EXPLORING THE ROLE OF REGIONAL RESEARCH AND DEVELOPMENT SUPPORT IN ENHANCING FOREIGN INVESTMENT IN POLAND: A SPATIAL ANALYSIS PERSPECTIVES

Eristian WIBISONO  *

*

Abstract. This study aims to investigate the nature and drivers of foreign investment in 16 regions of Poland. Using a spatial analysis approach, the study examines the spatial characteristics of the factors that influence foreign investment, namely labour and research and development (R&D) support. The results of the first analysis indicate strong spatial characteristics and interregional correlations in the observed variables, although they are not characterised by spatial dependence. The regression analysis results show that R&D expenditure significantly supports the enhancement of foreign investment alongside the labour factor, which has a more substantial impact.

Key words: foreign investment, labour, research and development (R&D), spatial analysis, Poland.

1. INTRODUCTION

Foreign investment has become a key driver of economic growth in the European Union region, contributing to economic integration and modernisation of the industrial sector in various Member States (Berkowitz et al., 2020; Drahokoupil, 2008; Radosevic and Ciampi Stancova, 2018). Since the transition in the 1990s, the Central and Eastern European (CEE) region, including Poland, has attracted foreign investors by dint of market openness and trade factors, especially after Poland’s accession to the European Union in 2004. Foreign investment in Poland has not only increased competition and market efficiency but has also facilitated the transfer of knowledge and technology. As a resource-rich country in the CEE region, Poland has experienced significant foreign investment, leading to an increase in foreign capital, labour dynamics, infrastructure development, and a diffusion of innovation and technology (Aghion et al., 2011; Gorynia et al., 2009; Krpec and Wise, 2022). With its strategic location in the heart of Europe and the advantageous connections via the Baltic Sea and the Eurasian region, Poland has gained recognition among global investors and ranks among the top ten European countries for foreign investment (Grgić, 2023; Kavalski, 2018; Krpec and Wise, 2022). As an EU Member State, Poland is using EU funds to improve its competitiveness by investing in innovation and infrastructure. Foreign investment in Poland is also increasingly targeting the services and technology sectors, helping to diversify the economy (Churski, 2008; Goujard and Guérin, 2018; Murzyn, 2020). As one of the key players in attracting foreign investment in the European region and beyond, Poland strategically benefits from several location factors, including an ample labour supply, a relatively stable economic environment, and government financial support to strengthen local infrastructure. The Polish government has also implemented various policy initiatives to attract foreign investment by encouraging innovation and strengthening domestic technology by supporting research and innovation activities. The presence of foreign investors has contributed to the growth of the local economy and industry (Brandt, 2018; Kapil et al., 2013; Tuznik and Jasinski, 2022).

Various studies have shown the significant economic impact of foreign investment, including its impact on labour absorption. Conversely, labour, as a critical factor of production, is also an essential consideration in influencing foreign investment decisions (Ambroziak and Hartwell, 2018; Bermejo Carbonell and Werner, 2018; Kurtishi-Kastrati, 2013; Su and Liu, 2016). In addition to the labour supply factor, the role of research and development (R&D) in encouraging foreign investment is also critical. Research conducted by Götz (2020) shows that support for R&D in a region can attract foreign investment because it can increase local innovation and productivity. When combined with the labour supply factor, R&D support directed not only at infrastructure investment but also at improving the quality of R&D personnel is an important input for innovation that will ultimately increase local innovation capacity and thus attract foreign investment (Tóth et al., 2020; Yaghi and Tomaszewski, 2024). Tuznik and Jasinski (2022) and Chybowska et al. (2018) reported that the Polish government has demonstrated the importance of R&D in driving innovation and economic growth by introducing various funding schemes and incentives to encourage domestic and foreign investment. This relationship highlights the need for a deeper understanding of how R&D support directly and indirectly affects foreign investment. However, the importance of regional R&D support in the context of foreign investment is less explored in literature. Previous studies on these factors have tended to consider them separately. There is a limited number of studies which link it to foreign investment, although some studies specifically examine R&D support in the context of foreign investment to support innovation (Castellani et al., 2022; Newman et al., 2015; Sharma, 2019). Conversely, studies of foreign investment are more likely to be associated with key factors of production, such as the quality and quantity of labour, and their impact on the economy (Asongu et al., 2018; Iamsiraroj, 2016; Newman et al., 2015). Therefore, the literature on foreign investment needs more attention, especially on how labour-intensive and knowledge-intensive foreign investment can complement each other. In such cases, a spatial analysis approach becomes important, especially to identify which regions have better availability of production factors, innovation, and productivity to attract foreign investment.

A study by Wibisono (2023) identified a spatial dependence between knowledge inputs and innovation in the Visegrad regions (Poland, Hungary, Czech Republic, and Slovakia). The study found that personnel with specialised skills in R&D significantly impact innovation, while public expenditure on R&D, although significant, negatively impacted innovation in the Visegrad region. A study by Hintošová et al. (2020) in the same region, where the analysis used a fixed effects model, found that R&D spending had a negative effect on FDI inflows in the Visegrad region over the period 1989–2016. Busom et al. (2014) have argued that continuous government funding of R&D can create dependency and reduce the competitiveness of firms, leading to a less competitive and less attractive environment for investment. Zúñiga‐Vicente et al. (2014) and Pellens et al. (2018) have argued that the negative effects of R&D may be due to inefficient resource allocation, with R&D support being directed to less productive and less competitive sectors. Thus, a region may have high R&D support but low foreign investment intensity, or vice versa.

These descriptions reveal some inconsistencies regarding the impact of R&D on foreign investment. Some studies show that R&D support has a positive impact on foreign investment through increased productivity and local innovation. Meanwhile, other studies in regional contexts, such as CEE or Visegrad, show a negative impact of R&D support on innovation and foreign investment inflows. The author argues that each country has specific regional characteristics, so the results may differ in the context of other countries or regions. These phenomena then raise the question of the extent to which R&D support, in addition to human capital support, affects foreign investment in the context of a specific region in a country such as Poland. Specifically, this study questions what the spatial characteristics of foreign investment, labour, and R&D support in Poland are, and to what extent labour and R&D support can influence foreign investment in its spatial context. Using a spatial analysis approach, this study investigates these questions by examining 16 voivodeship regions in Poland. The results of the first analysis indicate that there are strong spatial characteristics and interregional correlations in the observed variables, although they are not characterised by spatial dependence. Most regions in Poland are classified in the high and medium categories for the intensity of each observed variable, yet at least one third of the regions in Poland still need to improve in terms of foreign investment and its enabling factors. Furthermore, the estimation results of this study show that R&D support has a positive and significant influence on foreign investment, alongside the labour factor, whose influence is more substantial. The results of this study provide an essential contribution to the literature specifically examining R&D support or policies related to foreign investment, as well as have implications for broader regional policies of Poland and contribute to academics and practitioners in the field of international studies and regional studies.

The paper is organised as follows. The second section of the paper outlines background literature on foreign investment and its supporting factors, particularly in the context of regional and spatial analysis. The third section outlines the methodological approach used and the steps of the analysis. The fourth section presents the results and a discussion. The fifth section presents conclusions, implications, limitations, and opportunities for future research.

2. LITERATURE REVIEW

The economic characteristics of a region or country often play an essential role in MNEs’ investment decisions. Factors such as the host country’s labour force and the level of knowledge and technology are critical determinants (Castellani et al., 2006; Dunning and Lundan, 2008). These decisions reveal strategic differences in how foreign firms manage costs and acquire critical resources such as labour and knowledge. Recent literature provides valuable insights into foreign direct investment (FDI) preferences, whether for labour-intensive or knowledge-intensive firms or industries (Amoroso and Moncada-Paternò-Castello, 2018; Nielsen et al., 2018). However, there is an urgent need for a deeper understanding of the reasons behind these choices, especially in developing and transition economies such as Poland. Historically, Poland has been an attractive destination for foreign investment in labour-intensive sectors due to its low labour costs and growing infrastructure (Jantoń-Drozdowska and Majewska, 2016). However, as the economy has progressed and its innovation capacity has grown, there has been a noticeable shift towards knowledge-based sectors (Klagge and Klein-Hitpaß, 2010; Salamaga, 2023). This transition requires a comprehensive understanding of how research and development (R&D) policies or technological advances can influence foreign investment decisions. Poland faces particular challenges in transitioning from a labour-intensive to a knowledge-based economy. While the country has made significant investments in high technology and research, it needs to focus on attracting high-quality FDI and ensuring that the positive effects of these investments are spread evenly throughout the economy.

Labour-intensive industries depend highly on labour and often attract foreign direct investment (FDI) because of lower production costs. According to the Heckscher-Ohlin model and the classical theory of comparative advantage, countries with abundant labour at lower wages tend to attract foreign investment in sectors such as light manufacturing, textiles, and agribusiness (Rahman et al., 2019; Siddiqui, 2018). MNCs can reduce costs by taking advantage of cheap labour in these sectors. Some studies suggest that while labour-intensive sectors create jobs and income in the short term, they may be less stable in the long term because firms can quickly shift production to low-cost countries (Omoruyi, 2021). Excessive reliance on labour-intensive foreign investment may hinder economic diversification and long-term innovation, especially in developing countries seeking to transition to a knowledge-based economy. Conversely, knowledge-based firms depend on knowledge, technology, and innovation. Countries that invest in R&D or technological infrastructure often attract foreign investment in high-tech sectors. According to Porter’s (1990) theory of competitive advantage, countries with strengths in innovation and R&D are more likely to attract investment in knowledge-based industries (Ge and Liu, 2022). Studies show that MNEs are attracted to countries with thriving innovation ecosystems that offer advanced technologies, a skilled workforce, and growing markets (Suseno and Standing, 2018). While some studies show that countries with established innovation ecosystems tend to attract knowledge-based foreign investment, the literature needs a comprehensive analysis of the role of factors such as R&D policies in attracting FDI. For economies in transition, such as those in Central and Eastern Europe (CEE), deciding whether to attract foreign investment in labour-intensive or knowledge-intensive activities is challenging. Countries such as Poland have successfully attracted foreign investment in both sectors but with different policy strategies. Initially, foreign investment growth in the early stages of the transition was driven by labour-intensive manufacturing. However, investments in education, research, development, and technology have increased foreign investment inflows into more knowledge-intensive sectors (Bryl, 2018; Wyszkowska-Kuna, 2014).

