https://orcid.org/0000-0003-0593-2862

https://orcid.org/0000-0003-0593-2862

Abstract. The objective of the article is to analyse legal regulations concerning self-employed activity in force in Spain. Spain is the first EU Member State to have adopted a separate law (on 11 July 2007) to comprehensively and systemically regulate the legal status of the self-employed. The Spanish 2007 LETA act aimed to sort out the situation of the self-employed and grant them additional rights. A new category of economically dependent self-employed persons was introduced and accorded special protection. The author discusses the concept and typology of self-employment, including classic, economically dependent, and bogus self-employment. In her view, the Spanish solution of regulating self-employment in a single piece of legislation appears attractive, but the criteria introduced in the law to determine the status of economically dependent self-employed do not adequately fulfil their role in practice. Their restrictive nature, far-reaching casuistry, and the criterion of economic dependence of the self-employed, who must receive at least 75 per cent of their income from a single counterparty, which is difficult to verify objectively and relatively easy to circumvent, result in a negligible number of self-employed persons benefiting from the protective guarantees provided by LETA.

Keywords: self-employment, employment relationship, Spanish law, economic dependence, bogus self-employment

Streszczenie. Celem artykułu jest analiza regulacji prawnych dotyczących samozatrudnienia w Hiszpanii. Jest to pierwszy kraj w Unii Europejskiej, który zdecydował się na przyjęcie odrębnej ustawy z dnia 11 lipca 2007 r. normującej w sposób kompleksowy i systemowy sytuację prawną osób samozatrudnionych. Hiszpańska ustawa LETA z 2007 r. miała na celu uporządkowanie statusu samozatrudnionych i przyznanie im dodatkowych uprawnień. Stworzono nową kategorię osób samozatrudnionych ekonomicznie zależnych, której zagwarantowano szczególną ochronę. Autorka w rozdziale omawia pojęcie i typologię samozatrudnienia, w tym samozatrudnienie klasyczne, ekonomicznie zależne oraz fikcyjne. Jej zdaniem rozwiązania hiszpańskie polegające na uregulowaniu samozatrudnienia w jednym akcie prawnym wydają się atrakcyjne, jednak kryteria wprowadzone przez ustawodawcę warunkujące status samozatrudnionych ekonomicznie zależnych w praktyce nie spełniają odpowiednio swojej roli. Ich restrykcyjny charakter, daleko idąca kazuistyka oraz trudne do obiektywnej weryfikacji i stosunkowo łatwe do obejścia kryterium zależności ekonomicznej samozatrudnionych, którzy od jednego kontrahenta muszą osiągać co najmniej 75% swoich dochodów, skutkują tym, że liczba osób pracujących na własny rachunek korzystających z przewidzianych ustawą LETA gwarancji ochronnych jest znikoma.

Słowa kluczowe: samozatrudnienie, stosunek pracy, prawo hiszpańskie, zależność ekonomiczna, samozatrudnienie fikcyjne

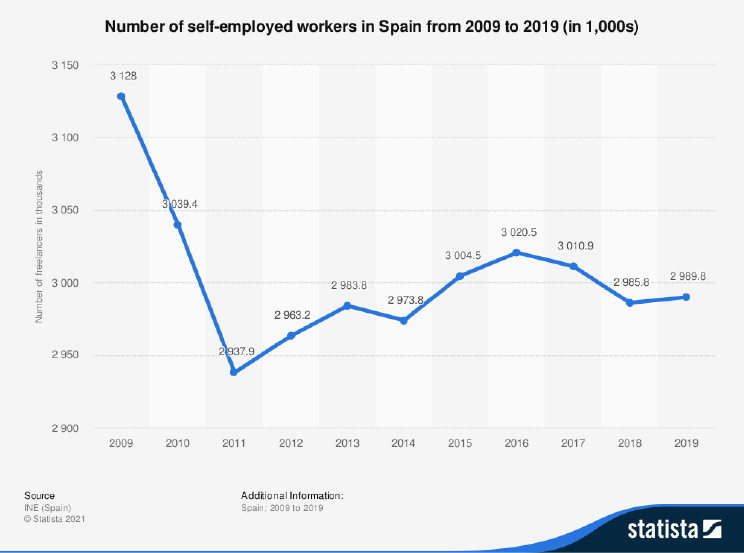

In Spain, Act 20/2007 of 11 July – the Self-Employment Act (Ley 20/2007, de 11 julio, del Estatuto del Trabajo Autónomo,[1] hereafter: LETA) is in force, under which this form of gainful activity has obtained its own regulation beyond the private law framework scattered throughout the legal system (Apilluelo Martín 2018, 35–36; Martín-Artiles, Godino, Molina 2019, 117). The 2007 reform is considered “paradoxical” for at least two reasons. On the one hand, this is because it involves the regulation of self-employment under a specific employment status with characteristics often similar to those of subordinate work. On the other hand, this reform took place when self-employment was already showing a downward trend (Riesco Sanz 2016). According to the most recent data, the number of registered self-employed in Spain has been declining slightly over the last several years, from 3.1 million in 2009 to less than 3 million in 2019.[2]

