https://orcid.org/0000-0003-1561-5916

https://orcid.org/0000-0003-1561-5916

Abstract. The purpose of the present article is to present to the readers the key concepts underlying the international research project funded by the National Science Centre and led by Prof. Tomasz Duraj titled “In Search of the Self-Employment Model in Poland. A Comparative Analysis”. The chief research task undertaken by the project participants is a complex legal analysis of self-employment – not only from the perspective of Polish regulations and case law, but also with regard to solutions existing in international and Union law as well as in selected European countries. The area of study covered such legal systems as those of the United Kingdom, Germany, Austria, Spain, France, Italy, Hungary, as well as Lithuania, Latvia, and Estonia. Most centrally, the results of the study will serve to develop an original legal model of self-employment in Poland, which will redefine the special status of the self-employed in an optimal way. The final result of the international research project are two twin studies to be published by Lodz University Press, one in Polish, in the form of a multi-author monograph, and the other in English, as two issues of the journal Acta Universitatis Lodziensis. Folia Iuridica. The present article demonstrates the scale, significance, and implications of self-employment as an atypical form of providing work, as well as the key scholarly objectives of the international research project and its importance for legal theory and practice. Next, the author discusses the concept and the plan of research work adopted in the project, the research methods applied, and the publication and popularization activities carried out by the project participants. The research undertaken under the project is innovative. This is because until now, no such large-scale study into the legal conditions of self-employment in Poland has been carried out. The final conclusions drawn in the research project make a significant contribution to the development of the theory of labour law and social security law, enriching the academic discourse in this area. An added value for Polish scholarly work is the organized study of foreign regulations on self-employment in selected European countries. Moreover, the de lege ferenda remarks prepared in the research project may be helpful to the Polish authorities in developing new legal solutions in the area of self-employment.

Keywords: Self-employment, activity as a self-employed person, economic dependence, bogus self-employment, protection guarantees to the self-employed, comparative law, labour law, social security law, optimal model of self-employment

Streszczenie. Celem artykułu jest zapoznanie czytelnika z kluczowymi założeniami, jakie legły u podstaw stworzenia międzynarodowego projektu badawczego finansowanego ze środków Narodowego Centrum Nauki, zrealizowanego pod kierunkiem prof. UŁ dra hab. Tomasza Duraja nt. „W poszukiwaniu prawnego modelu samozatrudnienia w Polsce. Analiza prawnoporównawcza”. Podstawowym zadaniem badawczym, które postawili przed sobą uczestnicy projektu jest kompleksowa analiza prawna samozatrudnienia, nie tylko z perspektywy polskiej regulacji i orzecznictwa sądowego, ale także w aspekcie rozwiązań obowiązujących w prawie międzynarodowym i unijnym, jak również w wybranych krajach europejskich. W obszarze badań naukowych znalazły się ustawodawstwa takich państw, jak: kraje wchodzące w skład Zjednoczonego Królestwa, Niemcy, Austria, Hiszpania, Francja, Włochy, Węgry oraz Litwa, Łotwa i Estonia. Co najważniejsze, wyniki przeprowadzonych badań posłużą do opracowania autorskiego prawnego modelu samozatrudnienia w Polsce, który na nowo w optymalny sposób zdefiniuje szczególny status osób samozatrudnionych. Końcowym rezultatem międzynarodowego projektu badawczego są dwa bliźniacze opracowania, które ukażą się nakładem Wydawnictwa Uniwersytetu Łódzkiego. Jedno w języku polskim – w formie monografii wieloautorskiej, a drugie w wersji angielskojęzycznej – w dwóch numerach czasopisma Acta Universitatis Lodziensis. Folia Iuridica. Artykuł w kolejnych częściach ukazuje skalę, doniosłość i znaczenie samozatrudnienia jako nietypowej formy świadczenia pracy zarobkowej, najważniejsze cele naukowe międzynarodowego projektu badawczego oraz jego znaczenie dla nauki prawa oraz praktyki. Dalej autor przedstawia przyjętą w projekcie koncepcję i plan badań naukowych, wykorzystane metody badawcze, a także podjęte przez uczestników projektu działania publikacyjne i popularyzatorskie. Realizowane w ramach międzynarodowego projektu badania naukowe mają charakter nowatorski. Do tej pory nie były bowiem prowadzone w Polsce na tak szeroką skalę badania nad prawnymi uwarunkowaniami samozatrudnienia. Sformułowane w ramach projektu badawczego wnioski końcowe stanowią istotny wkład w rozwój nauki prawa pracy i prawa ubezpieczeń społecznych, wzbogacając dyskurs naukowy w tym obszarze. Wartością dodaną dla polskiej nauki jest ujęcie w ramy uporządkowanego opracowania regulacji obcych dotyczących samozatrudnienia w wybranych krajach europejskich. Przygotowane w projekcie badawczym uwagi de lege ferenda mogą być również pomocne polskiemu ustawodawcy przy tworzeniu nowych rozwiązań prawnych w zakresie samozatrudnienia.

Słowa kluczowe: Samozatrudnienie, praca na własny rachunek, zależność ekonomiczna, samozatrudnienie fikcyjne, gwarancje ochronne samozatrudnionych, prawo porównawcze, prawo pracy, prawo ubezpieczenia społecznego, optymalny model samozatrudnienia

We hereby present to you the result of the work of scholars from various European countries who joined the research project funded by the National Science Centre and led by Prof. Tomasz Duraj, titled “In Search of the Self-Employment Model in Poland. A Comparative Analysis” (amount awarded: PLN 202,440). The project was ranked third in the OPUS 15 programme’s legal panel. Project work began in January 2019, and the team was joined by outstanding scholars from various academic centres around Europe: Prof. Catherine Barnard from the University of Cambridge, Prof. Rolf Wank from Ruhr-Universität Bochum, Prof. Gyulavári Tamás from Pázmány Péter Catholic University, Dr Ingrida Mačernytė Panomariovienė from the Law Institute of the Lithuanian Centre for Social Sciences, as well as Prof. Aneta Tyc, Dr Tatiana Wrocławska, Dr Marcin Krajewski, and Dr Mateusz Barwaśny from the University of Lodz.

The chief research task undertaken by the project participants is a complex legal analysis of self-employment – not only from the perspective of Polish regulations and case law, but also with regard to solutions existing in international and Union law as well as in selected European countries. The area of study covered such legal systems as those of the United Kingdom, Germany, Austria, Spain, France, Italy, Hungary, as well as Lithuania, Latvia, and Estonia. The final result of the international research project titled “In Search of the Self-Employment Model in Poland. A Comparative Analysis” are two twin studies to be published by Lodz University Press: one in Polish, in the form of a multi-author monograph, and the other in English, as two issues of the journal Acta Universitatis Lodziensis. Folia Iuridica, which has been indexed by the prestigious Scopus database. The publications have been funded by the National Science Centre (agreement no. UMO-2018/29/B/HS5/02534, research project no. 2018/29/B/HS5/02534).

