empirical data were entered into IBM SPSS Statistics and analysed with selected descriptive statistics, the Pearson correlation coefficient (see 4.2). Then, we used a stepwise linear regression model to examine the relationship between regional maturity (measured by RDMI) and various regional characteristics. In this analysis, only variables that were statistically significantly correlated with RDMI and uncorrelated with each other were included (see 4.3). Stepwise regression is a method for building predictive models by adding or removing predictor variables based on their statistical significance. The model iteratively selects the most relevant variables to explain the dependent variable (RDMI) while excluding less relevant or redundant predictors (Draper and Smith, 1998). The full set of explanatory variables included:

- GDP per capita,

- Number of universities per 10 million inhabitants,

- Number of university graduates per 10,000 inhabitants,

- Number of technology parks per 10 million inhabitants,

- Number of clusters per 10 million inhabitants,

- Total industrial enterprises that cooperated in the scope of innovation activity as % of all enterprises,

- Internal R&D staff per 1,000 professionally active persons,

- Total service sector enterprises that cooperated in the scope of innovation activity as % of all enterprises,

- Entities with foreign capital per 10,000 inhabitants,

- Value of foreign capital per 1 inhabitant in production age (Poland = 100),

- Industrial enterprises cooperating within the framework of a cluster initiatives or other form of cooperation as % of all innovation-active enterprises,

- Share of net revenues from the sale of products of entities classified as high and medium-high technology in net revenues from the sale of products of entities, classified in the section “Industrial processing”.

3.2. Research population and sample

The research population comprised Polish firms located within 16 regions of Poland (NUTS-2) and represented the whole industrial manufacturing sector according to NACE Rev. 2.0.

Most of the firms under the study (66.3%) are large entities – employing 500 or more persons. Then, 5.6% are entities employing from 10 to 49 persons, 15.4% – from 50 to 249 persons, and 12.8% – from 250 to 499. The size structure of the sample reflects the involvement of particular types of enterprises in R&D operations, according to the Central Statistical Office of Poland (2018). The manufacturing firms represented 21 industries NACE Rev.2. Among them, 31 entities belonged to the high-tech industries. The highest number of companies belongs to the manufacturing of food products (18.2%) and the manufacturing of fabricated metal products, except machinery equipment (12.0%). The studied firms are generally private (97.3%) and possess a 100% share of the Polish capital in the ownership structure (76.3%). Most firms operate in the Polish market for 11 to 15 years. Urban agglomerations are the central location of the firms’ manufacturing facilities. Nearly 90% of them are active exporters.

4. FINDINGS

4.1. Digital transformation across the regions in Poland

It appears that there is a considerable variation in the use of I4.0 solutions in different regions of the country. Considering the solutions used, the regions differ to the greatest extent in the use of augmented reality solutions (the coefficient of variation is 142%, 7% of companies in Śląskie (the Lower Silesia) region declare using it, while in 10 regions it is not used at all) and 3D production (the coefficient of variation is 84%), 10% of companies in Zachodniopomorskie (the West Pomeranian) region use it, while in 5 regions not a single company uses it (Table 3).

The technologies used on average by the fewest companies in all regions are augmented reality, 3D manufacturing, and the Industrial Internet of Things, while almost all companies (96%) use cybersecurity. Social media is used frequently or very frequently by 58% of industrial companies, while cloud computing is used by 42%. The use of a cybersecurity solution does not differentiate the development of individual regions, and this variable was eliminated from further analysis.

In the next step, Pearson correlation coefficients were determined between companies using particular I4.0 solutions in specific regions. Diagnostic variables cannot be strongly correlated with each other, as this would mean that they carry the same information. In our case, an excessively strong, statistically significant correlation exists only between mobile technologies and social media. We eliminate social media from further analysis (since technologies differentiate regions more while being less correlated with the other variables).

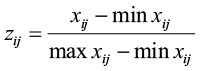

Since the use of particular I4.0 solutions varies quite a bit, a normalisation of diagnostic features was performed using one method – zeroed unitarisation. Zeroed unitisation formula:

where:

zij – normalised value of the j-th feature for the i-th object,

x̅j – arithmetic mean of the j-th feature,

minxij – minimum value of the j-th feature for the i-th object,

maxxij – maximum value of the j-th feature for the i-th object.

