Keywords: mergers and acquisitions, financial management, enterprise growth

JEL: F18, F64.

The last two decades of economic and structural changes in the automotive sector have contributed to a measurable consolidation activity among the industry’s players. Market demands for cheaper and better-equipped cars have led suppliers to specialize and internationalize. For many companies, mergers and acquisitions have become a common strategic response to these trends, further contributing to global dominance.

Modern research devotes considerable attention to the issue of the effectiveness of consolidation processes, but the extensive discussion does not provide clear, binding recommendations. Beginning with claims that acquisition processes are inefficient and generate losses, responsibility for the effectiveness of M&A is placed on virtually all possible areas of a company’s operation, including the external environment. Although the available literature comprehensively analyses the factors that may affect the effectiveness and efficiency of initiated transactions, it does not provide answers to all the doubts accompanying the discussed processes. The questions of whether to consolidate and how to do it rationally are still not resolved.

In the circumstances of the global market, Asian corporations are doing very well, competing successfully in areas such as productivity, production efficiency, manufacturing cost and, last but not least, quality. The countries of developing Asia (China, India) occupy leading positions in the ranking of world economic powers. Over the last twenty years, the GDP of these two countries has increased several times[1] and the number of consolidation deals carried out by developing countries has exceeded half of the world’s total. Perhaps, then, an analysis of deals made by emerging market entrepreneurs could prove helpful in identifying the determinants of M&A effectiveness. Would it be possible to implement the defined factors for the entire automotive industry, including highly developed countries? Or will developing countries become an example for organizations operating in other sectors of the economy? These are just a few of the questions that the authors of this article believe are worth answering.

The research on consolidations undertaken by companies from developing countries is not a dominant topic among researchers. There are, of course, publications available on selected countries or individual transactions from emerging markets, but one can see a gap in quantitative observations carried out on a large population with a broad spectrum of conditions. The shortage of specialized studies also applies to the automotive sector, whose specific characteristics could prove a valuable source of new insights. Therefore, the aim of this article is to compare the effects of mergers and acquisitions by entities from developed and developing countries. A verification will be made of the research hypothesis according to which companies from developing countries outperform their competitors from developed countries in consolidation transactions. The substantive basis for the hypothesis is the thesis of higher efficiency of companies from developing countries. They have a better cost position and operate in less saturated markets. On the other hand, they do not have such advanced technologies and developed infrastructure. This article focuses on consolidation transactions completed between 2000 and 2018, exclusively by listed automotive companies. 764 consolidation transactions extracted from the Thomson Reuters Eikon database were observed, for which a performance measurement method based on the relationship of the share price to the stock market index was adopted. Data analysis was carried out using descriptive statistics and statistical inference methods with support of SPSS software. This article will also assess the financial situation of companies carrying out capital consolidation in both regions.

Academic publications dedicated to the evaluation of the effectiveness of consolidation processes point to the dominant role of two research methods: event analysis based on market data and accounting data. In the first variant, researchers consider changes in the share prices of the acquiring and acquired company over a short time horizon, occurring from the publication of the announcement of the planned merger. The second way is to use statistical techniques based on pre- and post-acquisition financial and economic indicators.

Consolidation processes initiated by organizations are perceived by the environment as a sign of a significant change in corporate strategy. Stock market investors react to such events in different ways, buying or selling shares, reflecting the reaction of the stock market. The terms of investor reaction and stock market reaction are synonymous and have a direct impact on the additional value achieved by shareholders. The short-term effectiveness of listed company M&As has been addressed by Faccio, McConnell & Stolin (2006); Masulis, Wang & Xie (2007); Renneboog & Vansteenkiste (2019) or Lin et al., (2020), among others. The conclusions of the studies conducted are not definitive. A significant percentage of them indicate that shareholders of US acquiring companies earned positive abnormal returns (Moeller et al. 2005). A contrary opinion was represented by (Sudarsanam et al. 1996; Walker 2000) claiming that US acquiring companies achieved significantly negative additional returns in the period from six months before and twelve months after the transaction. Bruner (2002), on the other hand, takes the position that, overall, the additional returns to shareholders of US companies involved in an acquisition were zero. Examples of the occurrence of positive rates of return can be found in studies on other developed markets. In Japan they were confirmed by Kang, Shivdasani & Yamada (2000), in Canada by Eckbo and Thorburn (2000) and Ben-Amar & Andre (2006), and in several European countries by Faccio et al. (2006), Goergen et al. (2004), Martynova et al. (2008). A different observation was recorded by Sudarsanam & Mahate (2003) testing a sample of 519 UK companies. Two-thirds of the 1983–1995 transactions they examined ended with negative incremental returns for acquirers compared to the month of the announcement of the merger, and only one-third recorded increases. A similar opinion was taken by Campa & Hernando (2004), suggesting a negative balance of cumulative excess return for firms carrying out cross-border mergers and acquisitions. Ben-Amar & Andre (2006), Faccio, McConnell & Stolin (2006), focused their studies on the stock market’s reaction to a merger or acquisition announcement, with little attention to the theoretical aspects of shareholder behavior. Their observations revealed, among other things, positive returns for a research sample of 327 Canadian companies, value creation in cash and cross-border acquisitions, and greater value creation for acquisitions of family firms.