A novelty and also a curiosity on a global scale was the introduction by the Spanish authorities of a new category of the so-called economically dependent self-employed (trabajadores autónomos económicamente dependientes, TRADE), which the bulk of legal scholars, including the author of this article, treat as a subcategory of the self-employed in its classic form.[3]

The purpose of the present article is to provide an overview of the Spanish regulation of self-employment and to answer the question of whether it can serve as a model for the Polish legislature (cf. Musiala 2010, 145 et seq.). The author will discuss the concept and typology of self-employment, including classic self-employment, economically dependent self-employment, and bogus self-employment. Then, she will focus on the common scheme covering the professional and collective rights of the self-employed. A separate section will be devoted to the occupational status of the economically dependent self-employed.

Self-employed in Spain 2009–2019 (in thousands)

LETA shows the way in which a self-employed person should carry out a business or professional activity in order to fall within its scope. Article 1(1) LETA stipulates that the act applies to natural persons who regularly, personally, directly, on their own behalf, and outside the direction and control of another person carry out a business or professional activity for profit, regardless of whether they hire employees. The provision was supplemented by Act 27/2011 of 1 August on the update, adaptation, and modernization of the social security system (Ley 27/2011, de 1 de agosto, sobre actualización, adecuación y modernización del sistema de Seguridad Social[4]), which enabled the implementation of full-time or part-time self-employment.[5]

The scope of the act covers work performed regularly by relatives of self-employed persons who do not have the status of employees in accordance with the provisions of Article 1(3)(e) of Royal Legislative Decree 1/1995 of 24 March establishing the consolidated text of the Workers Act (el texto refundido de la Ley del Estatuto de los Trabajadores, aprobado por Real Decreto Legislativo 1/1995, de 24 de marzo,[6] hereafter: ET) (Article 1(1)(2) LETA).

In order to determine the personal scope of the act, attention should also be drawn to the sixth final provision of the Urgent Self-Employment Reforms Act 6/2017 of 24 October (Ley 6/2017, de 24 de octubre, de Reformas Urgentes del Trabajo Autónomo[7]) concerning the creation of a legal framework for the disabled children of the self-employed. This is because it amended the existing wording of the tenth additional provision of LETA relating to the social security system for family members of the self-employed worker. According to its new wording, self-employed persons may engage as employees children under the age of thirty, even if they live with them. In this case, unemployment insurance is excluded from the protective provisions granted to employed family members. The provision treats the children of self-employed persons who have reached the age of thirty but whose disability makes it difficult for them to work in the same way. Under Article 1(2) LETA, the act further applies to:

In addition, the law explicitly introduces other categories of persons to whom it applies. Firstly, the eleventh additional provision of LETA covers self-employed persons in the transport sector who are excluded from the scope of the ordinary labour legislation under Article 1(3)(g) ET. Secondly, sales representatives who are not subject to the special employment relationship set out in Royal Decree 1438/1985 of 1 August, which regulates the special nature of the employment relationship of persons engaged in commercial operations on behalf of one or more traders without their bearing the risks (Real Decreto 1438/1985, de 1 de agosto, por el que se regula la relación laboral de carácter especial de las personas que intervengan en operaciones mercantiles por cuenta de uno o más empresarios, sin asumir el riesgo y ventura de aquéllas[9]), and are subject to the Agency Contract Act (Ley 12/1992, de 27 de mayo, sobre Contrato de Agencia[10]) are likewise considered self-employed. Thirdly, self-employed insurance agents are treated in the same way and are subject to the Insurance and Reinsurance Mediation Act 26/2006 of 17 July (Ley 26/2006, de 17 julio, de Mediación de seguros y reaseguros[11]). Under Royal Decree 197/2009 of 23 February developing LETA on the subject of the economically dependent self-employed person’s contract and its registration and creating a state register of professional associations of the self-employed (Real Decreto 197/2009, de 23 de febrero, por el que se desarrolla el Estatuto del Trabajo Autónomo en materia de contrato del trabajador autónomo económicamente dependiente y su registro y se crea el Registro Estatal de asociaciones profesionales de trabajadores autónomos,[12] hereafter: RDTRADE), the legal regime established for economically dependent self-employed persons can be applied – with some modifications – to insurance agents (cf. Pérez Agulla 2016, 30–31).