Then, the standardised characteristics for a given spatial unit (region) were summed, and a ranking of the regions’ digital maturity was obtained (Regional Digital Maturity Index − RDMI) (Table 3). The regions were then divided into groups similar to each other, considering the average level of the maturity index (x) and the standard deviation (σ), adopting the following rule of thumb:

- regions most mature, i.e., above average: maturity index > [x + σ],

- mature regions: maturity index (from x to x + σ]

- underdeveloped regions: (x to x – σ]

- least developed regions: maturity index < x – σ].

| Region | Big data | Auto- nomous robots |

Simulation | Integration | Internet of things | Cybersecurity | Cloud computing | Additive manufacturing | Augmented reality | Mobile technologies | Social media |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Dolnośląskie | 10.00 | 6.67 | 23.33 | 3.33 | 6.67 | 100.00 | 33.33 | 3.33 | 6.67 | 26.67 | 73.33 |

| Kujawsko-Pomorskie | 4.55 | 4.55 | 18.18 | 4.55 | 0.00 | 95.45 | 36.36 | 0.00 | 0.00 | 9.09 | 40.91 |

| Lubelskie | 0.00 | 7.69 | 46.15 | 7.69 | 7.69 | 100.00 | 46.15 | 0.00 | 0.00 | 7.69 | 61.54 |

| Lubuskie | 7.14 | 7.14 | 35.71 | 14.29 | 7.14 | 100.00 | 64.29 | 7.14 | 0.00 | 28.57 | 71.43 |

| Łódzkie | 13.51 | 2.70 | 29.73 | 5.41 | 5.41 | 94.59 | 40.54 | 5.41 | 5.41 | 13.51 | 56.76 |

| Małopolskie | 9.68 | 3.23 | 16.13 | 9.68 | 6.45 | 93.55 | 45.16 | 3.23 | 0.00 | 16.13 | 48.39 |

| Mazowieckie | 9.09 | 6.82 | 29.55 | 4.55 | 0.00 | 100.00 | 47.73 | 4.55 | 4.55 | 11.36 | 47.73 |

| Opolskie | 25.00 | 18.75 | 25.00 | 12.50 | 6.25 | 100.00 | 31.25 | 0.00 | 0.00 | 25.00 | 81.25 |

| Podkarpackie | 9.09 | 13.64 | 36.36 | 9.09 | 4.55 | 100.00 | 36.36 | 9.09 | 4.55 | 18.18 | 50.00 |

| Podlaskie | 7.14 | 14.29 | 14.29 | 0.00 | 14.29 | 78.57 | 28.57 | 0.00 | 0.00 | 7.14 | 42.86 |

| Pomorskie | 0.00 | 13.64 | 36.36 | 4.55 | 9.09 | 100.00 | 50.00 | 4.55 | 0.00 | 13.64 | 63.64 |

| Śląskie | 6.12 | 10.20 | 30.61 | 14.29 | 8.16 | 97.96 | 46.94 | 4.08 | 2.04 | 16.33 | 65.31 |

| Świętokrzyskie | 9.09 | 13.64 | 36.36 | 13.64 | 0.00 | 100.00 | 50.00 | 0.00 | 4.55 | 18.18 | 59.09 |

| Warmińsko-Mazurskie | 12.50 | 6.25 | 18.75 | 6.25 | 0.00 | 100.00 | 50.00 | 6.25 | 0.00 | 6.25 | 62.50 |

| Wielkopolskie | 5.26 | 13.16 | 21.05 | 10.53 | 2.63 | 97.37 | 42.11 | 5.26 | 0.00 | 7.89 | 52.63 |

| Zachodniopomorskie | 0.00 | 10.00 | 30.00 | 10.00 | 10.00 | 80.00 | 30.00 | 10.00 | 0.00 | 10.00 | 60.00 |

| SD | 6.15 | 4.61 | 8.96 | 4.29 | 4.15 | 6.92 | 9.49 | 3.29 | 2.47 | 7.13 | 11.22 |

| Mean | 8.01 | 9.52 | 27.97 | 8.14 | 5.52 | 96.09 | 42.42 | 3.93 | 1.73 | 14.73 | 58.58 |

| Coefficient of variation | 76.707 | 48.4 | 32.042 | 52.718 | 75.11 | 7.198 | 22.4 | 83.6 | 143 | 48.388 | 19.15 |

Source: own work.