Using an event study technique, Gubbi, Aulakh, Pay, Sarkar, & Chittoor (2010) examined a population of 425 deals executed between 2000 and 2007 by Indian-owned companies. Pointing to the growing importance of developing countries, they demonstrated that emerging market companies transacted in developed countries and experienced additional returns. They conclude that organizations from emerging economies are merging to acquire strategic assets from mature markets, thereby overcoming their weaknesses and building a competitive position internationally. Similar observations are made by researchers focusing on Central and Eastern Europe (Karaszewski et al. 2018a, 2018b), as well as Zhu and Malhotra (2008). A study of 114 public companies listed on the Bombay Stock Exchange found additional returns following acquisitions of US companies up to 12 days after the announcement of the proposed transaction. Bhagat et al. (2011) analyzed 698 cases of mergers and acquisitions initiated between 1991 and 2008 by companies from eight emerging countries. Using Brazil, China, India, Malaysia, Mexico, the Philippines, Russia and South Africa as examples, the authors confirmed the additive return (AR) and cumulative return (CAR) gains in the range of (–120 +30) days after the event, while also indicating a positive correlation of the increase in the value of the acquirer assimilating the target company’s corporate governance. The research of Aybar & Ficici (2009) leads to a different conclusion. A study of 433 consolidation transactions carried out by 58 firms between 1991 and 2004 proves the disruptive effect of mergers on the value of acquiring companies. It is noteworthy that all the acquiring companies came from emerging markets, with more than ¾ of the deals concluded representing Asian entities and 15% from South America. In fact, only 39% of the acquisitions involved target companies from developed regions, and more than half of the transactions took place between similar cultural backgrounds. The observations were made in relatively short cycles of days. The 171 deals targeting companies categorized by the World Bank as developed countries had additional returns across periods, and these investments generated higher shareholder value than deals in developing countries. Interestingly, the study also found that greater cultural distance resulted in higher cumulative additional returns. Chen and Young (2010) analyzing cross-border mergers and acquisitions of Chinese listed companies pointed to political and managerial competence factors. According to the authors of the study, shareholders have less confidence in overseas consolidation transactions of Chinese state-owned enterprises. Using a final sample of 39 transactions from 2000 to 2008, they presented negative additional returns following the transactions.

Following on from considerations in the area of efficiency measured by market-based instruments, it is important to cite the paper by Nicholson and Salaber (2013), in which the authors analyze 203 Indian and 63 Chinese international consolidation transactions targeting companies in developed markets. Companies from both countries recorded additional returns following the consolidation announcement. This is testimony to the fact that shareholders recognized the competitive advantage and desirability of overseas expansion of these companies. The paper touches on the aspect of cultural differences and the ability to communicate in a global environment having a measurable impact on the performance of the merged companies. India, for which an important motive for cross-border mergers is the acquisition of high-tech markets, was a British colony and is a feminized society, so Indian companies have higher international communication skills, fewer obstacles to global integration and therefore easier access to new markets, products and customers. In this way, Indian companies use their cultural advantage to reach abroad, especially to developed economies and countries that recognize the potential of women. India’s concept of fast entry into developed markets is not a key driver for Chinese bidders, who face a high potential culture clash when acquiring foreign companies. Chinese firms are more interested in securing natural resources and acquiring better managerial skills, as many Chinese managers lack communication proficiency, cross-cultural knowledge, foreign management experience and English language skills (Dietz et al. 2008; S.L. Sun et al. 2012).