Research and development funding is increasingly important in attracting foreign direct investment (FDI). By supporting innovation capacity, competitiveness, and technological progress, R&D funding can increase the attractiveness of a country or region to foreign investors (Guimón, 2009; Guimón et al., 2018; Hu and Mathews, 2005). In practice, R&D funding can stimulate foreign investment inflows in several ways. First, investment in R&D promotes the creation and diffusion of innovations, leading to productivity and efficiency gains for local firms (Erdal and Göçer, 2015; Liang, 2017). A strong track record of innovation makes domestic firms more attractive to foreign investors seeking partnerships or a strong base for market entry at the local or regional level. Second, extensive R&D initiatives can foster a highly skilled and educated workforce, an essential factor that multinationals carefully consider when making investment decisions (Hegde and Hicks, 2008; Di Minin et al., 2012; Piva and Vivarelli, 2009). R&D funding is often linked to higher education and technical training programs that can upgrade the local workforce’s skills, attracting multinationals requiring specialised expertise. Third, R&D funding can strengthen a country’s global innovation and technology centre position. A positive reputation can significantly influence foreign investors’ perceptions of a country’s economic potential, encouraging more investment (Dunning and Lundan, 2009; Fu, 2008). Countries known for their vital R&D infrastructure and continued government support for innovation often attract high-tech foreign investment.

Several empirical studies have demonstrated the positive relationship between R&D investment and foreign investment inflows. De Beule and Somers (2017) and Du et al. (2022) have found that increased R&D intensity in a country significantly affects the location preferences of multinational firms, with increased R&D spending increasing the attractiveness of foreign investment. Ben Hassine et al. (2017) and Ghosh et al. (2018) have also concluded that R&D increases the attractiveness of locations for foreign investment and increases the potential for technological spillovers that benefit the domestic economy. The importance of R&D investment in promoting foreign investment is increasingly relevant in economic policy discussions in Central and Eastern Europe, including Poland, Hungary, the Czech Republic, and Slovakia. A recent study by Medve-Bálint and Éltető (2024) shows a positive correlation between increased public R&D funding in CEE including Poland and an increase in foreign investment inflows, especially in the high-tech sector. This suggests that R&D investment is an important policy tool for attracting foreign investment. However, it is important to keep in mind that the effectiveness of R&D investment in attracting foreign investment may depend on various region-specific contextual factors, including the advantage of the region’s location within a country (e.g., capital vs. peripheral), institutional stability, consistent economic policies, and supportive infrastructure (Jindra and Rojec, 2018; Zoltán and Gábor, 2022). Overall, the literature suggests that R&D investment is critical for attracting foreign investment by strengthening innovation capabilities, improving workforce skills, and building an international reputation as a centre of technological excellence.

Regional connectivity is essential in foreign investment location decisions. This can be explained by a spatial economic analysis. According to the agglomeration economic theory, firms tend to cluster together to benefit from lower transportation costs, improved market access, and technology spillovers (Lee and Hwang, 2014; Mariotti et al., 2010). In the context of foreign investment, a high concentration of foreign investment in a region can create an attractive environment for other investors due to improved infrastructure, availability of skilled labour, and strong industrial networks (Götz, 2020; Mariotti et al., 2010; Popescu, 2014). The density of foreign investment in a region can influence the attractiveness of foreign investment in neighbouring regions through the spillover effect mechanism. The spatial economic analysis suggests that investment decisions are influenced not only by a region’s characteristics but also by surrounding regions, especially those that are adjacent or related to it in terms of resource-related factors (Jaworek et al., 2019). For example, if a region has a high concentration of foreign investment in the technology sector, nearby regions may become more attractive for foreign investment due to the proximity of firms, which allows for the sharing of resources and knowledge. In addition, the level of foreign investment density in a region can influence investment decisions in neighbouring regions. Regions with high foreign investment density often become agglomeration centres, attracting other firms in the same industry and promoting economic diversification through multiplier effects. Successful industrial clusters in a region can indicate the quality of local institutions, supportive policies, and economic stability, all of which are attractive to foreign investors (Bailey, 2018; Feldman et al., 2005). These benefits not only attract direct foreign investment to the region but also enhance the reputation and trust of surrounding regions, which ultimately increases their attractiveness to foreign investment as well. The concept of spatial spillovers suggests that the positive effects of foreign investment density can extend beyond regional boundaries and enhance the broader economic potential of the region (Lin and Kwan, 2016; Serwicka et al., 2024). Therefore, government policies aimed at attracting foreign investment may be more effective if designed with these spatial effects in mind. A comprehensive understanding of the spatial interactions between regions and their impact on foreign investment is essential for policymakers to develop strategies that enhance the overall attractiveness of a region.

3. METHODOLOGY

This study is based on secondary data on foreign investment in domestic foreign-affiliated companies in the 16 voivodeships of Poland. The dataset contains information on the presence and activities of these firms in different regions. The study focuses on analysing the spatial distribution patterns of foreign investment and the factors influencing foreign investment decisions in Poland. The analysis is based on the most recent data available on the website of the Polish Statistical Office (https://stat.gov.pl). In the first stage, the spatial distribution of the observed variables is examined. In particular, a spatial analysis is used in this stage to examine the spatial relationship or spatial dependency of foreign investment and its determinants, such as labour force and R&D expenditures. The second step is to estimate the impact of labour force and R&D expenditures on foreign investment. The regression model assesses the impact of labour force (measured by total number of employees) and intramural R&D expenditure by cost type and province/region (RDP_EXP) on foreign investment (measured by total foreign capital, FORG_EQTY). Following the spatial regression estimation procedure outlined by Wibisono (2023), the estimation starts with an ordinary least squares (OLS) regression analysis, followed by an identification of spatial dependence and a subsequent spatial regression analysis. The operationalisation of these variables is documented in Table 1.

| Variables | Information |

|---|---|

| FORG_EQTY | Total foreign capital in firms with more than 10 employees (in million PLN) |

| TOT_EMPL | Total number of employees |

| RDP_EXP | Intramural expenditure on R&D by type of costs and voivodeships in 2020 (in thousands PLN) |

Source: https://stat.gov.pl/en/topics/economic-activities-finances [accessed on: 28.02.2023].

A logical explanation for the existence of spatial dependence effects of observed variables is that geographical distance may change the way knowledge and technology are transmitted from foreign firms to host firms in a given region (Makieła et al., 2021; Thompson and Zang, 2023; Tian and Zhang, 2019). Spatial analysis enables us to interpret the interactions arising from a variable observed at one location in a region as a result of the activity of the same variable in other regions around it (Capik and Drahokoupil, 2011; Orlic et al., 2018). Different sources and spillover mechanisms of foreign investment in one region may have the same or different effects on neighbouring regions. Large geographical distances should technically decelerate technology spillovers. However, with the advancement of the ICT industry today, geographical distance may have a reciprocal relationship with its negative effects (Leamer and Storper, 2017). Long distance or negative geographical proximity can still increase the knowledge spillover effect (Cieślik, 2020; Tchorek, 2016). In addition, geographic distance is expected to affect the spillover effects of foreign investment in terms of agglomeration or labour mobility. Foreign investment firms with greater financial capacity may ignore distance when hiring more skilled workers, leading to high labour intensity in certain regions and beyond (Chellaraj and Mattoo, 2019; Loncan, 2021; Wang et al., 2021).

This study applies the spatial regression analysis procedure by Wibisono (2023, pp. 114−116). Firstly, the spatial distribution analysis is observed to see the spatial distribution and intensity of the observed variables. Secondly, OLS regression and spatial regression analysis of the observed variables are performed. Before estimating spatial regression, it is important to determine the weighting matrix and identify spatial autocorrelation from the results of Moran’s I global univariate statistical analysis. The decision of modelling estimation is based on the best regression estimate among ordinary least squares (OLS), spatial lag model (SLM), and spatial error model (SEM). While the best estimate between SLM and SEM is based on the significance value of one of them or the most significant Lagrange Multiplier (LM) value if both are significant (Anselin, 2005; Lu and Zhang, 2010; Sisman and Aydinoglu, 2022).