| Position in the ranking |

Level of maturity | Region | Regional maturity index |

|---|---|---|---|

| 1 | The most mature regions – Digital Champions |

Lubuskie | 5.449 |

| 2 | Podkarpackie | 5.036 | |

| 3 | Mature regions – Digital Followers |

Opolskie | 4.564 |

| 4 | Świętokrzyskie | 4.509 | |

| 5 | Śląskie | 4.476 | |

| 6 | Dolnośląskie | 4.012 | |

| 7 | Łódzkie | 3.794 | |

| 8 | Pomorskie | 3.714 | |

| 9 | Zachodniopomorskie | 3.556 | |

| 10 | The less mature regions – Digital Mediocre |

Mazowieckie | 3.319 |

| 11 | Wielkopolskie | 2.974 | |

| 12 | Lubelskie | 2.945 | |

| 13 | Małopolskie | 2.836 | |

| 14 | Warmińsko-Mazurskie | 2.524 | |

| 15 | The least mature regions – Digital Loser |

Podlaskie | 2.048 |

| 16 | Kujawsko-Pomorskie | 1.083 |

Source: own work.

4.2. The relationship between regional maturity and the characteristics of the regions

In the next step, an attempt was made to determine the correlation between the determined regional digital maturity index and the operations of firms that represent the high and medium-high technology sector, the existence of clusters in the region and the organisation of special trainings for employees by firms in the area. Table 5 presents the correlation coefficients between the regional digital maturity index for particular areas and those selected variables. The regional digital maturity index is statistically significantly correlated with the operations of firms that represent the high and medium-high technology sector in the region (0.545) (https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:High-tech_classification_of_manufacturing_industries, accessed on: 23.02.2024) with the organisation of trainings for employees (0.609). And the regional digital maturity index is not correlated with regional clusters. However, it should be underlined that correlation does not show cause-and-effect relationships but only the co-occurrence of two phenomena.

| Pearson Correlation | Sig. (2-tailed) | |

|---|---|---|

| Number of clusters per 10 million residents | 0.025 | 0.927 |

| Share of net income from sales of products of entities included in high and medium-high technology in net income from sales of products of entities included in the section “Manufacturing.” | 0.545* | 0.029 |

| The company organises special training to improve the automation of production processes | 0.609* | 0.012 |

| * Correlation significant at the level of 0.05 (two-sided). | ||

Note: statistically insignificant variables are not included in the table.

Source: own work.

4.3. The relationship between the regional maturity index and companies’ and regions’ characteristics

The analysis assumed a directional relationship and used a linear regression model to determine the relationship between the regional maturity index and the explanatory variables (Table 6). The resulting model included two variables: the organisation of special training to improve the automation of production processes and the share of net product sales revenue of entities classified as high and medium-high technology in net product sales revenue of entities classified in the Manufacturing section (NACE Rev. 2.0). Both of these variables have an additive effect on the explanatory variable. A comparison of standardised coefficients (beta) allows us to conclude that the studied variable (RMI) is more sensitive to changes related to the organisation of training than to the share of net revenues from sales.

| Model | Unstandardised Coefficients | Standardised Coefficients | t | Sig. | |

|---|---|---|---|---|---|

| B | Std. Error | Beta | |||

| (Constant) | –0.298 | 0.801 | –0.372 | 0.716 | |

| The company provides special training to improve the automation of production processes | 0.063 | 0.017 | 0.607 | 3.707 | 0.003 |

| Share of net income from sales of products of entities included in high and medium-high technology in net income from sales of products of entities included in the section Manufacturing (acc. To NACE Rev. 2.0) | 0.038 | 0.014 | 0.458 | 2.794 | 0.015 |

| Model summary R R Square Adjusted R Square Std. Error of the Estimate F statistics |

0.811 0.658 0.606 0.71720 12.528 (Sig.<.001) |

||||

Source: own work.

The regression model is statistically significant throughout (F = 12.528, p < 001) and explains 65.8% of the variation in the phenomenon (R2 = 0.658). VIF and “tolerance” tests show no collinearity between the variables. The model also has the property of coincidence – there is a correspondence between the signs of the parameter ratings and the signs of the correlation coefficients.

5. DISCUSSION

In our paper, we provide insights on comparing the adoption of eleven I4.0 technologies across regions in Poland (NUTS-2). In doing so, we refer to De Propris and Bellandi’s (2021) claim to incorporate the regional dimension of the fourth industrial revolution to fully reflect the far-reaching consequences of the disruptive processes.

