Due to the recent introduction of the European Single Electronic Format (ESEF) in the European Union (EU), the study aims to explore the readiness of issuers of securities traded on EU-regulated markets to report their annual consolidated financial statements prepared under International Financial Reporting Standards (IFRS) using the Inline XBRL technology. The paper also offers preliminary insights into their selection of Inline XBRL implementation strategies. The study was conducted in the form of an online survey, with evidence being solicited from issuers of securities listed on the Warsaw Stock Exchange in Poland, whose financial reports were prepared in conformity with IFRS. In doing so, 35 representatives of public companies participated in our study, 25 of whom correctly completed the questionnaires. The results reveal that during the time frame of the study, the vast majority of surveyed organizations have already been in the process of adjusting their corporate procedures, practices, and infrastructures to the ESEF reporting requirements. In the context of theoretical preparedness, one of the significant findings to emerge from this study is that respondents acquired their expert knowledge in the field of ESEF mainly from webinars, conferences, training courses, and workshops. In turn, relating to practical readiness, the results indicate that respondents intended to use off-the-shelf tools or employ third-party service providers to produce Inline XBRL instance documents. Their decision to choose Inline XBRL implementation strategies, based on outsourcing and the bolt-on approach, aimed to comply with new regulations or to prevent modification of existing corporate reporting procedures and practices. Therefore, this study contributes to prior literature on XBRL and Inline XBRL standards adoption as well as implementation by focusing on the perspective of actors directly involved in the mandatory transition to the ESEF reporting regime.

Keywords: Inline XBRL, digital corporate reporting, ESEF, Poland

JEL: M41, M48, O33.

The last two decades have seen far-reaching changes throughout the financial reporting environment due to, among others, the continuous and dynamic development of information and communication technologies (ICT), introduced mandatorily or voluntarily at the organizational level, particularly in the accounting and finance functions. Since the World Wide Web’s inauguration in the 1990s, the Internet has started to play a critical role in corporate reporting practices, becoming a primary medium to communicate and present financial information (Debreceny et al. 2002; Allam & Lymer 2003; Smith & Pierce 2005). However, shifting from a paper paradigm has not significantly affected the content and arrangement of disclosures made. Internet-based financial reports have usually continued to replicate their existing hard copies, disseminating them in various electronic data presentation formats, including PDF, Excel, and Word files, or using HyperText Markup Language (HTML). Thus, they have been providing users with mainly unstructured data, requiring time-consuming and labor-intensive extraction and transformation into a more effective form for analysis and interoperability with other systems (Dunne et al. 2013). Higher interactivity and usability of disclosures have been, in turn, ensured by another technological solution simultaneously developed at that time, namely, eXtensible Business Reporting Language (XBRL).

XBRL is an open-source and royalty-free electronic standard created to facilitate and accelerate corporate financial information processing intra- and inter-organizationally (Bergeron 2003; Lampathaki et al. 2009; Piechocki et al. 2009). XBRL is based on eXtensible Markup Language (XML), thus allowing for standardizing and accommodating the content of disclosures through assigning unique tags providing contextual meaning to each financial and non-financial data item (Debreceny et al. 2009). From a technical point of view, in addition to communicating facts and interrelationships among reporting concepts, this technology also enables machine readability. Nevertheless, XBRL-related documents are not human-readable without using special software to render them into more conventional and user-friendly formats. In contrast to XBRL, its more advanced version – Inline XBRL – possesses the inscribed rendering mechanism. Hence, by embedding XBRL tags in HTML/XHTML documents, Inline XBRL produces more humanly visible and understandable representations of disclosures (Basoglu & White 2015). In doing so, by dint of their built-in technical capabilities, both XBRL and Inline XBRL overcome the constraints inherent in previous electronic data presentation formats (Troshani & Rowbottom 2021).

In fact, the applicability of XBRL and Inline XBRL extends beyond the scope of financial reporting. These technologies may be successfully used, for instance, for financial, banking, insurance, tax, or statistical reporting purposes, both nationally and internationally (e.g., Bonsón-Ponte et al. 2007; Bonsón et al. 2010; Mousa 2016; Roos 2010). Therefore, they have been adopted, voluntarily or mandatorily, in many jurisdictions, including Australia, Belgium, Denmark, France, Spain, Japan, Canada, South Korea, Germany, the United States (US), or the United Kingdom (UK) (Kernan 2008; Brands 2012; Singerová 2015; Enachi & Andone 2015). In the case of the European Union (EU) Member States, XBRL and Inline XBRL have been voluntarily implemented for financial reporting purposes at the national level so far. However, with the emergence of the European Single Electronic Format (ESEF), this circumstance has changed for a specific group of entities, starting with reporting periods beginning in 2020 or later (Di Fabio et al. 2019).

According to the Commission Delegated Regulation (EU) 2019/815 of December 17, 2018, which defines the specification of ESEF, annual consolidated financial statements of issuers of securities admitted to trading on EU-regu-lated markets, prepared under International Financial Reporting Standards (IFRS), should be only produced using Inline XBRL (EC 2018). As expected by the European Commission (EC), this technology should impact all relevant stakeholders positively (Di Fabio et al. 2019). Also, a considerable amount of prior academic literature on the topic has emphasized various potential benefits of XBRL-enabled financial reporting (e.g., Gunn 2007; Steenkamp & Nel 2012; Liu 2013). Nonetheless, the introduction of XBRL, and thus Inline XBRL, results in the need for undertaking particular activities and incurring necessary costs depending on the role played in the financial reporting supply chain. These additional burdens are especially apparent from the preparers’ side, who are simultaneously required to select a suitable XBRL/Inline XBRL implementation strategy for their organizations (Cohen 2009; Liu 2013). Correspondingly, the mandatory transition toward the ESEF reporting regime should also urge issuers to start appropriate preparations to adapt to the new business reality.

Therefore, the purpose of this research is to identify the level of readiness of issuers who are obliged to prepare their annual consolidated financial statements in conformity with IFRS (IFRS consolidated financial statements) to file submissions under the ESEF mandate. Specifically, we focus on several criticalities related to Inline XBRL implementation and usage. The core motivation for this study has emerged from the call for broader and deeper research on diverse preparers’ approaches to introducing XBRL or Inline XBRL in organizations, and their impact on existing procedures, practices, and infrastructures, especially in the context of different regulatory regimes (Janvrin & No 2012; Hsieh et al. 2019; Troshani & Rowbottom 2021). Hence, we decided to pose the following research questions:

RQ 1: At what stage of theoretical and technical preparation for ESEF reporting are the issuers of securities admitted to trading on EU-regulated markets whose consolidated financial statements comply with IFRS?

RQ 2: What strategy for implementation of Inline XBRL do they adopt concerning the ESEF mandate?

To provide an empirical response to the above research questions, we conducted an online survey among IFRS consolidated financial statement preparers listed on the Warsaw Stock Exchange (WSE) in Poland. In consequence, the research draws on the interpretation of 25 correctly completed questionnaires sent back in the vast majority by representatives of organizations with no previous experience in XBRL utilization. The findings reveal differences in the level of readiness for ESEF reporting among surveyed listed companies. Furthermore, issuers’ decisions to choose Inline XBRL implementation strategies based on outsourcing and the bolt-on approach were essentially driven by the need to comply with new regulations and prevent modification of existing corporate reporting procedures and practices. The above and other insights gained from our study may be of assistance especially to the regulatory and supervisory authorities responsible for developing digital reporting standards initiatives in the EU and third-party service providers or IT solution vendors.

The article additionally extends existing knowledge of Inline XBRL by shedding light on the process of producing Inline XBRL-formatted financial statements in the new regulatory context. While a large and growing body of literature has investigated the XBRL standard adoption (e.g., Pinsker & Li 2008; Felden 2011; Steenkamp & Nel 2012; Henderson et al. 2012; Markelevich et al. 2015; Ilias & Ghani 2015), there is still very little scientific understanding of XBRL and Inline XBRL implementation (e.g., Sledgianowski et al. 2010b; Janvrin & No 2012; Hsieh et al. 2019; Cong et al. 2019). Thus, despite its exploratory nature, this study may lay the valuable groundwork for future research by providing the initial feedback on the transposition of ESEF requirements into financial reporting procedures and practices from the preparers’ standpoint.

The paper is organized as follows. Section 1 outlines the theoretical background of the study, especially the concept of ESEF and the steps taken by the European Securities and Markets Authority (ESMA) to develop a new structured electronic format. Thereafter, Section 2 describes the research method and characterizes the research sample. Section 3 presents the results of the conducted survey. Next, we analyze and interpret our findings drawing on the extant XBRL literature, especially in the field of implementation strategies, in Section 4. The last part summarizes the article and indicates the limitations of the conducted study. Possible directions for future research are also suggested.