The phenomenon of self-employment has been known for many years in the European Union as a manifestation of individual entrepreneurship in the form of economic activity that provides a source of income for the individual. The spread of this form of activity, sometimes referred to as “gainful activity on one’s own account”, “independent gainful activity”, or “self-employed activity”, is the result of a further stage in the development of the labour market, which was preceded by the frequent use of part-time work, fixed-term work, or employee leasing.[2] Self-employment has been an important part of the EU labour market for many years. According to the most recent data published by the OECD, the average rate of self-employment in all EU Member States in 2021 was 15.27% of the total workforce[3] and has been reaching similar values for several years. However, looking at long-term statistics, it appears that the rate of self-employed individuals within the European Union has been gradually increasing. OECD documents from 2000 show that the proportion of the self-employed was around 12% (The partial renaissance of self-employment, OECD 2000, p. 159), while according to data published in 2002, the rate fluctuated around 14%. The largest share of self-employment is found in the service sector, where around 60% of workers are self-employed.[4]

The OECD recorded the highest level of self-employment in the European Union in 2021 in some southern European countries (Greece – 31.82%, Italy – 21.83%) and the lowest in countries such as Latvia (12.98%), France (12.61%), Hungary (12.51%), Austria (11.91%), Lithuania (11.63%), Sweden (10.60%), Luxembourg (10.23%), Denmark (8.84%), and Germany (8.75%).[5] EU countries that ranked close to the EU average in this statistical comparison include: Czechia (15.94%), Spain (15.84%), the Netherlands (15.77%), Portugal (15.48%), Finland (14.57%), and Belgium (14.14%). Relating this information to global data, the highest levels of self-employment in 2021 according to the OECD were in Colombia (53.06%), Mexico (31.82%), Turkey (30.16%), and Costa Rica (27.44%). In contrast, countries such as Israel (12.44%), Japan (9.83%), Australia (9.52%), Canada (7.69%), the United States (6.59%), and Norway (4.70%) performed well below the EU average.[6]

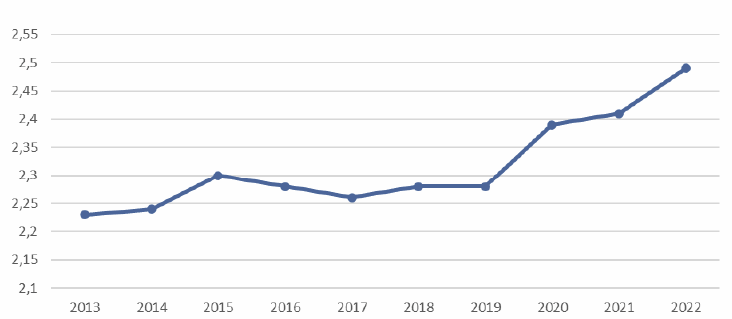

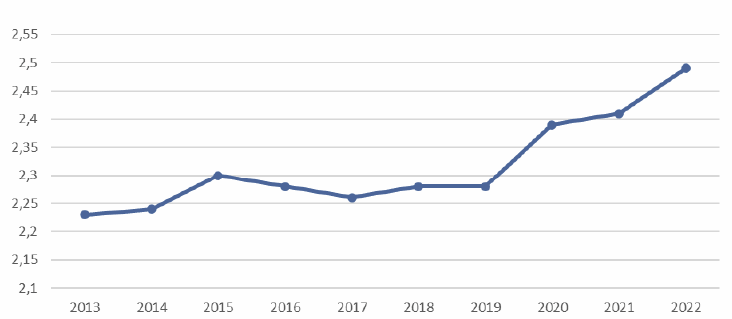

According to the OECD statistics presented above, Poland’s 2021 level of self-employment amounting to 19.73% significantly exceeded the EU average. In turn, estimates by the Polish Central Statistical Office (GUS) for the fourth quarter of 2022 indicate that there are nearly 16.8 million economically active people in Poland, of whom 3.13 million (18.63% of all employees) carried out gainful activity on their own account.[7] In this group, 686,000 were employers (entrepreneurs who hire at least one employee). After deducting them, the number of the self-employed in Q4 2022 amounted to 2.45 million people,[8] or 14.6% of the total workforce.[9] This is a high number, as it means that almost one in six people who carry out gainful activity in Poland does it personally as a self-employed worker, using their own knowledge, qualifications, and competences. It is worth noting that between 2013, when the average number of the self-employed was around 2.23 million, and 2022, when it settled around 2.49 million, this level increased by as many as 260 thousand people. Based on LFS studies,[10] it is clear that the scale of self-employment in Poland grows continually, as shown in the chart below[11]

The primary reason why self-employment has become more widespread in Poland and other European countries since the early 1990s is the increase in competitiveness in business, creating the need to reduce business costs (Duraj 2007). The use of self-employed workers allows contracting entities to significantly cut employment costs compared to the traditional employment relationship. Firstly, all public law burdens are shifted to the self-employed when it comes to both income tax and compulsory social security contributions. Secondly, the employer transfers to the self-employed all the social risks inherent in hiring employees (these risks are, by operation of law, borne by every employer in an employment relationship). In particular, there is no obligation to grant paid annual leave and other paid breaks and exemptions from the obligation to work (also in relation to pregnancy) or compensation for overtime, night work, or work on Sundays and holidays, and the self-employed, although very often economically dependent on the contracting entity, are deprived of most social rights and employee privileges.

Moreover, the large-scale use of self-employment guarantees the flexibility of the employment policy. The use of self-employed workers allows the contracting entity, which does not have to reckon with the constraints inherent in an employment relationship, to adapt the level of employment to its real needs, the economic situation, and the dynamically changing economic climate (especially in times of pandemics and armed conflicts). In this respect, it is not bound by the provisions of labour law, which provides for general and special protection of the permanence of employment. This is important especially in Poland, which is characterized by an unstable economic situation and, consequently, unstable demand for and supply of labour.

Another reason why the use of self-employment has grown in popularity is the possibility to use the potential of human labour more effectively. This is because the contracting entity is not bound by the restrictions imposed by labour legislation on the extent to which the employee is available to the employer. In particular, maximum daily and weekly working time standards, guaranteed rest periods, or restrictions on the permissibility of overtime, night work, or work on Sundays and public holidays do not apply.

Furthermore, the entity contracting out work to the self-employed is in a much better position to effectively protect its property interests. Firstly, a self-employed person – unlike an employee – always bears full material liability for both actual losses and lost benefits. Secondly, it is possible to introduce additional legal mechanisms into a civil law contract which are not allowed under the employment relationship and which will enable effective enforcement of property claims against a self-employed person (such as, for example: liquidated damages, blank promissory note, or external guarantee). Another major factor is the far-reaching freedom of shaping relations applicable under civil law contracts, which for example in Poland provided for under article 3531 of the Civil Code (Act of 23 April 1964, i.e. Journal of Laws of 2022, item 1360, as amended. Hereafter: the KC). As a result, the parties (especially the contracting entity) are in a position to shape mutual rights and obligations in a relatively free way, which is out of the question under the labour relationship, where the principle of employee privilege applies (Article 18 of the Labour Code, Act of 26 June 1974, i.e. Journal of Laws of 2022, item 1510. Hereafter: the KP). In particular, the parties to civil law contracts may introduce provisions that increase the motivation of the self-employed person to work better and more efficiently (performance evaluation criteria, result-based remuneration systems, result-based liability). This, in turn, makes it possible to reduce the economic risk of the business.