In the evaluation of cumulative additional returns (CARs), there are themes of politics and the quality of power exercised. Bekaert et al. (2014) indicate that the level of political stability can affect investors’ risk perceptions and thus lead to different market reactions to the announcement of a cross-border merger or acquisition. As organizations naturally seek to create order and stable conditions for cooperation, countries with high political stability pose lower risk and uncertainty for doing business. Thus, information about a planned consolidation transaction in a country with low political stability can induce negative stock market behavior generating negative returns for shareholders (Cao & Liu 2013). Brouthers and Hennart (2007) point out that low levels of political stability are likely to affect the post-acquisition operation of the firm, leading to higher integration and local sourcing costs, making it more difficult to generate positive returns and shareholder value creation.

The success and effectiveness of international consolidation transactions is significantly influenced by the quality of governance in the destination country of the investment (Bekaert et al. 2014; Berry 2006; Pástor & Veronesi 2013). Transparency of the applicable rules reduces ambiguity in their interpretation and reduces the effort and cost of obtaining information. Consequently, the company’s employees can devote the saved time and resources to integration and efficiency improvements. The higher quality of authority exercised and the greater institutional protection of foreign direct investment in developed countries provide a greater likelihood of acquiring advanced knowledge (Berry 2006). Indeed, it is well known that organizations from emerging countries, and China in particular, seek to acquire high quality knowledge through mergers and acquisitions. The combination of strategic resources: technological, market and managerial knowledge with low manufacturing costs allows companies from rising countries to achieve unique competitive advantages in both international and domestic markets (L. Cui et al. 2014; Liu et al. 2016a). This translates into the confidence of stock market investors, who welcome mentions of a planned consolidation transaction in a mature market, generating additional returns for shareholders.

The analysis of the effectiveness of consolidation processes was carried out on the basis of comparing changes in the share prices of companies making acquisitions with changes in the value of stock market indices at the same time. In the first phase of the analysis, the timeframe of observation and reference points against which the increase or decrease in the value of the company was assessed were determined. The starting point of consolidation was defined as the date of the public announcement of the intention to merge companies or the date of acceptance of the purchase offer. In order to eliminate the undesirable phenomenon of abnormal returns as a side effect of the public announcement, the study was carried out at two intervals: at the point seven days prior to the announcement of the planned acquisition (n-7) and on the last balance sheet day of the year, which was the 365th day after the announcement of the merger or acquisition. Stock indices were then selected as a benchmark for the change in the companies’ share prices. The study decided to compare the share prices of the acquiring company with the index of the stock exchange on which it is listed. Only one main stock market index for each market studied was classified for the analysis.

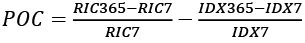

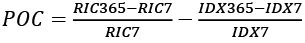

In the next step, the change in the share price of the acquiring company was compared with the change in the value of the stock market index, maintaining the same observation dates. The value of the profitability of consolidation (POC) was determined according to the following formula:

where:

RIC365 – the acquiring company’s share price one year after the announcement of the transaction

RIC7 – the acquirer’s share price seven days prior to the announcement date of the transaction

IDX365 – the value of the main stock market index one year after the announcement of the transaction

IDX7 – the value of the main stock market index seven days prior to the announcement date of the transaction

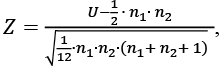

Based on the comparison of the mean and median, as well as the skewness coefficient and kurtosis analysis, it was found that most of the variables were characterized by outliers that caused significant deviations of the distribution of variables from the normal distribution. In comparison with the results of the Shapiro-Wilk test, it was decided to use nonparametric methods to compare the population from the point of view of financial indicators – the Mann-Whitney test, which requires at least the ordinal level of measurement of the dependent variable. It is used to compare two independent populations. The null hypothesis takes the following form:

H0: F1 = F2

H1: ~ H0,

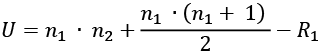

where F1 and F2 are the probability distributions of the dependent variable in the compared populations. If there are no associated ranks in the sample, the statistic is used as the test (Szymczak 2008):

where:  .

.

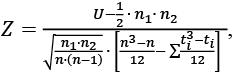

On the contrary, if there are tied ranks in the sample, the test statistic is (Szymczak 2008):

where: n = n1 + n2, t – the number of observations associated with a given rank.