As mentioned in the introduction, XBRL and Inline XBRL standards are already accepted and introduced in many jurisdictions from diverse geographic locations and in a wide variety of business areas of different types of organizations (Bartolacci et al. 2021). Nevertheless, prior literature has revealed that the diffusion of these technologies is primarily driven by the coercive pressure originating from regulators and supervisors (Troshani & Rao 2007). For instance, XBRL has been adopted on a mandatory basis for annual accounts of non-financial enterprises, associations, and foundations in Belgium in 2007, or for financial reporting of listed companies, mutual funds, and securitization fund management companies in Spain in 2005 (Liu et al. 2017; Escobar-Rodríguez & Gago-Rodríguez 2012). However, it is worth noting that in several jurisdictions with obligatory XBRL utilization for regulatory purposes, there are, simultaneously, other initiatives providing the possibility for voluntary application of this technology (Enachi & Andone 2015).

From the financial reporting perspective, one of the most recognizable projects of filing interactive data using XBRL was the US Securities and Exchange Commission’s (SEC’s) XBRL Mandatory Program, preceded by the SEC’s Voluntary XBRL Filing Program (Bartolacci et al. 2021). Nonetheless, both SEC and other regulatory and supervisory authorities worldwide have recently started to demand applying Inline XBRL for digital corporate reporting. The UK’s HM Revenue and Customs (HMRC), which developed this technology, have already required all private, limited, not-for-profit, and charity organizations to submit their tax returns in Inline XBRL from April 2011 (Mousa 2016). Besides the UK, Ireland has introduced Inline XBRL mandatory filing to all corporation taxpayers (with some exclusions) for accounting periods ending on or after December 31, 2013. In turn, Japanese listed companies and investment funds have used this standard for reporting obligations since 2013. Inline XBRL was also deployed, among others, in Australia, Denmark, South Africa, and Taiwan (ESMA 2016; XBRL International 2019a; XBRL International 2019b). Hence, the ongoing dissemination of XBRL and Inline XBRL internationally has provided accounting researchers with many opportunities to conduct meaningful studies in diverse business environments and reporting regimes.

Prior literature reviews have identified academics’ engagement in XBRL topics from this technology’s inception to the present (Roohani et al. 2010; Perdana et al. 2015a). Although XBRL research in the accounting field has significantly progressed over the past twenty years, its rapid growth is especially noticeable in the second decade of the twenty-first century (Bartolacci et al. 2021). In contrast, only a limited number of academic studies have examined the aspects related to the Inline XBRL standard to date. Therefore, due to the scant attention paid by scholars to Inline XBRL adoption and implementation issues and challenges, we review the published research on these themes in the context of the XBRL standard in the following subsection.

In recent years, most studies in XBRL introduction have mainly focused on addressing determinants of this technology adoption (e.g., Troshani & Rao 2007; Felden 2011; Henderson et al. 2012), identifying characteristics of its early or voluntary adopters (e.g., Premuroso & Bhattacharya 2008; Callaghan & Nehmer 2009), and describing the perceived benefits resulting from its application (e.g., Baldwin & Trinke 2011; Liu 2013). To reveal drivers and inhibitors of XBRL adoption, the authors usually used the following theories as to the theoretical foundation: the technological-organizational-environmental (TOE) framework, the technology acceptance model (TAM), and the institutional theory (El Ansary et al. 2020). Nevertheless, as noted by El Ansary et al. (2020), the factors included in previous research are not consistent and differ by dint of the XBRL adoption context. Similarly, Hoitash et al. (2021) indicate the discrepancies in the characteristics of voluntary XBRL adopters. In turn, a considerable amount of research has attempted to articulate the potential benefits derived by crucial stakeholders across the business reporting supply chain, thus presenting the diversity and dissimilarity of perceptions of the positive consequences of XBRL adoption (Nel & Steenkamp 2008; Liu 2013). Overall, prior academic literature has revealed a growing interest among scholars in XBRL adoption. However, conducted research has sometimes yielded inconsistent or contradictory findings.

Contrary to XBRL adoption literature, there are scarce studies that have explored the aspects related to XBRL implementation in organizations, including the factors determining the decision between insourcing and outsourcing of certain functions and activities concerned with this technology deployment (Troshani & Rowbottom 2021). These issues are of tremendous importance because the process of producing XBRL instance documents may significantly differ among preparers due to their flexibility to choose between multiple variations of implementation strategies with diverse combinations of characteristics, depending on their individual preferences (Hsieh et al. 2019). For instance, Janvrin and No (2012) distinguish three implementation approaches: outsourcing, the bolt-on approach, and the integration of XBRL with the existing information system.

In the first option, preparers outsource the preparation of the XBRL-tagged filings to the third-party service providers, who carry out the tagging process, and, if applicable, create additional extensions to the core taxonomy. Thus, the role of preparers is limited to delivering reports in the traditional versions, cooperating with external experts, and reviewing the accuracy and completeness of XBRL-tagged data (ESMA 2016).

The second and third solutions are examples of insourcing the process of producing XBRL instance documents. The bolt-on approach requires using off-the-shelf tools (in a cloud or desktop version) for single-handedly labeling data with XBRL tags in reports prepared in traditional formats. In addition, if applicable, preparers extend the core taxonomy by themselves. In turn, the integrated approach allows preparers to generate XBRL instance documents automatically. This possibility exists due to the corporate data sources standardization using XBRL taxonomy at the trial balance level in the reporting and consolidating applications or at the general ledger level in the ERP systems or accounting packages (ESMA 2016).

Other previous studies investigating the XBRL implementation have emphasized identical or similar methods (cf. Garbellotto 2009a, 2009b, 2009c, 2009d; Sledgianowski et al. 2010b; Hsieh et al. 2019). Moreover, the extant literature has also pointed out that introducing XBRL may be considered from the perspective of the adoption level of this technology in organizations, based on four types of XBRL users (non-adopters, low adopters, medium adopters, and high adopters) defined by Garner et al. (2013). Nonetheless, the non-adoption option does not apply when XBRL utilization is mandatory for entities.

Considering the possibility of utilizing alternative implementation approaches by organizations, Hsieh et al. (2019) examine the factors determining the public companies’ choice of a particular XBRL implementation strategy from two perspectives: opting between a disclosure management solution (DMS) and a stand-alone solution (SAS), as well as between outsourcing and in-house deployment. Comparing DMS and SAS software with definitions of implementation approaches described earlier, DMS is equivalent to the integrated approach, and SAS – to the bolt-on approach and services provided by third parties. Specifically, the authors focus on the effects of three types of factors: knowledge resources, task environment, and financial resources. The study conducted by Janvrin and No (2012) also emphasizes the importance of organizational readiness (financial or technical) and expertise in terms of XBRL implementation. Likewise, Henderson et al. (2012) pay particular attention to internal knowledge and learning from external sources in the context of organizational determinants affecting the decision on inter-organizational or internal in-house adoption of XBRL.

Indeed, in some cases, creating XBRL instance documents may turn out to be remarkably complicated due to the inherent complexities of accounting, taxonomic, and technological issues requiring appropriate competencies (Debreceny et al. 2020). Therefore, Janvrin and No (2012) highlight that developing an implementation plan and, subsequently, selecting a suitable implementation strategy should even begin with acquiring knowledge in the field of adopted technology and applicable regulatory requirements. However, on the one hand, Hsieh et al. (2019) point out that advanced XBRL knowledge is negatively related to outsourcing this technology. On the other hand, both Garner et al. (2013) and Janvrin and No (2012) suggest that organizations that have decided to outsource the XBRL tagging process should have some level of internal expertise to verify the correctness and accuracy of XBRL instance documents. Hence, initial internal XBRL knowledge resources may substantially influence the choice of a suitable implementation approach. And in turn, selecting a particular implementation approach may determine the degree to which expertise is needed to use this technology effectively.

Notwithstanding the above considerations, the level of technological and financial resources available for XBRL implementation may also be a relevant determinant in opting for the integration depth of this technology within an organization (Janvrin & No 2012; Hsieh et al. 2019). Each implementation approach demands various realization efforts and differs significantly regarding potential benefits (Garbellotto 2009b, 2009c, 2009d). Thus, entities’ decisions impact the degree to which they should adjust their reporting practices, procedures, and infrastructure, including legacy IT systems. For instance, Hsieh et al.(2019) reveal that organizations with concerns about XBRL compliance and more difficulties in their accounting processes are likely to choose SAS solutions for XBRL deployment. Also, Henderson et al. (2012) suggest that compatibility and complexity strongly affect internal rather than inter-organizational XBRL adoption. In turn, Cong et al. (2019) indicate that selection of outsourcing may increase the accuracy of XBRL disclosures but does not influence the speed of the filings.