Another important reason for the growth of self-employment in Poland and other European countries is the perception of this form of gainful activity as one of the basic instruments for creating new jobs in the economy. Indeed, the development of self-employment constitutes an important mechanism for counteracting unemployment and for the professional activation of the unemployed, and is a factor influencing the reduction of the so-called shadow economy. The setting up of a business by an individual not only rids them of the status of the unemployed, but also creates an opportunity to generate new jobs in the future in the event their business develops successfully. This is why the state’s anti-unemployment policy consists in creating mechanisms to make it easier for individuals to become self-employed as sole proprietors.

However, from the perspective of the self-employed, the attractiveness of this form of activity stems from the need to be an independent and autonomous worker who is not subject in providing work to the strict management by an employer entitled to specify the day-to-day duties of the self-employed person by means of binding instructions. This is a manifestation of the entrepreneurial and creative attitude in society. Such behaviour stimulates individuals to take up and run their own business and bear the associated risks. This phenomenon is particularly evident among young people (school leavers) and people of pre-retirement age, for whom – due to their qualifications and limited capacity for retraining – self-employment is the only viable form of earning an income.

The fundamental research objective of the project is a comprehensive theoretical analysis of the legal conditions of self-employment in a broad context taking into account both the international and the EU legal system, as well as the regulations of selected European countries, with particular emphasis on Polish rules. Most centrally, the results of the study will serve to develop an original legal model of self-employment in Poland, which will redefine the special status of the self-employed in an optimal way. For this purpose, it is necessary to present in the subsequent parts of the project a detailed legal analysis of self-employment in the light of international and EU regulations, as well as on the grounds of selected national legal systems in force in the United Kingdom, Germany, Austria, Spain, France, Italy, Hungary, Lithuania, Latvia, and Estonia. The choice of the countries is far from random. It reflects the authors’ conscious effort to show the diversity of national legislative approaches to the regulation of self-employment. The subject of analysis are therefore both those countries that have decided to adopt a separate law comprehensively and systematically regulating the legal situation of the self-employed (Spain) and those that have more or less extensive regulations in this area.

The specific research objectives of the project include in particular: to carry out a theoretical analysis of the terminology used to describe the institution of self-employment (clarification of the definition and the related conceptual system); to determine the way in which self-employment is standardized and the form of this regulation; to justify the need for the self-employed to benefit from the protection that labour law provides for workers hired under an employment relationship; to determine the scope of this protection and its distinctive criteria; to create an optimal model of legal protection of self-employment in Poland, which will take into account the standards of international and EU law and the requirements of the Polish Constitution, as well as the experience of the European countries analysed in the research project; to carry out a theoretical analysis of the phenomenon of bogus self-employment and to assess the effectiveness of the mechanisms to counteract this phenomenon in force in the Polish legal system; to develop a coherent and comprehensive model to counteract this pathology in Poland, combining solutions of labour law with tax law and social insurance law mechanisms; and to develop a uniform and coherent concept of self-employment in the Polish social insurance system.

The principal research hypothesis of the project is the observation that the current Polish legal system lacks a comprehensive regulation that would systematically standardize the most important aspects of the work of the self-employed, such as: the principles of providing services, working conditions, social and insurance protection, and the specific legal status of these persons. The Polish legislative approach to the matter of self-employment lacks a coherent idea, and the legal solutions regulating the situation of this category of workers are fragmented and rather haphazard. This results in a range of controversies and doubts, both in the legal doctrine and in court rulings, rendering the status of this group of persons unclear. Due to the lack of a legal regulation in our country that would comprehensively and systematically standardize the rules related to performing work as a self-employed person as well as clarify the legal status of this group of persons, it should be assumed that de lege lata, the general provisions of constitutional law, economic law, civil law, social insurance law, and tax law apply.

Following a comprehensive analysis of the existing regulations, the aim of the research project will be to prove the necessity to prepare a complete regulation defining the basic principles of operation and the specific status of the self-employed, forming a coherent legal model of self-employment in Poland. The research project should involve considering the manner of standardizing this matter and the form of this regulation (whether it should be a uniform legal act or maybe specific provisions in various acts already in force).

A further research objective will be to theoretically analyse the terminology used to describe self-employment and to develop a clear conceptual system of the subject. There is no uniform definition of self-employment either in international and EU law or in many of the national legal systems examined in the research project. In Poland, similarly, the authorities have not developed a legal definition of the term so far. Difficulties related to the interpretation of the term “self-employment” arise from the fact that this form of providing work has a complex character and, moreover, may involve numerous various activities. The concept of self-employment covers both natural persons who are sole proprietors based on an entry in the Central Registration and Information on Business Activity as well as natural persons who carry out their business in the form of a private partnership or as members of a liberal profession. This situation results in considerable discrepancies regarding the interpretation of the term “self-employment” in economics and legal theory. As a consequence, it is difficult to determine with any precision the group of persons to whom the status of the self-employed can be attributed and to whom the rules governing their legal situation apply. Broadly speaking, self-employment is a type of activity in which the natural person carrying out the activity in question, from a legal point of view, bears all the financial consequences and economic risks of such activity and is liable for its results with all their assets. There is little doubt that the phenomenon analysed in the research project primarily concerns natural persons with the statutory status of entrepreneur. However, there are significant discrepancies in the doctrine of law regarding the additional conditions that a natural person should fulfil in order to obtain the attribute of a self-employed person. Firstly, the question arises as to whether self-employment only arises when an individual provides their services exclusively or primarily to a single principal, so that there is a relationship of economic dependence between them (the so-called dependent self-employed), or whether the phenomenon also includes cases where work is provided to several (multiple) principals (the so-called independent self-employed). Secondly, there is also the issue of whether the self-employed should include only natural persons who employ no third parties to provide services to the principal, or whether this status should likewise be attributed to natural persons who engage third parties to carry out their own business activity, thus acquiring the status of employer.