The I4.0 technologies impact how and when corporate activities occur and where. New wave technologies affect companies and their locations. Impacting the firms’ locations, they contribute to the digital transformation of companies. Thus, our study contributes to the discussion on how the I4.0 may affect firms and how firms may be impacted by locational factors in these new circumstances. Companies do not operate within particular contexts that may facilitate or hinder their efforts to become innovative businesses and digitally mature organisations. To mature digitally, firms need to introduce I4.0 technologies, but their attempts need to be complemented by features from external settings. Territories equipped with particular socio-economic and institutional solutions may shape the level of I4.0 technology adoption. In conducting the study on the sample of 400 Polish firms located across the 16 regions in Poland, we have indicated how the location of firms impacts their propensity to adopt I4.0 technologies. It is noticeable that most of the previous studies used proximate variables (proxies) of I4.0, such as GPT or KET, HORIZON 2020 projects data, etc., which interact with the lack of a concrete definition of I4.0 and reflect the multidimensionality of the issue. Thus, in our study, we purposefully focused on eleven I4.0 technologies and their adoption to address the challenge of the lack of a concrete definition of I4.0 and, second, not to lose the multidimensionality of the fourth industrial revolution. The review of the literature confirms persistent regional inequalities, and growing spatial discrepancies with core – periphery patterns. And that is visible in our research since we identified four types of regions – the so-called digital champions, digital followers, digital mediocre, and digital losers. The results of our comparative analysis point to the significance of the share of net income from sales of products of entities included in high and medium-high technology in net income from sales of products of entities included in the section “Manufacturing”. Thus, the findings demonstrate that it is the technological intensity of the Manufacturing section (according to NACE Rev. 2.0) in the region that matters.

The results of our study resonate with the voices indicating the need to foster cohesion and reduce disparities among regions in Europe. Our findings bear essential policy implications as they illuminate that the nature of Europe’s diversification process is disproportionately benefitting already advanced regions. Whereas it might be right that some I4.0 adoption activities are spatially concentrated, as it may help Europe to gain leadership and compete with the US and China, it could become a critical policy challenge to promote innovation and diversification in peripheral regions and tackle spatial inequality. This is because related diversification is not a natural process. Still, it needs to be activated and promoted by public policy, as there might be severe bottlenecks in peripheral regions that block related diversification, such as a lack of finance, low education, lack of entrepreneurial culture, or missing regulations. The challenge for firms, regions or individuals remains to develop, create, and adopt the I4.0 technologies and adapt to the disruptive nature of I4.0. Hence, voices indicating that the ambitious goal of European Policy to foster cohesion and reduce disparities in research and technological development may be at risk, and it must be ensured that European regions have adequate capacities to anticipate and adapt to the disruptive nature of I4.0 technologies. Thus, seeking excellence and supporting technological development must be accompanied by actions aiming at reducing the existing divide between European regions and helping them raise capacities to adapt and apply such modern technologies. Most important for the fourth industrial revolution is probably the development of new competencies and skills in the workforce, new firm competencies, new public attitudes, and know-how. I4.0 is all about the business model change, not just the adoption of some technologies; it inevitably requires adjustment in the Human Resources area, including the appropriate parallel transformation of skills, competencies, job descriptions, etc.

Our study aligns with what Laffi and Boschma (2021) have argued about the 4.0 paradigm: it is not associated just with one technology but rather with a set of technologies. Thus, different technologies may be adopted to varying levels across regions. Referring to eleven different technologies, our research shows that almost all companies use cybersecurity solutions; many use social media and cloud computing technologies, while augmented reality, 3D manufacturing and the Industrial Internet of Things are often overlooked.

Previous studies suggested what should be done to make regions reroute towards I4.0 and transit their profiles, in particular stressing what state support was necessary in this regard, what the required resources were, etc., and thus they looked at regional issues in the context of the transformation of these regions assisted by appropriate policies. In our research, it is clear that companies need to relocate specific human resources to monitor and deal with I4.0 challenges and organise special training to improve the automation of production processes. Those are actions on the side of firms, but particular policy measures can facilitate them at the national and regional levels.