The basic OLS equation of the proposed regression estimation models is as follows:

FORG_EQTYi = α + β1 TOT_EMPLi + β2 RD_EXPi + ε

(1)

Spatial regression estimation that meets the requirements of the Spatial Lag Model (SLM) implies the existence of spatial dependence effects resulting from the spillover of lag variables from neighbouring regions. This effect is denoted by the spatial autoregressive coefficient (ρ) and must be evaluated to prove the existence of spatial autocorrelation of the observed lag variables (ρ≠0). The Y variable in one region and the lag variable from another adjacent region are associated with a spatial weighting matrix (W) so that a new variable (ρW) appears in the SLM regression model. This is what distinguishes the SLM spatial regression model from the OLS estimation model. The base equation for SLM is as follows:

Y = α + ρWY + βX + ε

(2)

The spatial regression estimation that meets the requirements of the Spatial Error Model (SEM) indicates the presence of spatial autocorrelation in the error term (ε). In SEM, the composition of ε consists of multiplying ε by the spatial weighting matrix (W). The parameter coefficient of ε is denoted by λ, whose existence must also be evaluated (λ≠0). The basic equation of SEM is as follows:

Y = α + βX + ε; where ε = λWε + ξ

(3)

4. RESULTS AND DISCUSSION

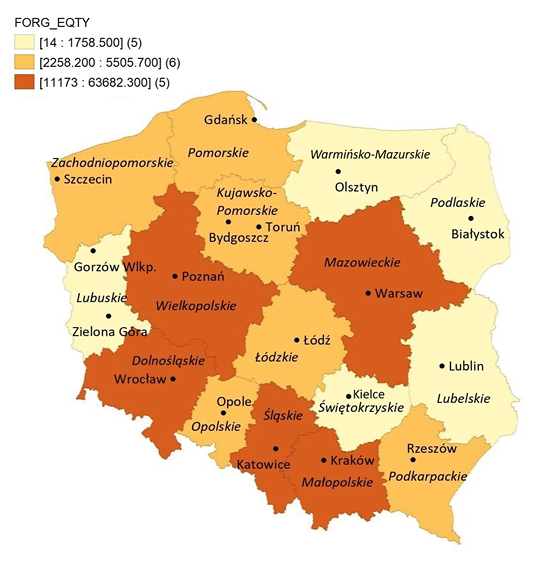

Figure 1 shows the spatial distribution of foreign capital investment in Poland’s 16 provinces (voivodeships). The distribution of foreign investment is shown in three quantile maps. The high quantile group, with foreign investment values ranging from 11,173 million to 63,682 million Polish zlotys (PLN), is represented by dark brown areas. This group includes five regions: Mazowieckie, Małopolskie, Śląskie, Dolnośląskie and Wielkopolskie, all of which are classified as regions with high foreign investment intensity. Mazowieckie, the country’s capital region, is the centre of government institutions and the headquarters of multinational companies. The region is an important economic centre characterised by rapid development, advanced infrastructure and wide market access. Śląskie is known for its strong industrial presence, with various manufacturing and high-tech companies attracted to the area due to its strong innovation and technology ecosystem. Similarly, Dolnośląskie, Wielkopolskie, and Małopolskie have advanced commercial and industrial centres, and strong international connections. Wroclaw, the capital of Dolnośląskie, thrives in manufacturing and electronics, while Poznań, the capital of Wielkopolskie, serves as one of Poland’s largest trade and logistics centres with easy access to Western European markets. Krakow, one of Poland’s most important historic cities, is home to leading universities and research centres that foster an environment conducive to technological innovation and development, making it an attractive destination for foreign investment focused on advanced technology domains.

Source: own work.

In the middle quantile, regions in Poland have attracted foreign investments for PLN 2,258 to 5,505 million. The six regions included in this category are Podkarpackie, Łódzkie, Opolskie, Kujawsko-Pomorskie, Pomorskie, and Zachodniopomorskie. Although not in the highest investment category, these regions offer unique investment potential. Podkarpackie, with Rzeszów as its capital, has a rich history in the aviation industry. The region benefits from a strong engineering and technological infrastructure, with an international airport in Rzeszów facilitating access to global markets and promoting various international partnerships. Łódzkie, located in the central part of Poland with the capital city of Łódź, has a long history of textile and manufacturing industries. Opolskie and Kujawsko-Pomorskie focus their investments on agribusiness, logistics, and light industry. Pomorskie and Zachodniopomorskie, both on the Baltic Sea, are critical players in the maritime economy and host Poland’s strategically important trade, logistics, and transport services industries. The remaining five regions are classified in the lower quantile, with an average foreign investment value of less than PLN 1,758 million. These regions are Warmińsko-Mazurskie, Lubuskie, Lubelskie, Podlaskie, and Świętokrzyskie. These regions are generally characterised by agriculture and light industry, which tend to develop (e.g., Lubelskie, and Lubuskie). Some are advanced in the tourism industry due to their magnificent landscapes (e.g., Warmińsko-Mazurskie, and Podlaskie). Świętokrzyskie has a history of industry, especially mining and minerals, but tends to lag despite being flanked by more developed regions.

Source: own work.

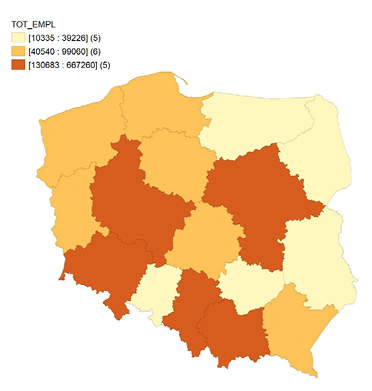

Foreign investment has been a critical driver of labour-intensive industrial development in Poland, where foreign firms often invest in labour-intensive manufacturing sectors such as textiles, electronics, and automotive (Dziemianowicz et al., 2018). In some cases, foreign investment is even directed to regions with abundant labour availability and relatively low labour costs (Drahokoupil et al., 2015; Jantoń-Drozdowska and Majewska, 2016). Figure 2 (left) shows that almost all regional distributions based on labour are similar to the distribution of foreign investment, except for Lubuskie, which has medium labour density but belongs to a region with low foreign investment density. Despite its moderate labour density, the relatively low density of foreign investment in Lubuskie may be due to a lack of specific skills or the level of education required by companies. Moreover, attracting foreign investment often depends on the availability and quality of R&D facilities. According to Crescenzi et al. (2016), regions can attract foreign investment by having a robust R&D infrastructure, mastering essential technologies that are in demand by many firms, or fostering strong innovation networks.

Using a three-quantile classification, the pattern of labour distribution can be categorised into high labour density areas (around 130,000 to 667,000 employees), medium labour density areas (around 40,000 to 100,000 employees), and low labour density areas (less than 40,000 employees). Several factors contribute to this similar spatial distribution pattern. According to Kottaridi et al. (2019), regions that can attract foreign investment usually have skilled labour available to meet the needs of the industry. Consistent with Götz (2020) findings, foreign firms are likely to invest in Polish firms in regions with access to an educated and trained workforce. Götz et al. (2023) and Tarlea (2017) have found that regions with leading universities and colleges in Poland often attract more foreign investment due to the availability of highly skilled graduates. In addition, high-quality infrastructure also facilitates efficient labour allocation, which allows for easy worker mobility. As a result, regions with high-quality infrastructure tend to have higher levels of labour allocation (Horobet et al., 2021; Salike, 2016). Ślusarczyk (2018) found that Polish local governments also offered incentives such as tax breaks or support for skills development to attract foreign investment. These policies not only attract foreign investment but also create jobs at the same time. As foreign investment inflows increase, so does the demand for labour. foreign investment is often industry-specific. Ablov (2015) showed that in Poland, regions with a concentration of specific industries were more likely to attract investment in these sectors and thus created more jobs in these industries. Several previous findings have shown that these points contribute to the pattern of labour distribution, which is reflected in the pattern of foreign investment concentration in Polish regions.

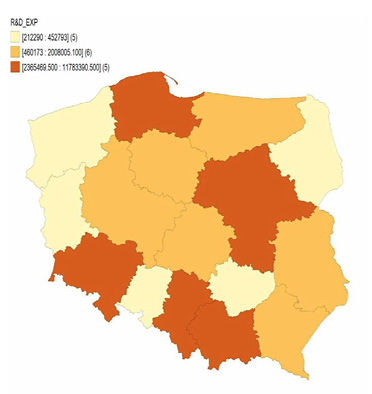

In the map of the spatial distribution of R&D expenditure (Fig. 2, right), the pattern of R&D expenditure is divided into three quantiles. The high quantile includes regions with total R&D expenditure ranging from about PLN 2,400 million to PLN 11,800 million. In particular, Mazowieckie, Małopolskie, Śląskie, Dolnośląskie, and Pomorskie are highlighted in this quantile due to their intensive R&D expenditure, which is represented by dark brown areas. The distribution of R&D in these top regions closely mirrors the distribution of foreign investment. However, while Pomorskie is in the middle quantile for the foreign investment distribution, it is in the top quantile for the R&D expenditure distribution. Moving to the middle quantile, the R&D expenditure of the regions ranges from around PLN 460 million to PLN 2,008 million. Interestingly, Wielkopolska, which is in the high quantile for foreign capital distribution, is classified in the middle quantile for R&D expenditure. Conversely, Lubelskie and Warmińsko-Mazurskie, which are in the lower quantile for foreign capital distribution, are in the middle quantile for R&D expenditure. Finally, the lower quantile includes regions with total R&D expenditure ranging from around PLN 212 million to PLN 452 million. Notably, Zachodniopomorskie has a low R&D density while having a medium foreign investment density, whereas the remaining regions have low densities for both R&D and foreign investment.