However, it is worth noting that most findings presented above concern the studies conducted in the conditions of the US SEC XBRL mandate (Janvrin & No 2012; Hsieh et al. 2019; Cong et al. 2019). Therefore, the emergence of a single electronic reporting format in the EU provides new opportunities for empirical verification of these explanations in the other digital reporting regime.

The European Single Electronic Format (ESEF) is a new and structured format created for the digital submission of annual financial reports (AFRs) of issuers whose securities are admitted to trading on the EU-regulated markets. The obligation to use ESEF was imposed on issuers by Directive 2013/50/EU (EC 2013) amending the Transparency Directive (EC 2004). It was introduced to provide benefits to issuers, investors, and competent authorities by simplifying the reporting process and facilitating the accessibility, analysis, and comparability of annual financial statements (EC 2013). Pursuant to the Transparency Directive, ESMA has been authorized to develop and submit the draft regulatory technical standards (RTS) for ESEF, with the consideration of current and future technological possibilities and the analysis and assessment of benefits and costs of the proposed solutions (EC 2013).

Accordingly, in September 2015, ESMA published the Consultation Paper, which presented, among others, possible options and scenarios for the ESEF implementation and a preferred choice based on the initial identification of benefits and costs. This document initiated an open public discussion in which inter-ested third parties were invited to comment on released solutions (ESMA 2015). Subsequently, in response to received comments, ESMA provided the Feedback Statement with a supplementary cost-benefit analysis and general foundations for technical specifications of a single electronic format (ESMA 2016). The feasibility of the adopted technical specifications, after further improvements, was evaluated during field tests carried out in the summer of 2017. Lessons learned from the field tests contributed to the refinement of the final version of draft RTS defining a new digital reporting format, which was announced on December 18, 2017 (ESMA 2017). The draft RTS submitted by ESMA was accepted and then, on May 29, 2019, published in the Official Journal of the European Union as the Commission Delegated Regulation (EU) 2019/815 of December 17, 2018 (ESMA 2020).

ESEF requires issuers whose securities are admitted to trading on EU-regulated markets to prepare and make their annual financial reports (AFRs) pub-licly accessible in the eXtensible Hypertext Markup Language (XHTML). As was previously stated, if AFRs contain IFRS consolidated financial statements, the issuers are also obliged to label particular data in these statements with XBRL and then embed XBRL tags in XHTML-formatted documents using the Inline XBRL specifications (EC 2018). New digital reporting guidelines come into force for financial years beginning on or after January 1, 2020. In the case of IFRS consolidated financial statements, XBRL tagging was initially deman-ded only from the primary financial statements. In other words, all items in the statement of financial position, statement of profit or loss and comprehensive income, statement of changes in equity, and statement of cash flow should be marked up in detail starting from January 1, 2020. In turn, block tagging of the notes to IFRS consolidated financial statements is compulsory for reporting periods commencing on or after January 1, 2022. There was also a possibility to label the notes simultaneously with primary financial statements, using block or detailed tags (EC 2018). However, due to the COVID-19 pandemic and the consequent difficulties in properly preparing issuers for ESEF reporting, the European Parliament and the Council assented to delay these obligations by one year. Nevertheless, the option of voluntarily applying the ESEF requirements in conformity with primary provisions was still retained (EC 2020).

To mark up disclosures, ESMA has provided issuers with its taxonomy version, namely the ESEF taxonomy. The basis of this taxonomy was the IFRS taxonomy, created and developed by the International Financial Reporting Foundation. The ESEF taxonomy uses and extends only the full IFRS taxonomy, thus omitting the IFRS taxonomy for SMEs and the IFRS taxonomy for Management Commentary (ESMA 2020b, 2020c; IFRS Foundation 2017). The content and schema of the core taxonomy are contained in the annexes to the Commission Delegated Regulation (EU) 2019/815. Depending on the issuance of new or amended IFRS standards, and other modifications relevant to ESEF, both the ESEF taxonomy and the Commission Delegated Regulation (EU) 2019/815 will be respectively updated (EC 2018). Furthermore, the EU regulator allows issuers to create extensions to the core ESEF taxonomy but only in the strictly defined manner described in the above regulation, making the ESEF taxonomy flexible to customize. On the one hand, using a standard taxonomy as a “minimum basis” as opposed to using it on a “blind basis” may compromise the full comparability of financial data reported by listed companies (Valentinetti & Rea 2013). On the other hand, the possibility of adjusting the core taxonomy to financial reporting practices used at the country, industry, or organization level can ensure greater comprehensiveness and usefulness of disclosures (Valentinetti & Rea 2011; Debreceny et al. 2011). Nevertheless, it is worth mentioning that in addition to extensions that are necessary to reflect the unique accounting disclosures correctly, the existing literature has also distinguished unnecessary extensions, aggregation extensions, and disaggregation extensions, the application of which is often unjustified (Debreceny et al. 2011). Also, Du et al. (2013) suggest that number of errors made is positively related to using own extensions by preparers. Hence, extending the core taxonomy may be controversial due to the risk of a decrease in the quality of disclosed corporate data (Troshani & Rowbottom 2021).

To conclude, the correct fulfillment of the Transparency Directive disclosure obligations necessitates issuers to produce AFRs exclusively in the version compliant with ESEF requirements within the Commission Delegated Regulation (EU) 2019/815 (EC 2020). Therefore, they should take appropriate steps for a successful transition to the new digital reporting regime beforehand.

As mentioned in the introduction to the paper, our study focuses only on issuers of securities admitted to trading on EU-regulated markets, whose AFRs contain IFRS consolidated financial statements. However, it is worth mentioning that in the Polish financial reporting practice, there is an obligation to use IFRS to prepare consolidated financial statements by banks, whether they are listed companies or not (Chojnacka et al. 2018). But the Commission Delegated Regulation (EU) 2019/815 does not apply to non-listed entities and thus they are not under our consideration in this research.

Although the transition to the ESEF reporting regime is imposed on all is-suers regardless of the accounting regulations and principles applied, we limited our study to the above group of stakeholders because of the additional obligation to embed XBRL tags in their disclosures using the Inline XBRL technology. Hence, to explore their readiness for ESEF reporting and Inline XBRL utilization, we conducted an online survey, with data being gathered from October 27, 2020, through December 27, 2020.

Despite the exploratory nature of the research, a survey-based approach was considered an appropriate method to solicit information about the above criticalities as a result of several circumstances. On the one hand, our choice emerged from the need to verify the state of preparedness for the new reporting initiative among a wide range of companies. On the other hand, due to the COVID-19 pandemic and the consequent additional responsibilities imposed on the accounting and finance personnel, it was easier to elicit evidence through a survey questionnaire than, for instance, through interviews. The following subsections present a detailed description of the applied approach.

Primary data was collected from issuers of securities listed on the WSE in Poland, one of the largest stock exchanges in Central and Eastern Europe. To recruit only IFRS consolidated financial statement preparers, we employed a non-random sampling technique, more specifically purposive sampling. This technique allowed us to select the most appropriate observation units with characteristics relevant to yield adequate information about the investigated phenomenon and thus meet research objectives (Saunders et al. 2009, p. 237). The basis for creating our e-mail addresses list was a database of 435 issuers listed on the main market, retrieved on October 16, 2020, from the WSE official portal (GPW n.d.). To establish whether issuers from the database fulfill the primary inclusion criteria, we reviewed their corporate websites and utilized the financial document browser provided by the Polish Ministry of Justice (Ministry of Justice n.d.). Once the initial sample was extracted, it was necessary to obtain contact details. Therefore, the corporate websites were then searched again to collect e-mail addresses. Consequently, we identified 321 IFRS consolidated financial statement preparers whose contact details, especially e-mail addresses, were publicly available.

Afterwards, the invitations to participate in the survey were distributed to eligible listed companies, using an e-mail address in the university’s domain as the only communication mode. We limited the recruitment to e-mail invitations because e-mail addresses were a commonly indicated contact channel for external stakeholders on corporate websites (Petrovčič et al. 2016, p. 320). Each message included a direct link to a web-based survey questionnaire administered in the university’s surveys system (LimeSurvey platform) and an attached standard version in DOCX and PDF formats. The application of the e-mail survey and web survey combination was aimed to improve the response rate by enabling potential respondents to choose the preferred survey mode. In turn, using both an e-mail address in the university’s domain and the university’s surveys system was intended to ensure the authenticity and security of the research and prevent the recruitment messages from being perceived as junk mail or spam mail (Groves et al. 1992; Tuten 1998; Evans & Mathur 2018). The questionnaire was addressed to heads of accounting and financial departments, personnel responsible for preparing annual consolidated financial statements, or other accounting and finance departments employees engaged in the ESEF reporting process in organizations. Accordingly, we sent e-mail invitations primarily to investor relations departments, secretariats, and management offices, or directly to accounting and finance departments, chief financial officers, and chief accountants.