Regional labels which reflect the results of our evaluation might come across as indeed surprising and intriguing, warranting further studies. These results could be interpreted as a sign of an uneven and patchy implementation in Poland, and the fact that equipment in certain technologies or other advances does not necessarily translate into I.40 maturity. These rather non-obvious and even surprising results certainly deserve further research and replication in the years to come, but we suspect that they may be a result of the technologies we have chosen for the survey as variables defining the digital revolution, eliminating those that do not differentiate between regions, on the one hand, and the fact that we rely on the explanations and opinions of respondents, which may not always reflect the actual state of affairs, on the other. Our research focuses on examining the relationship between the saturation of the region with 4.0 technology, as measured by the maturity index, and the characteristics of the region and the characteristics of the companies. The results obtained indicate that the maturity of the region and the saturation with selected Industry 4.0 technologies are related to the conscious training strategy and human resources development pursued at the company level and to the resources they obtain from selling their advanced products and services on the markets.

The results obtained are somewhat different from the commonly expected results, which suggest a simple dependence on a region’s endowment with knowledge-related factors, number of universities, patents, and level of GDP, but they do shed light on a new type of dependence, highlighting the conscious strategies adopted by companies and the efforts they put into the process of adopting Industry 4.0. In other words, the saturation of a region with Industry 4.0 technology is not so much the result of general knowledge-related conditions or the level of the economy in a given region but rather the result of more advanced factors and the conscious strategies of companies.

6. CONCLUSION

The results of our comparative study indicate that the highest degree of saturation in new technologies of I.40 (RDM) is in those regions that are successful in representing high/medium-high technology industries − successfully selling advanced products in high and medium-high technology sectors and are locations of firms that care for their staff and train employees, invest in HR development.

In other words, this would confirm the earlier research results (literature findings indicating deepening differences or widening the gap between I4.0 laggards and I4.0 leaders/self-reinforcing mechanisms), indicating that the implementation of Industry 4.0 technologies is more popular among the best performers/champions, the “the winner takes it all”. However, the ranking of Polish regions may be surprising (Lubuskie and Podkarpackie are the leaders). Those who successfully sell advanced manufacturing products and take care of their employees, i.e., who have the resources and can strategically invest them, who can consciously implement new I4.0 technologies. Thus, saturation with new I4.0 technologies results from a conscious training strategy/human resources policy and investment at the company level and more at the regional level, resulting from having significant funds from the sale of high-tech goods to invest. It appears that there is a correlation between the presence of high-tech and medium-high-tech firms in the region and the level of regional digital maturity. In areas where the share of net income from sales of products of entities included in high and medium-high technology in net income from products of entities included in the section “Manufacturing” is higher, the level of I4.0 technologies adoption among the firms in the region is also higher. Thus, the technological sophistication of the firms in the region contributes to the eagerness and openness for solutions of the fourth industrial revolution. The findings of our comparison may add to the discussion on the, unfortunately, perpetuating and deepening divide between technologically more advanced and technologically backward regions. In that context, instead of increasing inclusiveness I4.0 technologies will further differentiate the opportunities for social and economic progress within areas. A solution to that can emerge from another correlation identified in the study. Since the training of employees on automation of production is linked to adopting I4.0 technologies, further investment in the training and upskilling of human resources is needed. The positive message is that firms’ involvement in developing skills can be controlled, and the greater intensity of those developmental activities will translate into adopting I4.0 technologies. Intuitively, we may assume that clusters in a region will determine firms’ adoption of I4.0 technologies in the region where a particular cluster is located. Nevertheless, our comparative analysis has not revealed that kind of result. It stands in opposition to literature. But we need to consider the context of Poland – a CEE, post-transition country where the level of cluster development is still relatively low. Thus, even though clusters are related to innovation, knowledge sharing, and diffusion, they are not that obvious in a CEE country – Poland.

As regions tend to vary in their capacity for successful industrial digitalisation due to different historically accumulated innovative assets at the micro and meso-level, policy aiming at stimulating digitalisation processes in industries must also vary between regions. To formulate a well-suited policy, further investigation of regional determinants of I4.0 technology adoption should be the future research.

Autorzy

Acknowledgements.

The research has followed formal ethics standards on studies including human research participants established by the Committee of Ethical Science Research conducted with the participation of humans at PUEB.

Funds.

This work was supported by the Ministry of Science and Higher Education in Poland within the Regional Excellence Initiative under the Grant 004/RID/2018/19.