Another problem is to determine the material scope of the legal solutions regulating the work of the self-employed. With regard to this issue, the most important research task of the project will be to find an answer to the question of whether the self-employed should benefit from the protection that the labour legislation provides for persons hired on the basis of an employment relationship. As a matter of principle, the phenomenon of self-employment does not fall within the scope of labour law regulations, which governs employment, nowadays more often referred to as voluntarily subordinated work. In this type of work, a worker (employee) undertakes to perform activities of a specific type personally and against remuneration for the benefit of the employing entity (employer) and under its direction, at a place and time designated by the employer and at the employer’s risk (Duraj 2013). Meanwhile, work provided by a self-employed person is performed independently, autonomously, and without subordination to the employing entity as to the manner of its performance, and on the account and at the risk of the employee (sole proprietor), not of the employing entity (Duraj 2009, 24 et seq.). However, it should be noted that self-employed workers, especially if they provide their services to only one recipient, are most often strongly dependent on this entity. This dependence is, of course, of a completely different nature than employee subordination. It is multifaceted and may be manifested in particular in the following ways: economic dependence, where work for a given contracting entity constitutes the sole (main) source of income; control over the performance of tasks; making the self-employed person accountable for the results of their work (possible reduction in remuneration or contract termination); certain elements of subordination in terms of place and time of work; and the order and organization of work. However, in spite of the differences between this type of subordination and employee subordination, the situation of self-employed workers bears a significant resemblance to that of employees in many areas. It should therefore be considered whether self-employed persons in conditions of such (especially economic) dependence on the contracting entity should not, by analogy with persons providing work under an employment relationship, benefit from the protection regulated by labour law. The authors of the project put forward a research hypothesis that such protection is fully justified (Duraj 2018a, 37 et seq.; 2018b). The research objective will be to establish the scope of this protection and its distinctive criteria. Undoubtedly, this protection may not be as broad as that on the grounds of the employment relationship. The tendency to extend legal protection to the self-employed is in line with both international and EU law standards, where the protective regulations usually cover all working people, use the term “employee” in a broad sense (“workers” or “travailleurs”), and with the norms of the Polish Constitution (Basic Law of 2 April 1997, Journal of Laws No. 78, item 483, as amended), which broadly define protective guarantees (Duraj 2020b, 15 et seq.). This is also confirmed by the regulations of selected European countries studied in this project, where the self-employed are guaranteed (to a greater or lesser extent) certain rights and privileges characteristic of the employment relationship; most often, however, to a limited extent. Moreover, the spread of self-employment, where persons engaged in gainful activity very often function similarly to employees, forced the Polish authorities to extend to this category of workers protection which until recently had been reserved exclusively for employees. At present, the self-employed enjoy under Polish law: the protection of life and health, which covers all self-employed persons providing work in an establishment belonging to the entity organizing it (Duraj 2022a, 69 et seq.; 2022d, 103 et seq.); the prohibition of discrimination and the requirement of equal treatment in employment (Duraj 2022b, 161 et seq.); the guaranteed minimum wage and the protection of remuneration for work (Duraj 2021b, 49 et seq.; 2021e, 433 et seq.); the protection of maternity and parenthood (Duraj 2019a, 11 et seq.; 2019b, 341 et seq.; 2019c, 73 et seq.); and the right of association in trade unions, which consequently gives them broad collective rights (Duraj 2018c, 127 et seq.; 2018d; 2020a, 67 et seq.; 2020c, 1348 et seq.; 2021a, 7 et seq.; 2021c, 63 et seq.; 2021d, 83 et seq.; Tyc 2021, 135 et seq.). The actions of the Polish legislature in extending legal protection to self-employed persons should, in principle, be assessed positively. However, it is difficult to speak of the existence of a legal model for the protection of the self-employed in Poland at the moment. On the contrary, in the opinion of the authors of the research project, even a cursory analysis of the provisions reveals a complete lack of a systemic and comprehensive approach to this issue. We are dealing with randomness and fragmentation of legal solutions adopted in the field of protection of the self-employed. Changes in this area are often made ad hoc, without a coherent and well-thought-out concept, including under the influence of political factors. Legal regulations on the protection of persons who carry out business on their own account are not properly correlated with international and EU standards and the Polish Constitution. The rights guaranteed to the self-employed are scattered across many legal acts, which use diverse conceptual systems and unfounded criteria to determine the scope of this protection. Polish authorities completely fail to acknowledge the criterion of economic dependence on the contracting entity in this area. Such a criterion for the application of protective guarantees to the self-employed is present in the legislations of many of the European countries studied in the project, such as Spain, Italy, or Germany (Tyc 2020, 20 et seq.).

The research objective of the research project is to demonstrate the defectiveness of Polish norms regulating the rights guaranteed to the self-employed and to attempt to create in Poland an optimal model of legal protection of the self-employed that will take into account the standards of international and EU law and the requirements of the Polish Constitution, as well as the experience of the legislation of European countries analysed in the research project (Duraj 2017c; 2022c, 257 et seq.; 2022e, 5 et seq.; Barwaśny 2022, 183 et seq.; Duraj 2022f, 58 et seq.). The authors believe it reasonable to introduce in Poland a two-tier model of protection for this category of workers. The first tier should cover all self-employed who personally, at their own responsibility and risk, provide services as an entrepreneur to at least one contracting entity in the form of B2B cooperation. At this level, there is a need for a list of basic social rights applicable to all individuals performing paid work regardless of the legal basis. Referring to both the standards of international and EU law as well as the experience of the European countries’ legislation analysed in the research project and the provisions of the Polish Constitution, Polish authorities should provide the self-employed with the following in particular: protection of life and health, protection against discrimination and unequal treatment, protection of human dignity, protection of women immediately after childbirth, the right to maternity benefit, as well as freedom of association and the resulting collective protection and protection of the permanence of the civil law contract of a trade union activist. The second tier of protection, on the other hand, must apply to those self-employed who personally provide their services under conditions of economic dependence on a specific contracting entity. The idea is therefore to create a separate category of economically dependent self-employed persons, which will be positioned between workers hired under an employment relationship and ordinary self-employed entrepreneurs. They should be guaranteed the widest range of rights and privileges, most akin to the standard enjoyed by the employees. It is important that the provisions regulating the protection of the self-employed take full account of the specific nature of their activities and do not resort only to referring to the appropriate application of labour law provisions regulating the legal situation of employees. The problem of extending protective labour law provisions to the self-employed raised in the research project is part of a broader discussion on the future of labour law and its personal scope. Some representatives of the Polish legal theory advocate the concept of the expansion of labour law into non-employment relations (including self-employment), which is associated with the replacement of labour law by so-called employment law.