The above remarks should be supplemented by a list of individuals excluded from the scope of LETA. Under Spanish law, this group of individuals providing services that do not meet the conditions of Article 1(1) LETA comprises, in particular:

These are any types of the employment relationship expressly defined by law as special, e.g.: employment relationships of senior management; domestic help; prison inmates; professional athletes; artists at public shows; people involved in commercial operations on behalf of one or more entrepreneurs without bearing the risk; workers with disabilities who provide work in assistance centres; lawyers providing services in law firms (Article 2 LETA; Apilluelo Martín 2018, 59–61; Pérez Agulla 2016, 35).

The personal scope of LETA includes economically dependent self-employed persons, who, as indicated, are a subcategory of the self-employed in the classic form. Due to the special regulation, this group requires a separate discussion. According to the legal definition, economically dependent self-employed persons are those who carry out gainful economic or professional activities on a regular basis, personally, directly, and predominantly for the benefit of a natural or legal person, known as the client, on whom they are economically dependent in that they receive at least 75 per cent of their income from their work, business, or professional activities from the client (Article 11(1) LETA) (see also Célérier, Riesco-Sanz, Rolle 2017, 403; Sorge 2010, 252).

The above definition can be specified by referring to Article 2(1) RDTRADE. Pursuant to this provision, for the purpose of identifying an economically dependent self-employed person, the income received from the client by a self-employed person is understood to be the full income in cash or in kind derived from the self-employed person’s gainful economic or professional activities. The total income received in kind will be valued at its normal market value.

For the calculation of 75 per cent of income, only the total income received by the self-employed person from business or professional activities as a result of self-employed activity carried out for all clients, including the one that is taken as a reference for the purpose of determining economically dependent self-employed status, as well as income that they may have received as an employee under an employment contract with other clients or employers or with their client is taken into account. These calculations do not cover income from capital returns or capital gains received by self-employed persons from the management of personal assets, or income from transmission assets attributable to economic activities (paragraph 2 of Article 2(1) RDTRADE). It should be pointed out that legal scholars criticize the lack of regulation regarding the frequency of the calculation (e.g. monthly, quarterly, annually) (Pérez Agulla 2016, 37).

Moreover, it is emphasized in subject literature that if no contract has been signed to which the economically dependent self-employed person is a party, the burden of proving economic dependence lies with the person who wishes to be classified as such. It is pointed out that the proof here will be at least a certificate of the income on this account declared to the Treasury. In this way, it can be verified whether the legal requirement of economic dependence has been fulfilled in a given case. On the other hand, the person who denies the veracity of the legally declared data must prove its falsity or the existence of other income. In addition, the court may make its own assessment of the existence of other income, e.g. by taking into account the number of working hours specified in the contract, which in practice excludes the possibility of other gainful activity on one’s own account or for another person (Pérez Rey 2016, 18).

Unfortunately, the situation is complicated by the fact that the Spanish legislature has established – in addition to the key condition of 75 per cent – other rather casuistic conditions that must be met cumulatively in order for a person to qualify as economically dependent self-employed (Article 11(2) LETA). Firstly, one may not be responsible for hired employees or subcontract part or all of one’s activities to third parties, whether in relation to activities provided to a client on whom one is economically dependent or regarding services to other clients. This prohibition does not apply in cases where the law allows for the employment of a single employee, such as where there are risks during pregnancy and risks while breastfeeding a child under nine months of age. In such cases, however, the economically dependent self-employed person has the status of an entrepreneur under the terms of Article 1(1) ET. Secondly, one cannot carry out the activity in the same way that services are provided to the client by persons employed by the client under any form of employment. Thirdly, one must have one’s own production infrastructure and materials necessary to carry out the activity, independent of the client, if they are economically relevant in the said activity. Fourthly, one must carry out one’s activity according to one’s own organizational criteria, without prejudice to the technical instructions received from the client. Fifthly, it is also crucial for this person to receive consideration depending on the outcome of their activity, in accordance with the contract with the client and after the latter has assumed the risk.

However, owners of commercial and industrial establishments or premises and offices as well as offices open to the public, as well as professionals who exercise their profession jointly with others in a corporate system or in any other legal form permitted by law are not considered to be economically dependent self-employed (Article 11(3) LETA).