In both cases, the Z statistic is approximately normally distributed with parameters 0 and 1. Since the null hypothesis is that two independent samples come from a population with the same distribution, the differences between the populations are considered statistically significant if the probability in Mann’s test – Whitney is below the significance level α. The Mann-Whitney test was used to compare individual financial ratios between companies that were successful in the merger versus those that failed.

A positive POC value indicates a successful consolidation. Otherwise, the transaction was classified as unsuccessful. This approach made it possible not only to assess the outcome of a merger or acquisition, but also to determine its intensity. The results obtained in this way are of comparative value to the existing literature in the area of mergers and acquisitions.

Next, on the basis of the financial statements from the year preceding the acquisition, the financial ratios of the companies involved in the previously selected consolidation transactions were calculated. On the basis of the literature review carried out in the article, 15 ratios were selected to characterize the financial situation of the company and to determine the financial strategy applied by the company.

The results obtained gain comparative value against the existing literature in the area of mergers and acquisitions. Data analysis was performed using descriptive statistics methods, statistical inference methods and econometric models. In the first group, descriptive (descriptive) statistics were applied, including in particular the arithmetic mean, median and other quartiles, deciles and selected percentiles, standard deviation, skewness coefficient and kurtosis. These statistics allowed for the evaluation of the distributions of quantitative variables.

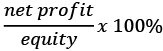

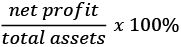

Table 1. Financial ratios used in the research of the financial statements of companies performing mergers and acquisitions along with their explanation.

| Name of the ratio | Ratio formula |

|---|---|

| Return on equity ROE (%) |

|

| Return on assets ROA (%) |

|

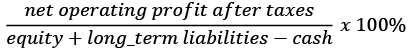

| Return on invested capital ROIC (%) |

|

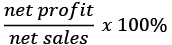

| Net profitability ratio (%) |

|

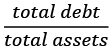

| General debt ratio |

|

| Equity debt ratio |

|

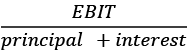

| Debt service coverage ratio |

|

| Asset coverage with equity capital ratio |

|

| Current liquidity ratio |

|

| Quick ratio |

|

| Working capital to total assets ratio |

|

| Receivables turnover ratio |

|

| Liabilities turnover ratio |

|

| Inventory turnover ratio |

|

| Asset turnover ratio |

|

Source: own elaboration

The article focuses on consolidation transactions completed between 2000 and 2018, exclusively by listed automotive companies, in which the buyer acquired more than 50% of the block of shares of the entity being purchased. Ultimately, 764 consolidation transactions extracted from the Thomson Reuters Eikon database were observed, for which a performance measurement method was adopted based on the relationship of the share price to the stock market index.[2]

The group of examined transactions was divided by the country of origin of the purchasing entity. Key to the objectives of the study was to examine the incidence of the phenomenon and its effects in developed and emerging countries.[3] Three quarters of the mergers were carried out by companies from developed countries – 591 transactions (77%), and nearly one in four mergers (173 cases – 23%) were concluded by entities originating from emerging countries. 58.7% of mergers were carried out in the buyer’s country. It should be noted here that the share of domestic mergers is significantly higher in emerging countries (75.1%) than in developed countries (53.8%) – these differences are statistically significant (p < 0.001).

A significant number of mergers (26.3%) involved investments undertaken in the United States, the country of acquisition also being US companies (n = 156). A total of 222 mergers (29.1%) were undertaken by US investors during the period under review. China was second from the point of view of both criteria. The country was slightly more frequent as a destination than as an acquirer, with 73 of the 81 mergers involving domestic investment. Third place was held by Japan, with 81 mergers, of which 50 were domestic. The majority of mergers and acquisitions overwhelmingly involved domestic cases. In particular, companies from Malaysia (n = 30), as well as from Indonesia (n = 3), Denmark (2), Taiwan (2) and Bulgaria, Pakistan, Poland, Tunisia, Ukraine and Vietnam (one merger each) were domestic. Australian (18 out of 19), Chinese (73 out of 81), Russian (7 out of 9), Turkish (2 out of 3) companies also carried out the vast majority of mergers in their home country.