As a result, 33 representatives of the eligible listed companies participated in the web survey. In addition, two respondents returned the completed questionnaires in the DOCX format via e-mails. The overall response to the survey was therefore poor and amounted to 10.9% of the total research sample. However, due to the incomplete or incorrect questionnaire completion, the responsesof 10 individuals were discarded. Hence, we qualified 25 usable received questionnaires for further analysis, finally reaching a response rate of 7.8%. A similar response rate has been observed in prior studies involving companies listed on the WSE in Poland (e.g., Dziawgo 2011; Chojnacka 2011; Łada 2011; Choj-nacka & Jadanowska 2020).

To process the obtained data, we used IBM SPSS Statistics 26. The analysis of the demographics of representatives and their listed companies reveals that questionnaires were usually completed by members of financial reporting teams (32%). Among respondents, there were seven CFOs (28%), five chief accountants (20%), and one deputy chief accountant (4%). Furthermore, two employees of the accounting departments (8%), one member of the ESEF reporting team (4%), and one person who performs various functions, including managing investor relations (4%), participated in the research on behalf of the surveyed entities. In addition, 60% of representatives of listed companies declared that they had been delegated to exercise direct supervision over the ESEF reporting process.

The respondents mainly represented organizations from the construction and development (32%), manufacturing (16%), and IT industries (12%). The majority of the surveyed entities employed less than 250 people in Poland (40%) and achieved over PLN 50 million revenues in the last year (88%). Moreover, in their shareholding structure prevailed the Polish capital. Notably, all of them were only listed on the WSE. The main characteristics are summarized in Table 1 below.

Table 1. Summary of sample characteristics (n = 25)

| Criteria | Frequency | Percentage |

|---|---|---|

|

Industry |

||

|

Construction and development |

8 |

32 |

|

Manufacturing |

4 |

16 |

|

IT |

3 |

12 |

|

Finance and insurance |

3 |

12 |

|

Food and beverage |

3 |

12 |

|

Transportation and logistics |

2 |

8 |

|

Mining |

1 |

4 |

|

Other services |

1 |

4 |

|

Number of employees |

||

|

< 250 |

10 |

40 |

|

250–499 |

5 |

20 |

|

500–999 |

5 |

20 |

|

1000–4999 |

2 |

8 |

|

≥ 5000 |

3 |

12 |

|

Total revenues (2019) |

||

|

< 2 million PLN |

1 |

4 |

|

2–9 million PLN |

1 |

4 |

|

10–49 million PLN |

1 |

4 |

|

≥ 50 million PLN |

22 |

88 |

|

Shareholding structure |

||

|

Polish capital prevails |

23 |

92 |

|

Foreign capital prevails |

2 |

8 |

Source: own elaboration.

Due to a low response rate, the survey results introduced in the next section should be interpreted only in the context of the research sample. The existing literature has highlighted several potential factors influencing the respondents’ participation in the online survey (Lozar Manfreda et al. 2008; Walston et al. 2006; Fan & Yan 2010; Daikeler et al. 2020). For instance, Schoenherr et al. (2015) suggest that achieving statistically significant response rates may be hampered by so-called “survey fatigue” amongst business professionals. They indicate that the reason for this phenomenon can be “the proliferation of empirical surveys to test business-related theory and practice…” (Schoenherr et al. 2015, p. 288). Considering our level of response rate and returns in similar studies, “survey fatigue” may be deemed one of the possible explanations for the low participation of respondents in this survey. On the other hand, another reason reported directly by some representatives of listed companies was the company’s policy not to participate in surveys.

The self-administered and structured questionnaire contained 35 questions, 26 of which addressed two issues raised in the research. They were the following: (1) the theoretical and practical issuers’ readiness to report their annual IFRS consolidated financial statements within the ESEF framework and (2) their opinions on the resulting changes (see Appendix A). The remaining nine questions on demographic data were presented at the end of the questionnaire. The survey was anonymous, so we did not require respondents to provide the entities’ names in the demographic section. Furthermore, it seemed more reasonable to develop a survey instrument in the Polish language since our study was conducted in Poland.

We mainly employed close-ended questions, both single-select and multi-select answer options. Most of them utilized nominal scaling. Moreover, to avoid bias in our results, we added an “other” answer option with a comment field to solve the problem of an insufficient range of selection answer options (Gideon 2012, p. 102). In turn, open-ended questions were only used to collect demographics. We decided to limit the application of open-ended questions in our survey in order not to induce respondent fatigue caused by a significant cognitive effort. Additionally, although open-ended questions may provide a varied and detailed set of answers, they typically achieve a higher non-response rate than close-ended questions (Reja et al. 2003; Zhou et al. 2017; Schmidt et al. 2020).

To develop survey questions and identify the most appropriate and comprehensive answer categories for the close-ended questions, we first examined regulations, working papers, and other official ESMA documents on ESEF. While constructing the questionnaire, we also referred to numerous studies demonstrated in the prior academic literature on XBRL and Inline XBRL (Gideon 2012, p. 102). Importantly for this paper, to define the order in which questions should be asked in the part related to the theoretical and practical issuers’ readiness to report their annual IFRS consolidated financial statements within the ESEF framework, we adopted the XBRL implementation process framework proposed by Janvrin and No (2012). More precisely, due to the research purposes and Inline XBRL capability to provide human-readable content, we focused especially on the first two phases: (1) plan implementation and (2) tag financial items and create taxonomy extensions. Subsequently, the draft survey instrument was reviewed by another independent accounting researcher, and then, after the discussion on inconsistencies and inadequacies, it was adjusted accordingly. Although the survey instrument described above was employed to collect data in a broader field, the following section exclusively introduces the results on the preparers’ readiness for ESEF reporting.