Bogus self-employment (falso autónomo) that conceals an employment relationship – from the point of view of Article 6(4) of the Spanish Civil Code (Real Decreto de 24 de julio de 1889 por el que se publica el Código Civil[13]) – is considered an abuse of rights. Under this provision, acts carried out in accordance with the content of a legal rule which aim at a result prohibited by or contrary to the legal system are considered to be an abuse of rights and do not prevent the proper application of the rule sought to be avoided. Bogus self-employment has momentous consequences for the dishonest employer. Indeed, it can be qualified as a serious breach of the law under Article 7(2) of Royal Legislative Decree 5/2000 of 4 August approving the consolidated text of the Social Order Infractions and Sanctions Act (Real Decreto Legislativo 5/2000, de 4 de agosto, por el que se aprueba el texto refundido de la Ley sobre Infracciones y Sanciones en el Orden Social[14]). According to this rule, a serious breach of the law is, among other things, a breach of the provisions on contractual terms, fixed-term contracts, and temporary contracts by using them to circumvent the law (see also Pérez Agulla 2016, 43). The Spanish labour inspectorate has its own methodology for carrying out inspection visits to detect bogus self-employment (De la Torre 2020, 250).

The situation of the bogus self-employed has sparked a debate in Spain on bringing them under the protective umbrella of labour law. However, the restrictive application of Article 1 ET determines that these persons do not need the intervention of the legislature to do so, as they are already genuine employees by virtue of the nature of the work they provide. For this reason, as Pérez Agulla points out, it is not possible to speak of insufficient labour or social security law regulation concerning this group, as the protection provided by these rules is fully applicable to the bogus self-employed (2016, 43).

A “common scheme” is provided for all self-employed persons, including the economically dependent self-employed. Under Article 3(1) LETA, the occupational scheme of self-employed workers is regulated by:

Importantly, the Spanish law in principle excludes self-employment from labour legislation. Under Article 3(3) LETA, by virtue of the first final provision of the ET, self-employment is not subject to labour legislation, except for those matters that are expressly provided for by law (see also Palomeque López 2004, 63).

The provisions of LETA refer to the professional rights (derechos profesionales) of the self-employed (Article 4). Firstly, they guarantee them the privilege of exercising the fundamental rights and public freedoms recognized in the Spanish Constitution and in international treaties and agreements ratified by Spain (Article 4(1)). Among the “fundamental individual rights” (derechos básicos individuales) of the self-employed, the provision points to: the right to work and the right to freely choose a profession or craft; the freedom of economic initiative and the right to free competition; and the right to intellectual property over one’s works or other protected objects.

Secondly, Article 4(3) LETA lists the individual rights of self-employed persons that they enjoy “in the exercise of their professional activity” (en el ejercicio de su actividad profesional). These rights are:

Article 5 LETA lists the fundamental professional duties (deberes profesionales básicos) of self-employed persons. They include duties:

Article 7 LETA concerns the form and duration of the contract. Pursuant to this provision, contracts entered into by self-employed persons with clients for the purpose of carrying out professional activities should be in written or oral form. Either party may at any time request the other to enter into a written contract (Article 7(1)). These are civil law contracts and may be entered into for the performance of a work or a series of works as well as for the provision of one or more services, for a period of time to be determined by the parties (Article 7(2)).

Article 19 LETA concerns the fundamental collective rights (derechos colectivos básicos) granted to self-employed persons, ranked from the perspective of individual rights (interests) (section 1) and collective rights (interests) (section 2). The former category includes:

This means that the self-employed enjoy the fundamental right to freedom of association, but not the right to form their own trade union to defend their rights (see Pereiro Cabeza 2008, 96).

By contrast, Article 19(2) LETA grants collective rights to associations of self-employed persons. These rights are:

The rights set out in Article 19(2) LETA have been granted also to trade unions in relation to affiliated self-employed persons (section 4). An example of confederation action is the creation by the Spanish Trade Union Confederation of Workers’ Commissions (Confederación Sindical de Comisiones Obreras, CC.OO) in Extremadura, in collaboration with the Spanish Labour Inspectorate, of an “email box” for employees and economically dependent self-employed persons to report abuse (Williams, Lapeyre 2017, 38).

The activities of professional associations of the self-employed are regulated by Organic Act No. 1/2002 of 22 March regulating the right of association and its implementing regulations (Ley Orgánica 1/2002, de 22 de marzo, reguladora del Derecho de Asociación[15]) and the special provisions of LETA (section 1).[16] The task of professional associations is to defend the professional interests of the self-employed. Furthermore, they have complementary functions, including taking legal action to achieve the objective. Under no circumstances may they make profit. They enjoy independence from the public administration as well as from any other public or private entity (section 2).

Professional associations of self-employed persons must register and file their statutes with a special public office register established for this purpose with the Ministry of Employment and Social Security or with the relevant autonomous community in which the association mainly carries out its activities. Such registration is detailed and differs from the registration of trade unions, companies, or other organizations that may be subject to registration by this public office (section 3).

