Oliwia Witecka

https://orcid.org/0000-0002-0228-804X

https://orcid.org/0000-0002-0228-804X

Tomasz Sosnowski

https://orcid.org/0000-0001-5610-0404

https://orcid.org/0000-0001-5610-0404

Female business angels in Europe: Identifying barriers and opportunities for institutional support

Summary

The purpose of this article is to present and assess the context of the investment of business angels in Europe from the perspective of women. Thus, the analysis covers the reasons for lower activity of women among business angels, identifies the main barriers hindering the growth of this informal part of the venture capital market, and then identifies potential opportunities for institutional support of women’s activity among business angels on selected European markets by indicating practical initiatives in this area. The subject of the analysis is European organizations that unite women business angels, and the characteristics of their performance are carried out based on data made available by these institutions.

The number of women investing in the business angel market in Europe is still relatively low, and the vast majority of investors are men. Previous research suggests that there is a positive correlation between the number of women investors and the number of women building and developing their own businesses. As a result, more and more initiatives and organizations supporting and bringing together women investors are emerging in Europe, providing opportunities to engage with women business founders. The growth of this part of the business angel market is relatively high, and every year more and more initiatives and ideas are created to support women in business. Women investors in the business angel market develop their skills, look for new challenges, and are willing to support other women who want to act as business angels.

Keywords: venture capital, female entrepreneurship, women business angel, business angels networks, glass ceilings.

JEL: G24, G11, G29

Introduction

The importance of women’s entrepreneurship from both an economic and social standpoint is recognized worldwide. Such an activity contributes to decreasing unemployment, improving the social status of women, and increasing the quality of social life in general (Xieet al. 2021, p. 470). However, there is a significant gender gap in entrepreneurial activities. According to Global Entrepreneurship Monitor, in most economies, new businesses are likely to have men as the principal founder and the lowest rates of early-stage female entrepreneurship are currently observed in Italy and Poland (Global Entrepreneurship Monitor 2020/2021). Given that this conclusion is the result of comparing all economies around the world, so the need to embrace an inclusive approach in entrepreneurship is important for Europe.

Gender differences in entrepreneurship are very often explained based on social role theory and specific characteristics attributed to women, such as a lower propensity to compete and being less willing to take risks (Wawryszuk-Misztal 2021). Recent studies have highlighted the importance of factors contributing to “glass ceilings”, known as gender biases, that affect investment and financial decisions of early-stage investors. In fact, male investors tend to show less interest in the business concepts of female entrepreneurs compared to markedly similar business proposals of men (Ewens & Townsend 2020). Gompers & Wang suggest that investor bias is a likely critical factor that contributes to women’s difficulty in raising capital for business growth, and they link the presence of the entrepreneurial gap and the lack of women entrepreneurs to the fact that few venture capital investors are women (Gompers & Wang 2017, p. 39). Linking this remark to the fact that female investors tend to show greater interest in female entrepreneurs (Ewens & Townsend 2020), it is important to recognize the role of women among active participants in the venture capital market as a capital provider, especially in the informal parts.

The main purpose of the paper is to provide some insight into the investments of business angel markets in Europe from the female perspective. To do this, first, we question the main reasons for the lower activity of female investors among business angels, and we seek to identify the main barriers that prevent further change. Although interest in this informal part of the venture capital market is becoming increasingly apparent among business peers, and the presence of women is increasingly recognized in the business world, the number of female investors in the angel investment market is still relatively low. Then, we turn our attention to identifying potential institutional support for women’s activity among business angels and answer the question of what practical initiatives are taken in selected European markets in this matter. As far as we know, the issue of women angel investors receives attention, and many local business networks undertake various activities to overcome the current disadvantage. However, knowledge of this is relatively fragmented and often does not reach those potentially affected.

This paper contributes to the literature on female entrepreneurship and the role of women in the venture capital market. This article will be of interest to those responsible for setting rules and recommendations that support the financing and development of companies with a high growth potential. It focuses the attention of people who actively promote the development of the venture capital market, both internationally and in regional/domestic markets, as well as those who support diversity and equality in business.

The cognitive objectives of the article in the theoretical analysis layer have been achieved through a critical analysis of the current literature relating to the topic of business angels. The empirical part of the study consists of the multi-criteria characteristics of specific initiatives and a comparative analysis of information provided directly by the organizations that undertake activities for the presence of women in the world of business angels in selected European countries. The main source of information includes specific reports and the official websites of business networks associating business angels and female entrepreneurs.

The structure of the paper is guided by its objectives. The next section presents the idea of business angels in the venture capital market and the profiles of a typical business angel in Europe. It also describes the organizational structures that support investor activity in this part of the market. The empirical part of the study identifies key constraints to women’s activity as business angels and the initiatives that support female business angels. This section describes organizations that operate in different European countries that bring together women business angels and support women in setting up their own innovative start-ups that have a growth potential and may interest investors. The final section provides conclusions.

The role and profile of business angel investors

As an alternative source of financing, venture capital plays an important role in financing the growth of companies, mainly small and medium-sized enterprises (Zinecker et al. 2021). This type of financing is often provided to companies that show potential for high growth in value (Panfil 2005, p. 12). Private direct investors – business angels – are one form of this type of financing.

Although the idea of business angels starts from the beginning of the 20th century, there is still no uniform, universally accepted definition. This is mainly due to changes in the capital market, investor preferences, and the fact that business angels are an informal source of financing for enterprises and that they usually want to remain anonymous (Cecelak 2017, p. 208).

Business angels are people with extensive professional experience, financial resources, and business contacts. By investing their private money, business angels are considered a segment of the informal private equity/venture capital market. Their investments demonstrate high potential growth/development above--average rates of return, and they are simultaneously characterized by an equally high risk of failure. Investment objectives are typically small or medium-sized private enterprises not available on stock markets. Currently, most projects are in the early stages of development, i.e., in the pre-seed, seed, and start-up stages.

Typically, business angels invest locally and in projects that relate to sectors in which business angels have worked and gained extensive experience. The investor provides their niche expertise and, in addition to financial support, business angels advise in decision-making regarding the enterprise, offer mentoring, aid in the form of market knowledge, technology, and business contacts. Investors can also indicate how to minimize or avoid potential losses (Piekunko-Mantiuk 2014; Cecelak 2017; Tamowicz 2007; Gemzik-Salwach & Perz 2019; Schmidt 2014, Świadek & Gorączkowska 2020).

Business angels play an important role in the capital market due to activities that help reduce the equity gap. They provide initial capital for start-up companies that have few if any existing financial options to move projects beyond the planning stages.

As individual investors, business angels continue to dominate the venture capital market, but significant changes, especially at the local level, have been observed in recent years. The business angels market began to evolve from the individual approach of investors to an organized market where business angels networks and syndicates are increasingly important in financing emerging enterprises (Schmidt 2014, p. 1–2).

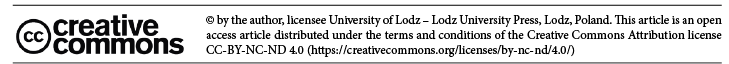

Nowadays, business angels often operate within various organizational structures. The most common typology is presented in Figure 1.