An important research objective of the project is the theoretical analysis of the phenomenon of bogus self-employment, which occurs on a large scale in Poland (Duraj 2017b, 103 et seq.). As our research shows, this pathology is present also in other European countries, albeit not as clearly as in Poland. The Polish Economic Institute assumes that the number of bogus self-employed circumventing labour provisions in our country fluctuates between 130,000 and 180,000 people,[12] although according to Prof. Tomasz Duraj (project PI), these figures are severely underestimated, with the number of such people being considerably higher (close to 500,000). According to the Institute, bogus self-employment remained at a similar level between 2010 and 2020 (the highest rate was recorded in 2018), and the phenomenon is most common in industries such as: IT (26,000 people), professional and scientific activities (25,000), healthcare (24,000), transport (17,000), construction (17,000), industry (13,000), finance and insurance (12,000), and trade and vehicle repair (11,000).[13] The primary reason for the use of self-employment in violation of labour legislation is the desire to reduce the public and legal burden and the labour costs associated with engaging employees, and the need to render the process of providing work more flexible. Therefore, it is very common in practice to use self-employment to perform work under conditions characteristic of an employment relationship (Duraj 2017a, 61 et seq.). Poland is witnessing a pathology whereby employers force their employees into self-employment bearing all the features of an employment relationship, in violation of labour law. According to A. Zoll, former Commissioner for Citizens’ Rights in Poland, forcing employees to shift to self-employment is a violation of human rights. In his opinion, “this pathology results from the situation on the labour market and the stronger position of the employer”. The aim of the research project is to carry out an in-depth analysis of the causes and circumstances of the use of self-employment in violation of labour law and to assess the effectiveness of mechanisms to counteract the phenomenon of bogus self-employment present in Polish law (Duraj 2023). The existing legal regulations in this area are insufficient and ineffective (Duraj 2017d, 355 et seq.). As the scale of abuse related to bogus self-employment in Poland is enormous, the research objective of the research project will be to attempt to develop a coherent and comprehensive model for counteracting this pathology, combining solutions from the field of labour law with mechanisms used in tax law and social security law. The optimal implementation of this objective will be achieved through a comparative analysis of legal solutions present in this area in the legislations of the European countries examined in the project. The phenomenon of bogus self-employment is in fact combated in all legal systems, even in the liberal United Kingdom, where it is referred to as “fake self-employment”. Furthermore, the problem of the abuse of self-employment in conditions characteristic of an employment relationship has been brought to the attention of the European Union. The European Economic and Social Committee has therefore issued an opinion on the abuse of the self-employment status,[14] which provides detailed guidance for the Member States. These will be used by the authors of this research project to construct a Polish model for counteracting this pathology.

Moreover, the research project aims at a theoretical analysis of self-employment from the perspective of social insurance law and an attempt to develop a uniform and coherent concept of self-employment in the Polish social insurance system (Krajewski 2021, 279 et seq.). Under current Polish law, we are faced with a situation in which self-employed persons, depending on the characteristics of their business activity, are subject to social insurance on the basis of various insurance titles. As a result of changes made to the Polish social insurance system, the provisions regulating the situation of the self-employed are often inconsistent, rendering it unstable. The proposition prepared in this research project will be based on the following principles: clear distinction of employment and self-employment in the social insurance system, distinction of the economically dependent self-employed and their coverage by insurance on the basis of the rules applicable to other employed persons (Krajewski 2022, 223 et seq.), preservation of the preference system for persons starting (running) non-agricultural activity in Poland, and exclusion of the economically dependent self-employed from the preference system.

The popularity of self-employment, the importance of this issue discussed above, as well as the lack of a comprehensive regulation that would systematically regulate the most important aspects of the work of self-employed persons determine the relevance of in-depth theoretical study of the legal aspects of self-employment. The problems of interpretation regarding the application of self-employment in Poland that arise in legal theory, case law, and practice point to the need to develop a uniform and comprehensive legal model of self-employment in Poland. The legal regulations in force in this area are not sufficient, and the Polish authorities have not even decided to elaborate a definition of “self-employment” and the related conceptual system. This gives rise to a number of controversies and doubts, making the status of this category of persons performing gainful employment unclear.

On the basis of the existing legal regulations in Poland, self-employed persons, even if they provide work for the contracting entity in conditions of strong economic dependence on it, similar to the situation of employees, enjoy no protection or privileges that would fully take into account the standards of international and EU law and the principles enshrined in the Polish Constitution. Therefore, there is evidently a need to carry out thorough research aimed at developing legal mechanisms in Poland that would guarantee the self-employed who are economically dependent on the contracting entity a minimum standard of social protection, obviously much lower than in the case of the employment relationship, using solutions in force in other European countries analysed in the project. This is where the theoretical significance of the research project can best be seen. The attempt to develop a legal model of self-employment in Poland that would take into account the social protection of the self-employed in conditions of economic dependence goes back to the foundations of labour law and its most basic legal constructions. It is a theoretical problem of great importance for labour law studies, referring to the future of this law and its personal scope. It is related to the concept of the expansion of labour law into non-employment relations (including self-employment), which may result in the replacement of labour law by so-called employment law.

Another matter of great scholarly importance is the theoretical elaboration of legal solutions in the fields of both labour law and social security law that would effectively support the development of self-employment, which in turn would encourage this form of gainful activity in Poland. The regulations in force in this area are inconsistent and not very transparent. In this context, there is a need to create a uniform concept of self-employment in the Polish legal system.

The theoretical analysis of bogus self-employment, whose huge scale poses currently a significant social problem in Poland, is likewise of great academic significance. Thorough research is therefore warranted to develop a coherent and uniform strategy to combat this pathology resulting in the development of effective legal mechanisms on the grounds of labour law, tax law, and social insurance law, allowing for the restriction of self-employment in conditions of employee subordination. The current legal solutions in this area are inconsistent and do not guarantee an effective fight against bogus self-employment in Poland.

The studies undertaken under the research project are innovative. So far, there has been no large-scale study in Poland into the legal conditions of self-employment that would cover not only the state of Polish legal regulations and jurisprudence, but also the solutions existing in international and EU law, as well as in selected European countries (the area of research includes the legal systems of such countries as: the United Kingdom, Germany, Austria, Spain, France, Italy, Hungary, Lithuania, Latvia, and Estonia). The issue of self-employment is of interest mainly to economics, as evidenced by the publication entitled Praca na własny rachunek – determinanty i implikacje (Self-employment – Determinants and implications), edited by Prof. Elżbieta Kryńska (No. 1 HO2C 074 28) (Kryńska 2007). On the other hand, legal theory analyses this issue in a very superficial, fragmentary, and general manner. There is no monographic study in the Polish legal literature that would comprehensively and exhaustively characterize the legal aspects of self-employment. The existing publications are usually merely commentaries and minor contributions and typically concern selected legal aspects of self-employment. This is why we have decided to undertake a research project whose objective is to attempt to prepare an original legal model of self-employment in Poland, taking into account the current views of legal theory and case law, international and EU regulations, as well as solutions employed in selected European countries.

The results of the study render it possible to redefine the specific legal status of the self-employed in terms of the rules on the provision of services, working conditions, responsibility for the performance of tasks, and the scope of social and insurance protection. They will contribute to resolving a number of disputes and clarifying a range of doubts that currently exist in legal doctrine and judicial decisions in the context of the legal situation of the self-employed. The final conclusions drawn in the research project make a significant contribution to the development of the theory of labour law and social security law, enriching the academic discourse in this area. An added value for Polish scholarly work is the organized study of foreign regulations on self-employment in selected European countries. Moreover, the de lege ferenda remarks prepared in the research project may be helpful to the Polish authorities in developing new legal solutions in the area of self-employment. The conclusions unequivocally show that the intervention of our authorities is necessary and urgent. There is no time for passivity and apathy on the part of the Polish legislature regarding the adoption of a comprehensive regulation of self-employment, which will systematically standardize the most important aspects of the work of self-employed persons, with particular emphasis on their social protection.