Cross-sectoral associations, confederations, unions, and federations of self-employed persons that are representative and more widely disseminated, at both national and regional level, under the terms of Article 21 LETA,[17] will be registered as public interest entities in accordance with the provisions of Articles 32–36 of Organic Law 1/2002 (section 4). Such professional associations may only be suspended or dissolved by a final decision of a judicial authority issued for a serious violation of the law (section 5) (for more on collective representation and social dialogue, see Martín-Artiles, Godino and Molina 2019, 120–121). As indicated above, all of the rights discussed in this article involve only the self-employed person exercising their freedom of association. However, the establishment of professional associations is not equivalent to the ability to form own trade unions.

The lack of a business partner led the Spanish Constitutional Court to deny the self-employed the right to strike (recognized in Article 28(2) of the Spanish Constitution) (judgment 11/1981 of 8 April; Moreno Vida 2017, 646). Spain still has no legislation extending the right to strike to the “classic” self-employed. However, this does not mean that economically dependent self-employed workers have no right to strike. Moreover, only the economically dependent self-employed have been granted the right to collective bargaining (see section 4.2. Professional interest agreements below).[18]

Article 22 LETA refers to the Self-Employment Council (Consejo del Trabajo Autónomo), which was established in accordance with the stipulations of Article 42 of Organic Law 1/2002 as the government’s consultative body on socio-economic and professional matters concerning the self-employed (section 1). Moreover, the aforementioned provision regulates the composition and open-ended list of the Council’s functions, which include, among others, design, opinion, and reporting functions (more: Alzaga Ruiz, Lasaosa Irigoyen 2018, 363–368).

The contract for the performance of professional activity (contrato para la realización de la actividad profesional) between the economically dependent self-employed person and their client (referred to in subject literature as a special employment contract, Célérier, Riesco-Sanz, Rolle 2017, 404) is concluded in writing and registered with the relevant public office, the registration not being public (Article 12(1) LETA). The provision requires the economically dependent self-employed person to clearly indicate in the contract their status of financial dependence on the client as well as any changes that occur in this respect. It is permissible to maintain dependency status in relation to one client only (section 2) (Riesco Sanz, 2016).

LETA regulates the specific situation in which a self-employed person is bound by contracts with several clients, but at some point begins to meet the conditions required for economically dependent self-employment. The provision of Article 12(3) LETA specifies that if a self-employed person who has entered into a contract for the performance of professional activities or services with several clients meets the conditions set out in Article 11 LETA, the contract signed between the parties must be fully respected until it is terminated, unless the parties agree to modify it in order to adapt it to the new conditions that result from economically dependent self-employment.

In addition, the Spanish legislature has introduced a rebuttable presumption of a contract for an indefinite period of time if the contract is not in writing or its duration is not specified (section 4).

The regulations stipulate the invalidity of any clauses of an individual contract of an economically dependent self-employed person who is a member of a trade union or an association of self-employed persons, if those clauses conflict with the provisions of a professional interest agreement (discussed below) signed by that union or association, which is applicable to that worker because they have agreed to it.

In addition to the above-mentioned sources in Article 3(1) and (3) LETA, the professional status of economically dependent self-employed workers is regulated also through professional interest agreements (los acuerdos de interés profesional) (Article 3(2) LETA). They are a form of collective agreements created specifically for this category of working persons (Pereiro Cabeza 2008, 94). Such agreements are concluded between associations or unions representing economically dependent self-employed workers and the companies for which the activity is carried out. They may determine the manner, time, and place of carrying out the activity, as well as other general terms and conditions. This means that the narrowly defined material scope of the agreements in question does not coincide with the material scope of collective agreements. The latter are namely not limited to the regulation of working conditions only.

The law on self-employment stipulates that professional interest agreements should in any case take into account the restrictions and conditions set out in antitrust legislation (Article 13(1) LETA). Professional interest agreements are made in writing (section 2) and clauses contrary to the law are void (section 3).

The rule that professional interest agreements are concluded on the basis of the Civil Code proves problematic. However, as rightly pointed out by J.M. Gómez Muñoz (2017, 140), the Spanish Civil Code does not regulate any procedure for the conclusion of the agreements in question. Such ambiguities are in contrast with the rules on representativeness and legitimacy to negotiate collective agreements, which are partly applicable to professional interest agreements. The author emphasizes that we are dealing here with a hybrid negotiation procedure characterized by a convergence of civil and labour law, including trade union law.

Another problem is the effectiveness of professional interest agreements, which is limited to the signatory parties and, where applicable, to members of self-employed persons’ associations or signatory trade unions, subject to their express consent (section 4). Professional interest agreements are therefore not normative; they are no sources of law. This means that they are not binding on non-signatory parties, unlike collective bargaining agreements, which are binding on all companies and workers covered by their scope (for more, see Pereiro Cabeza 2008, 94–95; Apilluelo Martín, Martínez Barroso, Sempere Navarro, Barrios Baudor 2018, 96–98).