Figure 1. Business angels organizational structures

Source: own study based on Lipińska A., Wpływ sieci aniołów biznesu na rozwój innowacyjnych przedsiębiorstw w gospodarce opartej na wiedzy, [in:] Uwarunkowania jakości usług w społeczeństwie sieciowym, Uniwersytet M. Curie-Skłodowskiej, Lublin 2016, pp. 5–6.

The groups that bring together business angels can be separated or distributed, among others, on networks, syndicates, and clubs,. The connections within them make it possible to define the relationships and dependencies, as well as the distribution of powers and responsibilities between business angels.

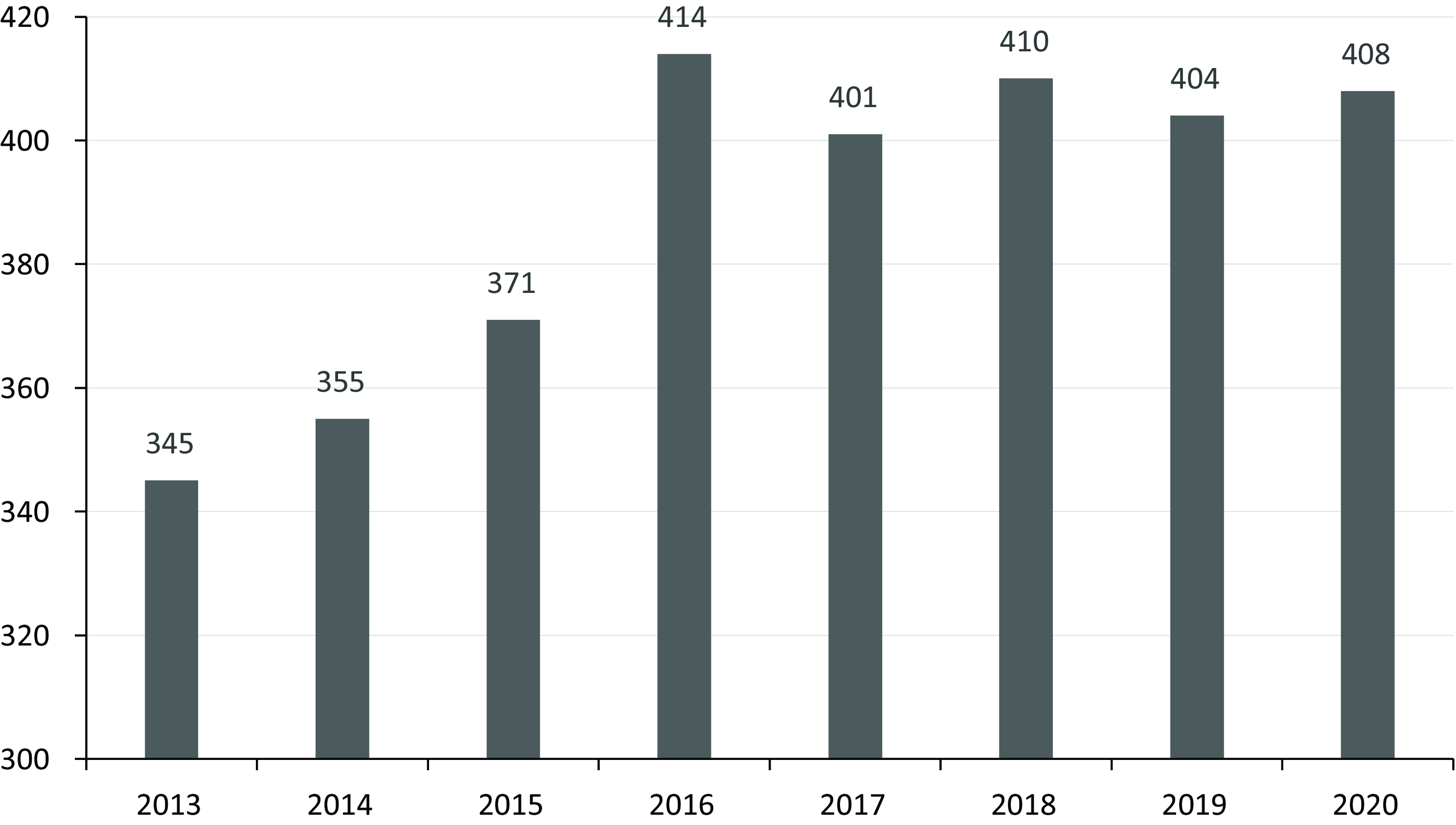

Local, regional, or even national business angel networks have existed for many years. According to a study conducted by the European Business Angels Network (EBAN), a number of business angel networks in the European market increased between 2013 and 2020, with the most in 2016 (see Figure 2). Since 2016, the number of active business angels networks has remained above 400. The number of business angels networks on the European market in 2020 was 408, and in 2019 it was 404, which is a decrease compared to 2018, when there were 410 (EBAN 2021, p. 12).

Networks create special channels of information flow, i.e., Internet platforms that help achieve savings and synergy, leading to lower transaction costs, i.e., costs for obtaining information, as well as distribution. They also bring together potential investors and originators (Tamowicz 2007, p. 33; Cegielska 2020, p. 7). There are national networks in European markets (see Table 1), bringing together investors from all over the country.

Table 1. Business angels networks in Europe

| Name |

Country |

Year of establishment |

Scope |

Mission |

|

France Angels – the National Federation of Business Angels

|

France

|

2001

|

National

|

To represent and promote the role of the business angels market in the country’s economy and to support investors even in the international area.

|

|

Italian Business Angels Network

|

Italy

|

1999

|

National

|

To provide entrepreneurs and start-ups with specific tools to build business activities and

to support investors who want to create new businesses and new jobs.

|

|

Asociación Española de Business Angels Networks

|

Spain

|

2008

|

National

|

To promote the activity of business angels that invest in the initial stages.

|

|

Austrian Angel Investors Association

|

Austria

|

2012

|

National

|

To promote Austrian business angels’ investments and create incentives for investors.

|

|

Czech Business Angel Association

|

Czech Republic

|

2019

|

National

|

To raise awareness about business angels investing, promoting relationships with new and potential business angels, and sharing experiences between investors.

|

|

UK Business Angels Association

|

Great Britain

|

2004

|

National

|

To build an investment ecosystem to finance high-potential entrepreneurs across the UK. The organization is also trying to raise qualifications and professionalize both the community of investors and founders.

|

|

European Business Angels Network

|

Europe

|

1999

|

International

|

To ensure effective and responsible investing by business angels in Europe and promote diversity within the investments.

|

|

Business Angels Europe

|

Europe

|

2013

|

International

|

To promote the growth of the angel market in Europe, raise awareness of angel investing, and create a connected ecosystem for angel investing across Europe.

|

Source: own study basis on: https://www.franceangels.org/la-federation/; https://www.iban.it/chi-siamo/; https://www.aeban.es/que-es-aeban/; https://www.aaia.at/en/about/; https://www.cbaa.cz/o-asociaci.html; https://ukbaa.org.uk/about/; https://www.eban.org/; https://www.businessangelseurope.com/about-us (accessed: 24.02.2022).