Finally, it should be highlighted that the achievement of the research objectives of this project is of universal value for labour law studies, going well beyond the issue of self-employment. Indeed, the results of the project will render it possible to point to new directions in the development of labour law and to reflect on the legitimacy of extending the protective regulations of labour law to various categories of persons who provide work independently, outside the employment relationship (especially on the basis of civil law contracts) in conditions of economic dependence on the employing entity, as well as on the scope of this protection and the most important criteria for its distinction.

The project’s research concept is based on the identification of separate research areas, which will result in subsequent articles published in English in two issues of the journal Acta Universitatis Lodziensis. Folia Iuridica.[15] The project has been divided into eleven research areas. The first seven will be discussed in the present issue of Folia Iuridica, while four more will appear in an issue to be published in 2024. The first article constitutes an introduction. It demonstrates the relevance of the subject matter in question, the main principles, the research objectives, and the methodology of the research project. The second article is devoted to the issue of self-employment from the perspective of international and EU regulations. This part of the study provides an excellent background for a detailed analysis of self-employment, which will be presented in the following articles from the perspective of national regulations, theoretical views, and case law in the United Kingdom (article 3), Germany and Austria (article 4), Spain (article 5), France and Italy (article 6), Hungary (article 7), and the Baltic States (Lithuania, Latvia and Estonia – article 8). The subject of the ninth article will be a thorough and multifaceted characterization of the Polish regulations shaping the legal situation of the self-employed, taking into account the position of legal theory and judicial decisions. This part will be concluded with critical comments on the current regulation of self-employment in Poland. The analysis will exclude the aspect of insurance of the status of the self-employed, which will become the subject of the tenth research area. Its essence will be a theoretical analysis of the issue of self-employment from the perspective of Polish social insurance law, as well as an attempt to develop a uniform and coherent concept of self-employment in the Polish social insurance system. The entire research project will be closed by the eleventh article, which will have a concluding character. This part will present the final results of the study. Based on the results, an attempt will be made to create an optimal legal model of self-employment in Poland, taking into account both the existing body of doctrine of Polish law and the jurisprudence of domestic courts, as well as international and EU regulations and legal solutions in force in selected European countries analysed under this research project. The model will propose a comprehensive regulation of self-employment in Poland, which will systemically standardize its most important aspects, such as: the principles of the provision of services, working conditions, social protection, and the special legal status of the self-employed. This section will conclude with de lege ferenda remarks addressed to the Polish legislature concerning the need to amend the existing legislation in the area of self-employment.

The international research project financed from the funds of the National Science Centre, carried out under the direction of Prof. Tomasz Duraj, entitled “In Search of the Self-Employment Model in Poland. A Comparative Analysis”, involved the use of several research methods. This was demanded by the multifaceted nature of the study on the legal status of the self-employed and the interdisciplinary approach to the issue in question. The primary research method in the project is the doctrinal methodology, which consists in a thorough and multi-level analysis of the norms regulating the situation of the self-employed. In addition, extensive use has been made of the comparative legal method. The present project involved top researchers from various European countries with extensive knowledge and experience in the legal aspects of self-employment, who carried out a thorough and multi-level analysis of foreign legal regulations in this research area. The selection of the countries covered by the study was not random, as already mentioned in an earlier section of this chapter. The regulations in force in selected European countries analysed in the project have been assessed from the point of view of their usefulness for the Polish legal system and will serve to build a legal model of self-employment in Poland. Taking into account the special character of the labour law rules, the axiological method, which refers to the basic values that should guide the authorities in shaping the legal situation of the self-employed, also could not be omitted. The historical method is likewise useful from the point of view of the undertaken considerations. It will help reveal the change in the legislature’s approach to the protection of the self-employed, resulting in the gradual expansion of labour law to include them in its personal scope. Moreover, this method is used in the analysis of the legal mechanisms for counteracting the phenomenon of bogus self-employment. The statistical method, in turn, is helpful in assessing the effectiveness of existing self-employment regulations (e.g. in terms of counteracting bogus self-employment or motivating individuals to become self-employed). The multifaceted approach of the authors of the project, which involved the intertwining and complementation of the above-mentioned methods in the study of self-employment, has resulted in a thorough and multifarious analysis of the title research issue.

In the course of the research project entitled “In Search of the Self-Employment Model in Poland. A Comparative Analysis”, its participants published partial results of the study of self-employment in academic journals and monographic studies, most of which are available online under the rules of open access. This activity resulted in the preparation of 15 articles in academic journals and four chapters in books. In addition, the research project participants presented their analyses and opinions on the legal status of the self-employed at numerous conferences, both international and regional (mainly in Poland), with their papers being published in conference proceedings.

As part of their scholarly and popularizing activities, Prof. Tomasz Duraj (project PI) and the Polish part of the research team organized three Polish conferences in the form of a cycle titled “Nietypowe stosunki zatrudnienia” (“Atypical Employment Relations”), which promoted partial results on the legal aspects of self-employment. The events were held at the Faculty of Law and Administration of the University of Lodz with the participation of the Centre for Atypical Employment Relations operating at the Faculty[16] and under the honorary patronage of the major Polish authorities that enforce in practice the regulations governing self-employment – the National Labour Inspectorate and the Social Insurance Institution. On 3 October 2019, the 2nd national conference titled “Zbiorowe prawo pracy czy zbiorowe prawo zatrudnienia? Ochrona praw i interesów zbiorowych osób wykonujących pracę zarobkową poza stosunkiem pracy” (“Collective Labour Law or Collective Employment Law? Protection of the rights and collective interests of persons engaged in gainful employment outside the employment relationship”) was held. It resulted in conference proceedings published in open access (Folia Iuridica 2021, No. 95).[17] It includes two papers by Prof. Tomasz Duraj: “Collective Rights of Persons Engaged in Gainful Employment Outside the Employment Relationship – an Outline of the Issue” (Duraj 2021a, 7–18) and “Powers of Trade Union Activists Engaged in Self-Employment – Assessment of Polish Legislation” (Duraj 2021d, 83–100), as well as an article by Prof. Aneta Tyc titled: “Collective Labour Rights of Self-Employed Persons on the Example of Spain: is There any Lesson for Poland?” (Tyc 2021, 135–142). An important role from the point of view of the promotion of the present research project and the dissemination of partial research results on the legal aspects of self-employment was played by the 4th Polish conference “W poszukiwaniu prawnego modelu ochrony pracy na własny rachunek w Polsce” (“In Search of a Legal Model for the Protection of Self-employment in Poland”). It was a two-day event (8–9 December 2021) and the largest Polish academic conference on labour law in 2021. A total of 228 people registered for the conference and 55 speakers delivered papers. The event was crowned with excellent proceedings volume titled “W poszukiwaniu prawnego modelu ochrony pracy na własny rachunek w Polsce” (“In Search of a Legal Model for the Protection of Self-employment in Poland”), which was published in open access in the journal Folia Iuridica 2022, No. 101.[18] The volume contained, among others, articles by the project members: Prof. Tomasz Duraj – “Prawny model ochrony pracy na własny rachunek – wprowadzenie do dyskusji” (“Legal Model of the Protection of Self-Employment – Introduction to the Discussion”) (Duraj 2022e, 5–19) and “Protection of the Self-Employed to the Extent of Non-Discrimination and Equal Treatment – An Overview of the Issue” (Duraj 2022b, 161–181), as well as: Dr Marcin Krajewski – “Economically Dependent Self-Employment – Is it Time to Single out a New Title to Social Security?” (Krajewski 2022, 223–234) and Dr Mateusz Barwaśny – “Right to Rest of the Self-Employed under International and EU Law” (Barwaśny 2022, 183–191). The promotion of partial results of research on the legal model of self-employment in Poland was also the subject of the 5th Polish academic conference titled “Stosowanie nietypowych form zatrudnienia z naruszeniem prawa pracy i prawa ubezpieczeń społecznych – diagnoza oraz perspektywy na przyszłość” (“The use of atypical forms of employment in violation of labour law and social insurance law – diagnosis and prospects for the future”). The event was held on 1–2 December 2022. It was attended by more than 300 people, including many prominent representatives of the doctrine of labour and social insurance law, as well as numerous representatives of the State Labour Inspectorate and the Social Insurance Institution. The two days of proceedings featured 40 speakers representing not only the labour and social insurance law academia, among them Prof. Tomasz Duraj with a paper titled “Stosowanie pracy na własny rachunek z naruszeniem przepisów prawa pracy – wnioski z projektu NCN nr 2018/29/B/HS5/02534” (“The use of self-employment in violation of labour law – conclusions from the NCN project No. 2018/29/B/HS5/02534”) (Duraj 2023). The perfect culmination of the event will be the publication of conference proceedings by Lodz University Press in 2023.