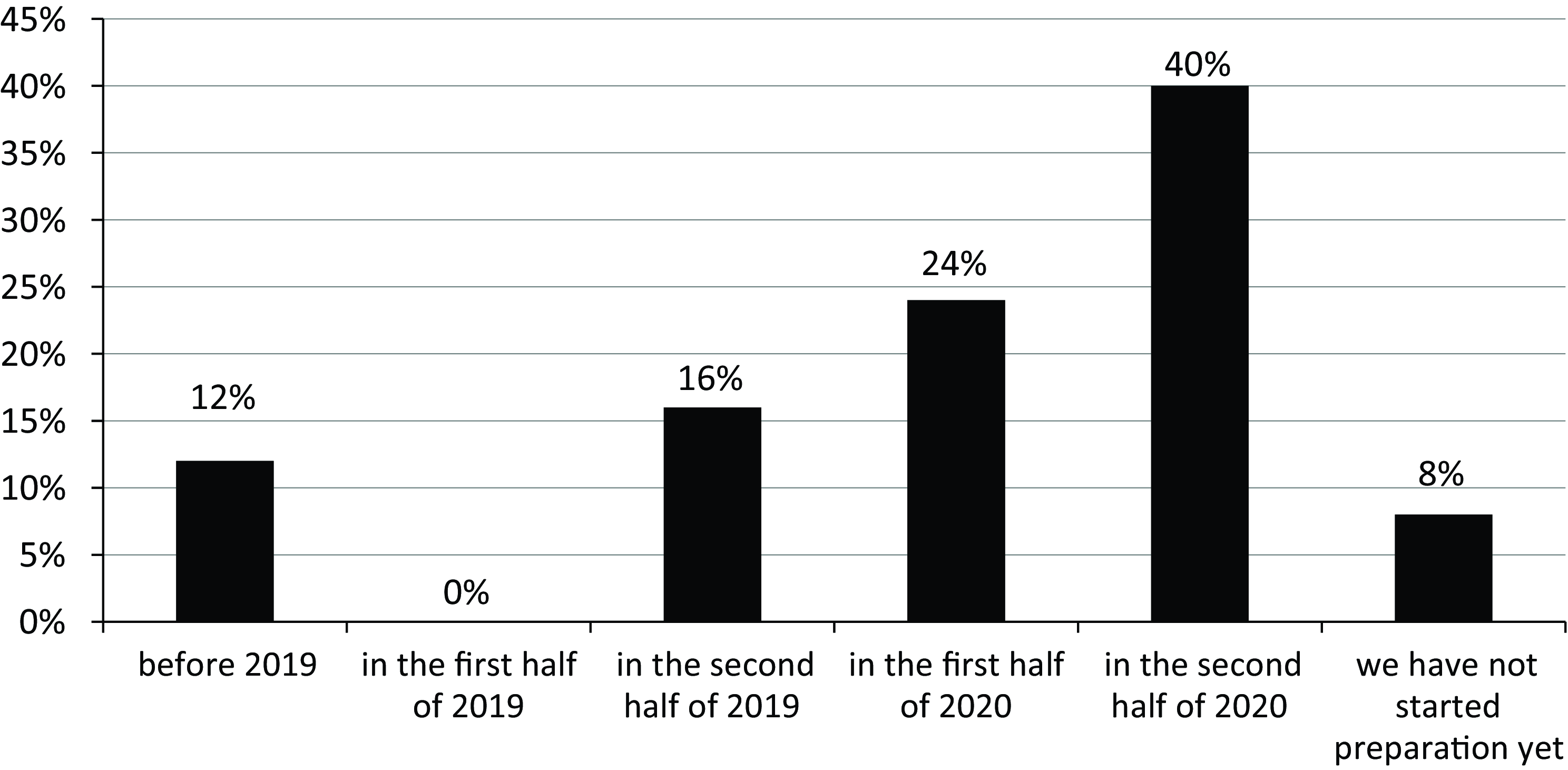

During the time frame of the study, the vast majority of surveyed companies (92%) have already been in the process of adjusting their corporate procedures, practices, and infrastructures to the ESEF reporting requirements. This finding may suggest that the respondents should be therefore familiar with the issues covered in this research. Nevertheless, 64% of them have just begun to prepare for ESEF reporting in 2020, despite the Commission Delegated Regulation (EU) 2019/815 has already informed about the principles of the new digital reporting in 2019 (see Figure 1). The earliest preparation for ESEF reporting has been undertaken by the three entities operating in the IT, financial and insurance, and mining sectors (see Table 2). On the other hand, only two survey participants stated that no action had yet been taken in this area in their listed companies at the time of the research.

Figure 1. The moment of starting preparation for ESEF reporting (n = 25)

Source: own elaboration.

Furthermore, when asked whether the allotted time was sufficient to conform with the recent EU legislation on digital reporting format, 68% of respondents answered positively. Only 8% of respondents found that the assigned time was too short to cope with the imposed obligations. More specifically, they were representatives of companies that had begun preparations for ESEF reporting in the second half of 2020. The rest of the survey participants (24%) could not give a clear response.

Table 2. The moment of starting preparation for ESEF reporting in the particular industries represented by respondents (n = 25)

| Industry | The moment of starting preparation for ESEF reporting: | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| before 2019 | in the first half of 2019 | in the second half of 2019 | in the first half of 2020 | in the second half of 2020 | we have not started preparation yet | ||||||||

| n | % | n | % | n | % | n | % | n | % | n | % | ||

|

1. |

Construction and development |

0 |

0 |

0 |

0 |

3 |

12 |

2 |

8 |

2 |

8 |

1 |

4 |

|

2. |

Manufacturing |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

4 |

3 |

12 |

0 |

0 |

|

3. |

IT |

1 |

4 |

0 |

0 |

0 |

0 |

2 |

8 |

0 |

0 |

0 |

0 |

|

4. |

Finance and insurance |

1 |

4 |

0 |

0 |

0 |

0 |

0 |

0 |

2 |

8 |

0 |

0 |

|

5. |

Food and beverage |

0 |

0 |

0 |

0 |

1 |

4 |

0 |

0 |

2 |

8 |

0 |

0 |

|

6. |

Transportation and logistics |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

4 |

0 |

0 |

1 |

4 |

|

7. |

Mining |

1 |

4 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

|

8. |

Other services |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

0 |

1 |

4 |

0 |

0 |

|

Total |

3 |

12 |

0 |

0 |

4 |

16 |

6 |

24 |

10 |

40 |

2 |

8 |

|

Source: own elaboration.

Indeed, with a view to the earlier referred XBRL implementation process framework, the correct transition to the new reporting regime requires the oblig-ated organizations to take appropriate actions to solicit expert knowledge and select the suitable implementation approach. Notably, steps taken in the plan implementation phase have, in consequence, a considerable impact on producing XBRL instance documents (Janvrin & No 2012). Hence, to determine the advancement of preparation in the above-mentioned areas, the results obtained in the study will be further presented respectively in three subsections. The first part will relate to the theoretical issuers’ preparedness for ESEF reporting. Next, the second part will concern their methods of creating Inline XBRL instance documents. The last part will demonstrate issues associated with the process of preparing IFRS consolidated financial statements under the ESEF mandate. Since the two surveyed listed companies (8%) have not yet started preparations for ESEF reporting, they were excluded from further analysis. Thus, the results reported in the following subsections will refer to 23 responses of surveyed entities, which have been in the process of adapting to the requirements of the new digital financial reporting format during the time frame of the study.

Understanding the significance and impact of the current ESEF regulations on IFRS consolidated financial statements preparation may not involve exclusively the need for issuers to familiarize themselves with applicable rules but also with foundational technical aspects and capabilities of the XBRL and Inline XBRL standards. It is worth emphasizing that only two listed companies in our sample have previously implemented XBRL due to the regulatory mandate regarding the Common Reporting (COREP) and Financial Reporting (FINREP) frameworks. Hence, the overwhelming majority of participants had no prior experience in the practical usage of this type of technology. In many organizations, the ESEF mandate could be therefore the first rationale for becoming acquainted with XBRL and Inline XBRL.

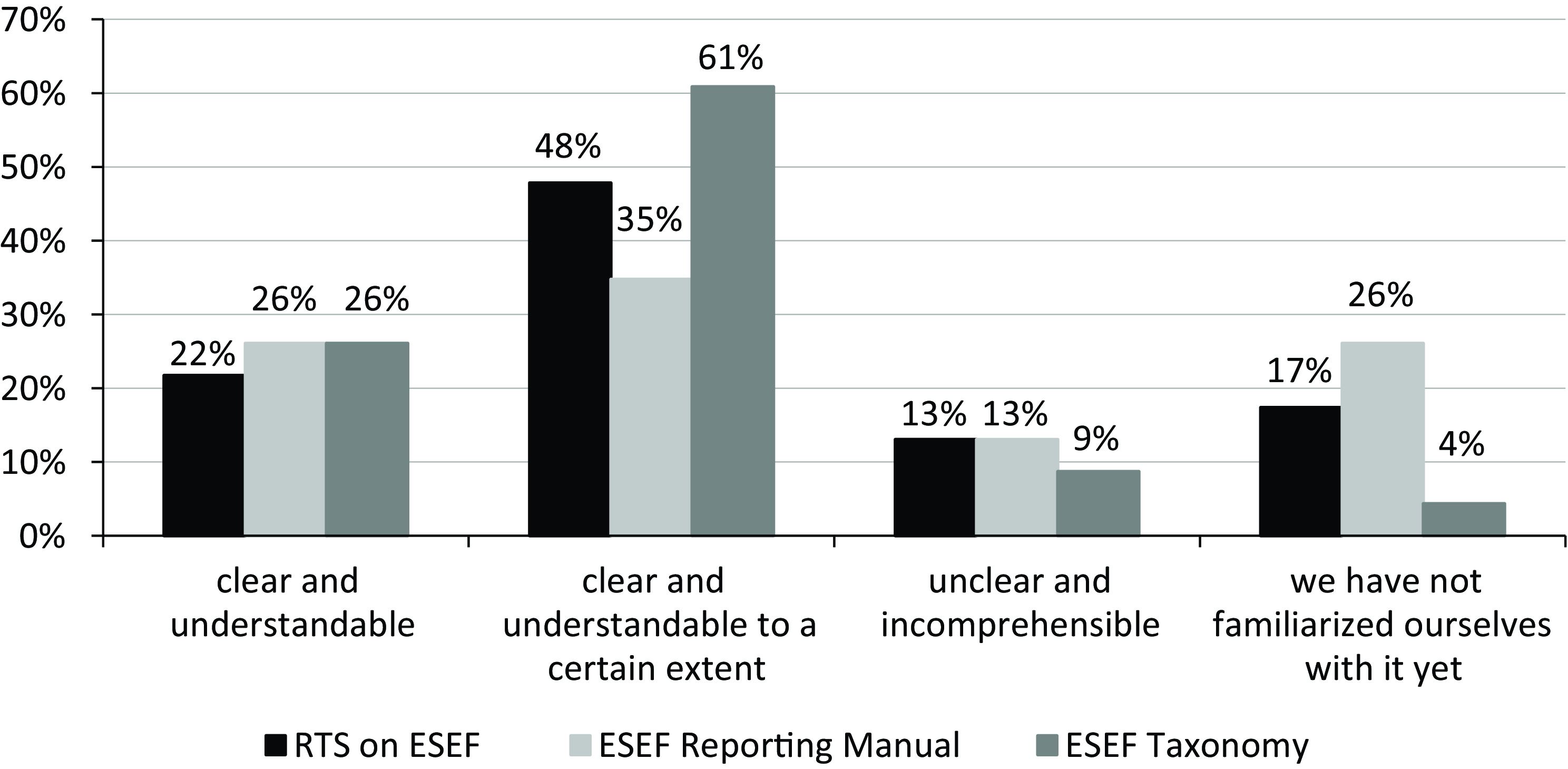

In order to verify respondents’ theoretical preparedness for new obligations, we first sought to explore their awareness and perception of key regulations and other guidance documents explaining the ESEF reporting principles. They were asked to state the clarity and understandability of the following publications: (1) Regulatory Technical Standards on the specification of a single electronic format, (2) the ESEF Reporting Manual, and (3) the ESEF Taxonomy. The responses to these questions are summarized in Figure 2 below.