Under LETA, the economically dependent self-employed have gained the right to interrupt their activity for 18 working days per year, although the contract or professional interest agreements linking them with the client may provide for more favourable rules for them (Article 14(1)). In addition, the individual contract or professional interest agreement determines the weekly rest and the procedure corresponding to the granting of leave, as well as the maximum daily working time and its weekly distribution (section 2).

The performance of activities within the scope of the business for longer than the time agreed in the contract is voluntary, but the economically dependent self-employed person may not exceed the maximum working time agreed in the professional interest agreement. In the absence of a professional interest agreement, however, the extension of working time may not exceed 30 per cent of the individually agreed basic working time (section 3).

When determining the working time schedule of an economically dependent self-employed person, the aim is to ensure that they are able to reconcile personal, family, and professional life (section 4). Significantly, the Spanish provisions grant an economically dependent self-employed person who has fallen victim to gender-based violence the right to adjust their working time schedule in order to ensure the effectiveness of their protection or right to comprehensive social assistance (section 5).

Section 15(1) LETA protects the economically dependent self-employed person from arbitrary and unjustified termination of the contract by the main client. Indeed, the provision requires that a valid reason justifying the unilateral decision to terminate the contract linking the parties exist. However, the authors of the law chose to include an open list of circumstances in this provision, as clearly evidenced by Article 15(1)(h), which admits “any other lawful reason”. The said list includes:

Where the contract is terminated at the will of one party due to a breach of contract by the counterparty, the terminating party is entitled to receive appropriate compensation (Article 15(2) LETA). This compensation is also due to the economically dependent self-employed person if the contract is terminated at the will of the client without due cause. If, on the other hand, the contract is terminated as a result of withdrawal by the economically dependent self-employed person with prior notice, the client may receive compensation if the withdrawal causes substantial damage that paralyses or interferes with the normal running of their business (section 3). Where the economically dependent self-employed person is the party entitled to compensation, the amount of compensation results from the individual contract or professional interest agreement. On the other hand, where the amount of compensation is not specified in the contract, it is determined taking the following into account: the remaining duration of the contract, the severity of the breach by the client, the investments and expenses anticipated by the economically dependent self-employed person in connection with the performance of the contracted professional activity, and the notice period given by the client at the date of termination of the contract (section 4).

Importantly, the courts competent to hear disputes arising from a contract between an economically dependent self-employed person and their client are the labour courts (Article 17 LETA). However, the bringing of an action insofar as it relates to the occupational status of the economically dependent self-employed person should be preceded by an attempt at conciliation or mediation before the relevant body appointed to fulfil this role. In addition, under the aforementioned professional interest agreement (Article 13 LETA), special bodies competent to settle disputes between the economically dependent self-employed worker and their client may be established. Out-of-court dispute resolution procedures in Spain are based on the principles of speed, efficiency, and gratuity (Musiala 2010, 153).

Article 16(1) LETA introduces a list of due reasons for the discontinuation of activity by an economically dependent self-employed person. These reasons are:

A contract or professional interest agreement may establish other legitimate reasons for the interruption of professional activity than those listed above (section 2).

The Spanish LETA act of 2007 aimed to sort out the situation of the self-employed and grant them special rights. A new category of economically dependent self-employed workers was created to be considered as a subcategory of the classic self-employed. On the one hand, these persons have been granted additional rights and, on the other hand, they fall under the so-called “common scheme”. Indeed, all self-employed persons have been granted certain professional rights and individual rights “in the exercise of their professional activity”. Moreover, self-employed persons benefit from basic collective rights ranked from the perspective of individual interests and collective interests. However, a closer analysis of Spanish legislation and case law makes it possible to conclude that, although the self-employed enjoy the right to freedom of association, they no longer have the right to form their own trade unions to defend their rights. They can only associate in professional associations. Furthermore, the classic self-employed do not enjoy the right to strike, which in turn is not excluded in the case of the economically dependent self-employed. It should be added that only this latter group of working persons has been granted the right to collective bargaining. They can conclude so-called professional interest agreements, which, however, are not binding on the non-signatory parties, unlike collective agreements, which are binding on all companies and workers covered by them. As indicated, the material scope of professional interest agreements is narrowly defined and thus does not coincide with the material scope of collective agreements.