From R&D expenditure distribution some questions may arise, such as why there are regions that have low R&D density but can have higher foreign investment density, for example, in Zachodniopomorskie or such as in Pomorskie, which belongs to the high R&D quantile but belongs to the medium foreign investment quantile. In this case, there are several possible reasons behind it. Pomorskie, despite belonging to the high R&D quantile, has a foreign investment density that is only at a medium level due to the role of infrastructure and accessibility that influence investment decisions. According to Bocheński et al. (2021), Pomorskie, which has the leading port in Gdańsk and is one of the main ports on the Baltic Sea, provides direct access to international markets, playing an important role in sea trade and transportation. This sector makes Pomorskie attractive to foreign investors seeking a location with high connectivity and direct access to global markets, regardless of whether the region has a density of R&D activity. Similarly, according to Saidi et al. (2020), a region can attract foreign investment in sectors that are less dependent on R&D, such as traditional manufacturing, transportation, and logistics, where the presence of R&D facilities is not a key determinant, but instead tends to be a facilitator or catalyst. Moreover, regions with lower R&D density may attract foreign investment in sectors that do not require large investments in technological innovation or scientific research but may focus more on strategic location or cost advantages. For instance, this is the case in Zachodniopomorskie, which is classified in the low R&D quantile but belongs to the medium foreign investment quantile. The availability of low operating costs and a competitive labour force could be a significant factor for foreign investment decisions in the region (Götz, 2020). Regions with lower R&D but skilled labour and low cost of living can attract investors, especially in labour-intensive industries that do not require high R&D activities. This allows the region to remain competitive in attracting foreign investment despite its lack of significant research and development activity.

Source: own work.

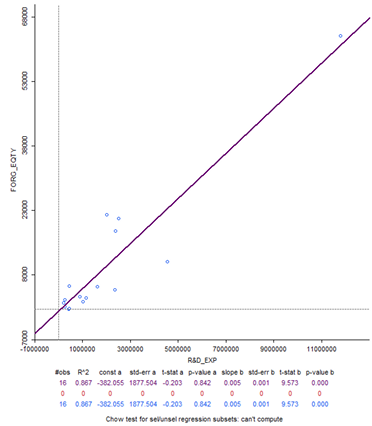

Figure 3 shows a strong positive correlation between the number of employees (by 97.4%) and R&D expenditure (by 86.7%) and foreign investment in the Polish regions. The scatter plot on the left shows a statistically strong positive relationship between total labour and foreign investment in Polish regions. The high level of total labour in Poland acts as a driver of foreign investment growth in these regions. The spatial distribution in Fig. 1 and Fig. 2 shows examples of how much labour is closely related to foreign investment. For example, Mazowieckie, where Poland’s capital is, has the highest quantile distribution for foreign investment and total labour. This is due to the fact that a large city like Warsaw provides access to a well-educated and skilled workforce, thus attracting foreign companies interested in investing or establishing a presence in cities in this region. Several other regions in the spatial distribution map also show that high total labour is likely associated with high foreign investment density. Meanwhile, the scatter plot on the right shows a statistically strong positive relationship between R&D spending and foreign investment. This implies that a larger budget allocated to R&D activities can potentially increase foreign capital inflows into the region. Referring to the spatial distribution maps in Fig. 1 and Fig. 2, for example, the Dolnośląskie (Wrocław) and Pomorskie (Gdańsk) regions are known to have vital innovation ecosystems and provide significant support for R&D activities and foreign investment (Baumane-Vītoliņa and Dudek, 2020). In line with this, some literature also shows that foreign firms often choose locations with high R&D activities with the potential to increase global competitiveness or access to new technologies (Belderbos et al., 2020; Di Minin et al., 2012; Rugman et al., 2012).

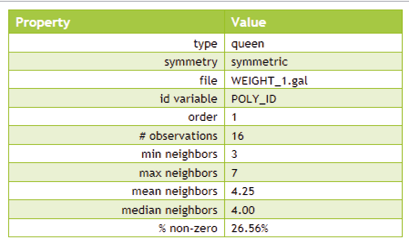

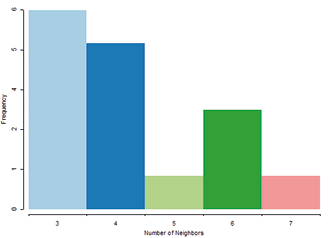

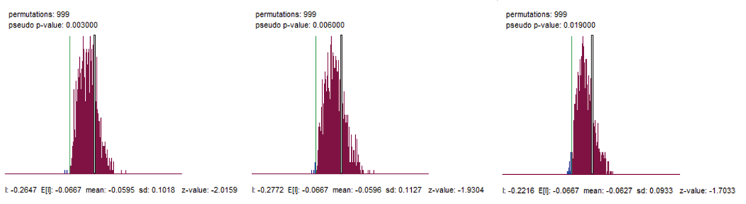

In Figure 4, we can see the spatial weight matrix representing the 16 voivodeship regions in Poland, along with a histogram graph showing their adjacency distribution. The adjacency approach is based on the Queen’s contiguity method, where regions are considered adjacent if they share a common corner or edge. The histogram shows that, on average, voivodeship regions in Poland have 3−5 neighbours, which is particularly noticeable at the edges of the country. Meanwhile, regions in the country’s middle tend to have more neighbours. For example, Łódzkie, Świętokrzyskie, and Mazowieckie have six neighbours, while Wielkopolskie has seven. Next, we examine whether this neighbourliness indicates a spatial autocorrelation between the regions. The chart in Fig. 5 displays the global autocorrelation distribution and Moran’s I values for the three observed variables. Moran’s I statistic is a widely used global spatial autocorrelation measure describing the correlation between the original variable (x-axis) and the spatially lagged variable (y-axis). The slope of the scatterplot corresponds to Moran’s I value (Anselin, 1995, 2005; Anselin and Florax, 2012). This scatterplot indicates negative slopes for the three observed variables, with Moran’s I values of -0.27 for foreign investment, -0.28 for labour, and -0.22 for R&D expenditures. Through a randomisation test with 999 permutations, these three variables were statistically significant with a p-value of less than 0.05. In this context, the negative and significant spatial autocorrelation suggests that high foreign investment, labour, and R&D expenditure values in a region are surrounded by regions with lower values, or vice versa. Szaruga et al. (2022), in their study on spatial autocorrelation in renewable electricity development in Poland, refer to this negative autocorrelation as spatial rivalry, indicating the potential for interregional competition and a tendency for a variable to have spatial distribution characteristics that spread rather than concentrate.

Source: own work.

Source: own work.

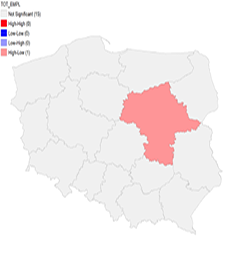

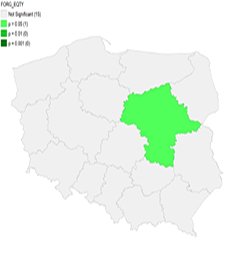

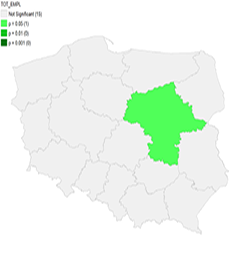

Spatial autocorrelation links global autocorrelation, which concerns the broader regional context, with local autocorrelation, which addresses the characteristics of individual regions. However, it does not indicate the significance of a specific variable within a region (Anselin, 1995; Getis, 2008; Kurek et al., 2021). LISA (Local Indicators of Spatial Association) is used in spatial analysis to identify non-random spatial patterns. The LISA cluster map in Fig. 6 shows groups of regions based on the three observed variables. The left side of the figure shows that there is only one region in Poland (Mazowieckie) that has a statistically significant level of foreign investment of the high-low type, meaning that this region has high foreign investment intensity, but its six neighbouring regions have lower foreign investment intensity. This condition is similar to the labour variable (middle figure), where Mazowieckie also has a significantly high level of labour density, while its six neighbouring regions have a lower level of labour density. This tendency can also be clearly observed in the LISA significance maps shown in Fig. 7 (left and middle), where the distribution of foreign investment and labour in the Mazowieckie region appears to be dispersed rather than spatially clustered.

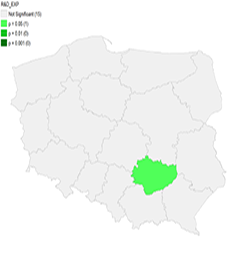

The significance and cluster map in terms of R&D expenditure in Polish regions is somewhat different. There is a significant difference in the level of R&D expenditure in the Świętokrzyskie region (Fig. 6, right), where this region has a low level of R&D expenditure, while its six neighbouring regions have medium and high levels of R&D expenditure, which is also reflected in Fig. 2. The same pattern can also be seen in the LISA significance map in Fig. 7 (right), where R&D expenditure around the Świętokrzyskie region shows distinct characteristics. Capello and Lenzi (2018) and Crescenzi and Gagliardi (2018) have mentioned that less-developed regions can improve their competitiveness through industrial cluster policies or new technologies. Meanwhile, Götz and Jankowska (2017) have stated that forming industrial clusters in less-developed regions urgently requires adequate R&D policies. Świętokrzyskie is characterised as an underdeveloped region where the economic and industrial base is limited to traditional sectors with low R&D intensity. This impacts its economic diversification, which tends to be weak compared to neighbouring regions. The significant difference in R&D expenditure and labour supply in Świętokrzyskie seems closely related to the fact that foreign capital investment in the region is relatively low.

Source: own work.

Source: own work.