Almost half (49%) of initiated M&As were successful. Analogous results were obtained for both groups of countries. In developed countries, 49.4 per cent of acquisitions were successful, compared with 45.7 per cent in emerging countries (the differences are not statistically significant – p = 0.386). The percentage of successful mergers is significantly higher, in a statistical sense (p = 0.033), for domestic than for international transactions – 51.9% and 43.8%. The different nature of this relationship for the two groups of countries is observed. For developed countries, domestic mergers were significantly more successful than international mergers (54.3% vs. 43.8%), while in emerging countries these differences are negligible (not statistically significant – p = 0.962).

Table 2. Characteristics of the success rates (POC) of the studied consolidation transactions by country group (%).

| Specification | Countries total | Developed countries | Emerging countries |

|---|---|---|---|

| Minimum | –1,05 | –1,05 | –0,89 |

| Maximum | 3,21 | 1,97 | 3,21 |

| Quartile 1 | –0,24 | –0,23 | –0,26 |

| Median | –0,01 | 0,00 | –0,03 |

| Quartile 3 | 0,30 | 0,28 | 0,38 |

| Mean | 0,05 | 0,05 | 0,08 |

| Standard deviation | 0,45 | 0,41 | 0,55 |

| Skewness | 1,65 | 1,14 | 2,24 |

| Kurtosis | 6,49 | 3,29 | 8,42 |

Source: own elaboration

The success of acquisition processes measured quantitatively (according to the POC formula) ranged from –1.05 to 3.21. For half of the companies, the index was at least –0.01, for 75 per cent a minimum of –0.24 and for 25 per cent no less than 0.30. Both the variation in the results as well as the skewness of the distribution and kurtosis are high. A comparison of organizations from emerging and developed countries in this respect shows that the differences are not statistically significant (Mann-Whitney test p = 0.776), although a slightly lower median value was recorded for emerging countries (Me = –0.03).

Table 3. Comparison of the financial position of companies in developed and emerging countries.

| Ratio | Developed countries | Emerging countries | p | ||

|---|---|---|---|---|---|

| n | Me | n | Me | ||

| Return on equity ROE (%) | 572 | 4,88 | 164 | 5,61 | 0,010** |

| Return on assets ROA (%) | 565 | 10,20 | 170 | 12,19 | <0,001*** |

| Return on invested capital ROIC (%) | 578 | 3,95 | 171 | 7,70 | <0,001*** |

| Net profitability ratio (%) | 555 | 23,25 | 163 | 20,28 | 0,083* |

| General debt ratio | 534 | 56,58 | 165 | 40,51 | 0,001*** |

| Equity debt ratio | 495 | 113,01 | 143 | 162,33 | 0,012** |

| Debt service coverage ratio | 558 | 2,46 | 161 | 1,99 | <0,001*** |

| Asset coverage with equity capital ratio | 584 | 1,44 | 173 | 1,62 | 0,020** |

| Current liquidity ratio | 580 | 0,97 | 169 | 1,08 | 0,001*** |

| Quick ratio | 586 | 0,14 | 173 | 0,22 | 0,002*** |

| Working capital to total assets ratio | 546 | 6,77 | 164 | 4,80 | <0,001*** |

| Receivables turnover ratio | 557 | 7,06 | 159 | 5,33 | <0,001*** |

| Liabilities turnover ratio | 561 | 6,48 | 156 | 4,85 | <0,001*** |

| Inventory turnover ratio | 574 | 1,27 | 164 | 0,89 | <0,001*** |

n – sample size, Me – median, p – Mann-Whitney test probability; only variables for which differences are statistically significant are included in the table (*a = 0,10, **a = 0,05, ***a = 0,01)

Source: own elaboration

Developing-country M&A firms were characterized by significantly more favorable indicators in terms of both profitability and liquidity than developed-country firms. This is true for all measures included in Table 3, and in particular for the measure of net profitability, which is significantly (almost twice) higher in emerging countries (Me = 7.7%) than in developed countries (Me = 3.95%). On the other hand, non-significant differences were observed for two other profitability indicators: return on equity and return on invested capital (ROIC). Their values were at analogous levels in both groups of countries. As far as the liquidity measure is concerned, the differences are statistically significant, albeit not that significant. Nevertheless, in emerging countries it reached the optimal level (for current liquidity Me = 1.62, quick liquidity Me = 0.97), while for developed countries the median was slightly below the limits of optimal levels. For debt, again more optimal levels were recorded for companies in emerging countries. In particular, the debt-to-equity ratio and equity multiplier turned out to be significantly higher (p close to 0), although the debt service coverage ratio was at a significantly higher level in the first group. In contrast, the turnover of receivables, payables, inventories and assets from the “efficiency” group were characterized by significantly longer turnover cycles in the case of acquisition initiatives of companies from emerging countries than in the case of developed countries. The share of working capital in total assets obtained better values for companies from emerging countries.