REFERENCES

ANDERSEN, A. D., MÄKITIE, T., STEEN, M. and WANZENBÖCK, I. (2024), Integrating industrial transformation and sustainability transitions research through a multi-sectoral perspective. https://doi.org/10.13140/RG.2.2.34164.73602

BAKER, P. M. A., GASPARD, H. and ZHU, J. A. (2021), ‘Industry 4.0/Digitalization and networks of innovation in the North American regional context’, European Planning Studies, 29 (9), pp. 1708−1722. https://doi.org/10.1080/09654313.2021.1963053

BALLAND, P. A., BOSCHMA, R., CRESPO, J. and RIGBY, D. (2019), ‘Smart specialisation policy in the EU: relatedness, knowledge complexity and regional diversification’, Regional Studies, 53 (9), pp. 1252−1268. https://doi.org/10.1080/00343404.2018.1437900

BALLAND, P. A. and BOSCHMA, R. (2021), ‘Mapping the potentials of regions in Europe to contribute to new knowledge production in Industry 4.0 technologies’, Regional Studies, 55 (10−11), pp. 1652−1666. https://doi.org/10.1080/00343404.2021.1900557

BEAUDRY, C. and SHIFFAUEROVA, A. (2009), ‘Who’s right, Marshall or Jacobs? The localisation versus urbanization debate’, Research Policy, 38 (2), pp. 318–337. https://doi.org/10.1016/j.respol.2008.11.010

BEHRENS, K., DURANTON, G. and ROBERT-NICOUD, F. (2014), ‘Productive cities: Sorting, selection, and agglomeration’, Journal of Political Economy, 122 (3), pp. 507–553. https://doi.org/10.1086/675534

BELLANDI, M., DE PROPRIS, L. and SANTINI, E. (2020), ‘A Place-Based View on Industry 4.0 in Local Productive Systems’, L’industria, Società editrice il Mulino, (1), pp. 51−69.

BENHABIB, J. and SPIEGEL, M. M. (2005), ‘Human capital and technology diffusion’, [in:] AGHION, P. and DURLAUF, S. N. (eds), Handbook of Economic Growth (1), pp. 935–966, Elsevier. https://doi.org/10.1016/S1574-0684(05)01013-0

BUGGE, M. M., COENEN, L. and BRANSTAD, A. (2018), ‘Governing socio-technical change: Orchestrating demand for assisted living in ageing societies’, Science and Public Policy, 45 (4), pp. 468−479. https://doi.org/10.1093/scipol/scy010

CHURSKI, P., HERODOWICZ, T., KONECKA-SZYDŁOWSKA, B. and PERDAŁ, R. (2021), ‘Spatial Differentiation of the Socio-Economic Development of Poland – “Invisible” Historical Heritage’, Land, 10 (11), 1247. https://doi.org/10.3390/land10111247

CIFFOLILLI, A. and MUSCIO, A. (2018), ‘Industry 4.0: national and regional comparative advantages in critical enabling technologies’, European Planning Studies, 26 (12), pp. 2323–2343. https://doi.org/10.1080/09654313.2018.1529145

CORRADINI, C., SANTINI, E. and VECCIOLINI, C. (2021), ‘The geography of Industry 4.0 technologies across European regions’, Regional Studies, 55 (10−11), pp. 1667−1680. https://doi.org/10.1080/00343404.2021.1884216

DE PROPRIS, L. and BAILEY, D. (eds) (2020), Industry 4.0 and regional transformations, UK: Routledge.

DE PROPRIS, L. and BELLANDI, M. (2021), ‘Regions beyond Industry 4.0’, Regional Studies, 55 (10−11), pp. 1609−1616. https://doi.org/10.1080/00343404.2021.1974374

DRAHOKOUPIL, J. and MYANT, M. (2015), ‘Putting Comparative Capitalisms Research in Its Place: Varieties of Capitalism in Transition Economies’, [in:] EBENAU, M., BRUFF, I. and MAY, C. (eds), New Directions in Comparative Capitalisms Research, International Political Economy Series, London: Palgrave Macmillan, https://doi.org/10.1057/9781137444615_10

DRAPER, N. and SMITH, H. (1998), Applied Regression Analysis, New York: John Wiley & Sons, Inc.

DYBA, W. and DE MARCHI, V. (2022). ‘On the road to Industry 4.0 in manufacturing clusters: the role of business support organisations’, Competitiveness Review: An International Business Journal, 32 (5), pp. 760−776.