One of the first national networks in Europe is France Angels – the National Federation of Business Angels. France Angels connects 64 business angels networks, but also individual investors (FA – accessed: 2.03.2022). It was founded in 2001 and has since brought together 12,500 business angels in the network or as individual members. EUR 686 million has been invested in 4,300 companies, and 21,000 vacancies have been created (French Federation of Business Angels 2021, p. 2).

The Italian Business Angels Network (IBAN) is a national network that is dynamically developing. It made 88 transactions in 2019 and invested over EUR 52 million (IBAN 2020, p. 6). Investments were directed at innovative start-ups, especially in the technology sector, mainly in northern Italy (IBAN 2020).

The Asociación Española de Business Angels Networks (AEBAN) was established in 2008 in Spain (AEBAN 2020, p. 4). AEBAN connects 31 business angel networks in the country, bringing together nearly 2,000 investors. In 2019, Spanish angels invested over EUR 150 million in over 500 transactions. The development of the Spanish business angels market is noticeable because there was reported a 34% increase in transactions compared to previous years (AEBAN 2020, p. 10).

The Austrian Angel Investors Association (AAIA) was established in 2012 and is one of the best examples of a network that has dealt perfectly with the COVID-19 pandemic. In 2020, 47% of Austrian investors focused on new investments, while 53% of business angels focused on an existing investment portfolio (Austrian Angel Investing Association & Austria Wirtschaftsservice 2021, p. 36). The slowdown in new investments in the first three months was the largest, but then investors realized the possibility of investing remotely(Austrian Angel Investing Association & Austria Wirtschaftsservice 2021, p. 39). Unfortunately, the business angel market is still largely dominated by men, which, regrettably, has created a bias. In 2020, the AAIA’s Angel Investing Report 2020 showed an overwhelming 94.7% of investors were men, and only 5.3% were women (Austrian Angel Investing Association & Austria Wirtschaftsservice 2021, p. 13). Currently, the network consists of over 200 investors, and as such, it is the leading network on the Austrian market (AAIA – accessed: 24.02.2022).

According to the Czech Business Angel Association (CBAA) the business angels market in the Czech Republic is underdeveloped, although nearly 70% of investors already have experience in making this type of investment. There are few business angels networks in the Czech Republic, which is why nearly 20% of investors do not know where to find start-up offers or suitable co-investors (DEPO Ventures 2020).

The UK Business Angels Association (UKBAA) is the national network ofinvestors in the Great Britain. Investors are concentrated mainly in the south of the country (UKBAA & British Business Bank 2020, p. 33). In the UK, the business angel market is very well developed. There are up to 9,000 investors, and the number of investments reached over 950 (EBAN 2021, p. 13). In 2020, in addition to the negative impact of the COVID-19 on investments, British investors additionally faced Brexit challenges (UKBAA & British Business Bank 2020, p. 18). However, a positive aspect of the network’s operation is the willingness of investors to co-invest with women. Nearly 30% cooperate with women in a syndicate, and 11% always include a female investor; over 40% of British business angels co-invest occasionally with women (UKBAA & British Business Bank 2020, p. 26).

International networks of business angels are increasingly being created to bring together national networks. This allows entrepreneurs to enter international markets and develop their start-ups. Representative examples of international networks are the European Business Angels Network (EBAN) and Business Angels Europe (BAE).

EBAN is one of the largest investor communities in Europe. It currently brings together over 150 business angels member organizations in over 50 countries. It was founded in 1999 with the cooperation of the European Commission. EBAN’s main mission is to conduct effective and responsible business angel investments. It is estimated that they invest almost EUR 11.4 billion yearly and simultaneously support the development of especially the SME sector, creating many workplaces. Currently, members of EBAN are national networks from countries including Spain, Italy, France, Great Britain, Austria, the Czech Republic, Belgium, Germany, and Denmark (EBAN – accessed: 15.02.2022).

BAE is the European Confederation of Angel Investing. BAE represents over 250 structured angel networks with over 40,000 individual business angels in these networks across Europe. It aims to promote the development of the business angels market in Europe, help to grow investing skills, and provide financial resources and support to start-up enterprises (BAE – accessed: 15.02.2022). It has created many programs that support the development of a network of business angels, including Women Business Angels for Europe’s Entrepreneurs (WA4E) and the Early Stage Investing Launchpad (ESIL), a program that supports countries with the least developed business angels market. BAE members include UKBAA, France Angels, the Italian Business Angel Network, BeAngels and BAN Vlaanderen (from Belgium), Associação Portuguesa Business Angels, AEBAN, CBAA, Business Angels Netwerken Nederland, the Scottish Angel Capital Association, and Business Angels Netzwerk Deutschland. Associated members include national networks from Switzerland, Sweden, Cyprus, and Armenia (BAE – accessed: 15.02.2022).

In addition to organizing numerous events for experienced investors and meetings on project analysis, over time, the networks began to offer investment training for aspiring business angels. This attracts inexperienced investors, allowing them to acquire the appropriate knowledge and skills to make the right decisions regarding projects (Tamowicz 2007, p. 35).