Another important event for the promotion of the research project and the dissemination of the partial results of the study on the legal aspects of self-employment was a separate panel organized by Prof. Aneta Tyc and the project PI at the prestigious international conference ICON•S Mundo, Conference of the International Society of Public Law: The Future of Public Law, held on 6–9 July 2021. The panel entitled “Legal Aspects of Self-employment”, chaired by Robert Siciński, M.A. (Faculty of Law of the University of Lodz), featured presentations by Prof. Aneta Tyc – “Collective labour rights of self-employed persons: a comparative approach”, Dr Marcin Krajewski – “Social insurance for the self-employed in Poland – selected issues”, and Dr Mateusz Barwaśny – “Legal protection against discrimination and unequal treatment of self-employed in Poland”, with Prof. Tomasz Duraj as one of the panellists.

Then, on 11 May 2022, a meeting was held between members of the research team and Prof. Jaime Cabeza Pereiro of the University of Vigo, who gave two lectures relating his topic to the present project. The topics were: “Boundaries between subordinate work and self-employment taking into account the case law of the CJEU” and “Self-employment – collective rights and competition law”.[19] In the course of this seminar, the project participants as well as the visitors were able to learn about the legal regulation of self-employment in Spain and to confront the experiences of its application in practice. Spain is the first EU Member State to have adopted a separate law, LETA of 11 July 2007, to comprehensively and systemically regulate the legal status of the self-employed. The conclusions from this event were used in the construction of the legal model of self-employment in Poland.

All publication and popularization activities of the participants of the research project entitled “In Search of the Self-Employment Model in Poland. A Comparative Analysis” undertaken in 2019–2023 are described in detail on the project’s webpage, which can be found on the website of the Faculty of Law and Administration of the University of Lodz.[20] Thanking all the participants of the international project for their full professionalism and commitment to all the research objectives, I present to you the first part of the study consisting of seven articles included in this Volume No. 103 of the journal Folia Iuridica.

Barwaśny, Mateusz. 2022. “Right to Rest of the Self-Employed under International and EU Law.” Acta Universitatis Lodziensis. Folia Iuridica 101: 183–191. https://doi.org/10.18778/0208-6069.101.13

Duraj, Tomasz. 2007. “Prawna perspektywa pracy na własny rachunek.” In Praca na własny rachunek – determinanty i implikacje. 19–48. Ed. by Elżbieta Kryńska. Warszawa: Instytut Pracy i Spraw Socjalnych.

Duraj, Tomasz. 2009. “Praca na własny rachunek a prawo pracy.” Praca i Zabezpieczenie Społeczne 11: 24–33.

Duraj, Tomasz. 2013. Podporządkowanie pracowników zajmujących stanowiska kierownicze w organizacjach. Warszawa: Difin.

Duraj, Tomasz. 2017a. “Granice pomiędzy stosunkiem pracy a stosunkiem cywilnoprawnym – głos w dyskusji.” Gdańsko-Łódzkie Roczniki Prawa Pracy i Prawa Socjalnego 7: 61–82.

Duraj, Tomasz. 2017b. “Problem wykorzystywania pracy na własny rachunek w warunkach charakterystycznych dla stosunku pracy.” In Nauka i praktyka w służbie człowiekowi pracy: inspekcja pracy – wyzwania przyszłości. 103–118. Ed. by Anna Musiała. Poznań: Wydawnictwo Naukowe Uniwersytetu im. Adama Mickiewicza.

Duraj, Tomasz. 2017c. “In search of the self-employment model in Poland: what is to be done?” European Research Conference. 81–84. London: Sciemcee Publishing.

Duraj, Tomasz. 2017d. “Legal mechanisms for counteracting the use of self-employment in terms specific to the employment relationship.” In Mezinárodní Masarykově Konferenci. 355–364. Hradec Králové: Magnanimitas.

Duraj, Tomasz. 2018a. “Funkcja ochronna prawa pracy a praca na własny rachunek.” In Ochronna funkcja prawa pracy. Wyzwania współczesnego rynku pracy. 37–56. Ed. by Anna Napiórkowska, Beata Rutkowska, Mikołaj Rylski. Toruń: TNOiK “Dom Organizatora.”.

Duraj, Tomasz. 2018b. “Protection of the self-employed – justification and scope.” In Pravni Rozpravy, New Features and Law. 199–206. Hradec Králové: Magnanimitas.

Duraj, Tomasz. 2018c. “Prawo koalicji osób pracujących na własny rachunek.” In Zbiorowe prawo zatrudnienia. 127–149. Ed. by Jakub Stelina, Jakub Szmit. Warszawa: Wolters Kluwer business.

Duraj, Tomasz. 2018d. “Self-employment and the right of association in trade.” European Research Conference. London, 28–30 March 2018, 9th International Scientific Conference, Comparative European Research: 58–61.

Duraj, Tomasz. 2019a. “Uprawnienia samozatrudnionych matek związane z rodzicielstwem – wybrane problemy.” Studia Prawno-Ekonomiczne 113: 11–29.