It is apparent from Figure 2 that most of the respondents have perceived the above publications as clear and understandable, but only to a certain extent (approx. 48%, 35%, and 61%, respectively). Furthermore, closer inspection of Figure 2 below shows that the majority of those who responded (approx. 96%) familiarized themselves with the ESEF Taxonomy, which is the basis for producing IFRS consolidated financial statements in a digitally-enabled version. On the other hand, the fewest participants (approx. 74%) read the content of the ESEF Reporting Manual, which is an ESMA educational material explaining, among others, the most common problems that could arise in creating an Inline XBRL instance document. Thus, although some level of misunderstanding of regulations and guidelines in official documents may lead to misconceptions and errors, respondents have appeared to be aware of crucial aspects of ESEF reporting (e.g., taxonomy).

Figure 2. The clarity and understandability of selected ESEF documents in the respondents’ opinion (n = 23)

Note: all results are rounded to the nearest integer.

Source: own elaboration.

Next, participants were asked to indicate their sources of expertise in the field of ESEF. To do so, we provided them with different examples of external expertise sources in the predetermined list, from which they could choose several categories. The “other” answer option with the commentary field was also available. Table 3 below lists external sources of expertise in ESEF reporting selected by respondents, presented in descending frequency.

Table 3. Ranking of external sources of ESEF expertise

| External source of ESEF expertise | Frequency | |

|---|---|---|

|

1. |

webinars and conferences organized by expert organizations, consulting companies, educational institutions, third-party service providers, or IT solution vendors |

20 |

|

2. |

training courses and workshops organized by expert organizations, consulting companies, educational institutions, third-party service providers, or IT solution vendors |

16 |

|

3. |

Polish Financial Supervision Authority website |

14 |

|

4. |

European Securities and Markets Authority website |

9 |

|

5. |

websites of expert organizations, consulting companies, educational institutions, third-party service providers, or IT solution vendors |

8 |

|

6. |

other* |

2 |

|

7. |

XBRL International website |

1 |

|

8. |

professional or practice journals |

0 |

* Respondents submitted the following answers: (1) cooperation with an auditor; (2) employment of an external advisor.

Source: own elaboration.

As can be seen above in Table 3, the respondents acquired their expert knowledge in the field of ESEF mainly from webinars and conferences organized by various competent organizations, or training courses and workshops. Other crucial sources of information for them were the Polish Financial Supervision Author-ity website and the ESMA website. Interestingly, none of them derived expertise from professional or practice journals. As an additional method to obtain expert knowledge, two respondents indicated the engagement of external specialists, such as auditors or consultants.

More importantly, some listed companies have already started educating and training their financial and accounting personnel to meet the upcoming requirements. Approximately 70% of representatives confirmed that their organizations had already provided employees with appropriate training or courses in ESEF reporting, organized, above all, by software vendors and expert organizations (see Table 4).

Table 4. Ranking of ESEF training/courses organizers

| Organizers of training/courses in the field of ESEF | Frequency | |

|---|---|---|

|

1. |

IT solutions vendor |

9 |

|

2. |

expert organization |

6 |

|

3. |

educational institution |

3 |

|

4. |

consulting company |

1 |

|

5. |

accounting systems vendor |

1 |

|

6. |

other* |

1 |

* Respondent submitted the following answer: European Securities and Markets Authority.

Source: own elaboration.

To conclude, the results described in this subsection emphasize that surveyed listed companies have already undertaken various educational activities with regard to theoretical preparation for ESEF reporting. Acquiring appropriate competencies and internal organizational knowledge resources may contribute to a more efficient and fluid transition through the process of implementing the guidelines resulting from the Commission Delegated Regulation (EU) 2019/815 to own financial reporting procedures.

As it was mentioned in the previous sections, for issuers preparing IFRS consolidated financial statements, adapting to ESEF reporting requirements ob-liges them additionally to select the method of producing Inline XBRL instance documents. As neither ESMA nor national authorities provide proper IT solutions for this purpose, organizations should decide whether they will carry out this process on their own or outsource it to a third-party service provider. That decision is of tremendous importance as it affects, among others, the extent to which issuers will have to develop their existing technological infrastructure (Kobiela-Pionnier 2020).

Among the surveyed sample, the highest percentage of participants (approx. 61%) indicated that their organizations intended to single-handedly prepare Inline XBRL instance documents using off-the-shelf tools for labeling financial statements with XBRL tags. The remaining part of the issuers (approx. 39%) decided to outsource this process. However, it is noteworthy that none of those surveyed considered automating the procedures of generating Inline XBRL instance documents by integrating the accounting systems or accounting packages with the XBRL taxonomy. The option of outsourcing the production of Inline XBRL instance documents was declared among representatives of listed companies operating in the construction and development, manufacturing, or food and beverage sectors (see Table 5). Notably, in-house XBRL tagging with off-the-shelf tools was chosen by all participants from the IT sector as well as the finance and insurance sector.

Table 5. Methods of producing Inline XBRL instance documents in the particular industries represented by respondents (n = 23)

| Industry | Methods of producing Inline XBRL instance documents: | ||||||

|---|---|---|---|---|---|---|---|

| outsourcing the process to third-party service providers | using off-the-shelf tools for XBRL tagging | integrating the accounting systems with the XBRL taxonomy | |||||

| n | % | n | % | n | % | ||

|

1. |

Construction and development |

4 |

17.39 |

3 |

13.04 |

0 |

0.00 |

|

2. |

Manufacturing |

3 |

13.04 |

1 |

4.35 |

0 |

0.00 |

|

3. |

IT |

0 |

0.00 |

3 |

13.04 |

0 |

0.00 |

|

4. |

Finance and insurance |

0 |

0.00 |

3 |

13.04 |

0 |

0.00 |

|

5. |

Food and beverage |

2 |

8.70 |

1 |

4.35 |

0 |

0.00 |

|

6. |

Transportation and logistics |

0 |

0.00 |

1 |

4.35 |

0 |

0.00 |

|

7. |

Mining |

0 |

0.00 |

1 |

4.35 |

0 |

0.00 |

|

8. |

Other services |

0 |

0.00 |

1 |

4.35 |

0 |

0.00 |

|

Total |

9 |

39.13 |

14 |

60.87 |

0 |

0.00 |

|

Source: own elaboration.

Moreover, almost 74% of respondents stated that their organizations had already selected a third-party service provider or an IT software vendor. Their decision-making process was most frequently based on an independent review and comparison of offers available on the market (10 respondents). Three surveyed issuers established cooperation with particular third-party service providers or IT solution vendors as a result of participation in training courses, conferences, or webinars organized by them. In turn, two respondents indicated that the decision to choose the appropriate entity had been made after consultation with an external advisor. The remaining two participants mentioned that their organizations had developed customized XBRL tagging tools on their own.

According to over half of those surveyed (approx. 57%), the primary driver influencing the choice of the above methods of creating Inline XBRL instance documents was the urge to comply with the mandatory ESEF reporting requirements. On the other hand, nearly 35% of respondents revealed that their organization had decided to avoid the need for a thorough remodeling of the process of producing the annual consolidated financial statements and introducing changes in the way financial information is processed internally. Surprisingly, no issuers intend to use the potential of interactive data for in-house purposes. The remaining respondents did not specify the reasons that had driven their decision-making process in the commentary field of the “other” option.

In the final question in this part of the survey, we asked representatives of listed companies whether their selected methods of creating Inline XBRL instance documents would enable them to validate the prepared reports in accordance with the validation rules published by ESMA. A significant proportion of respondents (approx. 70%) answered positively. The remainder (approx. 30%) did not know whether their methods would provide them with such a possibility.

Although adopting the appropriate approach to prepare Inline XBRL instance documents may significantly facilitate the fulfillment of the mandatory requirements, it should be emphasized that each solution is associated with a different level of involvement, both costs necessary to incur and human resources parti-cipating in the reporting process (ESMA 2016). Therefore, the selected approach should be properly adjusted to the individual preferences of each issuer.

As the correct preparation of IFRS consolidated financial statements in the ESEF framework currently requires XBRL tagging, issuers should take appropriate actions to accurately assign adequate elements from the ESEF taxonomy to all disclosed items. Therefore, to determine how the ESEF reporting process is organized in each surveyed listed company, we first asked respondents whether an initial marking up of IFRS consolidated financial statements with XBRL tags had already been carried out in their organizations. Just over a third of those who responded (approx. 35%) confirmed that they had conducted the pre-tagging of the disclosed information. The remainder of the participants (approx. 65%) have not yet attempted any tagging trial. Interestingly, further analysis of the obtained data indicated that more than half of these representatives’ listed companies had started preparing for ESEF reporting only in the second half of 2020.