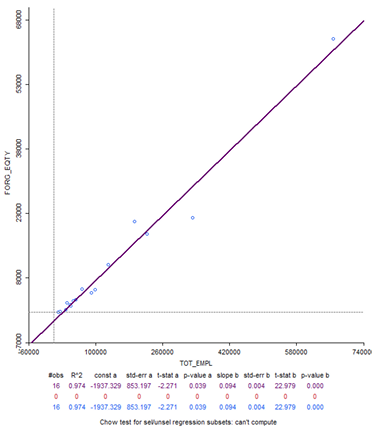

After analysing the spatial characteristics of the three observed variables, the next step is to estimate the impact of labour and R&D expenditures on foreign investment in Polish regions using a spatial regression approach. As described in the methodology section, the first step is to perform an OLS regression of the independent variables on the dependent variable, incorporating the weights obtained from the spatial distribution analysis. Based on the regression results presented in Table 2, the OLS regression results show that labour (TOT_EMPLY) and R&D expenditures (R&D_EXP) have a significant impact on foreign investment (FORG_EQTY), both individually and jointly. The adjusted R-squared value of 0.978 indicates that the two independent variables in the model explain 97.8% of the dependent variable, while other variables outside the model explain the remaining 2.2%. The probability values of the Breusch-Pagan and Jarque-Bera tests that exceed 0.05 indicate the robustness of the model to classical assumption problems such as heteroscedasticity and normality. The next step is to continue the estimation process using spatial regression. To estimate or run a spatial regression, we must first identify the presence of spatial dependence by performing a Lagrange Multiplier (LM) significance test based on the previous OLS model. As shown in Table 3, the OLS model shows insignificant LM values, as all spatial dependence test results yield probability values greater than 0.1. Therefore, the OLS model is the most appropriate model for this estimation process. The mathematical representation of this regression model is expressed in equation 4.

| Ordinary Least Squares Estimation | |||

|---|---|---|---|

| Dependent Variable: FORG_EQTY | |||

| Variables | Coefficient | Std-error | Probability |

| CONSTANT | -1982.83 | 744.859 | 0.01956 |

| TOT_EMPL | 0.0764292 | 0.00847613 | 0.00000 |

| R&D_EXP | 0.00115951 | 0.000499834 | 0.03726 |

| Adjusted R-squared | 0.978923 | ||

| F-statistic | 349.332 | ||

| Prob(F-statistic) | 5.02162e-12 | ||

| Regression Diagnostics | |||

| Multicollinearity | 6.438583 | ||

| Test On Normality of Errors: Jarque-Bera | DF 2 |

Value 0.8388 |

Probability 0.6574 |

| Diagnostics for Heteroskedasticity: Breusch-Pagan Test | DF 2 |

Value 2.6690 |

Probability 0.25936 |

Source: own work.

| Test | MI/DF | Value | Probability |

|---|---|---|---|

| Moran's I (error) | -0.1244 | -0.4583 | 0.64671 |

| LM (lag) | 1 | 0.0775 | 0.78066 |

| Robust LM (lag) | 1 | 0.2835 | 0.59442 |

| Robust LM (error) | 1 | 0.7090 | 0.39976 |

| LM (SARMA) | 2 | 0.7866 | 0.67483 |

Source: own work.

FORG_EQTYi = –1982.83 + 0.0764 TOT_EMPLi + 0.0011 RD_EXPi + ε

(4)

The results of this regression analysis show that the labour variable significantly affects foreign investment in the Polish voivodeship. This result is consistent with our previous observations during the descriptive analysis and the assessment of the spatial distribution. It is also consistent with the previous studies which show that regions with sufficient labour or relatively low labour costs tend to attract foreign investment (Götz, 2020; Siddiqui, 2018; Su et al., 2018). The spatial concentration of labour in some regions of Poland is very similar to the distribution of foreign investment, as shown in Fig. 1 and Fig. 2 (left). This supports the conclusion of Jantoń-Drozdowska and Majewska (2016) that the availability of labour strongly influences the location of foreign investment in transition economies in Europe and that this factor often attracts foreign investment to regions, especially when supported by relatively low labour costs. However, it is important to consider the long-term implications, as regions with high labour availability may become overly dependent on foreign investment, which may hinder innovation and economic diversification. According to Bermejo Carbonell and Werner (2018), a high labour supply may attract foreign investment in the short term but may lead to long-term dependency. Balancing labour-intensive foreign investment with investments in R&D capacity building and innovation is essential to promote sustainable economic growth and regional competitiveness (Cieślik et al., 2021; Paliokaitė, 2019; Yaghi and Tomaszewski, 2024).

The regression analysis results also show that investment in R&D significantly impacts foreign investment in Poland. Similarly, Roszko-Wójtowicz and Grzelak (2021) have found that R&D support for projects in special economic zones and smart specialisation strategies are essential for attracting foreign capital to different regions in Poland. The results also revealed a significant correlation between R&D expenditures and increased foreign investment in regions with high R&D intensity, such as Mazowieckie and Pomorskie. Ge and Liu (2022) have also confirmed that countries with solid R&D support or focusing on knowledge-based industries are more likely to attract foreign investment. Guimón et al. (2018) has argued that substantial R&D funding creates an attractive environment for innovation in developing countries that rely on advanced technologies. Carboni and Medda (2021) have also indicated that innovations resulting from R&D efforts can increase productivity and efficiency, making investments more profitable. Crescenzi and Gagliardi (2018) have argued that strong R&D policies and a supportive institutional environment are crucial for attracting foreign investment by reducing production costs through innovation and creating a more stable ecosystem. These concurrent findings may indicate that Polish regions with strong R&D support tend to have better access to innovation and the latest technologies, so similar support could be extended to weaker Polish regions if they want their regions to be more attractive to multinational companies, especially those that prioritise innovation.

5. CONCLUSIONS

This study aimed to analyse the spatial distribution and influence of labour and R&D expenditures on foreign investment in Polish domestic firms linked to foreign firms through capital investment. The literature has extensively studied the factors influencing foreign investment in Poland, especially in the context of foreign direct investment. However, there is limited literature that examines the impact of R&D expenditures, in addition to labour factors, on foreign investment in a more specific context. This study aimed to fill one of the gaps in the research on foreign investment and, in particular, to show how this R&D expenditure and the labour factor can influence foreign investment in Polish firms in the context of spatial regions. This study used a spatial analysis approach to further investigate the spatial characteristics and distribution and impact of labour factors and R&D expenditures on foreign investment. The results of this study have shown how the three variables are spatially distributed and how their spatial characteristics indicate strong spatial relationships between regions. Although preliminary analysis revealed the presence of significant spatial autocorrelation, this has not led to the identification of spatial dependence in the factors affecting foreign investment in Poland. However, the estimation results indicate that regional R&D support has a significant impact on foreign investment, in addition to labour supply support, which has a much more substantial impact.

The results of this analysis have several implications. First, the spatial distribution analysis shows that sixteen regions in Poland and three observed variables can be simultaneously classified into three parts: five regions with high intensity, six with medium intensity, and five with low intensity. Regions with high foreign investment intensity are supported by preliminary evidence from the spatial distribution analysis that labour supply in the same region tends to have similar foreign investment densities. However, there is little difference in the contribution of R&D to foreign investment, suggesting that the nature of R&D support in specific contexts and interests may be less necessary in some regions (such as regions with high investment due to trade and maritime transport services) but highly essential in others (such as the capital region or regions with specialised industrial clusters). However, lower R&D support does not necessarily lead to a weak effect on foreign investment flows. Second, the interaction between the two factors on foreign investment is further explored through regression analysis. These estimates show that R&D expenditure has a positive and significant effect on foreign capital investment in Polish regions. Looking closely at the mathematical model of the regression estimation results, the strength of the R&D expenditure parameter is not as strong as the labour factor, which in much of the literature has been shown to have a strong influence on the attractiveness of foreign investment. Nevertheless, this condition indicates that R&D support in Polish regions needs serious attention in order to have a greater impact on increasing foreign investment. Third, there are strong indications that foreign investment in Poland tends to be concentrated in labour-intensive industries, which may be profitable in the short term, but may create dependency and potentially reduce economic diversification or technological improvement in the long term. Economists generally argue that economic diversification or technological improvement has a more sustainable long-term impact on the economy. The literature on innovation also shows how a region can increase its productivity in the long run through innovation, which is strongly driven by support for R&D. Therefore, practitioners and policymakers in Poland need to consider that R&D support is essential not only for increasing technological capacity and promoting innovation, but also for making the region an attractive investment destination for foreign investors, especially those concerned with knowledge-intensive industries or those that require continuous innovation. The existence of research and innovation policies can effectively promote this objective.

Finally, the author acknowledges the significant limitations of this study. First, concerning the number of data observations and, in particular, the selection of voivodeship regions. The spatial analysis approach, which started with the analysis of the spatial distribution and its specific characteristics, did not lead to a spatial regression estimation as intended in the analysis or modelling strategy. Although there was some indication of spatial dependence, it did not drive the results of further analysis to find spatial dependence or spatial regression models. The author argues that one of the reasons for this is the insufficient size of the data observations. Therefore, future studies are strongly recommended to further analyse the impact of the variables observed in this study by using more extensive data, such as data at a lower regional level (NUTS-3) or microdata at the firm level. The data observations can also be extended by extending the coverage area to three other regions, such as Hungary, the Czech Republic, and Slovakia, which together with Poland are part of the Visegrad group. Second, in the results and discussion section, the author briefly touches on the unique characteristics of R&D in two adjacent regions directly on the Baltic Sea, namely Zachodniopomorskie and Pomorskie. It is strongly suspected that these two regions have strong maritime characteristics, so that they have the same levels of foreign investment intensity, although these two regions provide different R&D support. It will be interesting for future studies to explore this issue further.

Autorzy

Acknowledgements.

The author expresses gratitude to Professor Tamás Sebestyén, Professor Zoltán Gál, the editorial team, and the anonymous reviewers for their invaluable support, constructive criticism, and insightful suggestions.