The Spanish solution of regulating self-employment in a single piece of legislation appears attractive, but the criteria introduced in the law to determine the status of economically dependent self-employed do not adequately fulfil their role in practice. Their restrictive nature, far-reaching casuistry, and the criterion of economic dependence of the self-employed, who must receive at least 75 per cent of their income from a single counterparty, which is difficult to verify objectively and relatively easy to circumvent (through a fictitious multiplication of contractors), in a negligible number of self-employed persons benefiting from the protective guarantees provided by LETA. In fact, the data shows that of all those who actually remain economically dependent (over 1,200,000), only a small percentage (around 10,000) have the TRADE status. This means that the economically dependent self-employed represent less than 0.33 per cent of all the self-employed and less than 0.05 per cent of those in employment throughout Spain (Todolí-Signes 2019, 258 and 266). These figures therefore clearly show the marginal importance of the legal regulation of the subcategory of self-employed in question.

Nevertheless, I believe that the Spanish idea to introduce a separate regulation covering the self-employed should be assessed positively. Such a comprehensive approach to the problem would allow the Polish legislature to cope with the current regulatory chaos, which consists, among others, of the dispersion of legal rules (in particular those related to the protection of life and health, anti-discrimination, and unequal treatment, protection of remuneration, parenthood, and collective rights, especially freedom of association) and numerous references to regulations concerning employees without taking into account the specific nature of the self-employed or clarifying the scope of protection. Moreover, the Polish authorities should consider constructing clearer criteria for the acquisition of the right to a guaranteed minimum hourly rate. It should be stressed that the criteria for deciding “the place and time of the performance of the commission or provision of services” by the person accepting the commission or providing the services and the fact that they are entitled only to commission-based remuneration are not satisfactory. In this respect, it is worth noting the criterion of economic dependence introduced in Spain, but also proposed in the Polish draft of the 2008 Labour Code, which indicates a permanent bond between two entities. The hourly criterion of economic dependence from the 2018 draft individual labour code likewise seems interesting. A separate problem is related to the level of protection guaranteed by law to the self-employed. As T. Duraj (2020) rightly points out, such protection cannot be equated with that of the employment relationship. The author emphasizes that the broadest protection must be guaranteed to employees, “compensating” them, as it were, for their “permanent state of dependence on (subordination to) the employer”. From this point of view, it seems crucial to adapt the protection to the nature of the employment. Independent contractors (including self-employed persons), who are not under the direction of an employer issuing binding instructions, assume an increased risk and therefore their level of protection should naturally be correspondingly lower.

Alzaga Ruiz, Icíar. Elena Lasaosa Irigoyen. 2018. “Los derechos colectivos del trabajador autónomo”. In Tratado del Trabajo Autónomo. 331–373. Ed. by Guillermo L. Barrios Baudor. Cizur Menor: Thomson Reuters Aranzadi.

Apilluelo Martín, Margarita. 2018. “Ámbito subjetivo de aplicación”. In Tratado del Trabajo Autónomo. 35–62. Ed. by Guillermo L. Barrios Baudor. Cizur Menor: Thomson Reuters Aranzadi.

Apilluelo Martín, Margarita. Ma De Los Reyes Martínez Barroso. Navarro Sempere. Guillermo L.Antonio V. Barrios Baudor. 2018. “Régimen profesional del trabajo autónomo”. In Tratado del Trabajo Autónomo. 63–330. Ed. by Guillermo L. Barrios Baudor. Cizur Menor: Thomson Reuters Aranzadi.

Beuker, Laura. François Pichault. Frédéric Naedenoen. 2019. “Comparing the national contexts”. In The Challenges of Self-Employment in Europe. Status, Social Protection and Collective Representation. 140–177. Ed. by Renata Semenza, François Pichault. Cheltenham–Northampton, MA: Edward Elgar Publishing. https://doi.org/10.4337/9781788118453.00014

Carrasco, Raquel. Ejrnæs Mette. 2012. “Labor market conditions and self-employment: a Denmark-Spain comparison”. IZA Journal of Labor Policy 1: 13. https://doi.org/10.1186/2193-9004-1-13

Célérier, Sylvie. Alberto Riesco-Sanz. Pierre Rolle. 2017. “Trabajo autónomo y transformación del salariado: las reformas española y francesa”. Cuadernos de Relaciones Laborales 35(2): 393–414. https://doi.org/10.5209/CRLA.56769

Cherry, Miriam A. Antonio Aloisi. 2017. “’Dependent contractors’ in the gig economy: A comparative approach”. American University Law Review 66(3): 635–689.

Davidov, Guy. Mark Freedland. Nicola Kountouris. 2015. “The subjects of labor law: ‘Employees’ and other workers”. In Comparative Labor Law. 115–131. Ed. by Matthew W. Finkin, Guy Mundlak. Cheltenham–Northampton: Edward Elgar Publishing. https://doi.org/10.4337/9781781000137.00011

De la Torre, Carlos. 2018. “Liquid WorkForce: Nuevas reglas para el trabajo autónomo en la era digital”. Capital Humano 327: 118–120.