The conducted research does not allow the research hypothesis set out in the article to be accepted. A comparison of the effectiveness of mergers and acquisitions realized in developed and emerging countries showed no significant differences in a statistical sense. This means that the macroeconomic conditions of the country from which the company originates have no significant impact on the chances of success of the consolidation implemented by the company. The study found that domestic mergers are more likely to succeed than foreign mergers, which may be due to the additional costs of international integration and coordinating a company operating at a larger size. When it comes to international mergers, companies from developed countries do better. This may mean that they are able to acquire a better cost position by taking advantage of lower labor costs in emerging countries and closer access to raw materials. Expansion into emerging countries also gives such companies access to less developed and saturated markets. Entities from developed countries also appear to be better prepared culturally for international expansion. Companies from emerging countries tend to come from highly bureaucratic and often regulated systems, which can make the integration process more difficult. For them, the undoubted advantage of foreign consolidation is access to affluent markets and modern technology. However, the results of the research carried out do not indicate that these advantages of M&A are significantly present.

Many interesting findings are provided by an analysis of the financial situation of the companies surveyed. Companies from emerging countries are more profitable, have higher liquidity and are less indebted. On the other hand, entities from developed countries are characterized by better operating efficiency ratios, which suggests that they achieve higher margins. The study thus also contradicts the thesis that cost position is important for the efficiency of entities, especially in emerging countries. Interestingly, the higher efficiency of entities from developed countries does not translate into higher profitability. This situation can be explained by the higher indebtedness of these companies and the resulting higher financing costs.

In the context of the results of the comparison between the two groups of companies, it must be assumed that the factors determining the success of consolidation are microeconomic in nature and are independent of the country in which the transaction is carried out. Rather, they are of a general nature, depending on the financial situation of the entity making the acquisition or merger. Here, the results of the study seem to coincide with Jensen’s free cash flow theory, according to which acquirers with excess free cash flow are more likely to make hasty acquisitions and thus perform worse after a merger, compared to acquirers who had more limited financial resources. Companies from emerging markets are an example of fund-rich entities. They have high liquidity, are not significantly indebted and are more profitable. According to Jensen’s theory, they are therefore more prone to inadequate due diligence and thus risk less successful consolidation.

However, the above conclusions must be seen in the context of a number of limitations that may affect the results of the study. Only the financial position of the consolidating entity was considered in the analysis. The financial state of the company that was being acquired was not examined. This may affect the financial health of the combined entities. It is also worth bearing in mind the methodology used in the article. It juxtaposes accounting and market data. The valuation of the company at the time of the merger or acquisition may be re-levant to the results of the study. Where a company was significantly overvalued, its ability to further increase its market value was significantly limited. The authors are aware of this limitation of the study and have deliberately omitted the question of valuation as a category that is too complex and debatable in the context of the purpose of the study.

The practical implication of the research presented above seems to be a recommendation to apply a more aggressive financing policy for capital consolidation processes. Managers should make greater use of external financing. The cost of debt seems objective and forces the company to generate regular financial surpluses. The acquisition decision will therefore take this necessity into account and limit rash investment decisions. At the same time, an increase in debt may be perceived by shareholders as an additional risk thus preventing excessive share price increases when the intention to consolidate is announced. This creates better prospects for future growth in the company’s valuation and thus promotes a good assessment of the company’s future performance. These recommendations will not apply to companies that have shown better results from mergers or acquisitions in the study as they most often operate under such conditions.