EDLER, J. and BONN, W. P. (2018), ‘The next generation of innovation policy: Directionality and the role of demand-oriented instruments – Introduction to the special section’, Science and Public Policy, 45 (4), pp. 433−434. https://doi.org/10.1093/scipol/scy026

ESPON – https://www.espon.eu/about

GANCARCZYK, M. (2019), ‘The Performance of High-Growers and Regional Entrepreneurial Ecosystems: A Research Framework’, Entrepreneurial Business and Economics Review, 7 (3), pp. 99−123.

GRANT, M. J. and BOOTH, A. (2009), ‘A typology of reviews: an analysis of 14 review types and associated methodologies’, Health information & libraries journal, 26 (2), pp. 91−108.

GÖTZ, M. (2021), Clusters, Digital Transformation and Regional Development in Germany, Routledge.

HERVÁS-OLIVER, J.-L., SEMPERE-RIPOLL, F., ESTELLES-MIGUEL, S. and ROJAS-ALVARADO, R. (2019), ‘Radical vs incremental innovation in Marshallian Industrial Districts in the Valencian Region: what prevails?’, European Planning Studies, 27 (10), pp. 1924−1939. https://doi.org/10.1080/09654313.2019.1638887

HERVÁS-OLIVER, J. L., GONZÁLEZ-ALCAIDE, G., ROJAS-ALVARADO, R. and MONTO-MOMPO, S. (2021), ‘Emerging regional innovation policies for industry 4.0: analyzing the digital innovation hub program in European regions’, Competitiveness Review, 31 (1), pp. 106−129. https://doi.org/10.1108/CR-12-2019-0159

https://digital-strategy.ec.europa.eu/en/policies/countries-digitisation-performance [accessed on: 23.02.2024]

INGALDI, M. and ULEWICZ, R. (2019), ‘Problems with the Implementation of Industry 4.0 in Enterprises from the SME Sector’, Sustainability, 12 (1), p. 217. https://doi.org/10.3390/su12010217

ISAKSEN, A., TRIPPL, M., KYLLINGSTAD, N. and RYPESTØL, J. O. (2020), ‘Digital transformation of regional industries through asset modification’, Competitiveness Review: An International Business Journal, 31 (1), pp. 130−144. https://doi.org/10.1108/CR-12-2019-0140

ISAKSEN, A. and RYPESTØL, J. O. (2022), ‘Policy to support digitalisation of industries in various regional settings: A conceptual discussion’, Norsk Geografisk Tidsskrift – Norwegian Journal of Geography, 76 (2), pp. 82−93. https://doi.org/10.1080/00291951.2022.2060857

JANKOWSKA, B., DI MARIA, E. and CYGLER, J. (2021), ‘Do clusters matter for foreign subsidiaries in the era of industry 4.0? The case of the aviation valley in Poland’, European Research on Management and Business Economics, 27 (2), p. 100150.

KANG, H. S., LEE, J. Y., CHOI, S. S., KIM, H., PARK, J. H., SON, J. Y., KIM, B. H. and NOH, S. D. (2016), ‘Smart manufacturing: past research, present findings, and future directions’, International Journal of Precision Engineering and Manufacturing-Green Technology, 3 (1), pp. 111−128. https://doi.org/10.1007/s40684-016-0015-5

KINKEL, S., BAUMGARTNER, M. and CHERUBINI, E. (2022). ‘Prerequisites for the adoption of AI technologies in manufacturing – Evidence from a worldwide sample of manufacturing companies’, Technovation, 110, 102375. https://doi.org/10.1016/j.technovation.2021.102375

KLEIN WOOLTHUIS, R., LANKHUIZEN, M. and GILSING, V. (2005), ‘A system failure framework for innovation policy design’, Technovation, 25 (6), pp. 609−619. https://doi.org/10.1016/j.technovation.2003.11.002

LABORY, S. and BIANCHI, P. (2021), ‘Regional industrial policy in times of big disruption: building dynamic capabilities in regions’, Regional Studies, 55 (10), pp. 1829−1838. https://doi.org/10.1080/00343404.2021.1928043

LAFFI, M. and BOSCHMA, R. (2021), ‘Does a local knowledge base in Industry 3.0 foster diversification in Industry 4.0 technologies? Evidence from European regions’, Papers in Evolutionary Economic Geography (PEEG) 2112, Utrecht University, Department of Human Geography and Spatial Planning, Group Economic Geography, revised Mar 2021. https://doi.org/10.1111/pirs.12643