Duraj, Tomasz. 2019b. “Uprawnienia związane z rodzicielstwem osób samozatrudnionych – uwagi de lege lata i de lege ferenda.” Studia z Zakresu Prawa Pracy i Polityki Społecznej 26(4): 341–366. https://doi.org/10.4467/25444654SPP.19.023.10913

Duraj, Tomasz. 2019c. “The legitimacy of protection of parental rights of persons working outside the employment relationship in the light of the international, EU and Polish laws.” European Research Conference, London, 28–30 October 2019, 12th International Scientific Conference, Comparative European Research: 73–78.

Duraj, Tomasz. 2020a. “Prawo koalicji osób pracujących zarobkowo na własny rachunek po nowelizacji prawa związkowego – szanse i zagrożenia.” Studia z Zakresu Prawa Pracy i Polityki Społecznej 27(2): 67–77. https://doi.org/10.4467/25444654SPP.20.007.11945

Duraj, Tomasz. 2020b. “The Limits of Expansion of Labour Law to Non-labour Forms of Employment – Comments de lege lata and de lege ferenda.” In New Forms of Employment. Current Problems and Future Challenges. 15–31. Ed. by Jerzy Wratny, Agata Ludera-Ruszel. Wiesbaden: Springer. https://doi.org/10.1007/978-3-658-28511-1_2

Duraj, Tomasz. 2020c. Collective rights of the self-employed following the amendments to the Polish Trade Union Law. Hradec Králové: QUAERE.

Duraj, Tomasz. 2021a. “Collective Rights of Persons Engaged in Gainful Employment outside the Employment Relationship – an Outline of the Issue.” Acta Universitatis Lodziensis. Folia Iuridica 95: 7–18. https://doi.org/10.18778/0208-6069.95.01

Duraj, Tomasz. 2021b. “Ochrona wynagrodzenia za pracę w zatrudnieniu cywilnoprawnym – refleksje na tle ustawy o minimalnym wynagrodzeniu za pracę.” In Prawo pracy i prawo socjalne: teraźniejszość i przyszłość. Księga jubileuszowa dedykowana Profesorowi Herbertowi Szurgaczowi. 49–67. Ed. by Artur Tomanek, Renata Babińska-Górecka, Ariel Przybyłowicz, Karolina Stopka. Wrocław: E-Wydawnictwo. Prawnicza i Ekonomiczna Biblioteka Cyfrowa. Wydział Prawa, Administracji i Ekonomii Uniwersytetu Wrocławskiego.

Duraj, Tomasz. 2021c. “Ochrona osób samozatrudnionych w świetle przepisów zbiorowego prawa pracy po zmianach – wybrane problemy.” In Zatrudnienie w epoce postindustrialnej. 63–82. Ed. by Krzysztof Walczak, Barbara Godlewska-Bujok. Warszawa: C.H. Beck.

Duraj, Tomasz. 2021d. “Powers of Trade Union Activists Engaged in Self-Employment – Assessment of Polish Legislation.” Acta Universitatis Lodziensis. Folia Iuridica 95: 83–100. https://doi.org/10.18778/0208-6069.95.08

Duraj, Tomasz. 2021e. “The Guarantee Of A Minimum Hourly Rate For Self-Employed Sole Traders In Poland.” International Masaryk Conference, Hradec Králové, the Czech Republic, 20–22 December 2021, Magnanimitas: 191–197.

Duraj, Tomasz. 2022a. “Kilka refleksji na temat ochrony prawnej osób pracujących na własny rachunek w zakresie bezpiecznych i higienicznych warunków pracy.” In Pro opere perfecto gratias agimus, Księga Jubileuszowa dedykowana Profesorowi Tadeuszowi Kuczyńskiemu. 69–80. Ed. by Agnieszka Górnicz-Mulcahy, Monika Lewandowicz-Machnikowska, Artur Tomanek. Wrocław: E-Wydawnictwo. Prawnicza i Ekonomiczna Biblioteka Cyfrowa. Wydział Prawa, Administracji i Ekonomii Uniwersytetu Wrocławskiego.

Duraj, Tomasz. 2022b. “Protection of the Self-Employed to the Extent of Non-Discrimination and Equal Treatment – an Overview Of The Issue.” Acta Universitatis Lodziensis. Folia Iuridica 101: 161–181. https://doi.org/10.18778/0208-6069.101.12

Duraj, Tomasz. 2022c. “Self-employment and the legal model of protection in Poland.” Studia z Zakresu Prawa Pracy i Polityki Społecznej 29(3): 257–268. https://doi.org/10.4467/25444654SPP.22.021.16566

Duraj, Tomasz. 2022d. “Legal Protection of the Self-Employed to the Extent of Safe and Hygienic Working Conditions – Assessment of Polish Regulation.” Comparative European Research Conference, London, 25–27 April 2022, 17th Comparative European Research Conference, International Scientific Conference: 103–106.

Duraj, Tomasz. 2022e. “Prawny model ochrony pracy na własny rachunek – wprowadzenie do dyskusji.” Acta Universitatis Lodziensis. Folia Iuridica 101: 5–19. https://doi.org/10.18778/0208-6069.101.01

Duraj, Tomasz. 2022f. “Protection of the Self-Employed to the Extent of the Right to Rest in the Light of International, EU and Polish Standards.” Comparative European Research Conference, London, 28–30 November 2022, 18th Comparative European Research Conference, International Scientific Conference: 58–61.

Duraj, Tomasz. 2023. “Kilka uwag na temat stosowania pracy na własny rachunek z naruszeniem art. 22 Kodeksu Pracy.” Studia z Zakresu Prawa Pracy i Polityki Społecznej 3: 175–188.

Krajewski, Marcin. 2021. “Optymalizacja podstawy wymiaru składki na ubezpieczenie społeczne osób prowadzących pozarolniczą działalność gospodarczą.” Acta Universitatis Lodziensis. Folia Iuridica 97: 279–295. https://doi.org/10.18778/0208-6069.97.16

Krajewski, Marcin. 2022. “Economically Dependent SSelf-Employment – Is It Time to Single out a New Title to Social Security?” Acta Universitatis Lodziensis. Folia Iuridica 101: 223–234. https://doi.org/10.18778/0208-6069.101.17

Tyc, Aneta. 2020. “Samozatrudnienie czy praca podporządkowana? Przypadki Włoch i Hiszpanii.” Praca i Zabezpieczenie Społeczne 12: 20–28. https://doi.org/10.33226/0032–6186.2020.12.3

Tyc, Aneta. 2021. “Collective Labour Rights of Self-Employed Persons on the Example of Spain: Is There any Lesson for Poland?” Acta Universitatis Lodziensis. Folia Iuridica 95: 135–142. https://doi.org/10.18778/0208-6069.95.12

Tyc, Aneta. 2022. “Gig Economy: How to Overcome the Problem of Misclassifying Gig Workers as Self-Employed?” Revue Europénnee du Droit Social 56(3): 27–45. https://doi.org/10.53373/REDS.2022.56.3.0072