Aybar B., Ficici A. (2009), Cross-border acquisitions and firm value: An analysis of emerging-market multinationals, “Journal of International Business Studies”, 40(8): 1317–1338. https://doi.org/10.1057/jibs.2009.15

Bekaert G., Harvey C.R., Lundblad C.T., Siegel S. (2014), Political risk spreads, “Journal of International Business Studies”, 45(4): 471–493. https://doi.org/10.1057/jibs.2014.4

Ben-Amar W., André P. (2006), Separation of ownership from control and acquiring firm performance: The case of family ownership in Canada, “Journal of Business Finance & Accounting”, 33(3–4): 517–543. https://doi.org/10.1111/j.1468-5957.2006.00613.x

Berry H. (2006), Leaders, laggards, and the pursuit of foreign knowledge, “Strategic Management Journal”, 27(2): 151–168. https://doi.org/10.1002/smj.509

Bhagat S., Malhotra S., Zhu P. (2011), Emerging country cross-border acquisitions: Characteristics, acquirer returns and cross-sectional determinants, “Emerging Markets Review”, 12(3): 250–271. https://doi.org/10.1016/j.ememar.2011.04.001

Brouthers K.D., Hennart J.F. (2007), Boundaries of the firm: Insights from international entry mode research, “Journal of Management”, 33(3): 395–425. https://doi.org/10.1177/0149206307300817

Bruner R.F. (2002), Does M&A pay? A survey of evidence for the decision-maker, “Journal of Applied Finance”, 12(1): 48–68.

Campa J.M., Hernando I. (2004), Shareholder value creation in European M&As, “European Financial Management”, 10(1): 47–81. https://doi.org/10.1111/j.1468-036X.2004.00240.x

Cao C., Liu G. (2013), Political uncertainty and cross-border mergers & acquisitions, Working Paper. http://zicklin.baruch.cuny.edu/faculty/accountancy/events-research-workshops/Downloads/SWUFE-Chunfang_Cao.pdf. (accessed: 15.07.2022)

Chen Y.Y., Young M.N. (2010), Cross-border mergers and acquisitions by Chinese listed companies: A principal–principal perspective, “Asia Pacific Journal of Management”, 27(3): 523–539. https://doi.org/10.1007/s10490-009-9150-7

Cui L., Meyer K.E., Hu H.W. (2014), What drives firms’ intent to seek strategic assets by foreign direct investment? A study of emerging economy firms, “Journal of World Business”, 49(4): 488–501.

Dietz M.C., Orr G., Xing J. (2008). How Chinese companies can succeed abroad, “McKinsey quarterly”, 3: 22.

Eckbo B.E., Thorburn K.S., (2000), Gains to bidder firms revisited: Domestic and foreign acquisitions in Canada, “Journal of Financial and Quantitative Analysis”, 35(1): 1–25. https://doi.org/10.2307/2676236

Faccio M., McConnell J.J., Stolin D. (2006), Returns to acquirers of listed and unlisted targets, “Journal of Financial and Quantitative Analysis”, 41(1): 97–220. https://doi.org/10.1017/S0022109000002477

Goergen M., Renneboog L., (2004), Shareholder wealth effects of European domestic and cross-border takeover bids, “European Financial Management”, 10(1): 9–45. https://doi.org/10.1111/j.1468-036X.2004.00239.x

Gubbi S.R., Aulakh P.S., Ray S., Sarkar M.B., Chittoor R. (2010), Do international acquisitions by emerging-economy firms create shareholder value? The case of Indian firms, “Journal of International Business Studies”, 41(3): 397–418. https://doi.org/10.1057/jibs.2009.47

Karaszewski W., Jaworek M., Szałucka M. (2018), Greenfield or Acquisition Entry? An Impact of Foreign Direct Investment on the Competitiveness of Polish Investors, “Entrepreneurial Business and Economics Review”, 6(2): 137–152. https://doi.org/10.15678/EBER.2018.060207

Karaszewski W.M., Jaworek M., Szałucka M. (2018), Foreign Direct Investment Determinants among Polish Companies: Greenfield Investments vs. Acquisitions, “Trends Economics and Management”, 12(31): 19–30. https://doi.org/0.13164/trends.2018.31.19

Lin X., Li Y., Wan X., Wei J. (2020), Market reaction to the international acquisitions by Chinese firms: The role of potential intelligence sourcing and preannouncement, “Chinese Management Studies”, 14(4): 915–934. https://doi.org/10.1108/CMS-11-2019-0394

Liu X., Gao L., Lu J., Lioliou, E. (2016), Environmental risks, localization and the overseas subsidiary performance of MNEs from an emerging economy, “Journalof World Business”, 51(3): 356–368. https://doi.org/10.1016/j.jwb.2015.05.002

Martynova M., Renneboog L., (2008), A century of corporate takeovers: What have we learned and where do we stand?, “Journal of Banking & Finance”, 32(10): 2148–2177. https://doi.org/10.1016/j.jbankfin.2007.12.038