De la Torre, Carlos. 2020. “Plataformas digitales y fronteras entre trabajo autónomo y subordinado: ¿es necesaria una nueva regulación?” Capital Humano 349: 247–255.

Duraj, Tomasz. 2020. “The Limits of Expansion of Labour Law to Non-labour Forms of Employment – Comments de lege lata and de lege ferenda”. In New forms of employment and the challenges for Society, Law and Politics. 15–31. Ed. by Jerzy Wratny, Agata Ludera-Ruszel. Wiesbaden: Springer. https://doi.org/10.1007/978-3-658-28511-1_2

Gómez Muñoz, José Manuel. 2017. “Re-addressing Self-employment: Spain and the New Entrepreneurship”. In Core and Contingent Work in the European Union: A Comparative Analysis. Ed. Edoardo Ales, Olaf Deinert, Jeff Kenner. Oxford: Hart Publishing.

Gómez Muñoz, José Manuel. 2019. “Stimulating and protecting self-employment and entrepreneurship in Spain (2008–2018)”. Italian Labour Law e-Journal 12(1): 35–48.

Martín-Artiles, Antonio. Alejandro Godino. Oscar Molina. 2019. “Spain: The trend to professionals’ precarization”. In The Challenges of Self-Employment in Europe. Status, Social Protection and Collective Representation. 116–122. Ed. by Renata Semenza, François Pichault. Cheltenham–Northampton, MA: Edward Elgar Publishing.

Moreno Vida, Nieves. 2017. “Los instrumentos de «presión colectiva» y su singularidad en el trabajo autónomo”. In: El trabajo autónomo en el marco del Derecho del Trabajo y de la Seguridad Social: Estudio de su régimen jurídico. Actualizado a la Ley 6/2017, de 24 de octubre de Reformas Urgentes del Trabajo Autónomo. Ed. by José Luis Monereo Pérez, Francisco Vila Tierno. Granada: Editorial Comares.

Musiała, Anna. 2010. “Prawna regulacja pracy samozatrudnionego w świetle hiszpańskiej ustawy o pracy autonomicznej”. In Księga Pamiątkowa w Piątą Rocznicę Śmierci Profesora Andrzeja Kijowskiego. Ed. by Zdzisław Niedbała. Warszawa: Wolters Kluwer.

Palomeque López, Manuel Carlos. 2004. “Trabajo subordinado y trabajo autónomo en el ordenamiento laboral español”. Revista Gaceta Laboral 10(1): 61–71.

Pereiro Cabeza, Jaime. 2008. “The status of self-employed workers in Spain”. International Labour Review 147(1): 91–99. https://doi.org/10.1111/j.1564-913X.2008.00025.x

Pérez Agulla, Sira 2016. “Trabajo Autónomo. Régimen Jurídico de la Prestación de Servicios Tras las Reformas Legislativas de 2015”. In Colección Derecho del Trabajo y Seguridad Social. Ed. by Yolanda Sánchez-Urán Azaña. 1–177. Lisboa: Editorial Juruá.

Pérez Rey, Joaquín. 2016. El régimen profesional del trabajo autónomo económicamente dependiente: novedades legales y jurisprudenciales. Albacete: Editorial Bomarzo.

Riesco Sanz, Alberto. 2016. “Trabajo, independencia y subordinación. La regulación del trabajo autónomo en España”. Revista Internacional de Sociología 74(1): e026. https://doi.org/10.3989/ris.2016.74.1.026

Samek Lodovici, Manuela. François Pichault. Renata Semenza. 2019. “Conclusions: perspectives on self-employment in Europe”. In The Challenges of Self-Employment in Europe. Status, Social Protection and Collective Representation. 206–221. Ed. by Renata Semenza, François Pichault. Cheltenham–Northampton, MA: Edward Elgar Publishing. https://doi.org/10.4337/9781788118453.00016

Sorge, Stefanie. 2010. “German Law on Dependent Self-Employed Workers: A Comparison to the Current Situation Under Spanish Law”. Comparative Labor Law and Policy Journal 31(2): 249–252.

Todolí-Signes, Adrián 2019. “Workers, the self-employed and TRADEs: Conceptualisation and collective rights in Spain”. European Labour Law Journal 10(3): 254–270. https://doi.org/10.1177/2031952519867544

Tyc, Aneta. 2021. “Collective Labour Rights of Self-Employed Persons on the Example of Spain: Is There Any Lesson for Poland”. Acta Universitatis Lodziensis. Folia Iuridica 95: 135–142. https://doi.org/10.18778/0208-6069.95.12

Williams, Colin C. Frédéric Lapeyre. 2017. Dependent self-employment: Trends, challenges and policy responses in the EU. Working Paper No. 228. Genève: International Labour Organization. https://doi.org/10.2139/ssrn.3082819