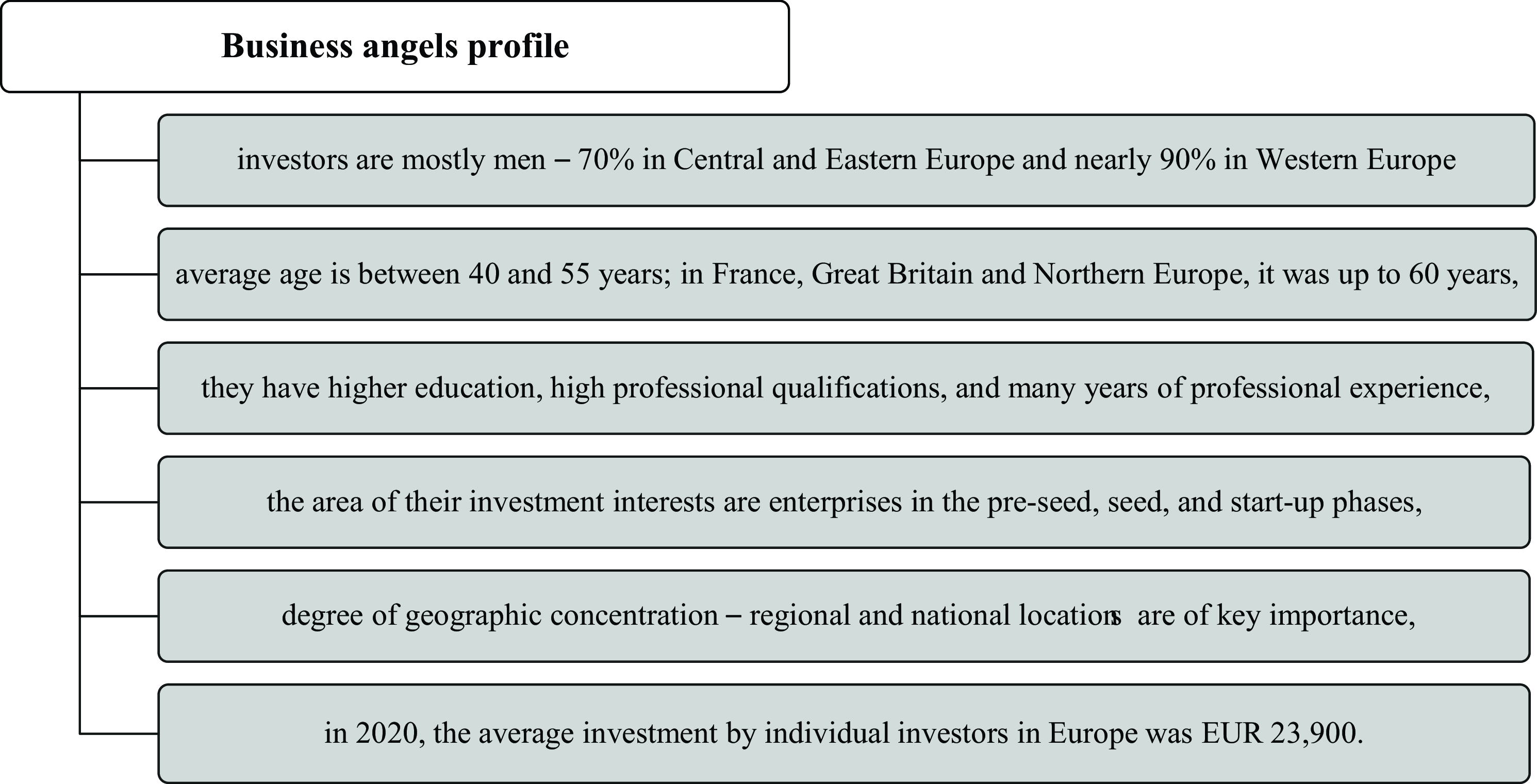

Business angels are not considered a homogeneous group that behaves in an identical manner, or that follows similar patterns. The differences concern preferences, criteria, and the course of the investment process. However, individual features seem to be consistent for most of them. Figure 3 presents research conducted by EBAN on the characteristics of business angels who were the most willing to invest in 2020.

Figure 3. Business angels profile

Source: own study based on Statistics Compendium European Early Stage Market Statistics 2020, EBAN, Brussels 2021, pp. 16–22,

https://www.eban.org/statistics-compendium-2021-european-early-stage-market-statistics-2/ (accessed: 5.02.2022); Cecelak J.,

Rola aniołów biznesu w finansowaniu przedsiębiorstw we wczesnych fazach rozwoju, [in:] Zeszyty naukowe PWSZ w Płocku, Nauki Ekonomiczne, PWSZ w Płocku, Płock 2017, p. 209.

Investors are usually men aged 40–55. They are educated with many years of professional experience (as an owner, board member, or company manager). The capital of an average investment is EUR 23,900.

The status and activity of female business angels

Women’s engagement in the business angel market is affected by the stereotypes that women are less inclined to take risks and there is a lack of sufficient infor-mation on this type of investment. The WA4E survey conducted in 2017–2018 identified the following reasons why there were few women business angels (BAE 2018, p. 16):

- lack of knowledge about the existence of this type of investment (52%),

- investments of this type seem too risky (48%),

- lack of knowledge about the existence of investors and business angel networks (46%).

Insufficient knowledge about this type of investment among women results in them missing opportunities that are available on the financial market. The impression that investments made by business angels are risky makes women decide to participate in less risky ventures. According to a BAE survey, almost 96% of the respondents who obtained the help of a financial advisor were not even informed about the possibility of acting as business angels. Many financial advisors were driven mainly by the stereotype that women are more risk-averse than men and that they prefer to use safer options with low investment risks (BAE 2018, p. 19). However, there is a group of women business angels who managed to gain experience in this market (48% of respondents). The percentage of investments made by this group of women was relatively small due to their insufficient experience (BAE 2018, p. 7).

The primary barrier to the development of female business angels is the lack of knowledge about this type of investment and the lack of female investors that could inspire women. Many women who have never invested will indicate that they are unfamiliar with business angels and investor networks (BAE 2018; Sohl & Hill 2007). A lack of education and experience makes women think that investing structures exist for ultra-high-net-worth individuals. Due to a small number of female investors, women who would like to develop as business angels lack support in finding profitable offers and in making investments. Many women in the WA4W study indicated that they lacked confidence in making financial decisions.