Funds.

Project no. TKP2020-IKA-08 has been implemented with the support provided from the National Research, Development and Innovation Fund of Hungary, financed under the 2020-4.1.1-TKP2020 funding scheme. The author gratefully acknowledges the research support and funding provided by the institution.

REFERENCES

ABLOV, A. (2015), ‘The firm-level and regional determinants of FDI distribution in Poland: Does sector of economy matter?’, Ekonomia XXI Wieku, 8, pp. 74–98, Wydawnictwo Uniwersytetu Ekonomicznego we Wrocławiu. http://dx.doi.org/10.15611/e21.2015.4.05

AGHION, P., HARMGART, H. and WEISSHAAR, N. (2011), ‘Fostering growth in CEE countries: a country-tailored approach to growth policy’, Challenges for European Innovation Policy, Edward Elgar Publishing. https://doi.org/10.4337/9780857935212.00011

AMBROZIAK, A. A. and HARTWELL, C. A. (2018), ‘The impact of investments in special economic zones on regional development: the case of Poland’, Regional Studies, 52 (10), pp. 1322–1331, Taylor & Francis. https://doi.org/10.1080/00343404.2017.1395005

AMOROSO, S. and MONCADA-PATERNÒ-CASTELLO, P. (2018), ‘Inward greenfield FDI and patterns of job polarization’, Sustainability, 10 (4), p. 1219, MDPI. https://doi.org/10.3390/su10041219

ANSELIN, L. (1995), ‘Local indicators of spatial association – LISA’, Geographical Analysis, 27 (2), pp. 93–115, Wiley Online Library. https://doi.org/10.1111/j.1538-4632.1995.tb00338.x

ANSELIN, L. (2005), ‘Exploring spatial data with GeoDaTM: a workbook’, Center for Spatially Integrated Social Science, pp. 165–223, https://www.geos.ed.ac.uk/~gisteac/fspat/geodaworkbook.pdf [accessed on: 5.08.2024].

ANSELIN, L. and FLORAX, R. (2012), New Directions in Spatial Econometrics, Springer Science & Business Media, https://link.springer.com/book/10.1007/978-3-642-79877-1 [accessed on: 5.08.2024].

ASONGU, S., AKPAN, U. S. and ISIHAK, S. R. (2018), ‘Determinants of foreign direct investment in fast-growing economies: evidence from the BRICS and MINT countries’, Financial Innovation, Springer, 4 (1), pp. 1–17. https://doi.org/10.1186/s40854-018-0114-0

BAILEY, N. (2018), ‘Exploring the relationship between institutional factors and FDI attractiveness: A meta-analytic review’, International Business Review, 27 (1), pp. 139–148, Elsevier. https://doi.org/10.1016/j.ibusrev.2017.05.012

BAUMANE-VĪTOLIŅA, I. and DUDEK, D. (2020), ‘Innovation ecosystems in the context of economic development: A case study of Kraków, Poland’, Studies of Transition States and Societies, 12 (1), https://nbn-resolving.org/urn:nbn:de:0168-ssoar-69225-1 [accessed on: 5.08.2024].

BELDERBOS, R., DU, H. S. and SLANGEN, A. (2020), ‘When do firms choose global cities as foreign investment locations within countries? The roles of contextual distance, knowledge intensity, and target-country experience’, Journal of World Business, 55 (1), p. 101022, Elsevier. https://doi.org/10.1016/j.jwb.2019.101022

BERKOWITZ, P., MONFORT, P. and PIEŃKOWSKI, J. (2020), ‘Unpacking the growth impacts of European Union Cohesion Policy: Transmission channels from Cohesion Policy into economic growth’, Regional Studies, Taylor & Francis. https://doi.org/10.1080/00343404.2019.1570491

BERMEJO CARBONELL, J. and WERNER, R. A. (2018), ‘Does foreign direct investment generate economic growth? A new empirical approach applied to Spain’, Economic Geography, 94 (4), pp. 425–456, Taylor & Francis. https://doi.org/10.1080/00130095.2017.1393312

DE BEULE, F. and SOMERS, D. (2017), ‘The impact of international R&D on home-country R&D for Indian multinationals’, Transnational Corporations, 24 (1), pp. 27–55, United Nations. https://doi.org/10.18356/f8785646-en

BOCHEŃSKI, T., PALMOWSKI, T. and STUDZIENIECKI, T. (2021), ‘The development of major seaports in the context of national maritime policy. The case study of Poland’, Sustainability, 13 (22), p. 12883, MDPI. https://doi.org/10.3390/su132212883

BRANDT, N. (2018), ‘Strengthening innovation in Poland’, OECD. https://doi.org/10.1787/18151973

BRYL, Ł. (2018), ‘Knowledge-intensive exports of CEE and developed nations – driven by foreign or domestic capital?’, International Entrepreneurship Review, 4 (3), p. 69, Cracow University of Economics, https://ier.uek.krakow.pl/index.php/pm/article/view/1761 [accessed on: 5.08.2024].

BUSOM, I., CORCHUELO, B. and MARTÍNEZ-ROS, E. (2014), ‘Tax incentives… or subsidies for business R&D?’, Small Business Economics, 43, pp. 571–596, Springer. https://doi.org/10.1007/s11187-014-9569-1

CAPELLO, R. and LENZI, C. (2018), ‘Knowledge, innovation and productivity gains across European regions’, Geography of Innovation, pp. 22–38, Routledge. https://doi.org/10.1080/00343404.2014.917167

CAPIK, P. and DRAHOKOUPIL, J. (2011), ‘Foreign direct investments in business services: transforming the Visegrád four region into a knowledge-based economy?’, European Planning Studies, 19 (9), pp. 1611–1631, Taylor & Francis. https://doi.org/10.1080/09654313.2011.586181

CARBONI, O. A. and MEDDA, G. (2021), ‘Innovative activities and investment decision: evidence from European firms’, The Journal of Technology Transfer, 46 (1), pp. 172–196, Springer. https://doi.org/10.1007/s10961-019-09765-6

CASTELLANI, D., CASTELLANI, D. and ZANFEI, A. (2006), Multinational Firms, Innovation and Productivity, Edward Elgar Publishing. https://doi.org/10.4337/9781847201591

CASTELLANI, D., MARIN, G., MONTRESOR, S. and ZANFEI, A. (2022), ‘Greenfield foreign direct investments and regional environmental technologies’, Research Policy, 51 (1), p. 104405, Elsevier. https://doi.org/10.1016/j.respol.2021.104405

CHELLARAJ, G. and MATTOO, A. (2019), ‘Estimating the Knowledge Capital Model for Foreign Investment in Services: The Case of Singapore’, East Asian Economic Review, 23 (2), pp. 111–147. https://dx.doi.org/10.11644/KIEP.EAER.2019.23.2.358

CHURSKI, P. (2008), ‘Structural funds of the European Union in Poland – Experience of the first period of membership’, European Planning Studies, 16 (4), pp. 579–607, Taylor & Francis. https://doi.org/10.1080/09654310801983506

CHYBOWSKA, D., CHYBOWSKI, L. and SOUCHKOV, V. (2018), ‘R&D in Poland: is the country close to a knowledge-driven economy?’, Management Systems in Production Engineering, 26 (2), pp. 99–105. http://dx.doi.org/10.1515/mspe-2018-0016

CIEŚLIK, A. (2020), ‘Determinants of foreign direct investment from OECD countries in Poland’, Eurasian Economic Review, 10, pp. 9–25, Springer. https://doi.org/10.1007/s40822-019-00136-y

CIEŚLIK, E., BIEGAŃSKA, J. and ŚRODA-MURAWSKA, S. (2021), ‘Central and Eastern European states from an international perspective: economic potential and paths of participation in global value chains’, Emerging Markets Finance and Trade, 57 (13), pp. 3587–3603, Taylor & Francis. https://doi.org/10.1080/1540496X.2019.1602519

CRESCENZI, R., DI CATALDO, M. and RODRÍGUEZ‐POSE, A. (2016), ‘Government quality and the economic returns of transport infrastructure investment in European regions’, Journal of Regional Science, 56 (4), pp. 555−582. https://doi.org/10.1111/jors.12264

CRESCENZI, R. and GAGLIARDI, L. (2018), ‘The innovative performance of firms in heterogeneous environments: The interplay between external knowledge and internal absorptive capacities’, Research Policy, 47 (4), pp. 782–795, Elsevier. https://doi.org/10.1016/j.respol.2018.02.006

DRAHOKOUPIL, J. (2008), Globalization and the State in Central and Eastern Europe: The Politics of Foreign Direct Investment, Routledge. https://doi.org/10.4324/9780203892084

DRAHOKOUPIL, J., MYANT, M. and DOMONKOS, S. (2015), ‘The politics of flexibility: Employment practices in automotive multinationals in Central and Eastern Europe’, European Journal of Industrial Relations, 21 (3), pp. 223–240, SAGE Publications Sage UK: London, England. https://doi.org/10.1177/0959680114546437

DU, H. S., BELDERBOS, R., and SOMERS, D. (2022), ‘Research versus development: global cities and the location of MNCs’ cross-border R&D investments’, Regional Studies, 56 (12), pp. 2001–2018, Taylor & Francis. https://doi.org/10.1080/00343404.2022.2033198

DUNNING, J. H. and LUNDAN, S. M. (2008), Multinational Enterprises and the Global Economy, Edward Elgar Publishing. https://doi.org/10.18356/43ce1fe7-en