Furthermore, as a part of their procedures, issuers should also assess whether the core taxonomy used for ESEF reporting is sufficient to label all reporting items included. Otherwise, it is possible to define an extended taxonomy element (EC 2018). Accordingly, almost 70% of the respondents revealed that the accurate tagging of their IFRS consolidated financial statements would require creating additional extensions to the core ESEF taxonomy. Table 6 below documents the industry affiliation of their entities, with the majority being from the construction and development, IT, or finance and insurance sectors. The necessity of tax-onomy adjustment resulted mainly from the presence of specific reporting items for the industry in which a particular issuer has operated (see Table 7). On the otherhand, above 17% of participants did not know whether defining new elements of the taxonomy would be necessary to reflect their organizations’ disclosures. Among them were only listed companies with no initial tagging trial. Notably, the published ESEF taxonomy was sufficient to tag all reporting items only for approximately 13% of those surveyed.

Table 6. The need for extending the core ESEF taxonomy in the particular industries represented by respondents (n = 23)

| Industry | Respondents who declared the need for extending the core ESEF taxonomy | Respondents who declared no need for extending the core ESEF taxonomy | Respondents who did not know whether the need for extending the core ESEF taxonomy would occur | ||||

|---|---|---|---|---|---|---|---|

| n | % | n | % | n | % | ||

|

1. |

Construction and development |

5 |

21.74 |

2 |

8.70 |

0 |

0.00 |

|

2. |

Manufacturing |

2 |

8.70 |

0 |

0.00 |

2 |

8.70 |

|

3. |

IT |

3 |

13.04 |

0 |

0.00 |

0 |

0.00 |

|

4. |

Finance and insurance |

3 |

13.04 |

0 |

0.00 |

0 |

0.00 |

|

5. |

Food and beverage |

0 |

0.00 |

1 |

4.35 |

2 |

8.70 |

|

6. |

Transportation and logistics |

1 |

4.35 |

0 |

0.00 |

0 |

0.00 |

|

7. |

Mining |

1 |

4.35 |

0 |

0.00 |

0 |

0.00 |

|

8. |

Other services |

1 |

4.35 |

0 |

0.00 |

0 |

0.00 |

|

Total |

16 |

69.57 |

3 |

13.05 |

4 |

17.40 |

|

Note: the percentages totals are overestimated and do not add up to 100 due to the rounded percentages in the table.

Source: own elaboration.

Table 7. Ranking of reasons for creating extended taxonomy elements

| Reasons for creating extended taxonomy elements | Frequency | |

|---|---|---|

|

1. |

presence of items specific to the industry in which the listed company operates |

8 |

|

2. |

presence of items unique to the activities carried out by a particular listed company |

6 |

|

3. |

other* |

2 |

|

4. |

presence of items resulting from the specificity of national regulations |

1 |

* Respondent submitted the following answer: no particular element in the ESEF taxonomy.

Source: own elaboration.

It is worth emphasizing that the Commission Delegated Regulation (EU) 2019/815 does not restrict issuers from the freedom to mark up their IFRS consolidated financial statements with greater granularity than required by the applicable guidelines. It also applies to the possibility of voluntary block tagging or detailed tagging of the notes to IFRS consolidated financial statements for 2020. Thus, we asked respondents whether they intended to mark up the notes to IFRS consolidated financial statements for 2020 (i.e., before the block tagging obligation). At the time of the survey, nearly 70% of respondents stated that they did not plan to take any action related to prior tagging. In turn, about 22% of participants did not know whether that additional activity would be carried out in their organizations. The findings indicate that only a small proportion of surveyed listed companies (approx. 8%) intend to voluntarily label the notes to IFRS consolidated financial statements for 2020, including one of the entities using block tags and the other using detailed tags.

Importantly, depending on the adopted method of preparing Inline XBRL instance documents, the tagging of IFRS consolidated financial statement may be based on data from various sources. Almost 61% of respondents declared that the basis for them would be a file in DOC format. Above 17% of participants’ listed companies intend to assign tags from the level of a PDF file. In turn, about 9% of respondents chose an XLS file for this purpose. Among the remaining parti-cipants, who selected the “other” answer option, two individuals indicated both the DOC and the XLS formats. By contrast, one representative still did not know which data source would be tagged in the organization.

Additionally, to verify the correct fulfillment of the ESEF reporting rules, essentially in the field of tagging disclosures, issuers of securities listed on the WSE, whose financial reports complied with IFRS, had the opportunity to use the national authority test environment to validate compliance with ESEF in the period from October 15–29, 2020. Nonetheless, a small proportion of listed companies (approx. 13%) submitted a trial report for validation test.

Considering the Inline XBRL adoption scenario chosen in the EU under the ESEF mandate, the survey results presented in Section 4, and, again, the structure of the XBRL implementation process proposed by Janvrin and No (2012), we distinguished three crucial aspects critical for the preparation for ESEF reporting. These are: (1) in-house expertise and external educational sources, (2) selection of an implementation approach, and (3) extending the core ESEF taxonomy. Hence, the findings presented in previous subsections will be further discussed under these three main headings.

Prior studies have usually indicated a scarcity of knowledge and experience in the use of the XBRL standard among various stakeholders (e.g., Pinsker 2003; Nel & Steenkamp 2008; Janvrin & No 2012; Dunne et al. 2013; Eni 2015; Abed 2018). In our survey, the vast majority of respondents also confirmed the non-application of this technology in their earlier reporting practices. Therefore, external educational resources may play a vital role in building adequate individual and organizational competencies (Hsieh et al. 2019). As noted by Attewell (1992), in particular, supply-side institutions could considerably contribute to reducing barriers to the acquisition of expertise by end-users in the adoption and implementation of complex technologies. It is also supported broadly by our results, which reveal that the financial and accounting personnel of the surveyed entities mostly participated in training courses organized by IT software vendors and expert organizations. Moreover, other crucial sources among respondents were mainly webinars and conferences organized by various competent organizations or training courses and workshops. In the same vein, studies conducted by Garner et al. (2013), Janvrin and No (2012), and Bartley et al. (2010) also highlight the usefulness of these educational resources in individual and organizational learning processes.

In turn, Perdana et al. (2015b) suggest that another effective communication channel for providing information about XBRL technology could be social media. In their investigation, the authors observe the substantial relevance of community discourses conducted through specialized discussion groups on LinkedIn in the dissemination of technical and non-technical XBRL knowledge (Perdana et al. 2015b). Thus, the availability and variety of external educational sources may have a decisive impact on the profound understanding and effective utilization of XBRL and Inline XBRL technologies inside organizations (Wang & Ramiller 2009). Hence, future studies with more focus on in-house expertise and external educational sources are highly recommended.

Our results indicate that surveyed entities intend to implement Inline XBRL only through outsourcing and the bolt-on approach. In addition, referring to the framework of Garner et al. (2013), they may be recognized as low and medium adopters. In the same vein, survey evidence from ESMA’s extended cost-benefit analysis also suggests the predominance of outsourcing and bolt-on approach (both cloud and desktop version) among issuers in jurisdictions with proven and mature XBRL or Inline XBRL deployments for reporting financial information purposes (ESMA 2016). The above findings are consistent with that of Janvrin and No (2012), who conducted semi-structured interviews with nine accountants responsible for implementing XBRL at accelerated filer companies under the US SEC mandate. Their participants decided to purchase bolt-on software or employ third-party service providers. Nonetheless, contrary to Janvrin and No (2012), other findings from the same local jurisdiction were presented by the Financial Executives Research Foundation’s survey in 2013, in which 71% of respondents declared the use of an integrated approach, more specifically a disclosure management solution (ESMA 2016). On the other hand, the investigation conducted by Garner et al. (2013) reveals that organizations generally selected one of the two following options: they converted financial statements in-house and used XBRL for internal and external purposes (high adoption) or outsourced the process to a third party (low adoption). To date, the obtained results are therefore inconsist-ent and may depend on various factors.