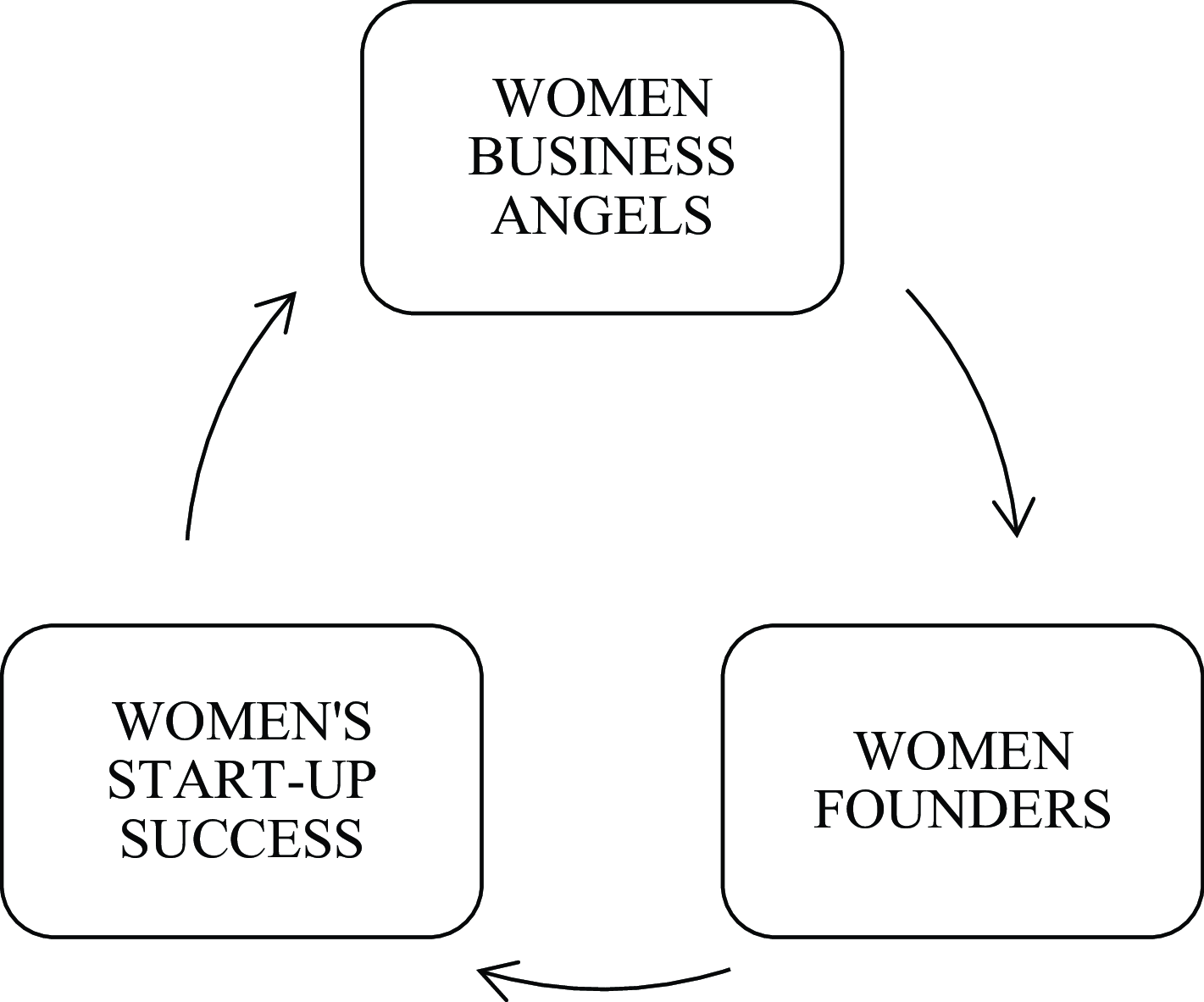

Figure 4. Women’s interdependence in business

Source: own study.

Female investors are more likely to invest in companies of female founders.Furthermore, there is a significant development of new sectors related to female-focused technology (i.e. FemTech), including the development of innovative start-ups and the support of female founders. As a result of a small number of female investors, female entrepreneurs are much less successful in start-ups and, therefore, they are less likely to become business angels in the future. Due to a small number of women business angels, there is much less available capital in the market for female entrepreneurs. This means that both the existence of female entrepreneurs and female business angels are interdependent, and have a large impact on each other.

The reason for the small number of female investors is the priorities they follow in a given stage of life (BAE 2018). The very term “stage of life” may be associated with some potential barriers for women on the market. The barriers faced by female entrepreneurs or women participating in the business market include, above all, appearance, motherhood, and the “glass” phenomena in the workplace (Turkowska-Kucharska 2015; Imadoğlu et al. 2020; European Commission 2018; Różycka 2019). Such discrimination means that women do not feel confident in the labor market and are less likely to become business angels in the future. The mechanisms referred to as glass phenomena mainly hinder women’s promotion and promote hiring men to executive positions (Powell & Butterfield 2015). The most common problem is the glass ceiling, which prevents women from being promoted to higher positions and limits their development in the workplace. Other phenomena regarding discrimination against women in the workplace are glass walls, glass escalators, glass cliffs, and tokenism. They are mainly characterized by the fact that women perform auxiliary functions and men are promoted to higher positions; however, they create the illusion that a given enterprise strives for gender equality (Wawryszuk-Misztal 2021). Inequalities in the organizational structure of enterprises are the main obstacle to the professional career development of women, according to data from 2019 (Imadoğlu et al. 2020, p. 91). The occurrence of these phenomena at the beginning of their careers may result in later reluctance to start their own businesses or become an investor.

The COVID-19 pandemic, despite its many negative effects around the world, accelerated existing trends and attitudes towards flexible work. It increased the conscious use of differentiated approaches to innovation and business success, as well as more empathic and transparent leadership. Thus, it is an ideal opportunity for women to demonstrate skills, rise successfully in business, and occupy high job positions. The possibility of investing remotely is developing more and more dynamically, allowing women to reconcile household duties with investing (Grant Thornton 2021, p. 3).

One of the other barriers is a low number of women investing in syndicates. The main reasons are the limitations for women in joining them and the negative experiences of female investors related to participating in male-dominated groups (BAE 2018).

The way inequalities can be reduced in an enterprise’s organizational structure is to support enterprises in which women are founders. Organizations that bring together female investors and female entrepreneurs are being established to give support and exchange experiences. In most European countries, initiatives are created to spread knowledge about investments made by business angels, e.g., courses and seminars are organized where essential knowledge about the investing process is transferred. There are also competitions where women can submit their ideas for start-ups, which serves as an opportunity to obtain financing or gain business contacts.

Most often, female investors are also women who had to go through the various levels of their career; therefore, they understand the importance of eliminating glass phenomena and other methods of discriminating against women by removing existing barriers. Thus, it is vital for female investors and female entrepreneurs to support each other for their ideas to be successful on the market.

Venture capital investments are time-consuming, costly, and involve a high risk of failure, and therefore, they require much commitment, knowledge, and experience (Cegielska 2020). The business angels market for women still has untapped potential for dynamic development. For this reason, more and more organizations, initiatives, and networks connect women business angels, and founders of enterprises are being created in Europe. These organizations focus on helping to break down barriers and support women in achieving success in business. In addition, they offer support, training, courses, webinars, and the possibility of common investments for female business angels who want to fulfill themselves in a specific field. They also make a great effort to reduce discrimination against women on the business market by promoting gender diversity in teams. European networks and the ways they support female investors are presented in Table 2.

Table 2. European initiatives that support women business angels

| Name of the supporting organization/program |

Country |

Year of establishment |

Characteristic |

|

Femmes Business Angels

|

France

|

2003

|

The first network of female business angels dedicated to promoting the role of women in the economy. Since 2017, FBA has organized the “Winday” Women Investors Forum.

|

|

Angel Academe

|

Great Britain

|

2014

|

Angel Academe organizes numerous events for experienced investors and aspiring business angels. One event was the Investor Academe webinar in January 2021, which was hosted by three experienced business angels.

|

|

Nordic Female Business Angels Network

|

Scandinavian countries

|

2015

|

It supports female entrepreneurship, spreads knowledge about investing, and creates an integrated network of women business angels, e.g., by creating an educational platform, the NFBAN Social Impact Investment Lab (SIIL).

|

|

Investing Women Angels

|

Scotland

|

2013

|

The main goal is to support female investors. In 2015, the AccelerateHER Awards program was created, which is characterized by courses conducted by experienced business angels and the possibility of participating in international market-building missions, including in Berlin and the USA.

|

|

VC Black Swan Fund

|

Poland

|

2015

|

The founders promote gender diversity on the Polish market and support women who have already started investing and those who are just planning it.

|

|

Women Business Angels

|

Hungary

|

2017

|

The association supports women who want to become business angels. As part of the assistance, in 2021, they launched the First Business Angel Training Course – an international business angels course. Moreover, the WBA Angels Club was established, which focuses on Central and Eastern Europe.

|

|

Women Angels for STEAM

|

Spain

|

2018

|

The organization mainly supports women in making investments, especially in STEAM projects, where women are a clear minority.

|

|

Angels 4 Women

|

Italy

|

2018

|

The association was established to support women business angels and women starting their own enterprises, especially in the business and finance sector. Currently, the most interesting topics focus on ecological construction, agriculture, logistics, health, livestock, and the garment sector.

|

|

Women Investing In Tech

|

Lithuania and other Baltic countries

|

2020

|

In 2020 and 2021, the Business Angel Leaders Program created special editions of the program called Women Investing In Tech to help women business angels extend their knowledge about this type of investment.