LEPORE, D. and SPIGARELLI, F. (2020), ‘Integrating Industry 4.0 plans into regional innovation strategies’, Local Economy, 35 (5), pp. 496−510. https://doi.org/10.1177/0269094220937452

MACKIEWICZ, M. and GÖTZ, M. (2024), ‘The role of clusters in advancing Industry 4.0 solutions: insights from the Polish automotive context’, Digital Policy, Regulation and Governance, 26 (4), pp. 357−374. https://doi.org/10.1108/DPRG-07-2023-0098

MAROUFKHANI, P., IRANMANESH, M. and GHOBAKHLOO, M. (2023), ‘Determinants of big data analytics adoption in small and medium-sized enterprises (SMEs)’, Industrial Management & Data Systems, 123 (1), pp. 278–301. https://doi.org/10.1108/IMDS-11-2021-0695

MEYER, K. E. and PENG, M. W. (2005), ‘Probing theoretically into Central and Eastern Europe: Transactions, resources, and institutions’, Journal of International Business Studies, 36 (6), pp. 600–621.

MÉNIÈRE, Y., RUDYK, I. and VALDES, J. (2017), Patents and the fourth industrial revolution, European Patent Office, Munich, Germany.

MICEK, G., GWOSDZ, K., KOCAJ, A., SOBALA-GWOSDZ, A. and ŚWIGOST-KAPOCSI, A. (2022), ‘The role of critical conjunctures in regional path creation: a study of Industry 4.0 in the Silesia region’, Regional Studies, Regional Science, 9 (1), pp. 23−44. https://doi.org/10.1080/21681376.2021.2017337

MORRAR, R., ARMAN, H. and MOUSA, S. (2017), ‘The Fourth Industrial Revolution (Industry 4.0): A Social Innovation Perspective’, Technology Innovation Management Review, 7 (11), pp. 12−20. http://doi.org/10.22215/timreview/1117

PAGANO, M., WAGNER, CH. and ZECHNER, J. (2020), ‘Disaster Resilience and Asset Prices’, Journal of Financial Economics (JFE), (forthcoming). http://dx.doi.org/10.2139/ssrn.3603666

PINHEIRO, F. L., BALLAND, P. A., BOSCHMA, R. and HARTMANN, D. (2022), ‘The Dark Side of the Geography of Innovation. Relatedness, Complexity, and Regional Inequality in Europe’, Papers in Evolutionary Economic Geography (PEEG), 2202, Utrecht University, Department of Human Geography and Spatial Planning, Group Economic Geography, revised Jan 2022.

PINTAR, N. and SCHERNGELL, T. (2021), ‘The complex nature of regional knowledge production: Evidence on European regions’, Research Policy, 51 (8), 104170. https://doi.org/10.1016/j.respol.2020.104170

PHUYAL, S., BISTA, D. and BISTA, R. (2020), ‘Challenges, Opportunities and Future Directions of Smart Manufacturing: A State of Art Review’, Sustainable Futures, 100023. https://doi.org/10.1016/j.sftr.2020.100023

POPKOVA, E. G., RAGULINA, Y. V. and BOGOVIZ, A. V. (2019), Industry 4.0: Industrial Revolution of the 21st Century, Springer.

RÜßMANN, M., LORENZ, M., GERBERT, P., WALDNER, M., ENGEL, P., HARNISCH, M. and JUSTUS, J. (2015), Industry 4.0: The future of productivity and growth in manufacturing industries, Boston Consulting Group (BCG), pp. 1−14.

SMIT, J., KREUTZER, S., MOELLER, C. and CARLBERG, M. (2016), Industry 4.0, European Parliament.

SOVACOOL, B. K., AXSEN, J. and SORRELL, S. (2018), ‘Promoting novelty, rigor, and style in energy social science: Towards codes of practice for appropriate methods and research design’, Energy Research & Social Science, 45, pp. 12−42.

RAŠKOVIĆ, M. (2022), ‘International business policymaking for a «wicked» world’, Journal of International Business Policy, 5, pp. 353–362. https://doi.org/10.1057/s42214-021-00113-w

TORRACO, R. J. (2005), ‘Writing Integrative Literature Reviews: Guidelines and Examples’, Human Resource Development Review, 4 (3), pp. 356−367. https://doi.org/10.1177/1534484305278283