DUNNING, J. H. and LUNDAN, S. M. (2009), ‘The internationalization of corporate R&D: a review of the evidence and some policy implications for home countries 1’, Review of Policy Research, 26 (1−2), pp. 13–33, Wiley Online Library. https://doi.org/10.1111/j.1541-1338.2008.00367.x

DZIEMIANOWICZ, W., ŁUKOMSKA, J. and AMBROZIAK, A. A. (2018), ‘Location factors in foreign direct investment at the local level: the case of Poland’, Regional Studies, Taylor & Francis. https://doi.org/10.1080/00343404.2018.1530750

ERDAL, L. and GÖÇER, İ. (2015), ‘The effects of foreign direct investment on R&D and innovations: Panel data analysis for developing Asian countries’, Procedia-Social and Behavioral Sciences, 195, pp. 749–758, Elsevier. https://doi.org/10.1016/j.sbspro.2015.06.469

FELDMAN, M., FRANCIS, J., and BERCOVITZ, J. (2005), ‘Creating a cluster while building a firm: Entrepreneurs and the formation of industrial clusters’, Regional Studies, 39 (1), pp. 129–141, Taylor & Francis. https://doi.org/10.1080/0034340052000320888

FU, X. (2008), ‘Foreign direct investment, absorptive capacity and regional innovation capabilities: evidence from China’, Oxford Development Studies, 36 (1), pp. 89–110, Taylor & Francis. https://doi.org/10.1080/13600810701848193

GE, S. and LIU, X. (2022), ‘The role of knowledge creation, absorption and acquisition in determining national competitive advantage’, Technovation, 112, p. 102396, Elsevier. https://doi.org/10.1016/j.technovation.2021.102396

GETIS, A. (2008), ‘A history of the concept of spatial autocorrelation: A geographer’s perspective’, Geographical Analysis, 40 (3), pp. 297–309, Wiley Online Library. https://doi.org/10.1111/j.1538-4632.2008.00727.x

GHOSH, A., MORITA, H. and NGUYEN, X. (2018), ‘Technology spillovers, intellectual property rights, and export-platform FDI’, Journal of Economic Behavior & Organization, 151, pp. 171–190, Elsevier. https://doi.org/10.1016/j.jebo.2018.03.016

GORYNIA, M., NOWAK, J. and WOLNIAK, R. (2009), ‘Poland’s Investment Development Path: in search of a synthesis’, International Journal of Economic Policy in Emerging Economies, 2 (2), pp. 153–174, Inderscience Publishers. https://doi.org/10.1504/IJEPEE.2009.027635

GÖTZ, M. (2020), ‘Attracting foreign direct investment in the era of digitally reshaped international production. The primer on the role of the investment policy and clusters – the case of Poland’, Journal of East-West Business, 26 (2), pp. 131–160, Taylor & Francis. https://doi.org/10.1080/10669868.2019.1692985

GÖTZ, M. and JANKOWSKA, B. (2017), ‘Clusters and Industry 4.0 – do they fit together?’, European Planning Studies, 25 (9), pp. 1633–1653, Taylor & Francis. https://doi.org/10.1080/09654313.2017.1327037

GÖTZ, M., ÉLTETŐ, A. and SASS, M. (2023), ‘Still attractive for FDI? Location advantages of Visegrád countries in the digital era-the case of Poland and Hungary’, European Journal of International Management, 20 (1), pp. 66–88, Inderscience Publishers (IEL). https://doi.org/10.1504/EJIM.2023.130383

GOUJARD, A. and GUÉRIN, P. (2018), ‘Financing innovative business investment in Poland’, OECD. https://doi.org/10.1787/18151973

GRGIĆ, G. (2023), ‘The changing dynamics of regionalism in Central and Eastern Europe: The case of the Three Seas Initiative’, Geopolitics, 28 (1), pp. 216–238, Taylor & Francis. https://doi.org/10.1080/14650045.2021.1881489

GUIMÓN, J. (2009), ‘Government strategies to attract R&D-intensive FDI’, The Journal of Technology Transfer, 34, pp. 364–379, Springer. https://doi.org/10.1007/s10961-008-9091-1

GUIMÓN, J., CHAMINADE, C., MAGGI, C. and SALAZAR-ELENA, J. C. (2018), ‘Policies to attract R&D-related FDI in small emerging countries: Aligning incentives with local linkages and absorptive capacities in Chile’, Journal of International Management, 24 (2), pp. 165–178, Elsevier. https://doi.org/10.1016/j.intman.2017.09.005

BEN HASSINE, H., BOUDIER, F. and MATHIEU, C. (2017), ‘The two ways of FDI R&D spillovers: Evidence from the French manufacturing industry’, Applied Economics, 49 (25), pp. 2395–2408, Taylor & Francis. https://doi.org/10.1080/00036846.2016.1240345

HEGDE, D. and HICKS, D. (2008), ‘The maturation of global corporate R&D: Evidence from the activity of US foreign subsidiaries’, Research Policy, 37 (3), pp. 390–406, Elsevier. https://doi.org/10.1016/j.respol.2007.12.004

HINTOŠOVÁ, A. B., BRUOTHOVÁ, M. and VASKOVÁ, I. (2020), ‘Does foreign direct investment boost innovation? The case of the visegrad and baltic countries’, Quality Innovation Prosperity, 24 (3), pp. 106–121. https://doi.org/10.12776/qip.v24i3.1519

HOROBET, A., POPOVICI, O. C. and BELAȘCU, L. (2021), ‘Shaping competitiveness for driving FDI in CEE countries’, Romanian Journal of European Affairs, 21 (2). http://rjea.ier.gov.ro/wp-content/uploads/2021/12/Art.-4.pdf

HU, M.-C. and MATHEWS, J. A. (2005), ‘National innovative capacity in East Asia’, Research Policy, 34 (9), pp. 1322–1349, Elsevier. https://doi.org/10.1016/j.respol.2005.04.009

IAMSIRAROJ, S. (2016), ‘The foreign dzirect investment–economic growth nexus’, International Review of Economics & Finance, 42, pp. 116–133, Elsevier. https://doi.org/10.1016/j.iref.2015.10.044

JANTOŃ-DROZDOWSKA, E. and MAJEWSKA, M. (2016), ‘Investment attractiveness of Central and Eastern European countries in the light of new locational advantages development’, Equilibrium. Quarterly Journal of Economics and Economic Policy, 11 (1), pp. 97–119. http://dx.doi.org/10.12775/EQUIL.2016.005

JAWOREK, M., SZAŁUCKA, M. and KARASZEWSKI, W. (2019), ‘Limiting factors of foreign direct investment undertaken by Polish enterprises’, Journal of East-West Business, 25 (3), pp. 293–317, Taylor & Francis. https://doi.org/10.1080/10669868.2019.1616648

JINDRA, B. and ROJEC, M. (2018), ‘How to increase knowledge spillovers from foreign direct investment in new EU Member States 1’, Teorija in Praksa, 55 (3), pp. 645–693, University of Ljubljana, Faculty of Social Sciences, https://www.proquest.com/scholarly-journals/how-increase-knowledge-spillovers-foreign-direct/docview/2136873896/se-2 [accessed on: 5.08.2024].

KAPIL, N., PIATKOWSKI, M., RADWAN, I. and GUTIERREZ, J. J. (2013), ‘Poland enterprise innovation support review: from catching up to moving ahead’, World Bank, Washington DC, pp. 11–18. https://documents.worldbank.org/curated/en/914151468093563494/pdf/753250WP0P09660ATION0SUPPORT0REVIEW.pdf [accessed on: 5.08.2024].

KAVALSKI, E. (2018), ‘China’s belt and road initiative in central and Eastern Europe’, Asian International Studies Review, 19 (2), pp. 13–31, Brill. https://doi.org/10.1163/2667078X-01902002

KLAGGE, B. and KLEIN-HITPAß, K. (2010), ‘High-skilled return migration and knowledge-based development in Poland’, European Planning Studies, 18 (10), pp. 1631–1651, Taylor & Francis. https://doi.org/10.1080/09654313.2010.504346

KOTTARIDI, C., LOULOUDI, K. and KARKALAKOS, S. (2019), ‘Human capital, skills and competencies: Varying effects on inward FDI in the EU context’, International Business Review, 28 (2), pp. 375–390, Elsevier. https://doi.org/10.1016/j.ibusrev.2018.10.008

KRPEC, O. and WISE, C. (2022), ‘Grand development strategy or simply grandiose? China’s diffusion of its Belt & Road Initiative into Central Europe’, New Political Economy, 27 (6), pp. 972–988, Taylor & Francis. https://doi.org/10.1080/13563467.2021.1961218

KUREK, S., WÓJTOWICZ, M. and GAŁKA, J. (2021), ‘Using Spatial Autocorrelation for identification of demographic patterns of Functional Urban Areas in Poland’, Bulletin of Geography. Socio-Economic Series, 52. https://doi.org/10.2478/bog-2021-0018

KURTISHI-KASTRATI, S. (2013), ‘The Effects of Foreign Direct Investments for Host Country’s Economy’, European Journal of Interdisciplinary Studies, 5 (1), https://ejist.ro/files/pdf/369.pdf [accessed on: 5.08.2024].