|

|

Business Angels Netzwerk Deutschland

|

Germany

|

2020/2021

|

As part of increasing the number of women business angels in Germany, the “Female Funding 21” competition was organized in 2021, and 2021 was called “Women Business Angels Year 2020/21” (WBAY).

|

Source: own study based on Femmes Business Angels: https://www.femmesbusinessangels.org/en/women-business-angels/about-us/ (accessed: 9.04.2021); Angels 4 Women: https://angels4women.com/ (accessed: 8.04.2021); Nordic Female Business Angels Network: https://www.nfban.org/ (accessed: 1.04.2021); Women Angels for STEAM: https://wa4steam.com/aboutus/wa4steam-who-are-we/ (accessed: 7.04.2021); Angel Academe: https://www.angelacademe.com/ (accessed: 9.04.2021); Startup Lithuania: https://www.startuplithuania.com/news/baltic-sandbox-presents-women-investing-in-tech-inviting-female-business-angels/ (accessed: 6.04.2021); Women Business Angels: https://www.wbusinessangels.com/en/why-women-business-angels/ (accessed: 9.04.2021); Women Business Angels Year 2020/21: https://wbay2021.de/ (accessed: 6.04.2021); https://businessinsider.com.pl/gospodarka/fundusze/black-swan-fund-fundusz-pfr-i-sieci-przedsiebiorczych-kobiet/lfedynr (accessed: 10.04.2021).

The first female network to be established in Europe is the French Femmes Business Angels – FBA. Established in 2003, it currently brings together 150 women business angels and has invested in nearly 200 start-ups. Since 2017, the FBA has organized three editions of the “Winday” Women Investors Forum, which aims to promote and present women’s activities as business angels. The speeches are intended to encourage women to actively participate in the economy and show the importance of the role of women in the world (FBA – accessed: 13.12.2021). In France, the number of women business angels is constantly growing, totaling 560 in 2019 (French Federation of Business Angels 2020, p. 5).

The Nordic Female Business Angels Network (NFBAN) was established in 2015 with its headquarters in Finland. The organization provides services to investors from Scandinavia and from around the world. The NFBAN initiative enables women from all Scandinavian and Baltic countries to connect on one educational platform, the NFBAN Social Impact Investment Lab (SIIL). This platform is a place for the mutual exchange of knowledge, ideas, and experiences from investments made as business angels. For entrepreneurs, it brings benefits in the form of presenting ideas, receiving practical business advice, and opportunities to access capital (NFBAN – accessed: 1.02.2022).

Baltic Sandbox is part of the Business Angel Leaders Program. In 2020, it created a special edition of the program called Women Investing In Tech, mainly aimed at business angels women from Central and Eastern Europe and the Baltic States. Thirty business angels graduated from the program, some of whom decided to invest in two start-ups (BALP – accessed: 13.01.2022). During the five-week workshops, the women who participated could deepen their knowledge and competencies in assessing start-ups and creating a strong investor profile. They could also learn effective methods of investing in a consortium and meet European industry leaders (https://www.startuplithuania.com/news/baltic-sandbox-presents-women-investing-in-techinviting-female-business-angels/, accessed: 13.10.2021). The next edition of the Women Investing In Tech program was carried out in May and June 2021 (BALP – accessed: 13.10.2021).

Women Business Angels (WBA) is an association founded in 2017 that aims to develop innovation in Hungary and Central and Eastern Europe (WBA – accessed: 15.03.2022). The association is active and organizes workshops at the local and international levels. Between 2017 and 2019, they conducted a pilot training program for business angels, and in 2021 they launched the First Business Angel Training Course, the first international business angels course. The course was conducted in the first half of 2021 and lasted ten weeks. The main themes of the course were the basic issues related to avoiding typical pitfalls, the structure of investments, and the role of business angels throughout the life cycle of a start-up. The factors that influence the valuation of a start-up, trends in various sectors, and ways to effectively use frequently occurring changes were also discussed. An additional advantage of the course is the participation of the most famous and experienced business angels in Europe, as well as the opportunity to present aspiring start-ups, giving them the chance to establish new business contacts. Furthermore, the WBA Angels Club was established, focusing on Central and Eastern Europe (WBA – accessed: 15.03.2022).

In Germany, 2021 was named “Women Business Angels Year 2020/21” (WBAY). As business angel investments in Germany are dominated by men, the Business Angels Netzwerk Deutschland (BAND) decided to increase the number of women business angels to 25% by 2025. The aim is to increase the number of women founders of companies who, after exiting the market, will become business angels (WBAY – accessed: 6.02.2021). Thus, on March 8, 2021, workshops for women investing in innovative start-ups were held. Subsequently, on March 18, 2021, the “Female Funding 21” competition was organized for women founders, who could prepare initial presentations and show their business ideas. A cash prize was awarded for the best idea. The participants were able to expand business contacts and obtain financing for their ideas. Participating teams came from all over the country, but most were from Berlin (WBAY – accessed: 6.04.2021). Interestingly, many ideas were related to digital technology and innovations in medicine and health, including start-ups related to FemTech, i.e., female-focused technology (https://www.clearviewip.com/reports/femtech-ip-infographic/, accessed: 6.04.2021). Other start-up ideas concerned industries related to the dynamic e-commerce and the EdTech sector.

To provide women with greater visibility of their innovative start-ups, BAND created a special section on the WBAY website, “Woman Entrepreneurs Parcours21” (WEP21), where female start-ups with a logo and contact details are uploaded (WBAY – accessed: 6.04.2021). At first WEP21 was limited to those female start-ups that have applied for “Female Funding 21”. Currently, it is available to all start-ups whose founders are women, or at least half of the founding team is made up of women (BAND – accessed: 6.04.2021; WBAY – accessed: 6.04.2021).

The international initiative Women Angels for STEAM (WA4STEAM) is an association for women business angels that launched in 2018 in Spain. Currently, it has nearly 100 members in six different countries, i.e., in Jordan, the United Arab Emirates, Great Britain, Switzerland, Belgium, and, of course, Spain. Members have knowledge in a variety of areas, including finance, mathematics, law, accounting, engineering, communication, and education. This increases the possibility of contributing much greater value together, especially in the early stages of start-ups development (WA4STEAM – accessed: 7.04.2021). Thanks to the diversity in the team, the female members are involved in promoting female entrepreneurship and encouraging them to invest in STEAM projects (Science, Technology, Engineering, Arts & Architecture, and Mathematics sectors).

Following the agreement between the SPK Mentors Club and the VC Black Swan fund, the Black Swan Prestige Club was established in Poland at the end of 2018. The club’s initiative is to support women who have already started investing and those who are just planning to start investing. The club currently has over 50 members (https://siecprzedsiebiorczychkobiet.pl/klub-black-swan-prestige/, accessed: 10.04.2021). On September 10, 2019, the VC Black Swan Fund entered into one of the largest investments, using the maximum possible amount – PLN 4 million. The project concerned Medical Marketplace, which deals with supplying medical facilities, including medical, chemical, and office supplies. Previous large investments include WoshWosh and Hicash. WoshWosh deals with cleaning, renewing, and repairing footwear, while Hicash runs a platform for people dealing with business, or how to invest money and in what (VC Black Swan – accessed: 15.01.2022).