Masulis R.W., Wang C., Xie F. (2007), Corporate governance and acquirer returns, “The Journal of Finance”, 62(4): 1851–1889. https://doi.org/10.1111/j.1540-6261.2007.01259.x

Moeller S.B., Schlingemann F.P., (2005), Global diversification and bidder gains: A comparison between cross-border and domestic acquisitions, “Journal of Banking & Finance”, 29(3): 533–564. https://doi.org/10.1016/S0378-4266(04)00047-0

Nicholson R.R., Salaber J. (2013), The motives and performance of cross-border acquirers from emerging economies: Comparison between Chinese and Indian firms, “International Business Review”, 22(6): 963–980. https://doi.org/10.1016/j.ibusrev.2013.02.003

OECD.org – OECD (2013), https://www.oecd.org/

Pástor L., Veronesi P. (2013), Political uncertainty and risk premia, “Journal of Financial Economics”, 110(3): 520–545. https://doi.org/10.1016/j.jfineco.2013.08.007

Renneboog L., Vansteenkiste C. (2019), Failure and success in mergers and acquisitions, “Journal of Corporate Finance”, 58: 650–699.

Sudarsanam S., Holl P., Salami A. (1996), Shareholder wealth gains in mergers: Effect of synergy and ownership structure, “Journal of Business Finance & Accounting”, 23(5–6): 673–698. https://doi.org/10.1111/j.1468-5957.1996.tb01148.x

Sudarsanam S., Mahate A.A. (2003), Glamour acquirers, method of payment and post-acquisition performance: The UK evidence, “Journal of Business Finance & Accounting”, 30(1–2): 299–342.

Sun S.L., Peng M.W., Ren B., Yan D. (2012), A comparative ownership advantage framework for cross-border M&As: The rise of Chinese and Indian MNEs, “Journal of World Business”, 47(1): 4–16. https://doi.org/10.1016/j.jwb.2010.10.015

Szymczak, W. (2008), Podstawy statystyki dla psychologów: Podręcznik akade-micki (pp. 198–200), Centrum Doradztwa i Informacji Difin, Warszawa.

worldbank.org. (2018), GDP (current US$) | 1997–2017 by country. PKB 1997–2017. https://data.worldbank.org/indicator/NY.GDP.MKTP.CD?end=2017&start=1997

Zhu P., Malhotra S. (2008), Announcement effect and price pressure: An empirical study of cross-border acquisitions by Indian firms, “International Research Journal of Finance and Economics”, 13(1): 24–41.

Celem artykułu jest porównanie efektów fuzji i przejęć realizowanych przez podmioty z krajów rozwiniętych i rozwijających się. Artykuł obejmuje transakcje konsolidacyjne zrealizowane w latach 2000–2018 przez giełdowe spółki z branży motoryzacyjnej. Obserwacji poddano 764 transakcje konsolidacyjne pozyskane z bazy Thomson Reuters Eikon, dla których przyjęto metodę pomiaru efektywności opartą o relację kursu akcji z indeksem giełdowym. Analizę danych przeprowadzono z wykorzystaniem metod statystyki opisowej oraz metod wnioskowania statystycznego. Porównanie efektywności fuzji i przejęć zrealizowanych w krajach rozwiniętych i rozwijających się nie wykazało istotnych różnic w sensie statystycznym. Oznacza to, że uwarunkowania makroekonomiczne kraju, z którego pochodzi przedsiębiorstwo, nie mają istotnego wpływu na szanse powodzenia realizowanej przez niego konsolidacji. Firmy z krajów rozwijających się okazały się bardziej rentowne i mniej zadłużone, posiadały także wyższą płynnością finansową. Z kolei podmioty z krajów rozwiniętych charakteryzowały się lepszymi wskaźnikami efektywności działania, co sugeruje, że osiągały wyższe marże. Rezultaty przeprowadzonego badania przeczą więc tezie o znaczeniu pozycji kosztowej dla efektywności podmiotów, zwłaszcza w krajach rozwijających się. Analiza wyników porównania obu grup przedsiębiorstw pozwala przypuszczać, że czynniki determinujące sukces konsolidacji mają charakter mikroekonomiczny i są niezależne od kraju, w którym realizowana jest transakcja.

Słowa kluczowe: fuzje i przejęcia, zarządzanie finansami, wzrost przedsiębiorstwa