LEAMER, E. E. and STORPER, M. (2017), ‘The economic geography of the internet age’, Economy, Routledge, pp. 431–455. https://doi.org/10.1057/palgrave.jibs.84909988

LEE, K.-D. and HWANG, S.-J. (2014), ‘Regional heterogeneity and location choice of FDI in Korea via agglomeration and linkage relationships’, Journal of the Asia Pacific Economy, 19 (3), pp. 464–487, Taylor & Francis. https://doi.org/10.1080/13547860.2014.908535

LIANG, F. H. (2017), ‘Does foreign direct investment improve the productivity of domestic firms? Technology spillovers, industry linkages, and firm capabilities’, Research Policy, 46 (1), pp. 138–159, Elsevier. https://doi.org/10.1016/j.respol.2016.08.007

LIN, M. and KWAN, Y. K. (2016), ‘FDI technology spillovers, geography, and spatial diffusion’, International Review of Economics & Finance, 43, pp. 257–274, Elsevier. https://doi.org/10.1016/j.iref.2016.02.014

LONCAN, T. (2021), ‘The effects of project scale on FDI location choices: Evidence from emerging economies’, Management International Review, 61 (2), pp. 157–205, Springer. https://doi.org/10.1007/s11575-021-00442-1

LU, J. and ZHANG, L. (2010), ‘Evaluation of parameter estimation methods for fitting spatial regression models’, Forest Science, 56 (5), pp. 505–514, Oxford University Press. https://doi.org/10.1093/forestscience/56.5.505

MAKIEŁA, K., WOJCIECHOWSKI, L. and WACH, K. (2021), ‘Effectiveness of FDI, technological gap and sectoral level productivity in the Visegrad Group’, Technological and Economic Development of Economy, 27 (1), pp. 149–174. https://doi.org/10.3846/tede.2020.14017

MARIOTTI, S., PISCITELLO, L. and ELIA, S. (2010), ‘Spatial agglomeration of multinational enterprises: the role of information externalities and knowledge spillovers’, Journal of Economic Geography, 10 (4), pp. 519–538, Oxford University Press. https://doi.org/10.1093/jeg/lbq011

MEDVE-BÁLINT, G. and ÉLTETŐ, A. (2024), ‘Economic nationalists, regional investment aid, and the stability of FDI-led growth in East Central Europe’, Journal of European Public Policy, 31 (3), pp. 874–899, Taylor & Francis. https://doi.org/10.1080/13501763.2024.2305834

DI MININ, A., ZHANG, J. and GAMMELTOFT, P. (2012), ‘Chinese foreign direct investment in R&D in Europe: A new model of R&D internationalization?’, European Management Journal, 30 (3), pp. 189–203, Elsevier. https://doi.org/10.1016/j.emj.2012.03.004

MURZYN, D. (2020), ‘Smart growth in less developed regions – the role of EU structural funds on the example of Poland’, Innovation: The European Journal of Social Science Research, 33 (1), pp. 96–113, Taylor & Francis. https://doi.org/10.1080/13511610.2019.1611418

NEWMAN, C., RAND, J., TALBOT, T. and TARP, F. (2015), ‘Technology transfers, foreign investment and productivity spillovers’, European Economic Review, 76, pp. 168–187, Elsevier. https://doi.org/10.1016/j.euroecorev.2015.02.005

NIELSEN, B., ASMUSSEN, C. and GOERZEN, A. (2018), ‘Toward a synthesis of micro and macro factors that influence foreign direct investment location choice’, The Routledge Companion to the Geography of International Business, Routledge, pp. 190–212.

OMORUYI, E. M. M. (2021), ‘China’s Shifting Labour-Intensive Manufacturing Firms to Africa: A Particular Focus on Ethiopia and Rwanda’, Journal of Comparative Asian Development (JCAD), 18 (2), pp. 1–36, IGI Global, https://www.igi-global.com/article/chinas-shifting-labour-intensive-manufacturing-firms-to-africa/285550 [accessed on: 5.08.2024].

ORLIC, E., HASHI, I. and HISARCIKLILAR, M. (2018), ‘Cross sectoral FDI spillovers and their impact on manufacturing productivity’, International Business Review, 27 (4), pp. 777–796, Elsevier. https://doi.org/10.1016/j.ibusrev.2018.01.002

PALIOKAITĖ, A. (2019), ‘An innovation policy framework for upgrading firm absorptive capacities in the context of catching-up economies’, Journal of Entrepreneurship, Management and Innovation, 15 (3), pp. 103–130, Fundacja Upowszechniająca Wiedzę i Naukę “Cognitione”. https://doi.org/10.7341/20191534

PELLENS, M., PETERS, B., HUD, M., RAMMER, C. and LICHT, G. (2018), ‘Public investment in R&D in reaction to economic crises-a longitudinal study for OECD countries’, ZEW-Centre for European Economic Research Discussion Paper, No. 18–005. https://dx.doi.org/10.2139/ssrn.3122254

PIVA, M. and VIVARELLI, M. (2009), ‘The role of skills as a major driver of corporate R&D’, International Journal of Manpower, 30 (8), pp. 835–852, Emerald Group Publishing Limited. https://doi.org/10.1108/01437720911004452

POPESCU, G. H. (2014), ‘FDI and economic growth in Central and Eastern Europe’, Sustainability, 6 (11), pp. 8149–8163, MDPI. https://doi.org/10.3390/su6118149

PORTER, M. E. (1990), ‘The competitive advantage of nations, London and Basingstoke’, Macmillan, https://economie.ens.psl.eu/IMG/pdf/porter_1990_-_the_competitive_advantage_of_nations.pdf [accessed on: 5.08.2024].

RADOSEVIC, S. and CIAMPI STANCOVA, K. (2018), ‘Internationalising smart specialisation: Assessment and issues in the case of EU new member states’, Journal of the Knowledge Economy, 9 (1), pp. 263–293, Springer. https://doi.org/10.1007/s13132-015-0339-3

RAHMAN, R., SHAHRIAR, S. and KEA, S. (2019), ‘Determinants of exports: A gravity model analysis of the Bangladeshi textile and clothing industries’, FIIB Business Review, 8 (3), pp. 229–244, New Delhi, India: SAGE Publications Sage India. https://doi.org/10.1177/2319714519872643

ROSZKO-WÓJTOWICZ, E. and GRZELAK, M. M. (2021), ‘Multi-dimensional analysis of regional investment attractiveness in Poland’, Equilibrium. Quarterly Journal of Economics and Economic Policy, 16 (1), pp. 103–138, Instytut Badań Gospodarczych. https://doi.org/10.24136/eq.2021.004

RUGMAN, A. M., OH, C. H. and LIM, D. S. K. (2012), ‘The regional and global competitiveness of multinational firms’, Journal of the Academy of Marketing Science, 40, pp. 218–235, Springer. https://doi.org/10.1007/s11747-011-0270-5

SAIDI, S., MANI, V., MEFTEH, H., SHAHBAZ, M. and AKHTAR, P. (2020), ‘Dynamic linkages between transport, logistics, foreign direct Investment, and economic growth: Empirical evidence from developing countries’, Transportation Research Part A: Policy and Practice, 141, pp. 277–293, Elsevier. https://doi.org/10.1016/j.tra.2020.09.020

SALAMAGA, M. (2023), ‘Study on the influence of foreign direct investment on innovations in enterprises in Poland using the ECM panel model’, Argumenta Oeconomica, 50 (1). http://dx.doi.org/10.15611/aoe.2023.1.06

SALIKE, N. (2016), ‘Role of human capital on regional distribution of FDI in China: New evidences’, China Economic Review, 37, pp. 66–84, Elsevier. https://doi.org/10.1016/j.chieco.2015.11.013

SERWICKA, I. E., JONES, J. and WREN, C. (2024), ‘Economic integration and FDI location: Is there a border effect within the enlarged EU?’, The Annals of Regional Science, 72 (1), pp. 85–106, Springer. https://doi.org/10.1007/s00168-022-01190-2

SHARMA, C. (2019), ‘Effects of R&D and foreign technology transfer on productivity and innovation: an enterprises-level evidence from Bangladesh’, Asian Journal of Technology Innovation, 27 (1), pp. 46–70, Taylor & Francis. https://doi.org/10.1080/19761597.2019.1597634

SIDDIQUI, K. (2018), ‘David Ricardo’s comparative advantage and developing countries: Myth and reality’, International Critical Thought, 8 (3), pp. 426–452, Taylor & Francis. https://doi.org/10.1080/21598282.2018.1506264

SISMAN, S. and AYDINOGLU, A. C. (2022), ‘A modelling approach with geographically weighted regression methods for determining geographic variation and influencing factors in housing price: A case in Istanbul’, Land Use Policy, 119, p. 106183, Elsevier. https://doi.org/10.1016/j.landusepol.2022.106183

SU, W., ZHANG, D., ZHANG, C., ABRHÁM, J., SIMIONESCU, M., YAROSHEVICH, N. and GUSEVA, V. (2018), ‘Determinants of foreign direct investment in the Visegrad group countries after the EU enlargement’, Technological and Economic Development of Economy, 24 (5), pp. 1955–1978. https://doi.org/10.3846/tede.2018.5487

SU, Y. and LIU, Z. (2016), ‘The impact of foreign direct investment and human capital on economic growth: Evidence from Chinese cities’, China Economic Review, 37, pp. 97–109, Elsevier. https://doi.org/10.1016/j.chieco.2015.12.007

SUSENO, Y. and STANDING, C. (2018), ‘The systems perspective of national innovation ecosystems’, Systems Research and Behavioral Science, 35 (3), pp. 282–307, Wiley Online Library. https://doi.org/10.1002/sres.2494

SZARUGA, E., FRANKOWSKA, M. and DRELA, K. (2022), ‘Spatial autocorrelation of power grid instability in the context of electricity production from renewable energy sources in Polish regions’, Energy Reports, 8, pp. 276–284, Elsevier. https://doi.org/10.1016/j.egyr.2022.10.104