Investing Women Angels is Scotland’s first all-female organization of dedicated business angels that focuses on investing, although it pushes forward and supports female business founders throughout the UK. In 2021 they invested £2.1 million, of which 90% was invested in female founded companies (IWA – accessed: 31.03.2022). In cooperation with AccelerateHER they help with a series of long-term scaling and investment courses and provide support from experienced business angels. In addition, they organize “international market-building missions” and provide limited space for female entrepreneurs. The first conference was held in December 2021 in Germany in Berlin, the next mission was scheduled for 2022 in the United States. Participation in this program gives women advice that ‘moneycan’t buy’ such as the access to international business contacts (https://www.scottish-enterprise-mediacentre.com/news/scottish-enterprise-partnership-to-support-female-business-founders-achieve-global-growth, accessed: 10.01.2022).

To sum up all the examples, networks that bring together business angels offer a range of meetings and training sessions for experienced and aspiring business angels. Such events cover all aspects related to business angels investments, from the basics of investing through project evaluation, support in making transactions, to exiting the investment. Tips are given on how to avoid potential pitfalls when investing, and information is provided on the benefits and consequences of high-risk investments, as well as financial, legal, and tax aspects. For more experienced business angels, presentations of pre-analyzed ideas take place. An additional advantage is the participation of experienced and well-known business angels, making it possible to establish business contacts.

Conclusions

In Europe, networking initiatives are increasingly founded with the aim of providing a network for women founders and angels, and giving them the expertise they need to invest. Their core mission is to bring together current and potential investors with professional skills from diverse backgrounds, and their primary value is to create an integrated network to support women investors and spread the word about business angels investing. Members have expertise in a variety of sectors, which allows investors to be open to new, innovative ideas in high-growth sectors including digital technology, medical innovation, FemTech, e-commerce, and EdTech.

In general, when selecting projects, investors specifically focus on social utility, ecosystem impact, innovation in technology, and commerce. By supporting innovative start-ups, they create new jobs that promote the well-being of society, which ultimately leads to economic growth. At the same time, in addition to supporting innovative projects, they aim to promote gender diversity and remove barriers in the market that discriminate against women and their ideas.

Women business angels play a key role for female-led businesses; they are innovative and open to new technologies. They are ready for change and are increasingly comfortable in their role as investors. Additional support for the growing importance of the role of women in business is the fact that they make up a larger portion of society. Further understanding the needs of consumers, they are constantly working to develop their skills, and looking for the next challenge that will help them advance their careers and increase their organization’s relevance in a competitive environment. Contrary to public opinion, the effect of the COVID-19 pandemic has not stopped their activities in Europe, but only motivated them to take further action. Initiatives to support women business angels and business owners are being created throughout Europe. Creating networks and organizations of women investors benefits emerging companies by allowing them to enter international markets. AccelerateHER serves as an excellent example, offering women the opportunity to participate in international partnerships, not only in Europe but also in the United States. With contacts and new opportunities, female investors are expanding companies and achieving international success. Enlarging networks, new opportunities, commitment, and a willingness to take action, female investors are able to support start-ups in reaching the next milestones on their path of growth and achieving international success.

Oliwia Witecka, Finance and International Business student, University of Lodz, Faculty of Economics and Sociology, UL0240017@edu.uni.lodz.pl; oliwiawitecka@interia.pl, https://orcid.org/0000-0002-0228-804X

Dr Tomasz Sosnowski, University of Lodz, Faculty of Economics and Sociology, Department of International Investments and Finance, tomasz.sosnowski@uni.lodz.pl, http://orcid.org/0000-0001-5610-0404

References

AAIA, The Austrian Angel Investors Association, https://www.aaia.at

AEBAN (2020), 2020 report business angels investment in start-ups activity and trends, Spain, AEBAN 2020, https://media.iese.edu/research/pdfs/75033.pdf

Angel Academe, https://www.angelacademe.com/

Austrian Angel Investing Association & Austria Wirtschaftsservice (2021), Angel Investing Report 2020, Vienna, https://www.eban.org/aaia-x-aws-present-the-angel-investing-report-2020/

BAE (2018), The Barriers and Opportunities for Women Angel Investing in Europe, Business Angels Europe 2018, https://www.businessangelseurope.com/wa4e

BAE, The European Confederation of Angel Investing, https://www.businessangelseurope.com

BALP, Business Angel Leaders Program, https://businessangelleaders.eu

BAND, Business Angels Netzwerk Deutschland (BAND), https://www.business-angels.de

Business Angels Netzwerk Deutschland, https://www.business-angels.de/woman-entrepreneurs-parcours21-mehr-sichtbarkeit-fuer-female-start-ups/

Cecelak J. (2017), Rola aniołów biznesu w finansowaniu przedsiębiorstw we wczesnych fazach rozwoju, [in:] Zeszyty naukowe PWSZ w Płocku, Nauki Ekonomiczne, PWSZ w Płocku, Płock.

Cegielska E. (2020), Limitations on the activity of business angels in financing startups, SGH, Warszawa. https://doi.org/10.22630/ASPE.2020.19.3.23

Czech Business Angel Association, https://www.cbaa.cz/en/

DEPO Ventures (2020), Business Angels in The Czech Republic Survey 2020, Prague, https://www.eban.org/czech-republic-angel-investors-survey-2020/

EBAN (2021), Statistics Compendium European Early Stage Market Statistics 2020, European Business Angels Network 2021, Brussels, https://www.eban.org/statistics-compendium-2021-european-early-stage-market-statistics-2/

EBAN, The European Business Angels Network, https://www.eban.org

European Commission (2018), Report on equality between women and men in the EU 2018, Luxembourg.

Ewens M., Townsend R.R. (2020), Are early stage investors biased against wo-men? “Journal of Financial Economics”, 135(3). https://doi.org/10.1016/j.jfineco.2019.07.002

FA (2021), France Angels, https://www.franceangels.org

FBA, French Femmes Business Angels, https://www.femmesbusinessangels.org

Femmes Business Angels, https://www.femmesbusinessangels.org/en/

Femtech & IP (2018), ClearViewIP, United Kingdom, https://www.clearviewip.com/reports/femtech-ip-infographic/

French Federation of Business Angels (2020), Investissements des business angels 2019, France, p. 5, https://www.franceangels.org/chiffres-cles/

French Federation of Business Angels (2021), Annual Investment Report 2020, France, https://www.businessangelseurope.com/post/france-angels-despite-covid-49m-invested-in-2020

Gemzik-Salwach A., Perz P. (2019), Startups financing in Poland, “Humanities and Social Sciences” 24(26), Rzeszów. https://doi.org/10.7862/rz.2019.hss.24

Global Entrepreneurship Monitor 2020/2021, Global Report, https://www.gemconsortium.org/report/50691.