The existing XBRL literature has indicated that the choice of an appropriate implementation approach may be, among others, driven by achievable benefits or unavoidable challenges and costs (e.g., Garner et al. 2013). Garbellotto (2006, 2008, 2009d) stresses that solely an integrated approach enables the full use of the potential of XBRL, thus providing the most apparent benefits to the organization. Nevertheless, both the surveyed listed companies and participants of other studies (ESMA 2016; Janvrin & No 2012; Bartley et al. 2010) avoid the integration of existing accounting information systems with the XBRL taxonomy. It is worth noting that regulatory and supervisory mandates have obligated entities to introduce XBRL/Inline XBRL merely for external financial reporting without requiring the utilization of these technologies for internal purposes (Garner et al. 2013). Prior literature has highlighted various objectives of implementing XBRL internally and the resulting long-term values (e.g., Baldwin et al. 2006; Garbellotto 2006, 2008, 2009d; Gray & Miller 2009; Henderson et al. 2012). Notwithstanding those positive aspects, organizations still choose outsourcing and bolt-on solutions primarily to meet regulatory requirements (Garbellotto 2009a, 2009b; Sledgianowski et al. 2010a; Janvrin & No 2012; Hsieh et al. 2019). It is also consistent with the results of our study. Moreover, the integrated approach may require a thorough remodeling of financial procedures and modification of the existing accounting information systems (Henderson et al. 2012). Hence, to prevent complex problems with adjusting the method of financial information processing in the organization, some of the surveyed listed companies decided to introduce the process of Inline XBRL instance document preparation as an additional step at the end of the financial reporting supply chain. According to Garbellotto (2009a, 2009b), such action does not generate any particular benefits other than compliance with the regulatory mandate. Thus, there is abundant room for further progress in determining drivers and inhibitors influencing preparers’ decisions to select the particular implementation approach, especially in the context of the ESEF reporting regime.

A significant proportion of the respondents declared in the survey questionnaire the need for creating additional extensions to the core ESEF taxonomy, generally due to the presence of items specific to the industry in which their organizations operate. However, it is worth noting that the analysis of the extensions in 2009 US GAAP conducted by Debreceny et al. (2011) in the first year of XBRL filing to the SEC reveals that 40% of the added elements turned out to be unnecessary because of the presence of semantically equivalent elements in the core taxon-omy. Therefore, Bonsón et al. (2009) emphasize that, in the case of discrepancy between the elements available in the core taxonomy and the reporting items indicated for labeling, it is critical to investigate the sources of this mismatch and the underlying causes. Nonetheless, field tests of the ESEF specification carried out before the adoption of the draft RTS showed that the defined extension concepts of the ESEF taxonomy had usually represented a small percentage of all elements used by participants to mark up the disclosures (ESMA 2017).

An alternative to creating additional extensions may be the change of previous methods of presenting financial disclosures to conform them to the normalized taxonomy (Debreceny et al. 2011; Rowbottom et al. 2021). However, according to Rowbottom et al. (2021), Troshani et al. (2018), and Locke et al. (2018), these activities can concur to “quasi-standardize” common reporting practices and lead to the perception of a core taxonomy as a “digital representation” of accounting standards. Thus, to develop a full picture of these issues, additional studies will need to be undertaken.

The present study set out to explore the readiness of issuers of securities admitted to trading on EU-regulated markets to report their IFRS consolidated financial statements under the ESEF requirements. The results reveal that surveyed issuers were at different stages regarding theoretical and technical preparation for ESEF reporting. The organizations, which have already started to adapt to new regulations at the time of the study, decided to incorporate the process of production of Inline XBRL instance documents as an additional step at the end of the financial reporting supply chain. Their chosen implementation strategy, based on outsourcing and the bolt-on approach, have primarily aimed at meeting basic regulatory requirements and avoiding modification of existing financial reporting procedures. Thus, they have to incur additional costs and workload without achieving benefits commensurate with those that can be gained through integrating the applied technology with legacy IT/IS systems and using it for internal purposes (Garbellotto 2009a).

However, this study has its own set of limitations. Above all, the small number of participants selected through purposive sampling restricted the ability to apply more sophisticated statistical analysis and then generalize the findings. Therefore, the presented results should be interpreted only in the context of our research sample. Nonetheless, the response rate is consistent with those achieved in other surveys involving public companies listed on the WSE (e.g., Dziawgo 2011; Łada 2011; Chojnacka & Jadanowska 2020). Moreover, although the Commission Delegated Regulation (EU) 2019/815 is in force in the entire EU, our results refer solely to organizations from one particular location. Thus, the obtained empirical evidence may be specific to the territory of the issuers. Hence, for instance, research conducted in the Member States with proven and mature XBRL/Inline XBRL implementations for financial reporting purposes may lead to disparate conclusions. In addition, our findings are based on respondents’ self-declaration and thus may not always be without arbitrariness. Other methods should be employed in further research to increase the objectivity of the conclusions.

Despite its caveats, this study may serve as preliminary insights on the level of issuers’ preparedness for ESEF reporting and their strategies for implementing Inline XBRL technology. The resulting findings may be usable for regulatory and supervisory authorities, reporters, third-party service providers, and IT solution vendors (Sledgianowski et al. 2010b). Future research should focus on a more detailed examination of the factors determining the selection of a particular implementation strategy in the context of the ESEF mandate and compare them with factors identified in prior literature (e.g., Janvrin & No 2012; Henderson et al. 2012; Hsieh et al. 2019). Furthermore, due to the time of the study, it may also be relevant to analyze the impact of the COVID-19 pandemic and the consequent difficulties in properly preparing issuers for ESEF reporting on the implementation approach chosen by them. More research is also needed to establish the importance of internal expertise and available external educational resources in the Inline XBRL implementation process (Attewell 1992; Janvrin & No 2012; Henderson et al. 2012; Perdana et al. 2015a; Hsieh et al. 2019). In turn, the stream of research in the field of extensions of the core ESEF taxonomy could mainly concern the assessment of the degree of alignment of the taxonomy to the reporting practices of companies, determination of the sources of possible discrepancies and underlying causes as well as the resulting level of risk of comparability of financial disclosures made by entities (Bonsón et al. 2009; Valentinetti & Rea 2011, 2013; Li & Nwaeze 2015; Troshani et al. 2018).

Note: the survey questionnaire was developed in Polish, and its translation into English was done by the author for article purposes.

| General questions | ||

|---|---|---|

|

1. |

When have you started preparing for reporting in the European Single Electronic Format (ESEF)? |

a) before 2019 |

|

b) in the first half of 2019 |

||

|

c) in the second half of 2019 |

||

|

d) in the first half of 2020 |

||

|

e) in the second half of 2020 |

||

|

f) we have not started preparation yet |

||

|

2. |

In your opinion, is the time assigned to preparing for ESEF reporting sufficient? |

a) yes, it is |

|

b) no, it is not |

||

|

c) it is hard to say |

||

| Questions related to theoretical preparedness for ESEF reporting | ||

|

1. |

Have you ever used eXtensible Business Reporting Language for reporting your business information before? |

a) yes, in banking reporting (COREP, FINREP) |

|

b) yes, in insurance reporting (Solvency II) |

||

|

c) yes, in sustainable reporting (e.g., GRI) |

||

|

d) yes, in financial reporting (other stock exchanges requirements) |

||

|

e) yes, ................................................... |

||

|

f) no |

||

|

2. |

Are the Regulatory Technical Standards (RTS) on ESEF published by ESMA clear and understandable for you? |

a) yes, they are |

|

b) no, they are not |

||

|

c) they are clear and understandable to a certain extent |

||

|

d) we have not familiarized ourselves with them yet |

||

|

3. |

Is the ESEF Reporting Manual published by ESMA clear and understandable for you? |

a) yes, it is |

|

b) no, it is not |

||

|

c) it is clear and understandable to a certain extent |

||

|

d) we have not familiarized ourselves with it yet |

||

|

4. |

Is the ESEF Taxonomy published by ESMA clear and understandable for you? |

a) yes, it is |

|

b) no, it is not |

||

|

c) it is clear and understandable to a certain extent |

||

|

d) we have not familiarized ourselves with it yet |

||

|

5. |

From what sources do you obtain expertise in the scope of ESEF reporting? |

a) Polish Financial Supervision Authority website |

|

b) European Securities and Markets Authority website |

||

|

c) XBRL International website |

||

|

d) websites of expert organizations, consulting companies, educational institutions, third-party service providers, or IT solution vendors |

||

|

e) webinars and conferences organized by expert organizations, consulting companies, educational institutions, third-party service providers, or IT solution vendors |

||

|

f) training courses and workshops organized by expert organizations, consulting companies, educational institutions, third-party service providers, or IT solution vendors |

||

|

g) professional or practice journals |

||

|

h) other, ......................................................................... |

||

|

6. |

Have your company’s employees participated in a training course in the field of ESEF reporting? |

a) yes, they have |

|

b) no, they have not |

||

|

7. |

If yes, who was the organizer of the training course in which your employees participated? |

a) accounting system vendor |

|

b) IT solutions vendor |

||

|

c) consulting company |

||

|

d) expert organization |

||

|

e) educational institution |

||

|

f) other, ......................................................................... |

||

| Questions related to selecting the method of producing Inline XBRL instance documents | ||

|

1. |