Gompers P.A., Wang S.Q. (2017), Diversity in innovation (No. w23082). National Bureau of Economic Research, https://www.nber.org/system/files/working_papers/w23082/w23082.pdf; https://doi.org/10.3386/w23082

Grant Thornton (2021), Women in Business 2021. A window of opportunity, Canada. https://media.iese.edu/research/pdfs/75033.pdf (accessed: 7.04.2021).

https://siecprzedsiebiorczychkobiet.pl

https://www.grantthornton.ca

https://www.scottish-enterprise-mediacentre.com/

IBAN (2020), Il mercato dell’angel investing in Italia: I risultati della survey annuale 2019, IBAN 2020, http://www.iban.it/it/3594 (accessed: 15.04.2021).

Imadoğlu T., Kurşuncu S.R., Çavuş F.M. (2020), The effect of glass ceiling syndrome on women’s career barriers in management and job motivation, “Holistica Journal of Business and Public Administration”, vol. 11. https://doi.org/10.2478/hjbpa-2020-0021

IWA, Investing Women Angels, https://www.investingwomen.co.uk

Lipińska A. (2016), Wpływ sieci aniołów biznesu na rozwój innowacyjnych przedsiębiorstw w gospodarce opartej na wiedzy, [in:] Uwarunkowania jakości usług w społeczeństwie sieciowym, Uniwersytet M. Curie-Skłodowskiej, Lublin.

NFBAN, The Nordic Female Business Angels Network, https://www.nfban.org

Panfil M. (2005), Fundusze Private Equity. Wpływ na wartość spółki, Difin, Warszawa.

Piekunko-Mantiuk I. (2014), Aniołowie biznesu i ich rola w finansowaniu startupów, „Ekonomia i Zarządzanie”, nr 4, Politechnika Białostocka, Białystok.

Powell G.N., Butterfield D.A. (2015), The glass ceiling: what have we learned 20 years on?, “Journal of Organizational Effectiveness: People and Performance”, 2(4). https://doi.org/10.1108/JOEPP-09-2015-0032.

Różycka M. (2019), Czy istnieje „kobiece oblicze sukcesu” w biznesie, „Zeszyty Naukowe ZPSB Firma i Rynek”, Zachodniopomorska Szkoła Biznesu, Szczecin.

Schmidt D. (2014), Entrepreneur’s choice between Venture Capitalist and Business Angel for Start-Up Financing, Anchor Academic Publishing, Hamburg.

Sobczak A. (2018), The Queen Bee Syndrome. The paradox of women discrimination on the labour market, “Journal of Gender and Power”, 9(1), Uniwersytet A. Mickiewicza, Poznań.

Sohl E.J., Hill L. (2007), Women Business Angels: Insights from Angel Groups, University of New Hampshire, USA. https://doi.org/10.1080/13691060701324536

Startup Lithuania, https://www.startuplithuania.com/

Świadek A., Gorączkowska J. (2020), The institutional support for an innovation cooperation in industry: the case of Poland.Equilibrium, “Quarterly Journal of Economics and Economic Policy”, 15(4): 811–831. https://doi.org/10.24136/eq.2020.035

Tamowicz P. (2007), Business angels Pomocna dłoń kapitału, Polska Agencja Rozwoju Przedsiębiorczości, Gdańsk.

Turkowska-Kucharska W. (2015), Czynniki warunkujące znaczenie kobiet menedżerów w zarządzaniu organizacją, [in:] W. Harasim (red.), Zarządzanie wartościami niematerialnymi w erze gospodarki cyfrowej, Wyższa Szkoła Promocji, Mediów i Show Businessu, Warszawa.

UKBAA & British Business Bank (2020), The UK Business Angel Market 2020, Sheffield, https://www.businessangelseurope.com/post/latest-uk-business-angel-market-report-launched-with-ukbaa

VC Black Swan, https://blackswanfund.pl

WA4STEAM, The Women Angels for STEAM, https://wa4steam.com

Wawryszuk-Misztal A. (2021), Finansowe czynniki i konsekwencje różnicowania składu osobowego zarządów i rad nadzorczych polskich spółek publicznych, Uniwersytet M. Curie-Skłodowskiej, Lublin.

WBA, Women Business Angels, https://www.wbusinessangels.com

WBAY, Women Business Angels Year 2020/21, https://wbay2021.de

Xie Z., Wang X., Xie L., Dun S., Li J. (2021). Institutional context and female entrepreneurship: A country-based comparison using FSQCA, “Journal of Business Research”, 132. https://doi.org/10.1016/j.jbusres.2021.04.045

Zinecker M., Skalicka M., Balcerzak A.P., Pietrzak M.B. (2021). Identifying the impact of external environment on business angel activity, “Economic Research-Ekonomska Istraživanja”, pp. 1–23. https://doi.org/10.1080/1331677x.2021.1888140

Streszczenie

Kobiece anioły biznesu w Europie: identyfikacja barier i możliwości wsparcia instytucjonalnego

Celem artykułu jest przedstawienie i ocena kontekstu inwestycji dokonywanych na przez aniołów biznesu w Europie z perspektywy kobiet. Analizie poddano przyczyny mniejszej aktywności kobiet wśród aniołów biznesu, zidentyfikowano główne bariery stojące na przeszkodzie rozwoju tej nieformalnej części rynku venture capital, a następnie zidentyfikowano potencjalne możliwości wsparcia instytucjonalnego aktywności kobiet wśród aniołów biznesu na wybranych rynkach europejskich poprzez wskazanie praktycznych inicjatyw w tym obszarze. Przedmiotem oceny były głównie europejskie organizacje zrzeszające kobiety anioły biznesu, a badanie przeprowadzone było na podstawie danych udostępnianych przez wybrane organizacje.

Liczba kobiet inwestujących na rynku aniołów biznesu w Europie jest nadal stosunkowo niska, a zdecydowaną większość inwestorów stanowią mężczyźni. Wyniki dotychczasowych badań wskazują, iż występuje silna korelacja między liczbą kobiet inwestorek a liczbą kobiet budujących i rozwijających własne przedsiębiorstwa. W związku z tym w Europie powstaje coraz więcej inicjatyw oraz organizacji wspierających i zrzeszających kobiety inwestorki, dzięki którym istnieje możliwość nawiązania współpracy z kobietami założycielkami przedsiębiorstw. Dynamika wzrostu tej części rynku aniołów biznesu jest stosunkowo wysoka, a z roku na rok powstaje coraz więcej inicjatyw i pomysłów wspierających kobiety w biznesie. Kobiety inwestorki na rynku aniołów biznesu rozwijają swoje umiejętności, szukają nowych wyzwań i chętnie udzielają wsparcia innym kobietom chcącym działać w roli aniołów biznesu.

Słowa kluczowe: venture capital, kobieca przedsiębiorczość, kobiety anioły biznesu, sieci aniołów biznesu, metody dyskryminacji kobiet.

https://orcid.org/0000-0002-0228-804X

https://orcid.org/0000-0002-0228-804X

https://orcid.org/0000-0001-5610-0404

https://orcid.org/0000-0001-5610-0404